lozanona/iStock via Getty Images

Barron’s Lead Story: April 9, 2022

The lead article in Barron’s blared: “Retail Crime is Hurting Companies and Making Inflation Worse. What Investors Should Know.”

Barron’s makes three salient points:

- Crime is a top issue facing retailers.

- While crime is up, there has been a “yearslong trend in decreasing punishment for shoplifters.”

- Retail crime is a “National Crisis.”

Retailers are telling investors about the cost of retail crime. Barron’s cited the CEO of Walgreens Boots Alliance, Inc. (WBA) who told analysts in January that pilferage is up 52% compared to two years ago.

The “national crisis” facing retailers is deeply disturbing at multiple levels.

Emerging Risk: The Decline and Fall of the American Ethos

In the immediate aftermath of the Great Financial Panic of 2008-2009, I chaired the Emerging Risk Committee for a large U.S. bank.

Call me an old school fuddy-duddy, but if I were in that role today, I would escalate an emerging risk for board and executive debate and discussion.

That risk: A decline in the standards of moral behavior long associated with what I call the “American Ethos.”

Merriam-Webster defines “ethos” as “the distinguishing character, sentiment, moral nature, or guiding beliefs of a person, group, or institution.”

The American Ethos is shaped by stories about people like George Washington who, legend has it, got a new hatchet for his sixth birthday. Young George promptly chopped down a family cherry tree. When confronted by his father, George responded, “yes I did it.” Impressed by his son’s integrity, Mr. Washington responded calmly, telling George and generations of Americans that honesty was worth more than a thousand cherry trees.

Then there is Abraham Lincoln. As a young man he worked as a store clerk. Having discovered he overcharged a customer six cents, “Honest Abe” walked three miles to the customer’s home to return the money. For more than a century, stories about Lincoln taught school-age children lessons of personal accountability to right a wrong.

More recently Martin Luther King, Jr. extolled the virtue of “character,” teaching children and Americans of all ages that “dignity and discipline” in pursuit of freedom and justice are hallmarks of the American Dream.

The American Ethos centers on honesty, personal accountability, character, and justice for all. It is this system of beliefs that constitutes the very foundation of the U.S. economy.

Retailers are not alone in their exposure to a permanent decline in the American Ethos. Banks are at risk, too. While this risk is systemic to all banks, it is especially acute for lenders to the broad swath of Mass Market borrowers.

Character Matters: The “Five C’s of Lending”

Every banker is (or should be!) taught the “Five C’s of Lending.”

- Character

- Capacity

- Collateral

- Capital

- Conditions

The most important “C”? Character.

A nation built on a bedrock of national and individual character is a nation where banking can thrive.

Factors Contributing to High and Increasing Moral Hazard Risk

I offer several observations supporting the risk of a decline in American’s north stars of character and personal accountability.

Policies promulgated at the state and federal government, while well-intended and necessitated by exigencies associated with COVID-19, may be directly contributing to a decline in Americans’ deep-rooted sense of personal accountability.

- Retail Crime Surge: As noted above, the rise in retail crime seems linked to a drop in prosecution. The Hoover Institution noted in August 2021 that “Shoplifting is Now De Facto Legal in California.”

- Student Lending: On April 6, 2022, President Biden extended, yet again, the Student Loan “payments pause” until August. In 2022, student loans total $1.75 trillion. For perspective, per the FDIC, total bank credit card loans as of YE 2021 were $871 billion, auto loans $537 billion, and unsecured consumer loans $473 billion.

- Rental Eviction Moratorium: First introduced by Congress in March 2020, rent payment moratorium remained in place through August 2021; if President Biden had his way, the moratorium would have been extended past August.

- Government Transfer Payments:

- Through February 20 of this year, there has been $789 billion in Payment Protection Plan loan forgiveness.

- The IRS reported in January that it has “successfully delivered more than $1.5 trillion to people across the nation through Economic Impact Payments, tax refunds and advance Child Tax Credit payments.”

Bank Loans Look Healthier Than Ever for a Reason

FDIC reports indicate banks at year-end 2021 had the best credit numbers in modern history. Humm, any chance these sterling numbers might have something to do with Fed and Federal government intervention?

