JHVEPhoto/iStock Editorial via Getty Images

Here at the Lab, we recently commented about Air Liquide’s (OTCPK:AIQUF, OTCPK:AIQUY) pre-Q3 2022 sales communication. Cross-checking our internal estimates, we were right to be supportive of Air Liquide’s accounts. Indeed, the company is demonstrating resiliency across its division, and we expect upward earnings revision from Wall Street analysts.

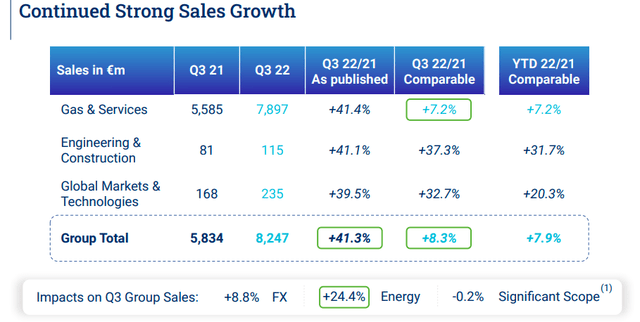

The French gas giant recorded €8.2 billion in sales, with a 4% higher performance versus consensus expectations. Looking at the divisional level, this support was led by the Industrial Merchant segment, whereas the Large Industry partially offset Air Liquide’s three-month numbers. We should report an important investment backlog at €3.4 billion, with almost 50% of the company’s projects associated with energy transition. Air Liquide confirmed its guidance with an expected increase at the EBIT margin level and higher net profit against last year at CER. Important to note is the company’s savings program that is well on track.

Air Liquide Order Backlog (Air Liquide Q3 Results Presentation)

In our pre-Q3 comment analysis, we were skeptical about Europe’s Large Industry division. We forecasted pretty resilient volumes with a decrease in steel of approximately 20% and flat chemicals assumption thanks to biofuel demand. Looking at the company press release, this is exactly what has happened. “Large Industries were impacted by a slowing demand from Steel” and “Chemical customers showed a limited decrease in a context of soaring energy prices”. European revenue performances were mixed; however, considering the high energy prices, the company recorded a solid outcome (supported by the Healthcare division and a strong resilience in cylinder gas).

Concerning the other regions, the Americas Gas and Services was up by almost 13%. Despite a lower contribution from steel due to lower demand, the division was up by almost 6% on a quarterly basis. Electronics, hydrogen, and industrial merchant segments were considerably up. The same trajectory was recorded also in the APAC area, where the Electronics segment outperformed thanks to an increase in rare gas prices. Solid results were achieved in the Global Markets & Technologies as well as in the Engineering division. The former recorded a strong momentum in biogas, and we believe the Russian/Ukraine conflict is a key catalyst in that regard, whereas the latter achieved new order intakes related to air separation units and helium liquefaction.

Air Liquide Sales (Air Liquide Q3 Results Presentation)

Conclusion and Valuation

- The order backlog is back to growth and is in line with the Q1 numbers;

- We were forecasting a strong price momentum in the second part of the year. With the company’s latest guidance and Q3 results analysis, this is confirmed;

- Related to point two, the company is also progressing in achieving better profitability;

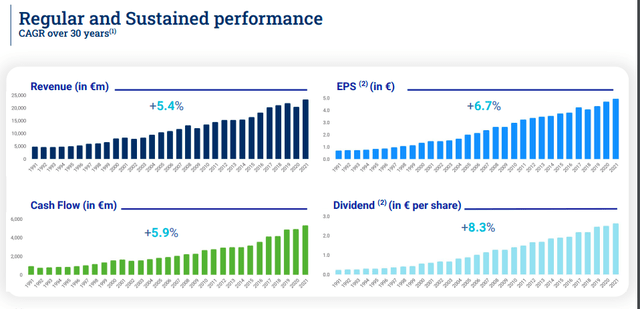

- Air Liquide has a strong track record (see figure below);

- Despite all the positive above points, the company is still trading at a discount compared to Linde and APD both at the EV/EBITDA level and at the P/E ratio. Therefore, we confirm our valuation with a price target of €190 per share.

Air Liquide’s Track Record (Air Liquide Q3 Results Presentation)

Be the first to comment