martin-dm/E+ via Getty Images

A year ago, Agree Realty Corporation’s (NYSE:ADC) stock price was close to its current price. On the other hand, Simon Property Group (NYSE:SPG) stock price increased more than 10% YoY. I am bullish on ADC as I see a promising future for Agree Realty. Also, Simon Property is a buy as the stock is worth $159 per share, around 25% more than its current price. In a word, ADC is a long-term stock buy, and SPG is a buy. According to Seeking Alpha ratings (Wall Street price target), ADC has an average price target of $71, and SPG has an average price target of $157. Although they are both opportunistic, I choose SPG over ADC.

4Q and full year 2021 financial results

In its fourth-quarter and full-year 2021 financial results, Agree Realty Corporation announced a fourth-quarter core funds from operations (FFO) per share of $0.92 (up 10.5% YoY), and full-year 2021 FFO per share of $3.58 (up 10.9% YoY). ADC reported 2021 net real estate investments of $4367 million, compared with 2020 net real estate investment of $3304 million, up 32%. ADC’s total revenue (rental income) increased from $249 million in 2020 to $339 million in 2021, up 36%. Also, its 4Q 2021 total revenue grew by 28% to $91 million. In 4Q 2021, ADC reported a net income (attributable to common stakeholders) of $31 million, or $0.44 per diluted share, compared with 4Q 2020 net income of $24 million on $0.42 per share. Moreover, the company reported a 2021 net income of $1.78 per diluted share, compared with a 2020 net income of $1.74 per diluted share.

In its 4Q 2021 financial results, Simon Property Group announced a 4Q 2021 FFO of $3.09 per diluted share (up 42.5% YoY), and a full-year 2021 FFO of $4.5 billion (up 31.1% YoY). SPG reported 2021 total assets of $33777 million, compared with 2020 total assets of $34787 million, down 3%. Also, its total liabilities decreased from $31127 million in 2020 to $29377 million in 2021. The company’s total revenue increased from $710 million in 4Q 2020 to $858 million in 4Q 2021. SPG reported a 2021 total revenue of $3177 million, compared with a 2020 total revenue of $2845 million. SPG’s net income (attributable to common stakeholders) jumped from $1109 million or $3.59 per diluted share in 2020 to $2246 million or $6.84 per diluted share in 2021. The company reported a 4Q 2021 net income of $1.53 per diluted share, up 78% compared with the same period last year.

