Carl Court

Thesis

Airbnb (NASDAQ:ABNB) stock moved down 8% after the company presented Q2 2022 earnings. And I argue rightly so. The company is richly valued and has priced too much optimism surrounding the pent-up demand release caused by Covid-19 lockdowns and travel restrictions. That said, although Airbnb delivered a strong quarter and robust guidance, the company failed to convince buy-side expectations. Locking at the price-action following the earnings results, I argue that the market is beginning to acknowledge that Airbnb’s valuation is hard to justify, even under favourable conditions.

Airbnb lost about 35% of equity value YTD, versus a loss of less than 15% for the S&P 500.

Seeking Alpha

Airbnb’s Q2 earnings

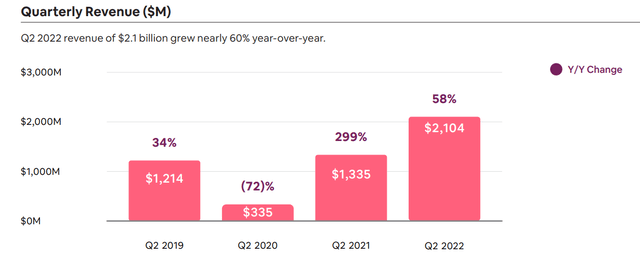

During the period from April to end of June, Airbnb generated gross booking value of $17 billion and total revenues of $2.10 billion, which is slightly below analyst consensus estimates of $2.11 billion. Notably, revenues increased approximately 58% as compared to last year, or 64% excluding foreign exchange headwinds. Airbnb highlighted that this was the company’s most profitable Q2 ever. During the period, Airbnb achieved adjusted EBITDA of $711 million (34% margin) and net-income of $379 million – which is a jump of almost $700 million as compared to the same period pre-covid (2019). Earnings per share was $0.56 versus $0.43 expected by analyst consensus.

Airbnb Investor Presentation Q2 2022

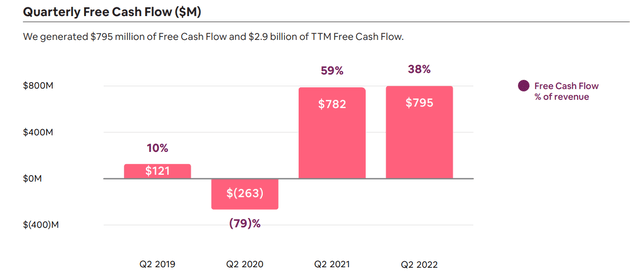

Airbnb generated a record $795 million of free cash flow. Notably, this is about $670 million higher than the same metric before Covid in Q2 2019. But as compared to Q2 2021, free cash flow is almost flat — only plus $13 million.

Airbnb Investor Presentation Q2 2022

Defying a challenging macro-environment, as compared to Q2 2021, Airbnb saw a 25% increase in nights and experiences booked to 103 million. And according to the company:

strong guest demand exceeded our expectations.

Bullish Guidance and Share Buybacks

Airbnb guided the street with a bullish outlook for Q3 2022: The company expects record revenues between $2.78 billion and $2.88 billion. Airbnb further noted, that on July 4th, which is already in Q3, Airbnb broke the company’s single-day revenue record, indicating strong travel demand. Nevertheless, the Q3 guidance is not without risk/uncertainty, as management highlighted:

We did see some elevated cancellations in the back of the quarter relative to our forecast … We believe that some of the elevated cancellations were related to flight cancellations around the world, but it was mostly in North America towards the end of Q2 2022

Airbnb closed the quarter with $9.9 billion of cash and short term investment against total debt of $2.4 billion. Given the company’s ‘comfortable’ financial position, management announced:

We’re so confident in our long-term growth and profitability that today, we’re announcing a $2 billion share repurchase program. And this is coming only a year and a half after our IPO.

Negative Price-Action

Despite an overall strong quarter for Airbnb, investors should note that the company failed to meet buy-side expectations. In fact, after the Q2 announcement, ABNB shares dropped by more than 8% in extended hours trading. Whenever a stock trades down on good news, this is a warning signal.

The explanation is simple: Airbnb stock has been and still is priced to perfection. And ultra-bullish sentiment and speculative patience can only be sustained for so long. I argue that the market is beginning to acknowledge that Airbnb’s valuation is hard to justify, even under favourable conditions.

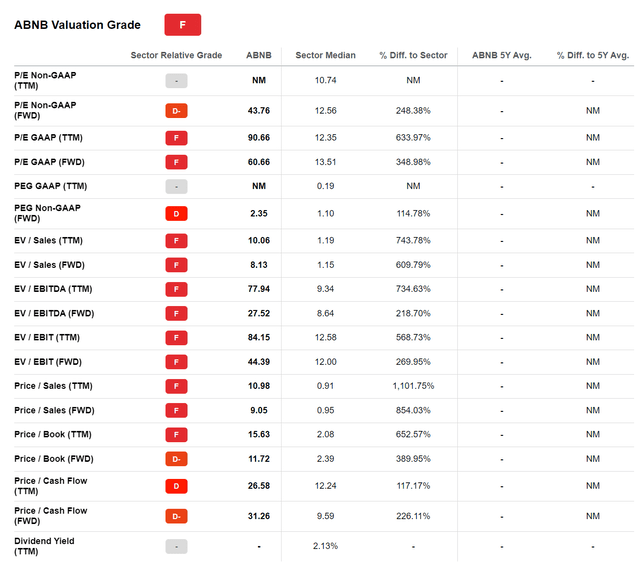

At this point it is worth noting, that Airbnb currently trades at TTM 90x P/E, 11x P/S and 15x P/B. I argue this is way overvalued. As compared to the reference sector (Seeking Alpha Valuation Score), ABNB’s multiple are at a 200% – 600% premium to peers.

Seeking Alpha

Implications and Recommendation

Airbnb shares dropped more than 8% after the earnings announcement and I argue the stock has room to trade even lower still. In my opinion, the company’s valuation is unreasonable for investment purposes and as the market is slowly waking up to the company’s rich valuation, I advise to jump ship as long as the water is only swaggy — not stormy.

That said, Airbnb currently trades at 11x P/S. Given the still elevated level of risk and uncertainty with regards to Uber’s business profitability, I believe this valuation is too risky. In my opinion, the stock should trade at maximum 5x P/S. And accordingly, I see more than 50% downside. My target price is $55/share.

Be the first to comment