Justin Sullivan/Getty Images News

Agree Realty (NYSE:ADC) is not obviously cheap relative to better known peers, but in exchange for a lower yield and slower growth, the company offers a best in class credit portfolio and a very conservatively managed balance sheet. With the stock yielding 4%, I could see a sizable re-rating occurring over the following years as Wall Street comes to appreciate both the value of net lease REITs following the pandemic, as well as the extra safety provided by ADC’s prudent capital allocation strategy. I rate the stock a buy as one of the few buyable opportunities in the REIT sector today.

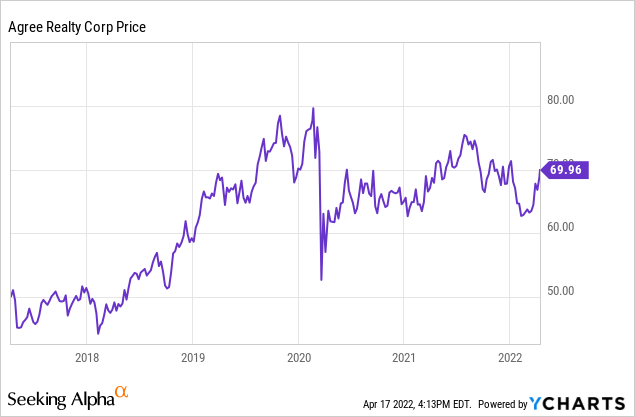

ADC Stock Price

ADC finds itself trading just around $70 per share.

I last covered the stock in October of 2020, when I called the stock a buy due to its relative undervaluation to bonds. The stock has since underperformed the broader market index, largely due to fears that rising interest rates may have on its business model. This fear may represent an attractive buying opportunity.

What is Agree Realty?