ADC and SPG: metrics, multiples, and development activities

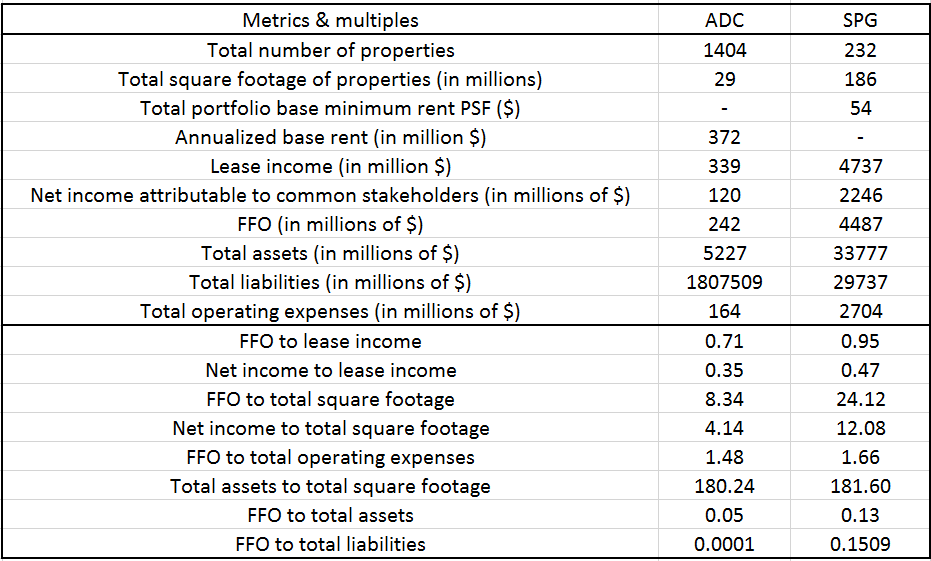

Table 1 shows that SPG is a much bigger RETI than ADC. In 2021, SPG’s total square footage of properties was 6.4 times more than ADC’s. Also, SPG’s 2021 lease income is 14 times more than ADC’s. But, being big does not necessarily represent better performance. Thus, I used different multiples to compare ADC with SPG. The multiples I used in this section indicate that SPG is doing better than ADC. The FFO to lease income ratio of ADC is lower than SPG’s. Also, ADC’s FFO to total square footage ratio is lower than SPG’s. Moreover, SPG’s FFO to total operating expenses is 12% higher than ADC’s. Based on these multiples, SPG is doing better than ADC. However, ADC’s promising future makes it a long-term buy stock. In the fourth quarter of 2021, ADC raised net proceeds of $375 million by completing a forward equity offering of 5570000 shares of common stock. The company raised $1.1 billion in 2021 through three offerings and increased its revolving credit facility from $500 million to $1000 million in 4Q 2021. In 2021, ADC invested or committed $1.43 billion in 297 retail net lease properties.

Table 1 – ADC and SPG: metrics and multiples

Author’s calculations based on ADC and SPG’s 4Q 2021 financial results

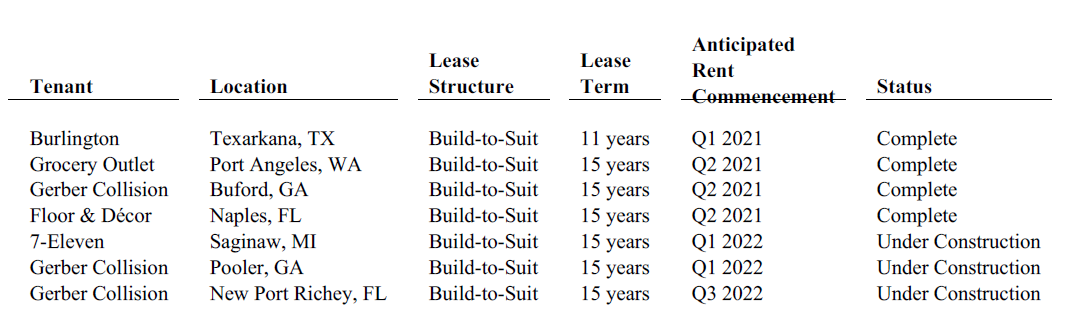

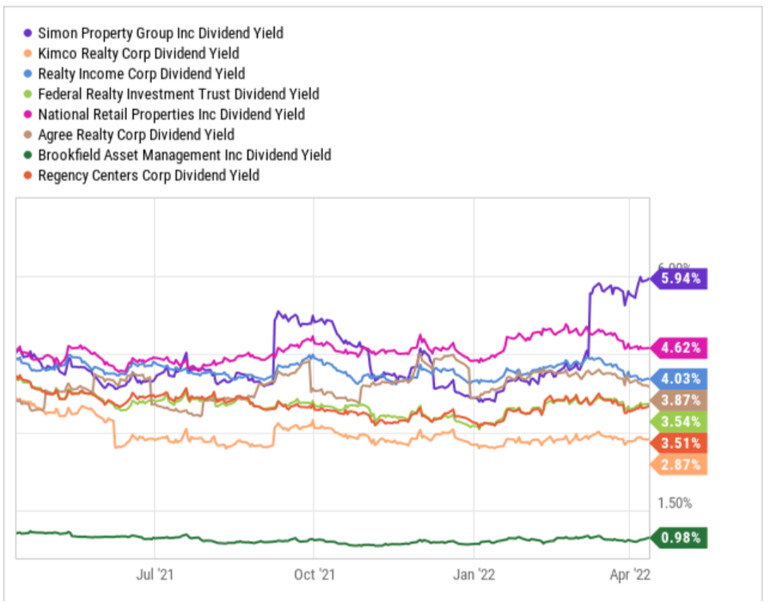

Do ADC’s future developments have the potential to make the stock more attractive? According to Figure 1, ADC completed four new projects. Also, at the end of 2021, ADC had three projects under construction, which are expected to complete in 3Q 2022 (7-Eleven and Gerber Collision are tenants of these projects). Since 2010, ADC has invested $5.6 billion in high-quality retail net lease properties. (see Figure 2).

Simon Property is also expanding. Simon owns a 50% interest in a center that opened with 92000 square feet on 15 October 2021 in South Korea. The company owns a 40% interest in a project located in Japan which is expected to open in October 2022. Simon owns a 74% interest in a project located in France which is expected to open in spring 2023.