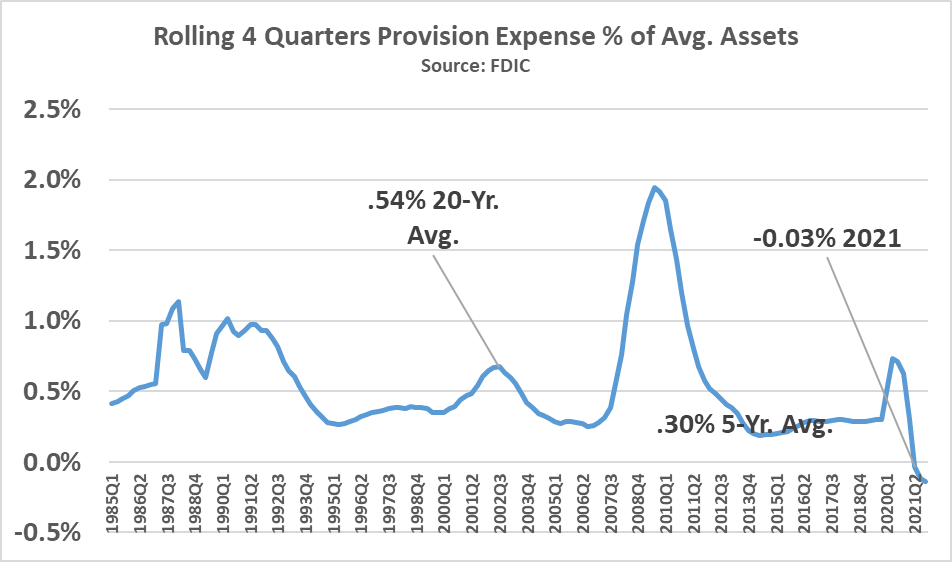

This next chart will look familiar to readers of my April 7 article about upcoming first quarter 2022 bank earnings.

Take a careful look at the trend line. Note that the Provision expense (i.e., banks setting aside capital for future charge-offs) turned negative in 2021. This is truly bizarre.

Provision Expenses % of Assets (FDIC)

Two factors drive the unprecedented decline of Provision expense into negative territory. Both are one-time events.

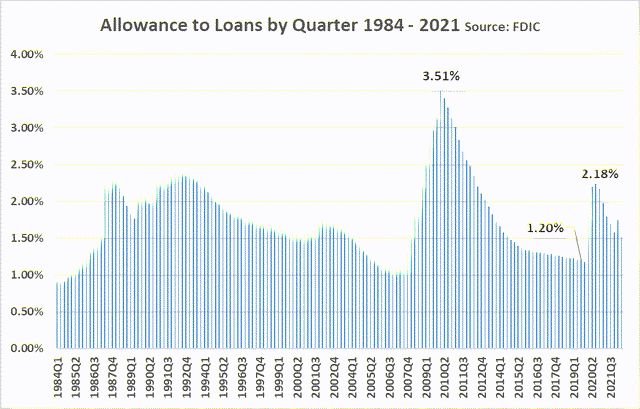

First, the ill-timed (and ill-advised) introduction of a new accounting standard (“Current Expected Credit Losses“) pumped up the Allowance for Loan and Lease Losses in 2020. This accounting action occurred independent of Covid-19 in 2020. As the next chart shows, CECL contributed to a near-doubling of the Allowance to Loan ratio in 2020. As Covid economic concerns waned in 2021, and credit worries abated, banks reduced Allowance by reversing Provision expense.

Second, and more importantly, the Federal government and Federal Reserve inflated the economy in 2020-2021 (and now in 2022 with Student Loans) with easy money. See student loan deferrals, rent moratorium, and $2.3 trillion in government transfer payments.