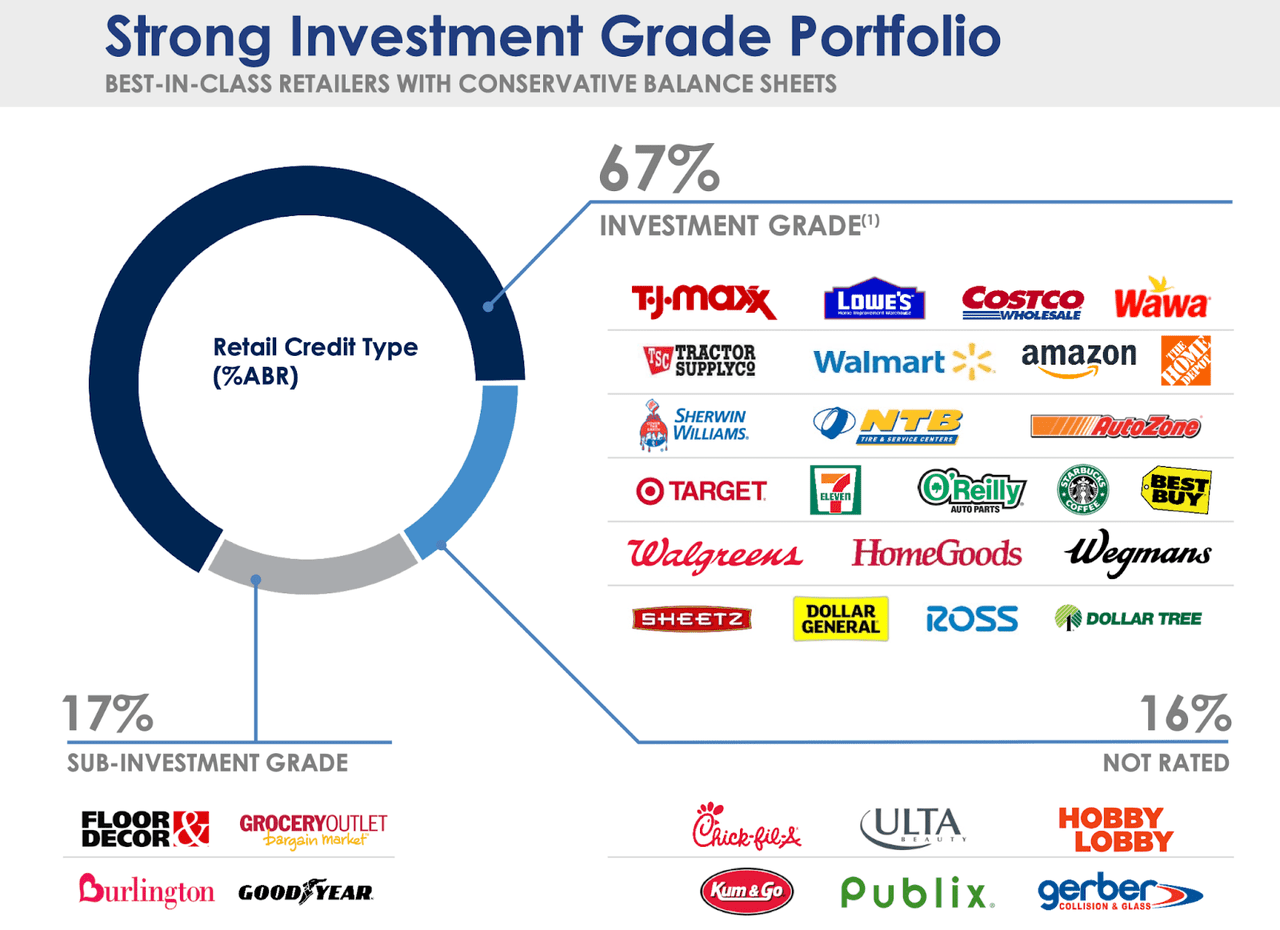

ADC is a triple net lease REIT (‘NNN REIT’). Triple net leases are leases where the tenant is responsible for real estate taxes, insurance, and maintenance expenditures. This kind of lease structure enables ADC to realize high profit margins and makes its business more resemble that of a “real estate bank” than real estate operator. There are many popular NNN REITs including Realty Income (O), STORE Capital (STOR), and Spirit Realty (SRC). ADC is lesser known but that is a shame – the company has differentiated itself from peers due to its high 67% exposure to investment grade tenants.

Agree Realty April 2022 Presentation

We can see below that it ranks much higher than the rest of the pack. I note that NETSTREIT (NTST) is a much smaller operator and Four Corners Property Trust (FCPT) has outsized restaurant exposure – ADC’s best comparable is Realty Income.

Agree Realty April 2022 Presentation

Substantially all NNN REITs performed strongly during the pandemic, facing minimal issues with rent collection even amidst lockdowns. ADC collected 95% of rent even in the worst quarter of the pandemic. I expect NNN REITs to eventually experience significant multiple expansion due to their strong performance during the pandemic, as that represented the ultimate bearish scenario yet their business models continued to excel.

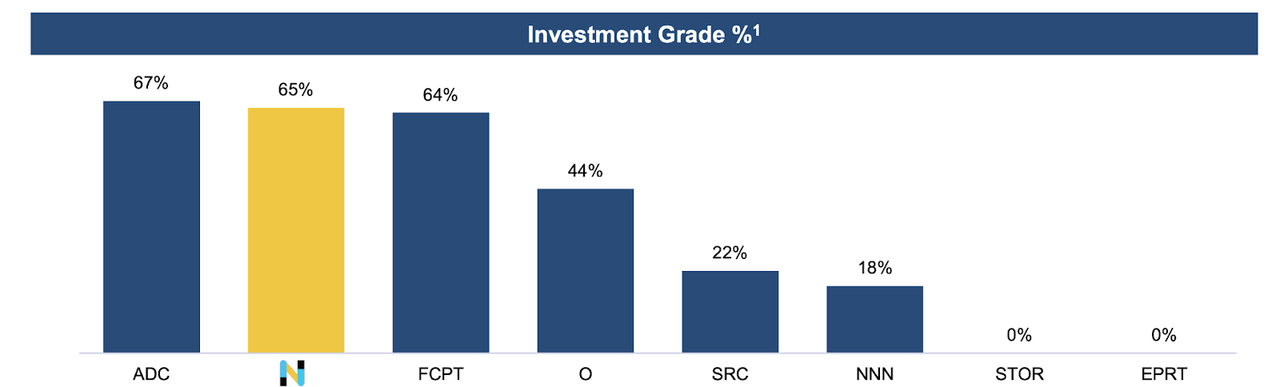

ADC has further differentiated itself through its continued investment in ground leases. Ground leases make up around 14% of total annual rent, with 87% of ground leases being from investment grade tenants.

Agree Realty April 2022 Presentation

Ground leases are interesting because ADC may theoretically be able to drive stronger leasing spreads upon lease expiration. The 12 year weighted average lease term is quite low, and it will be interesting to see whether ADC will be able to realize stronger internal growth due to the ground leases.