Figure 1 – ADC had 3 projects under construction as of 31 December 2021.

ADC’s 4Q 2021 financial report

Figure 2 – ADC has invested $5.6 billion in high quality retail net lease properties since 2010

ADC’s 4Q 2021 investor presentation

Performance

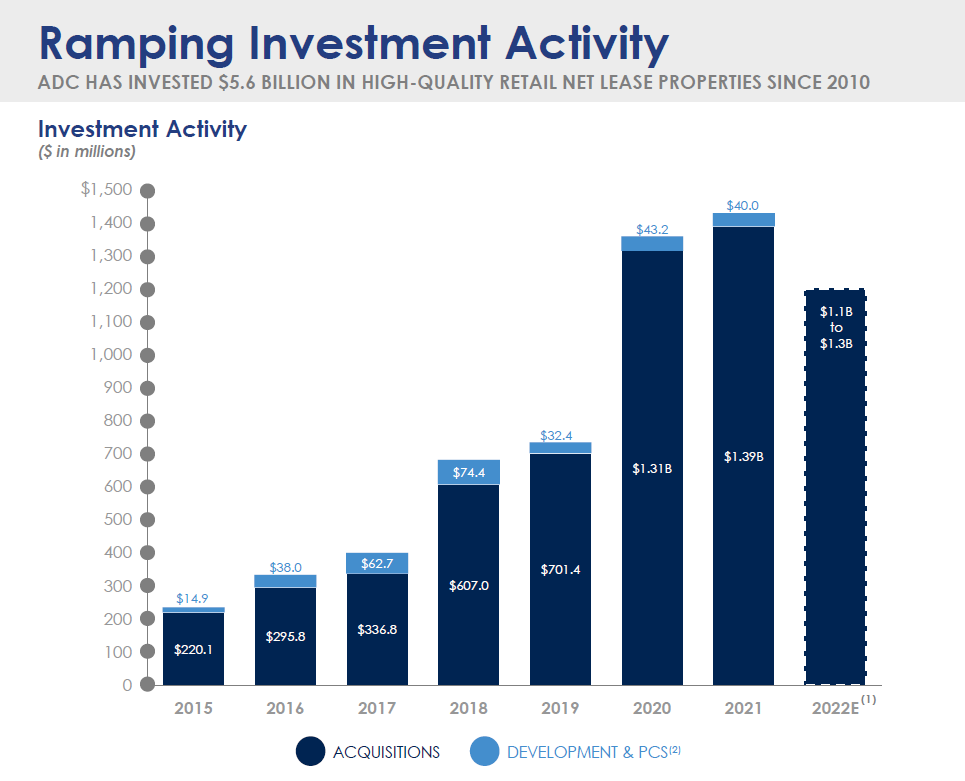

Simon Property has a 5.94% dividend yield. As Figure 3 indicates, SPG has the highest dividend yield among its peers. Its yield is over 260 bps higher than the peer’s average of 3.34%. Agree Realty Corporation’s dividend yield is in a good condition as well. Its yield is 3.87%, which is in line with the peers’ average. A higher dividend yield implies that the stock brings more regular income. On the other hand, the higher the dividend yield, the riskier it may be. Thus, it is crucial to delve deeper to analyze the circumstances that lead to a higher dividend yield. In doing so, I investigate the company’s other metrics like dividend payout ratio and current ratio to take a better picture of SPG and ADC’s returns.

