ipopba/iStock via Getty Images

“Be yourself; everyone else is already taken.” ― Oscar Wilde

Today, we are taking another look at a company in the fintech field. So many have become ‘Busted IPOs‘ with the recent downturn in the overall market. A full analysis as well as recommendation follow below.

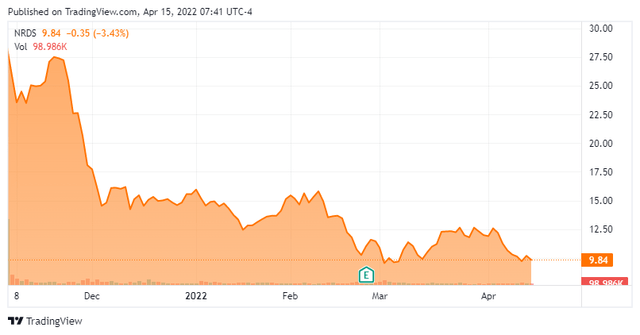

NRDS – Stock Chart (Seeking Alpha)

Company Overview:

NerdWallet, Inc. (NASDAQ:NRDS) is a San Francisco based digital platform that provides information on and access to financial products for individuals and small businesses in the U.S., UK, and Canada. The comparison site and app deliver independent and objective data, education, and guidance on credit cards, mortgages, insurance, personal loans, student loans, banking, investing, as well as small-to-medium sized business [SMB] products free of charge. NerdWallet was founded in 2009 and went public in November 2021, raising net proceeds of $139.6 million at $18 per share. The stock currently trades just under $10.00 a share, translating to a market cap of $675 million.

The company is capitalized by two classes of stock. The 34.1 million publicly traded Class A shares confer one vote per, whereas the 31.7 million privately held Class B shares bestow ten votes per and are convertible into Class A ownership. Owing to this arrangement, Co-Founder, Chairman & CEO Tim Chen controls 91% of the voting power.

Business Model:

While not charging the consumer to use its services, NerdWallet makes money by playing matchmaker, albeit with a long-term view. It prioritizes the user experience on its platform by not simply offering every available financial product – although it works with over 400 financial services partners – but rather by providing unbiased product reviews and decision-making tools that help said user arrive at his or her best option. As such, when it makes a tech-driven recommendation for its users, it engenders greater trust; thus, increasing the likelihood of an endorsed engagement consummating in a transaction. However, NerdWallet does not generate fees only from funded loans, but also collects revenue per click, per lead, and per action from its partners. This approach has resulted in ~16 million monthly unique users on average to its platform in 2020 and ~19 million in 2021. The company has been able to convert these platform visits into over 10 million registered users.

Globally, management believes its total addressable market equals the financial services industry’s advertising spend, which totaled $73 billion in 2021, of which $23 billion was spent on digital advertising in the U.S. NerdWallet’s platform competes with similar but vertical-specific offerings from Bankrate, Credit Karma (KARMA), LendingTree (TREE), and Zillow (Z).

The company’s largest expense line is sales and marketing, which consists of advertising to increase brand awareness, costs to drive traffic to its platform, and related personnel costs. This line comprised 58% of NerdWallet’s FY21 total expenses, with R&D (17%) and G&A (11%) the next largest.

Acquisitions for Expansion

After spending more than a decade building a brand in the U.S., NerdWallet will use the capital provided by its IPO to expand the depth of its offerings and its geographic footprint. To that end, the company moved into the UK with the September 2020 acquisition of Know Your Money, which is a mini-NerdWallet in that market. The cost for this expansion was an upfront consideration of $12.3 million with potential earnouts of $11.0 million over the two years post-close. It followed with an organic expansion into Canada in 3Q21.

To enhance its SMB offerings, the company purchased Fundera in October 2020 for an upfront consideration of $29.2 million with contingent earn-outs up to an additional $66 million

Revenue Disaggregation

The company disaggregates its revenue into three categories covering nine verticals: Credit cards; Loans; and Other. Credit cards are fees from self-described consumer cards. It was responsible for FY21 revenue of $123.8 million, 33% of total and up 58% from FY20.

Loans include personal, auto, and student loans, as well as mortgages. It accounted for FY21 revenue of $126.4 million, 33% of total and up 55% from FY20.

Other includes insurance, banking, investing and SMB products. It contributed FY21 revenue of $129.4 million, 34% of total and up 51% from the prior year.

Stumble After Strong Debut

Shares of NRDS made a strong public debut on November 4, 2021, opening at $23.50 and subsequently trading to $34.44 before ending the day at $28.30. The intraday high and closing prices on that day would mark the top for NerdWallet, which would then experience an eight-session, 47% plunge in late-November and early-December to $14.24. This noteworthy price action was simply post-IPO malaise and not a function of any negative revelations or analyst commentary.