ADC Earnings

In 2021, ADC saw AFFO per share increase 9.7% to $3.51. The company has also increased its annualized dividend to $2.808 per share, representing 8% year over year growth.

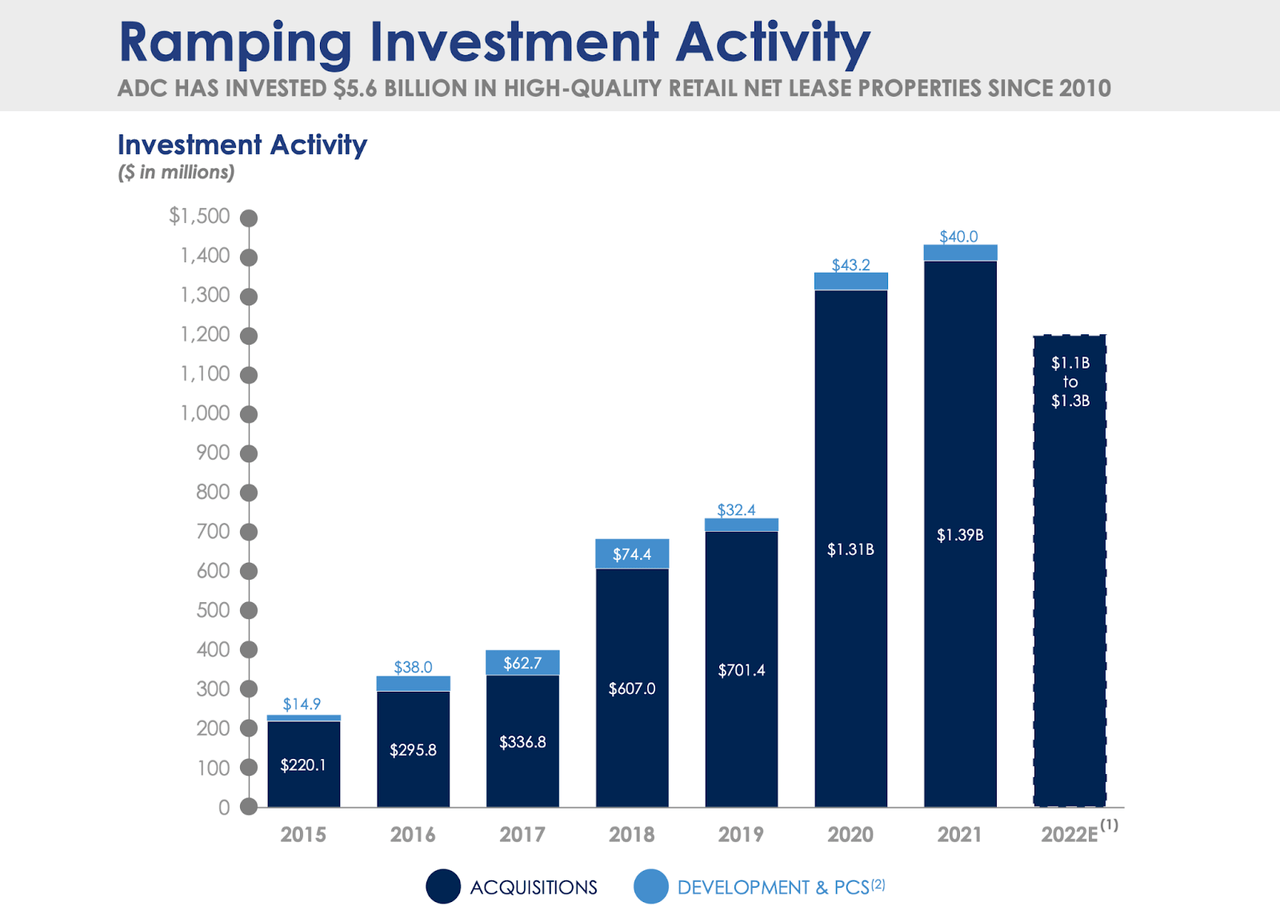

ADC has been able to drive strong growth in recent years largely due to its ramp up of investment activity.