Figure 3- ADC and SPG’s dividend yield vs. peers

Ycharts

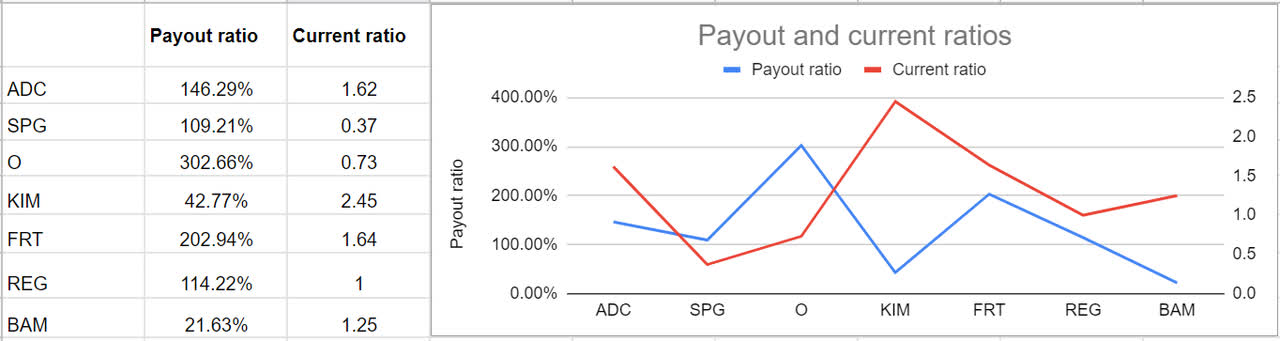

Agree Realty Corporation’s payout ratio is 146.29%, which is 1405 bps higher than the peer group’s average of 132.24%. ADC’s current ratio is 1.62x. Its current ratio is 30% higher than the peer group’s average of 1.24x. Simon Property’s payout ratio is 109.21%, 2921 bps lower than the average. Moreover, SPG’s current ratio is 0.37x, which is far lower than the peers’ average. Briefly, under a lens of balance sheet structure, ADC is performing well, and its management is using the assets efficiently. Furthermore, Kimco Realty Corporation (KIM) has the highest current ratio, and Realty Income Corporation (O) has the highest payout ratio (see Figure 4).

Figure 4- ADC and SPG’s ratios

Author

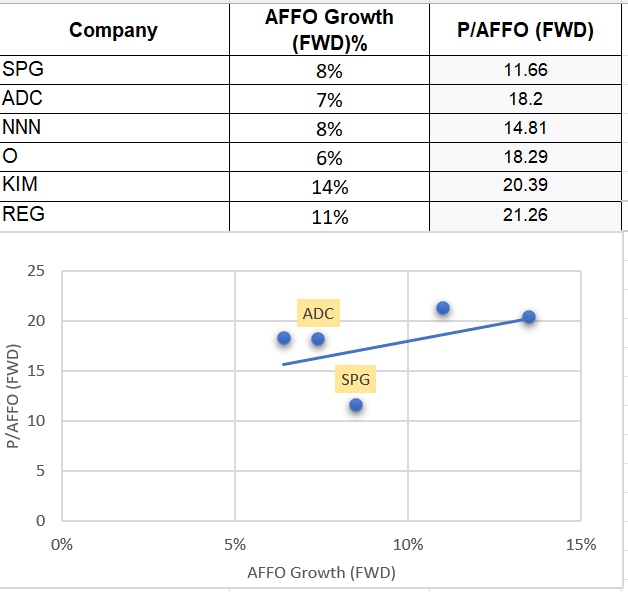

Agree Realty Corporation’s forward AFFO growth rate is 7%. Also, the company’s forward P/AFFO ratio is 7% and 18.2x. On the other hand, SPG has a forward AFFO growth rate of 8% and a forward P/AFFO ratio of 11.66x (see Figure 5). In terms of AFFO growth rate and P/AFFO ratio, SPG is better than ADC.

Figure 5 – ADC and SPG’s forward AFFO growth and forward P/AFFO vs. peers

Author

Valuation

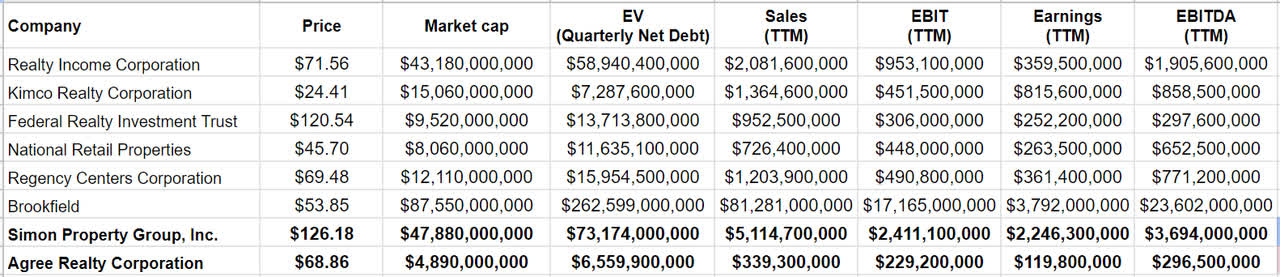

Competitive Companies Analysis (CCA) has been used to evaluate ADC and SPG stocks and estimate their fair value. Comparing Simon Properties Group with its peers and using the CCA method, I estimate that SPG’s fair value is about $159 per share, about 24% upside potential. Also, evaluating Agree Realty Corporation represents that the stock’s fair value is $70.14, in line with its market price. The CCA method is based on real market data and is appropriate for real state companies like ADC and SPG. Also, I considered factors like size, industry classification, and profitability to choose the peer companies. Data was gathered from the most recent quarterly and TTM data (Table 2).