Allowance (FDIC)

Bank Risk Profiles

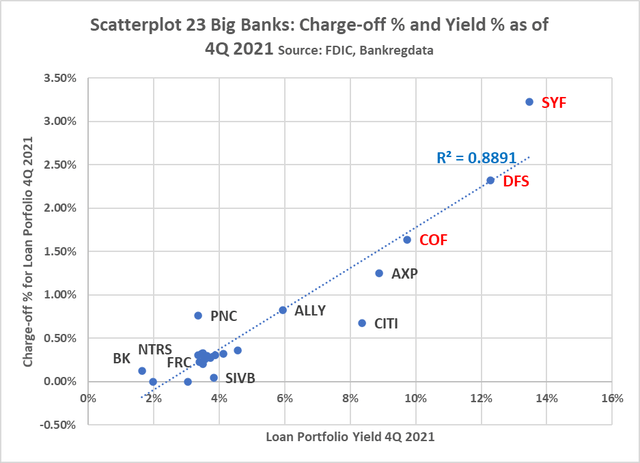

You might find this next chart interesting given industry credit quality metrics. It offers a simple picture of how risk profiles vary among 23 large U.S. banks.

The scatterplot is from 4Q 2021 FDIC data. It shows:

1) The average yield of each big banks’ loan portfolio in 4Q 2021 (X-axis)

2) The charge-off ratio (Y-axis) for the same banks. Footnote: The chart reflects bank subsidiary numbers, not the holding companies.

Yield & Charge-offs 4Q 2021 (FDIC, BankRegData)

Observations from the chart:

- Note the trend line showing an r-squared of .89.

- The high r-squared indicates a strong correlation between yield (i.e., return) and charge-offs (i.e., risk).

- Four banks–Bank of New York Mellon (BK), Northern Trust Corp. (NTRS), First Republic Bank (FRC), and SVB Financial Group (SIVB)–show no or little recent loss history; all four have lower yielding loan portfolios.

- Three banks whose primary business is credit card lending–Synchrony Financial (SYF), Discover Financial Services (DFS), and Capital One Financial Corp. (COF)–have the highest yields and charge-offs.

- American Express Co. (AXP), Citigroup Inc. (C), and Ally Financial Inc. (ALLY) have risk appetites more aggressive than the industry’s conservative banks but moderate compared to SYF, DFS, and COF.

- Megabanks JPMorgan Chase & Co. (JPM), Bank of America Corp. (BAC), Wells Fargo & Co. (WFC), and U. S. Bancorp (USB) are among the banks clustered around a .25-.40% charge-off rate and 3%-4.5% loan portfolio yield.

Historic Charge-offs for Three Banks with More Aggressive Risk Appetites

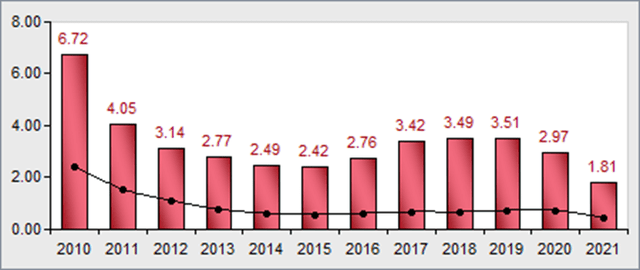

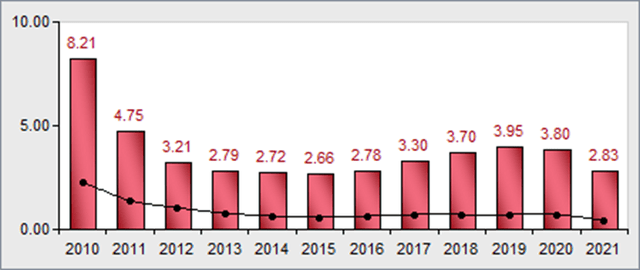

Let’s expand the view of charge-off history by examining data from 2010 to 2021 for Synchrony, Discover, Cap One, and ALLY. The four charts that follow compare each bank’s charge-off history (see bars) compared to peers (see trend line). All data is from the FDIC as documented by BankRegData.

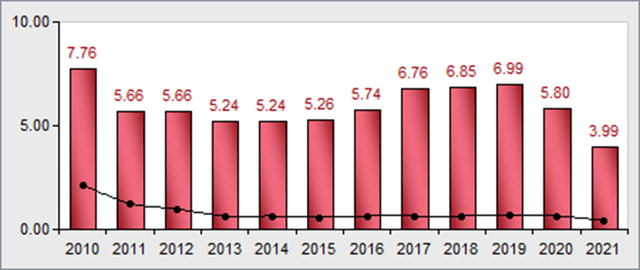

The chart below reflects the amount of charged-off loans and lease financing receivables debited to the allowance for loan and lease losses for the fourth quarter of each year. % Annualized.

