Evkaz

AGNC Investment Corp. (NASDAQ:AGNC) is feeling the effects of widening mortgage-based securities spreads as well as rising interest rate volatility.

The central bank has become extremely aggressive in 2022 in order to tame inflation with higher benchmark interest rates, and it recently hiked interest rates another 75 basis points, which has resulted in a significant valuation haircut for mortgage trusts.

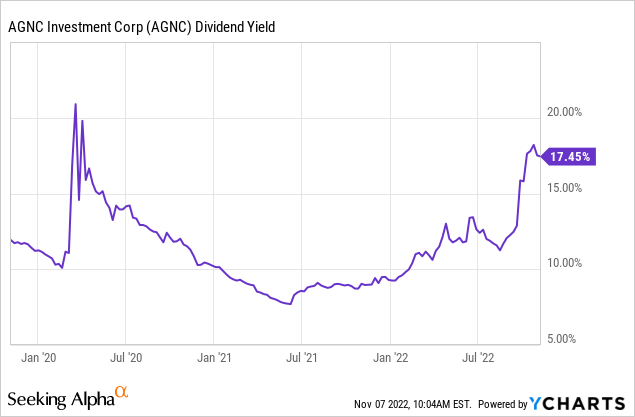

Given AGNC Investments’ higher interest costs and ongoing book value pressure, I believe the 17.3% dividend yield is a major red flag, and yield seekers should avoid buying the drop for AGNC.

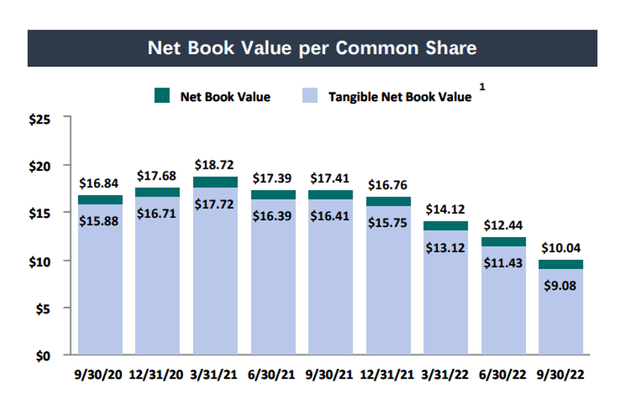

AGNC Reported Yet Another Big Drop In Book Value

AGNC Investment’s book value was slashed in the third quarter as interest rates remained volatile, spreads in the MBS market widened, and interest costs rose.

All three factors wreaked havoc on the mortgage trust sector, including AGNC Investment, which reported a 19% QoQ drop in book value. The mortgage trust’s book value has dropped by 40% since the end of 2021, and as I pointed out in my article Annaly: A Trail Of Blood, the mortgage trust sector may be in for more pain as long as interest rates remain near 40-year highs.

Net Book Value Per Common Share (AGNC Investment Corp)

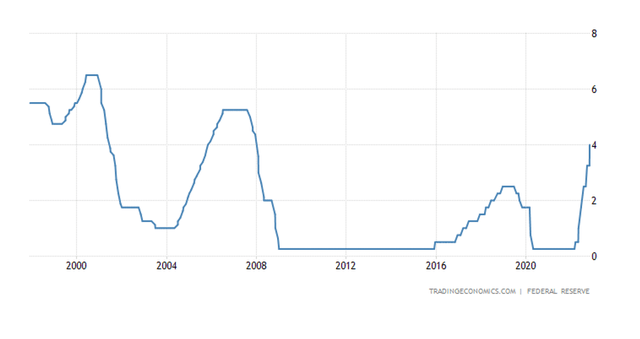

Central Bank Intervention And Policy Risk

In the first week of October, the central bank raised its benchmark interest rate by 75 basis points, the fourth 75-basis-point increase in 2022. This year, the central bank has begun an aggressive rate hike cycle in order to counteract 40-year high inflation rates, which have wreaked havoc on the stock market and are harming consumers as well as investors. Interest rates are now set at 3.75%-4.00%, the highest level since 2008.

Interest Rates (Tradingeconomics.com)

Fed Chair Jerome Powell’s comments strongly suggest that the central bank will continue to raise interest rates, albeit at a slower pace in the future.

Despite rising inflation and growing concerns that the United States’ economy will enter a deeper and more painful recession, the labor market remained resilient in October. According to the most recent labor market report, 261K new jobs were created in October, giving the central bank carte blanche to raise interest rates even further.

Discount To Book Value Set To Grow Larger

AGNC Investment faces significant book value risks. The mortgage trust’s stock is currently trading at a 17% discount to book value, but investors should not believe that the current pricing situation cannot worsen.

As long as the central bank’s interest rate hikes remain aggressive, investors must accept that AGNC Investment will have to absorb additional book value losses.

AGNC’s 17.3% Yield Accurately Reflects Heightened Book Value Risks In A Highly Volatile Interest Rate Environment

The central bank’s aggressive rate hike cycle may put significant pressure on the mortgage trust’s book value in the future, which is why I believe AGNC Investment’s book value cannot be trusted.

The 17.3% yield also suggests that the market does not believe AGNC Investment’s book value losses have ended, which should be a huge warning to income investors.

Why AGNC Investment Could See A Lower/Higher Valuation

To see higher stock valuations and book values for AGNC Investment and other mortgage real estate investment trusts, the central bank would have to stop raising interest rates and create more predictability for investors about the short-term path of interest rates. This is unlikely to occur because the central bank’s policy is dependent on inflation rates remaining elevated for an extended period of time.

A weakening labor market, on the other hand, would likely cause the Fed to ease off the gas and reduce rate hikes, potentially leading to a repricing of mortgage trusts.

My Conclusion

A 19% drop in book value in just the last quarter, in my opinion, is so disastrous that investors can’t have any real confidence in AGNC Investment’s book value. The same is true for the trust’s excessive 17.3% yield. If the Fed continues to raise rates, which is likely, AGNC will face new book value losses and possibly a lower dividend. Since the end of 2021, the mortgage trust’s book value has dropped by 40%, representing unprecedented value destruction.

Furthermore, as interest rates rise, I expect pressure to mount on AGNC Investment’s net interest spread.

The stock is currently trading at a 17% discount to book value, which, in my opinion, is insufficient to compensate for the risks associated with an investment in this specific mortgage real estate investment trust.

Be the first to comment