schulzhattingen/iStock Editorial via Getty Images

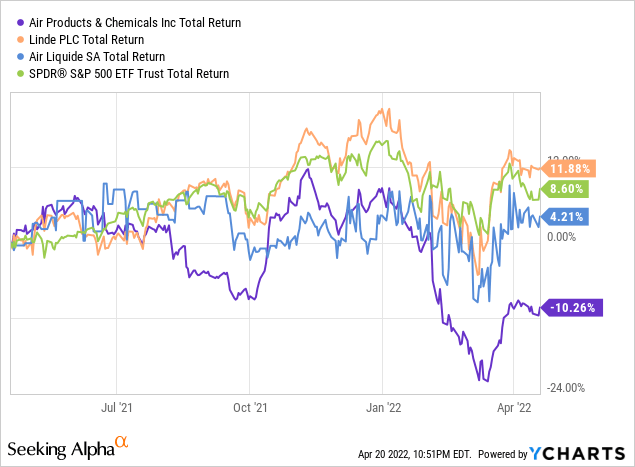

Over the last twelve months, Air Products (NYSE:APD) has underperformed both its peer group and the broader S&P 500 with a loss of over 10% of value. Meanwhile, Linde (LIN) returned 12% and even L’Air Liquide (OTCPK:AIQUF) returned 4%. This is especially disappointing since industrial gas producers tend to offer greater stability due to the long-term nature of their contracts. With management aiming to spend over $30 billion in capital between 2018 and 2027, there is still nevertheless runway for value creation, particularly in carbon capture, green hydrogen, and further momentum in emerging markets. It will, however, take a while before the company to get back to scale following the Praxair / Linde and Air Liquide / Airgas transactions. Since my bearish article on Air Products back in July, the stock has fallen ~15%. In my view, the downside has now been materially factored into the stock price.

According to Seeking Alpha data, the Street is currently split on the stock. 12 analysts rate the stock a “buy” or “strong buy”, but 13 are “hold”. The sentiment has become slightly more bearish over the past few quarters and reflects a competitive environment and anticipated weakening in the economy as inflation takes hold. The release of lower-than-expected guidance for 2Q22 have set shares towards a decline, with the outlook being from analysts that Air Products won’t be able to pass on inflationary costs to customers. Even still, revenue growth was actually good in the first quarter (up 26%) and adjusted EBITDA, the main metric of value, was solid (up 8%).

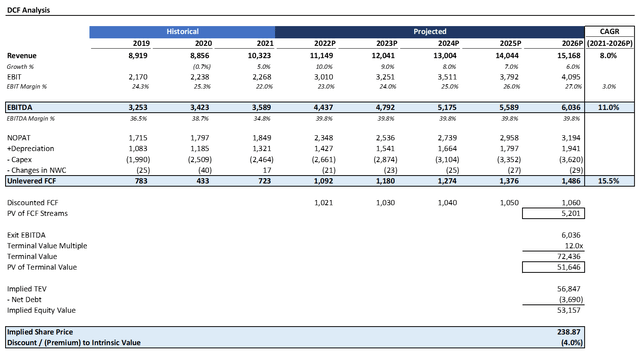

DCF Analysis Indicates Fair Valuation

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. I forecast revenue growing at 10% in 2022 before leveling off to 6% in 2026. I assumed EBIT margins expanding to 27%. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity. By 2026, I have EBITDA at $90 million.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 12x and a discount rate of 7%, the stock is more or less fairly valued. Generally, it has traded in the ~10-14x range over the past 10 years, and it currently trades at 14.4x EBITDA. For context, Air Liquide trades at 15.7x and has never gone ended a year below 12x since 2015; Linde trades at 17.6x and hasn’t ended a year below 12x since 2015. In addition to having a beta of 0.88 and a 2.4% dividend yield, Air Products has a solid operating margin of 20.7% vs. 16.2% for Linde; I suspect that shareholders will rotate to industry discounted peers to normalize the variance in multiples and risk profile.

Source: Created by author using data from Yahoo! Finance

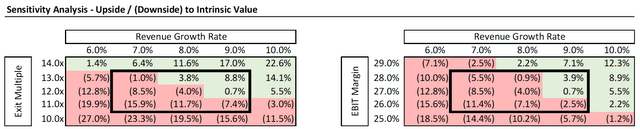

Interestingly, if the multiple were to expand to 14x, there would be 12% upside here. On the flip side, even if the multiple were to contract to the low end of the historical average, there’s only 19.5% downside, which is more than offset by the dividend yields and 7% returns implicit in my discount rate. Importantly, the stock isn’t so sensitive to changes in margins; a 1% change in margin yields only a ~3% change in returns.

Upside Catalysts

There are several reasons I’m reversing my outlook on Air Products. Firstly, I’m encouraged by the company’s increasing aggression in emerging markets. The recent acquisition of Air Liquide’s industrial gas business in the UAE demonstrates Air Products’ commitment to expanding its footprint abroad and strengthening product sourcing & reliability. At the same time, the company is poised to demonstrate momentum in the Middle East with its Jazan project in Saudi Arabia kicking into full gear and improved merchant gas pricing relative to other specialty verticals. Phase I closed in late October 2021 and offers a material equity affiliate income stream. Air Products also inked a JV agreement with SARGAS to install a new air separation unit (ASU) in Omar that will produce over 400 T/D of oxygen and nitrogen

It should also be noted that management has a strong long-term track record. Going back to 2014, it has delivered a solid EPS CAGR of 11% while dividend have increased by a CAGR of 10%. This has generally been a very linear trend as well, reflecting the consistency and predictability of execution. This has occurred despite adjusted EBITDA margins slipping from a peak of 42.7% back in mid-2020 to 33.5% today; thus, I believe there is even greater upside from a recovery through cost rationalization.

Further, I am very bullish on the company’s deepening effort within the green economy. The NOEM project will provide the needed first mover advantage in green hydrogen; it takes six years to build these plants, and by getting in early, Air Products is positioning itself to be the trusted partner as companies move towards carbon neutrality mandates. The launch of a green liquid hydrogen plant in Arizona provides a reliable supply of decarbonized fuel, particularly in route to the California market, where the government is always partial to ESG initiatives.

Risks

While I am generally bullish on the stock, it is not without it risks. For one, it continues to be a distant third wheel to Linde and Air Liquide. While the company still has $18 billion capital left in its aggressive capital plan, this comes with considerable execution risk. Most of the projects planned are world-scale projects at $2-7 billion in capital required. Expect startup delays and volatile demand markets continuing to keep investors on the fence until traction has been meaningfully demonstrated. These projects take several years to complete and, if the last few years have been any indication, it’s unclear what the state of the economy will be when actual production ramps up. Investors have flocked to Air Products over the years for its consistency, but the game plan going forward brings heightened risk that erodes the traditional investment thesis. Lastly, the CEO is 77 and had his employment contract extended to 2025; Seifi Ghasemi has been critical to the company’s growth, and it’s not clear what the success planning will look like to ensure that, when the projects do startup, they’ll be in good hands.

Conclusion

I don’t often change my mind on my outlook for stocks, but I believe the recent pullback in price at Air Products warrants that decision. At the end of the day, Air Products is a reliable cash cow producer with reasonable leverage at only ~2x debt and a track record of consistently growing dividends by double-digits. Although there is inevitable risk inherent in the timing of projects going into 2026, the secular tailwinds supporting carbon capture and green hydrogen position the company for material upside. There are a few stocks in today’s market that provide high quality business models with a history of operating execution, yet are not overvalued. Air Products is one such stock.

Be the first to comment