Table 2 – SPG, ADC, and peers’ financial data

Author (based on Seeking Alpha data)

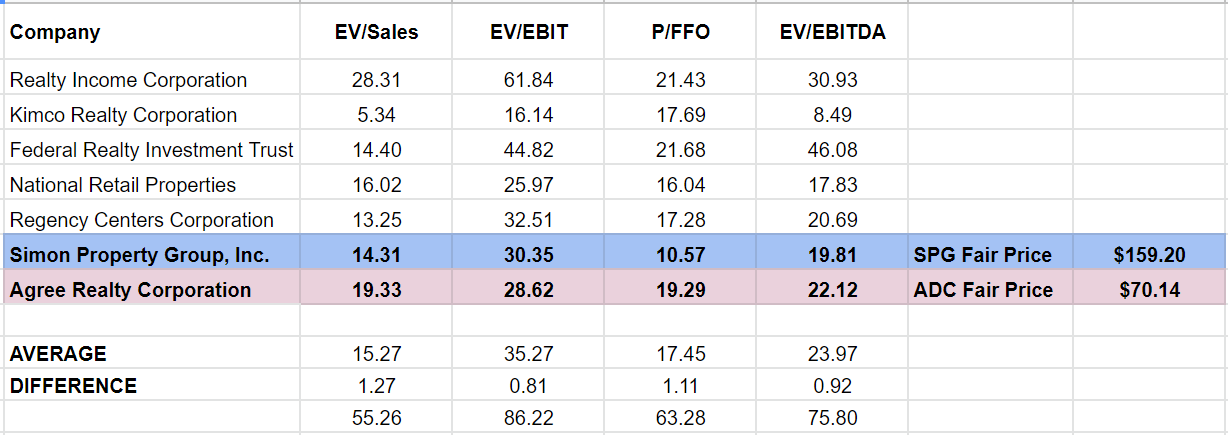

Agree Realty Corporation’s P/FFO ratio is 19.29x, which is 10% higher than the peer group’s average of 17.45x. Moreover, ADC’s EV/EBITDA amount is 22.12x, which is 7% lower than the peers’ average of 23.97x. Generally, it shows that ADC’s share price is lower than its actual worth. Comparing Simon Property’s financial ratios with other peers shows that SPG looks like an appealing stock- its EV/EBIT is 30.35x, and its EV/EBITDA is 19.81x, which are 5% and 11% lower than the peers’ averages, respectively. Conversely, these lower ratios indicate that the stock is undervalued (see Table 3). Apart from SPG and ADC stocks, I have done some analysis on the peer companies as well. Kimco Realty Corporation’s EV/sales and EV/EBIT are 5.34x and 16.14x, which are 62% and 49% lower than their averages, respectively. Thus, the stock may be relatively undervalued.