From the charts:

- For the three card lenders, credit numbers in 2021 were wildly better than metrics from the prior ten years.

- Excluding 2021, charge-off rates since 2010 averaged ~6%+ for Synchrony.

- Capital One’s charge-off rate in 2021 was half the run rate from the 2010-2020 average.

- Discover suffered from the biggest charge-off rates of the four banks in 2010 but appears to have trended downward more than the Synchrony and Cap One since that time.

Synchrony Loan Charge-offs Year-to-Date. Source: FDIC/BankRegData

Synchrony Charge-offs (FDIC, BankRegData)

Capital One Loan Charge-offs Year-to-Date. Source: FDIC/BankRegData

Capital One Charge-offs (FDIC, BankRegData)

Discover Loan Charge-offs Year-to-Date. Source: FDIC/BankRegData

Discover Charge-offs (FDIC, BankRegData)

Industry-Leading Returns Not Sustainable

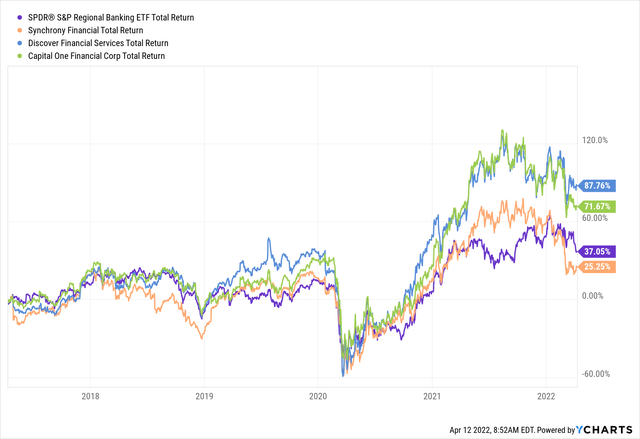

Here is one final chart. It shows total returns since April 2017.

The three large banks with more aggressive risk profiles show five-year average total return nearly double (62%) that of regional banks (37%). In other words, risk-taking generates superior returns.

Of course, superior returns for aggressive lenders make sense when the Fed and the Federal government juice the economy.

However, absent more government largesse, the aggressive lenders’ industry-leading returns are not sustainable. In fact, a correction is already underway.

Five-Year Total Returns for SYN, COF, DFS, KRE

5-Year Total Returns (YCharts)

Investment Implications: 2022-2023

Recession risk is on the rise as the Fed attempts to beat down inflation. Research I conducted for my 2016 book about bank investing clearly showed that bank earnings and stock prices fall during recessions.

And investors who think high inflation is good for bank stocks may want to read my 2021 Seeking Alpha article about Inflation Risk. The average bank in my study saw its stock price drop 54% from YE 1972 to YE 1974.

Given my conservative investor risk appetite, I find two compelling reasons to avoid banks with aggressive risk profiles in 2022:

- Increased probability that charge-offs will begin to revert to normal trends in 2022 as the boon from government stimulus fades away.

- Increased probability for recession risk given an inverted yield curve, inflation, and the war in Ukraine.

Investment Implications: 2024 and Beyond

As a rising tide lifts all boats, an ebbing ethos has the potential to lower bank earnings for all banks over time.

A decline in the American Ethos could be a game-changer for banks with business models geared around aggressive unsecured lending (i.e., credit card).

Lenders most vulnerable are those that extend unsecured credit to borrowers whose FICO scores are below the U.S. average of 716.

If the decline and fall of the American Ethos proves real, banks will eventually see a spike in credit defaults and charge-offs. In response, banks will reduce their risk profiles by cutting back on aggressive lending. The cutback in lending will mean declining earnings assets (loans) and shrinking net interest margins.

Final Thoughts

As I weigh the balance between risk and reward, I am avoiding banks with aggressive risk profiles in favor of more conservative banks.

In closing, I find myself reflecting on sage counsel I received early in my banking career: “There are old bankers, and there are bold bankers, but there are not old, bold bankers.”

A 2022 corollary: “There are old bank investors, and there are bold bank investors, but there are no old, bold bank investors.”

Be the first to comment