Agree Realty April 2022 Presentation

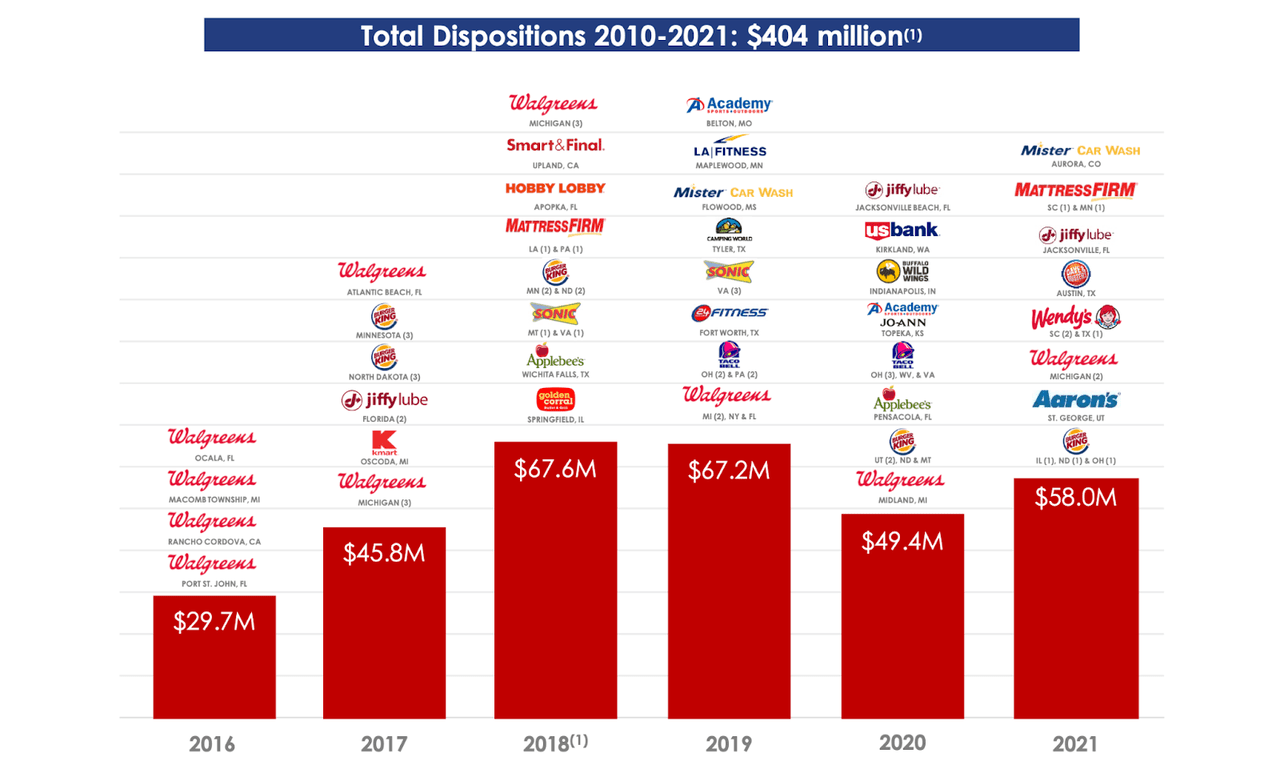

One way in which I have assessed portfolio quality in the NNN REIT space is by comparing acquisition activity with disposition activity. In general, NNN REITs are long term investors and prefer to just keep collecting rents instead of recycling assets. High levels of dispositions in the NNN REIT space often is an indication of poor credit underwriting. In 2021, ADC disposed of only $58 million of assets – far lower than the $1.39 billion of acquisitions. That 4.2% ratio is very close to the 3.9% ratio generated by Realty Income in the same year.

