peshkov

Thesis

AGNC Investment Corp.’s (NASDAQ:AGNC) Q3 release corroborated our conviction that a significant level of pessimism has been reflected in its current valuation.

We highlighted in our previous article that panic sellers had thrown in the towel, bailing out of the mREIT. With its portfolio heavily weighted toward agency mortgage-backed securities (MBS), management also attributed it to the de-rating moves (in driving liquidity) by the market ahead of other fixed income securities.

Despite reporting a tangible book value per share (TVBPS) metric that came in well below its previous quarter, AGNC held its recent lows robustly. Wall Street analysts further slashed forward estimates on its TBVPS, reflecting significant headwinds from the Fed’s aggressive rate hikes.

Therefore, we postulate that the buying opportunity for a potentially significant mean-reversion setup looks highly appealing. Its valuation and price action also remain highly constructive, despite the slashed forward estimates and market pessimism.

Management was also confident during the earnings call, accentuating that the current opportunity looks “undeniably attractive.”

With AGNC’s price action still forming a base and yet to take off, we encourage investors still biding their time to add more exposure. Notwithstanding, we need to remind investors that the upcoming November FOMC could introduce unexpected downside volatility if Powell and his team find a way to upend the bullish thesis. Hence, investors should be prepared for a potentially highly volatile week ahead and keep spare ammunition.

We reiterate our Speculative Buy rating on AGNC and maintain our medium-term price target of $10.

AGNC’s Estimates Were Slashed Further

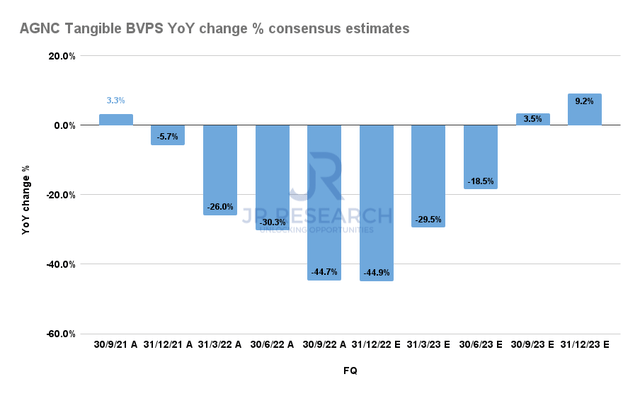

AGNC Tangible BVPS change % consensus estimates (S&P Cap IQ)

AGNC posted a TBVPS of $9.08 in Q3, impacted further by market volatility amid the Fed’s increasingly hawkish posture. Hence, it led to a -44.7% YoY growth and a 20.6% decline from Q2.

The company had already guided its BVPS outlook in its Q3 prelim release in early October. Hence, the market wasn’t surprised by the performance. However, Street analysts turned increasingly cautious as they slashed its forward estimates, factoring in an increasingly hawkish Fed into their projections.

As seen above, the revised estimates indicate that AGNC could post a BVPS decline of 45% YoY in Q4. However, it implies only a 4.4% QoQ decline.

Therefore, we postulate that Street analysts have considered the potential for the Fed’s terminal rates peaking in Q4’22/Q1’23 before pausing or reversing. The forward Fed Fund rate (FFR) has also priced in a 5% terminal rate by the end of Q1’23 or early Q2.

Therefore, unless Powell and his team have markedly different ideas from the current market expectations, we postulate that the recent panic selloff should have formed its medium-term bottom.

Management also telegraphed its conviction in the earnings call, as CEO Peter Federico articulated:

It is important to understand the unique opportunity that we believe is on the other side of this historic repricing event. When you look at (Agency MBS) returns where they are today, you have to say this is potentially a once-in-a-lifetime return opportunity. Even adjusting for the current level of rate volatility, spreads on Agency MBS are compelling. And when rate volatility ultimately settles, Agency MBS will materially outperform. Moreover, this recovery could be very rapid. (AGNC FQ3’22 earnings call)

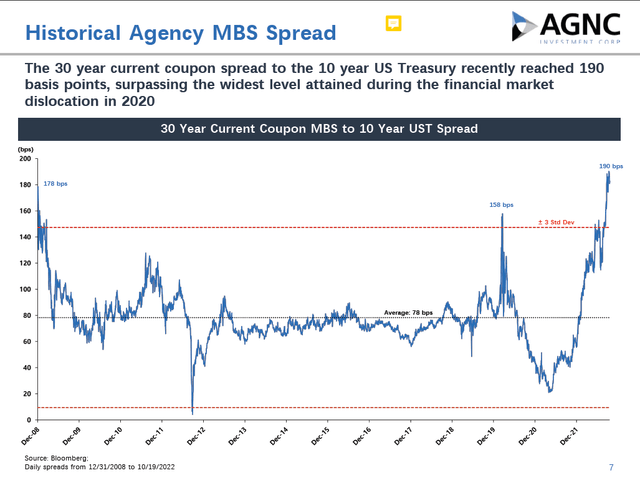

Agency MBS spreads Vs. 10Y yields historical spreads % (‘AGNC’)

We are in the Fed pause/pivot camp. Therefore, we concur that the Fed could be nearing the end of its rate hikes as the economy stumbles toward a recession.

Management also highlighted that the Agency MBS spread (as seen above) exceeded levels last seen in the 2007/08 financial crisis, well above its long-term average of 78 bps. Therefore, it augurs well for management’s confidence in a significant mean reversion opportunity in the works.

But does the price action support the thesis?

Is AGNC Stock A Buy, Sell, Or Hold?

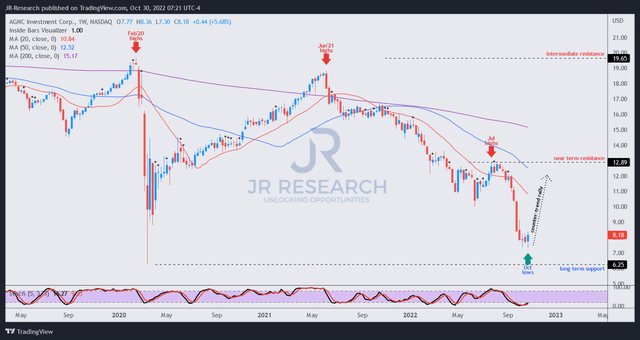

AGNC price chart (weekly) (TradingView)

Despite slashed forward estimates by the Street, AGNC’s bottoming process remains robust. Therefore, if bad news didn’t “kill” its consolidation, we postulate that buyers are likely accumulating.

Before they push the prices markedly higher to revert the skewed reward-to-risk profile from these levels, we encourage investors to go on board. Of course, the market is likely anticipating an in-line FOMC press conference (aligned with the market’s expectations of FFR peaking at 5% in early 2023).

Given the uncertainties, we deduce that the market is still tentative about re-rating AGNC markedly higher from here. But, we see an attractive reward-to-risk profile skewed toward the upside from these levels.

Hence, we urge investors to look past the market pessimism and follow AGNC’s bottoming process.

We reiterate our Speculative Buy rating on AGNC.

Be the first to comment