Table 3- Valuation based on CCA method

Author’s calculations

Risks

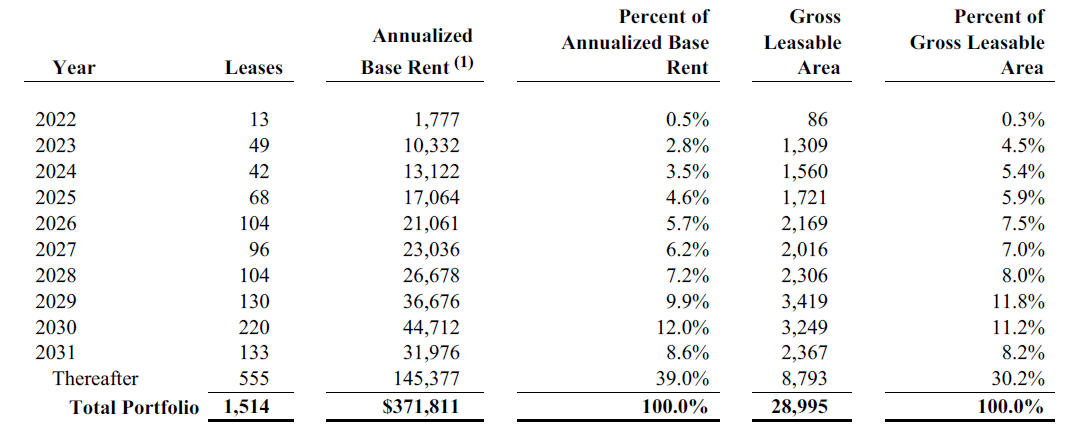

As of December 31, 2021, ADC’s lease maturities represented 0.5% of annualized base rents. Assuming no tenants exercise renewal options, ADC’s 2031 lease maturities represent 39% of annualized base rents (see Figure 6). ADC needs to keep its tenants exercising renewal options. Keep an eye on the company’s news on this subject.

Figure 6 – ADC’s annualized base rent (assuming no tenants exercise renewal options)

ADC’s 4Q 2021 financial report

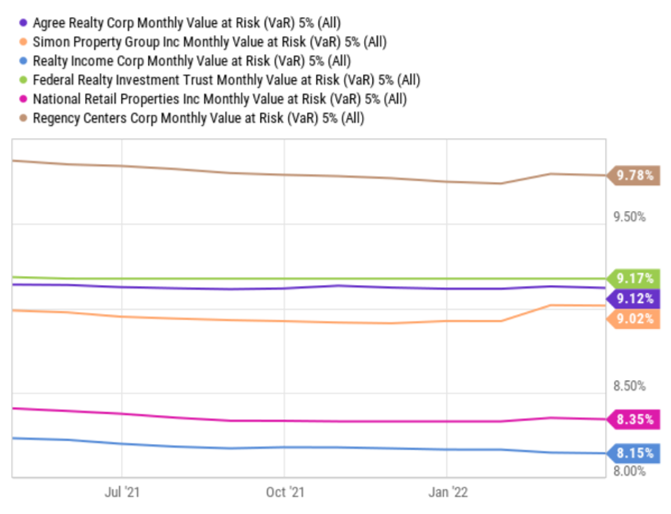

Simon Property and Agree Realty companies’ variable at risk (VAR) measurements are higher than the peers’ average. VAR is a measurement that shows total potential loss through a specific time period. Therefore, it could be a risk to be considered (see Figure 7).

Figure 7 – ADC and SPG value at risks vs. peers

Ycharts

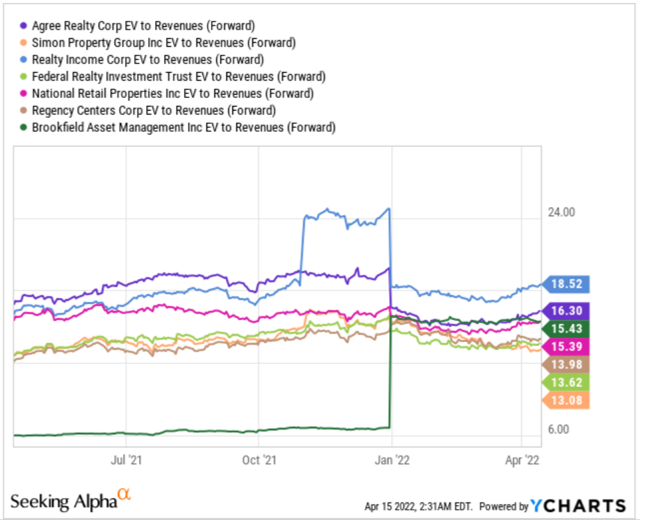

Finally, ADC’s forward EV/Revenue ratio is higher than the peer group. This ratio compares the company’s forward revenues to its enterprise value, and a higher amount signals that the company is overvalued (see Figure 8).

Figure 8 – ADC and SPG’s forward EV/revenues vs. peers

Ycharts

Summary

In a nutshell, based on my valuations and the companies’ financial statements analysis, I evaluate that Agree Realty Corporation stock is worth around $70 per share and Simon Property Group stock is worth around $159 per share. According to their 4Q and full-year 2021 financial results, both stocks performed well in different ways. If you are on board, consider that although ADC and SPG are appropriate choices for growth investors, they are volatile stocks.

Be the first to comment