schulzhattingen/iStock Editorial via Getty Images

Here at the Lab, with the latest initiation of coverage of Linde in a publication called Defensiveness At A Discount, we can clearly say that we have a good grip on specialty gas companies. Following Air Liquide and Linde’s Q3 results, today we are commenting on Air Products and Chemicals’ (NYSE:APD) latest quarterly numbers. This year, we already analyzed the company twice and since then, the company has clearly outperformed the S&P 500 return. In the article below, we highlight six positive catalysts that support our analysis. One of our upsides was related to the semiconductor industry, and during Q4, APD signed two agreements for a total consideration of $1.3 billion to supply its special gases to semiconductor producers.

Great Mix Between Value and Growth (Mare Evidence Lab’s Previous Publication)

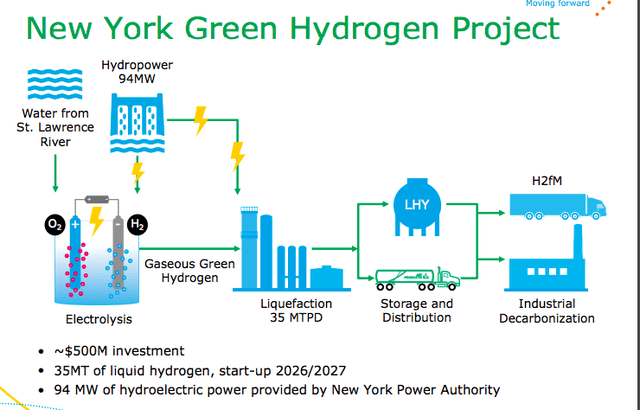

In addition, in our latest publication, we also emphasized and reviewed the company’s latest CAPEX projects, which are key catalysts for APD’s future earnings growth engine. Financially speaking, we are confident that the company has the ability to invest in new projects while maintaining its superior credit rating, and increasing its DPS year-on-year. Aside from the four mega investments below, over this quarter, the company announced a new plan to invest a total amount of $500 million to build a new green hydrogen facility located in NY. This is not coming as a surprise, indeed, during an investor day held in September, ADP’s management emphasized how there is additional room for CAPEX growth for a total consideration of $4 billion.

APD Ongoing CAPEX Projects (Mare Evidence Lab’s Previous Publication)

We reaffirm our valuation.

New York New Project (APD Q4 Results Presentation)

Q4 Results

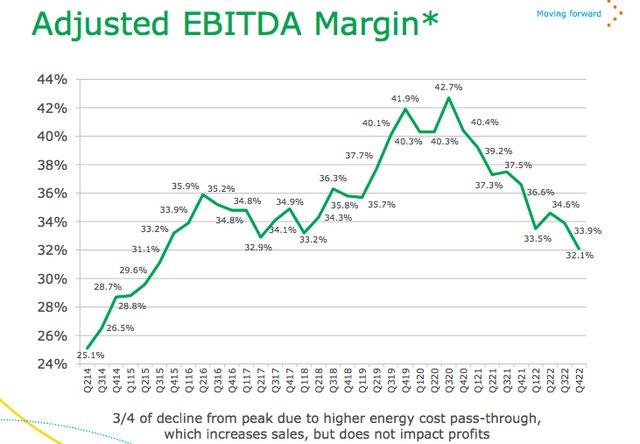

APD’s EBITDA increased by 10% on a yearly basis and was supported by a plus 9% in volume growth. Adjusted EBITDA and EPS were ahead of analyst consensus estimates by 2% and 3.5% respectively. However, looking at the company’s margin, APD was still negatively influenced by the ongoing EU energy crisis, which was a major drag in the Q4 accounts.

APD EBITDA Evolution (APD Q4 Results Presentation)

As already performed in Q3, looking at the GEO performance:

- America‘s region recorded an EBITDA of $515 million, surpassing the consensus estimate and signaling a plus 8% on a yearly basis thanks to volume growth (at 12%). There was a rebound in sales for refinery and merchant gas;

- Asia‘s EBITDA stood at $373 million and was a positive beat. Volumes were up by 16% and the new startup plants more than offset the COVID-19 lockdowns;

- Europe‘s EBITDA delivered $217 million and was lower than estimates. Looking at APD’s press release, we can note that energy costs negatively impacted its EBITDA margin by almost 750 basis points;

- Jazan in the Middle East & India region also contributed $63 million to the company’s equity income.

Conclusion and Valuation

All in all, we are not making any changes to our target price. We were already ahead of Wall Street analyst estimates. The company slightly increased its guidance on the EPS level, and this confirms our long-term buy rating. In the meantime, it is still affected by the higher energy price environment; however, our outperform is due to APD’s defensiveness and to its sustainable investment as well, which will lead the company to an above-average return over the years. With our EPS set for $12.35 in 2024, we continue to value APD at a price of $300 per share.

Be the first to comment