Agree Realty April 2022 Presentation

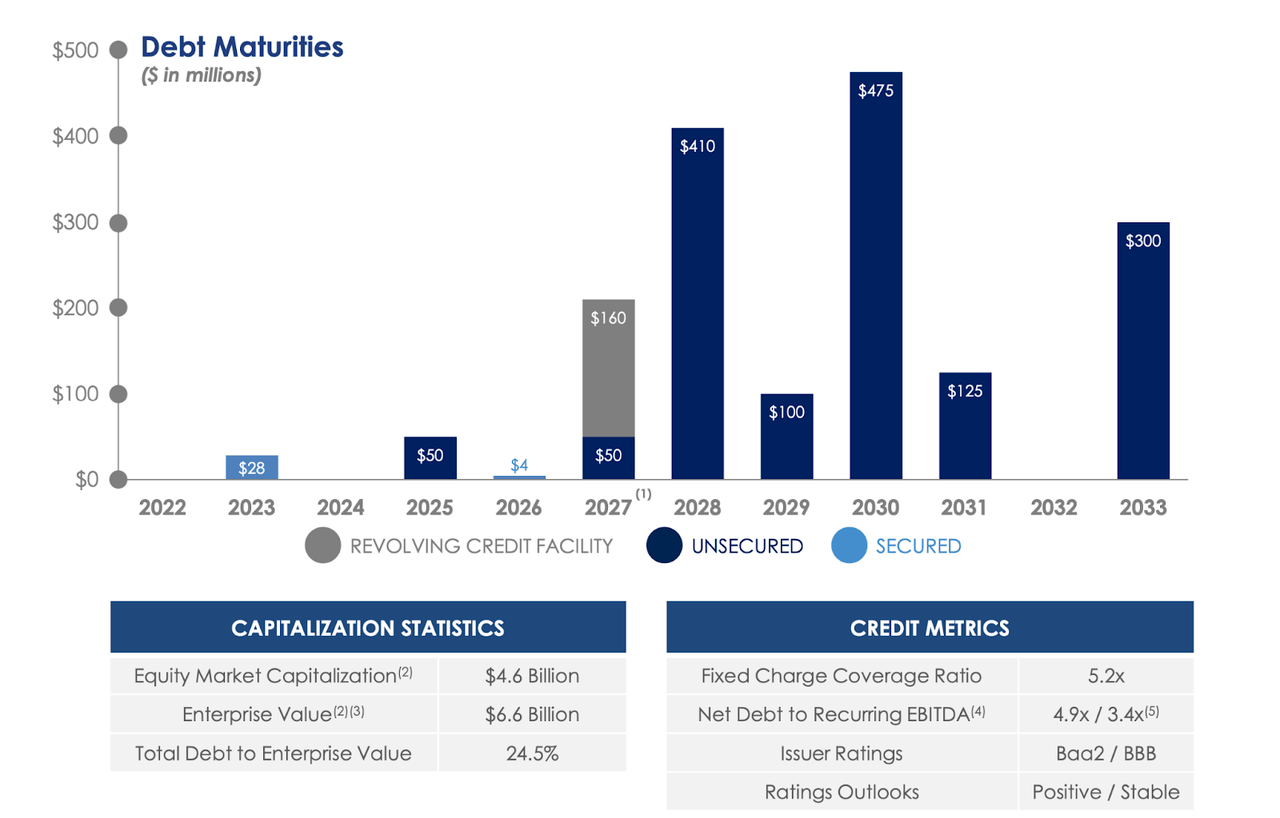

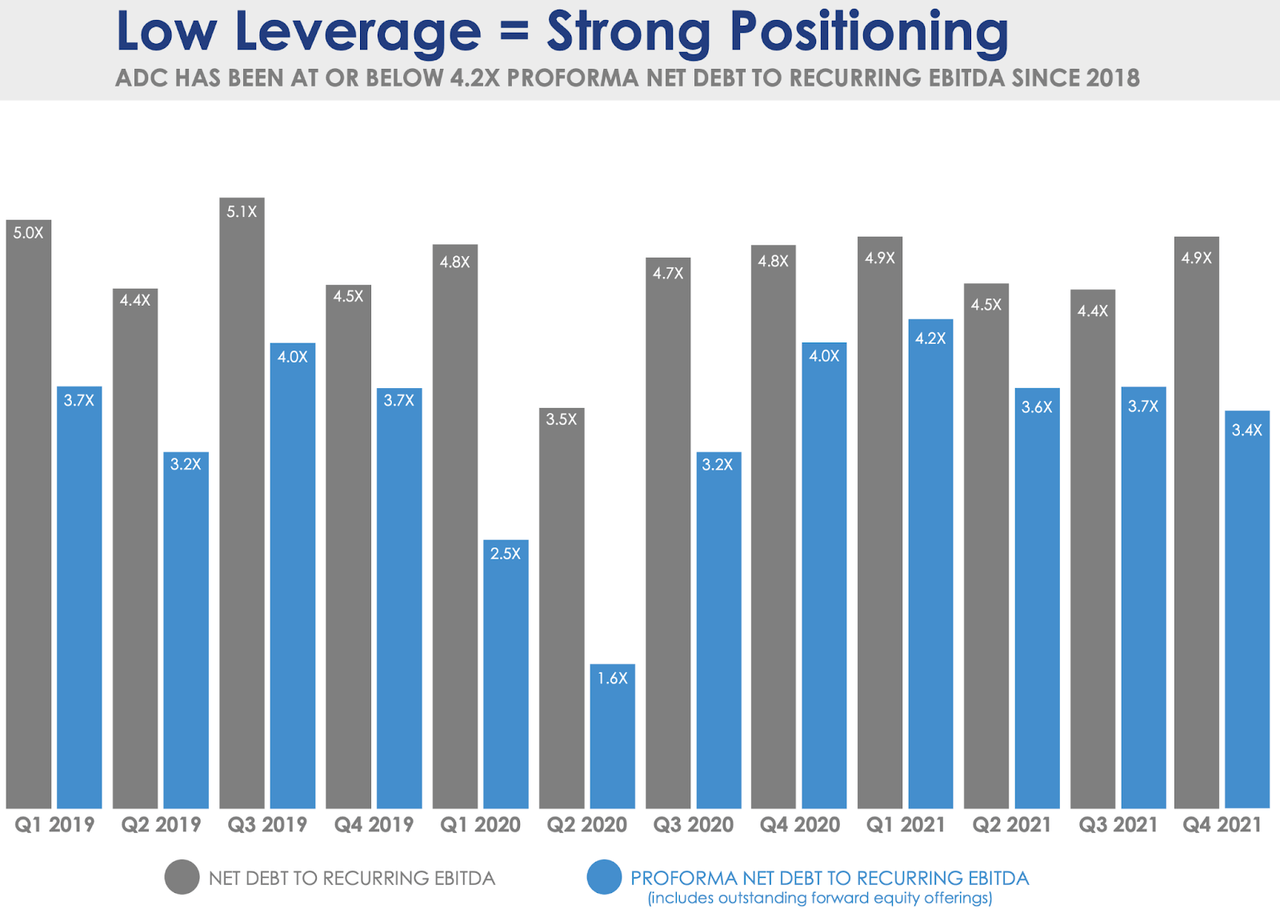

I have already discussed how ADC has differentiated itself through high exposure to investment grade tenants and ongoing investment in ground leases. There is yet another differentiating factor: leverage. Whereas many NNN REIT peers maintain debt to EBITDA multiples around 5.5x, ADC has maintained a 4.9x debt to EBITDA multiple.

Agree Realty April 2022 Presentation

Inclusive of forward equity offerings, leverage should decline to the 3.4x level. We can see below that ADC has historically maintained lower leverage ratios.

Agree Realty April 2022 Presentation

Is ADC Stock A Buy, Sell, or Hold?

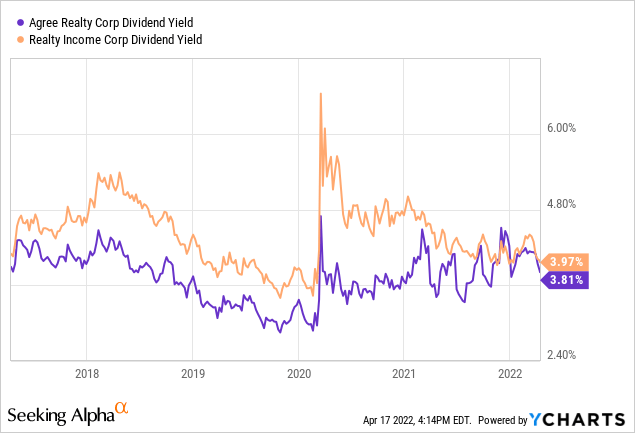

The higher portfolio quality and lower leverage ratios have caused ADC stock to historically trade at rich premiums to Realty Income on the basis of dividend yield. That discount has all but evaporated in recent trading:

Some of that has to do with Realty Income’s anticipated accelerated growth from its acquisition of Vereit, but ADC has guided for high single digit AFFO growth in 2022. The fact that ADC’s leverage ratio is much lower than O while maintaining a higher exposure to investment grade tenants should warrant a premium valuation more in-line with that seen in prior years. Assuming no multiple expansion at Realty Income, I could see ADC trading at a 3% to 3.2% dividend yield. At the high end, that represents around 20% upside from multiple expansion alone. This is the kind of stock that can grow at a 5% clip over the medium to long term, driven by investment activity, annual lease escalators, and perhaps eventually leverage expansion. The main risk to this thesis is that of deteriorating investment sentiment. If ADC’s portfolio credit quality comes under question, then the stock might not be able to maintain a premium valuation on the basis of its lower risk image. The company’s performance has not given any indication that this is of high risk, and I find it more likely that the stock eventually realizes multiple expansion as it is essentially offering a growing dividend yield at arguably low risk. I rate the stock a buy as I view it relatively undervalued to Realty Income and undervalued in its own right.

Be the first to comment