4Q21 Earnings & Outlook

In fact, the company did not make its first earnings announcement as a publicly traded entity until February 24, 2022. On that date, it reported a 4Q21 loss of $0.13 a share (GAAP) on revenue of $99.5 million versus a loss of $0.07 a share (GAAP) on revenue of $56.7 million, representing a 75% improvement at the top line. These results beat Street expectations by $0.06 and $11.8 million, respectively.

4th Quarter Highlights (February Company Presentation)

For FY21, NerdWallet lost $0.82 a share (GAAP) and generated positive Adj. EBITDA of $27.1 million on revenue of $379.6 million versus a gain of $0.09 a share (GAAP) and Adj. EBITDA of $24.4 million on revenue of $245.3 million in FY20, representing a 55% increase at the top line. It goes without saying that business in FY20 was challenging, making for an easy comp, but the company’s FY21 top line still grew at a 29% CAGR from FY19 and a 36% CAGR since FY14. However, the FY21 growth was at the expense of Adj. EBITDA, which declined $17 million from FY19’s $44.1 million result, stemming from a planned increase in marketing spend.

February Company Presentation

Management did provide a financial forecast for 1Q22, which called for Adj. EBITDA of $4.5 million on revenue of $123.5 million (based on midpoints), representing a 37% year-over-year increase at the top line. It did not render a FY22 forecast. Here is the financial forecast for 1Q22:

FINANCIAL OUTLOOK

We are providing guidance for the first quarter 2022:

Revenue is expected in the range of $122 – $125 million, 37% year-over-year growth rate at midpoint

Adjusted EBITDA is expected in the range of $3 – $6 million.

Brand investments will create variability in our quarterly margins, but we expect year-over-year accretion in our 2022 annual Adjusted EBITDA margin.

Although the 4Q21 report was certainly upbeat and better than expectations, all it did was temporarily halt the decline in share price, which later fell below $10 in early-March.

Balance Sheet & Analyst Commentary:

Thanks in large measure to its recent IPO, NerdWallet held cash and equivalents of $167.8 million and no debt as of December 31, 2021. This amount should be enough to allow the company to aggressively expand geographically and deepen its product footprint, both organically and through acquisition, considering it generated net cash from operating activities of $7.2 million in FY21.

As referenced before, Street analysts are not the cause of the protracted decline in NerdWallet, featuring three buys and four outperforms against only one hold and a median twelve-month price objective of $30 – although, the three analysts proffering commentary since the company’s first earnings report have all lowered price objectives to $30 (KeyCorp), $17 (Oppenheimer), and $13.50 (Morgan Stanley). They expect NerdWallet to lose $0.40 a share on revenue of $483.4 million in FY22, followed by a loss of $0.19 a share on revenue of $581.6 million in FY23.

CEO Chen used the considerable and (in his eyes) unjustified fall in his company’s stock to initiate a position in the publicly traded Class A shares, purchasing just over $1.2 million in stock in aggregate during March.

Verdict:

Despite not having tripped over itself out of the publicly traded starting gate, NerdWallet is a victim of the recent yet meaningful shift away from growth stocks in an inflationary environment. Investors modeling companies that aren’t expected to generate positive earnings for several years are compelled to discount those future earnings at higher rates, lowering their present value, and thus the value of the company. NerdWallet is EBITDA profitable but with Street analysts not expecting the company to breakeven on an net income basis until sometime in 2024 (at the earliest), trading at ‘only’ 1.3x FY22E sales when growth is expected to decelerate to 27% (and 21% in FY23) is now not considered ‘cheap’.

Also, in rising rate environments, the cost of financing increases, pushing down demand for financial products from consumers. For example, mortgage refinancings drop, and although NerdWallet’s mortgage platform engages a greater mix of first-time homebuyers, the perception of a falloff in demand is enough to negatively impact its stock. Thus, despite the tailwinds of ever increasing ad dollars earmarked for digital, as well as the company’s expansion into the UK and Canada, the top-line growth expectations over the next two years seem optimistic, especially considering NerdWallet’s current penetration of the domestic market.

As a company with only one quarter under its belt in the public arena, its reluctance to provide a full-year outlook may be prudent, but it does not engender confidence in this highly uncertain environment. As such, we’ll take a wait-and-see approach until NerdWallet provides more visibility regarding its long-term earnings outlook or if signs of inflation’s abatement emerge.

“It’s discouraging to think how many people are shocked by honesty and how few by deceit.” ― Noël Coward

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment