Leon Neal/Getty Images News

I’m not a huge fan of GlaxoSmithKline (NYSE:GSK) and the way it’s been performing over the past 10 years or so. To be clear, the last 10-year average returns for the company are less than 2% CAGR.

While the recent set of results since early 2021 might look impressive, it’s important to point out that this was mainly a reversal from a crash that occurred with COVID-19.

So what we have at this time is a GSK that’s valued at a close to 10-year ATH. This is not necessarily a good thing or a good time for investing.

With that said, let’s look at the recent set of results.

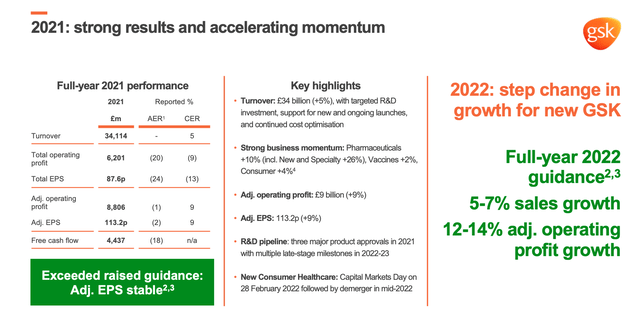

GlaxoSmithKline – Recent Results

In my earlier articles, I’ve pointed to both the upsides and downsides to GSK – because there’s plenty of both of these. On the plus side, you have a great set of fundamentals with a 48% straight pharma, 24% vaccine, and 28% consumer health exposure. This is really a good mix and one that can technically handle a lot of the ebb and flow in the sometimes volatile markets the company is in.

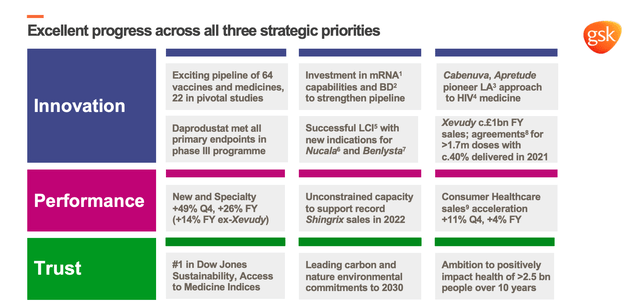

GSK also has a lot of growth in HIV, which is expected to grow mid-to-high single digits, to look at pharma specifically. The company is also a major player in the vaccine category and is a major player in consumer health at a #2nd place after the market leader Johnson & Johnson (JNJ). In Vaccines, the Shingrix vaccine against shingles is seeing some really good numbers as well.

So, there is an upside there – and there are positives.

But there are also some significant risks to consider.

Management in GSK is a problem and hasn’t been positive for years. Looking at the company’s share price, this is not a strange thing to happen after 10 years of a 2% CAGR. The current CEO, Emma Walmsley, hasn’t been able to pivot or bring fresh air to GSK either.

The company has very poor pipeline productivity on a historical basis, which has had the tendency to really screw company earnings sideways. Costly R&D years with little to show for it, a portfolio of legacy drugs In steady decline, and a near-zero presence in markets that present growth opportunities for other companies have left GSK on the negative side of “Unappealing” for a long time.

The one geography which was considered high growth at one point, China, is no longer that. After a massive corruption scandal back in 2013, the company has faced no shortage of headwinds in the nation – and is just recently starting to turn things around.

Those are some of the fundamental drawbacks to GSK – so you see that despite some good fundamentals, there are also some significant downturn potentials here.

COVID-19 has been a net benefit to GSK, thanks to COVID-19 treatment initiatives and related cost-cutting on the side of GSK. These upsides mainly had the role of really offsetting the significant negatives in non-COVID-19 areas that GSK was facing over the past few years.

However, 2021 was a solid year for GSK, really confirming some of the fundamental plusses I’ve mentioned here. That’s why GSK has been doing so well.

The company even gave us 2022 guidance, where the company expects excellent overall results from the coming year. Overall, it can be said that GSK is currently outperforming on the basis of two factors.

First, and as I mentioned, GSK has delivered solid earnings for the full year of 2021. Secondly, more changes are coming that could significantly change GSK’s near-term and longer-term earnings profile. It’s my stance that investors and analysts are already assuming these possibilities to be realized, and for these forecasts to be accurate.

It’s important for me to point out that many of these earnings-related upside results come from non-recurring sources, such as COVID-19. While some of these shortfalls will eventually be weighed up by recoveries in non-COVID-19 treatment areas, these still represent uncertain upsides.

The non-COVID-19 positives are less substantial. The appointment of new research heads and rotation in management is positive, but have yet to yield real, positive results and concrete implications for the long term.

Upsides are visible across all of the company’s business segments.

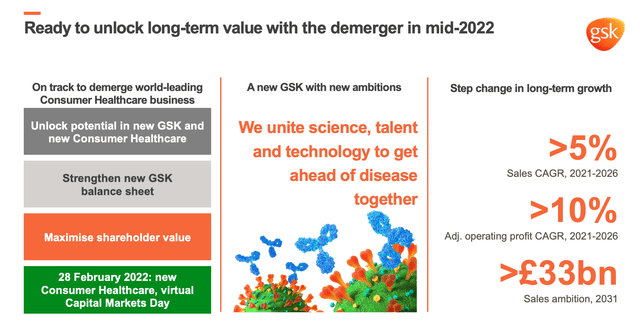

GSK’s plan is to de-merge the recently failed takeover bid consumer healthcare unit from the main company. This is one of the main value drivers expected for 2022. How the company will handle this de-merger given the current state of politics and the world, as well as inflation and other macro factors remains to be seen. For now, the guidance is a demerger in the middle of 2022.

There’s a lot of upside to the demerger possibility, and this isn’t an article on that possibility. However, it needs to be said because the upside for GSK as a main company is a lot of solid fundamental improvements, even if they’re losing what gives the company through-cyclical safety.

There’s a lot to like about GSK ex-consumer healthcare as well. Shingrix is seeing a 2022 recovery, and there’s plenty of upside in some of the company’s products coming out of COVID-19. Innovative HIV medicines are expected to contribute to growth as well and continue their impressive rates of sales growth we’ve been seeing for the past few years.

What I see as perhaps the biggest arguments for GSK at this time is the increased cost control and margins that the company is showing us. GSK doesn’t have a bad portfolio, and if it can get some cost control and start showing improved results from R&D, then this is a company that can really deliver the goods.

Remember, very clearly however, that GSK has failed consecutively to do so for the past 10 years.

Let’s look at the valuation.

Valuation for GlaxoSmithKline

GSK needs to be valued like other pharma companies in the same situation. That means we’re forecasting a relatively low growth rate in terms of DCF. The reason for this? Declining legacy sales, particularly Advair, and some of the uncertainty of the pipeline weakness that still, despite some more upside, isn’t really clear here. There is a clear risk to the company’s forward results, despite some of the plusses here.

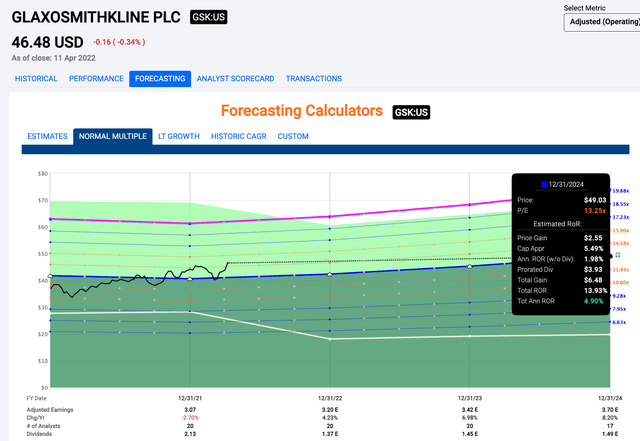

Looking at company EPS estimates, we find GSK’s 5-year valuation average at 13.25x and not a particularly appealing upside even to a 5-8% forward EPS growth.

As I said – not particularly appealing. 5% annually for an investment in a global pharma company? There are literally 4 other companies in similar positions that will give you better RoR.

It’s not as though this company has the forecast accuracy on a historical basis to back some of the positives up with. Nor, as we’ve said, have the last 10 years been all that good for company returns here.

To my mind, GlaxoSmithKline still has a lot to prove before we can start applying higher multiples to the company. Not all analysts agree with me here. Some equity analysts consider GSK 15% undervalued here. S&P Global analysts don’t agree. 21 analysts average an upside of less than 3% at this valuation.

I take an even more conservative tact here. I wouldn’t buy GSK at anywhere above 13.5x Normalized P/E which makes the company overvalued here. You can no longer argue for the consumer health upside, due to the fact that GSK intends to divest this, even in the form of a de-merger. The company lacks the solid legacy and solid pipelines of Roche (OTCQX:RHHBF, OTCQX:RHHBY) and Novartis (NVS). The company also doesn’t have exclusivities such as Novo Nordisk (NVO), and the company lacks high-growth application areas as we see in AstraZeneca (AZN).

In short, I believe the company lacks the specific appeal of any of its peers that I am heavily invested in. I believe there is a valid reason why GSK doesn’t command a premium and hasn’t for some time. It has underperformed – quite clearly.

Once the company proves that it can manage a turnaround and good earnings without its consumer healthcare division, that’s a time to start looking more seriously at GSK. Until that point though, I’m not crazy about investing at a premium here.

Even if the upside here’s realistic, your upside would be barely 10-13% per year. There are plenty of companies, even in this space, that trade at better multiples and upside here.

So, I consider GSK a “HOLD”. My PT for the company is the lower range of its historical conservative valuation range. I wouldn’t buy the company at more than $42/share. While this represents a significantly lower price target than most analysts here, it’s where I consider the company to be fairly traded.

The company is therefore a “HOLD” with a conservative PT of around $42, no more.

Thesis

The thesis for GSK is currently the following:

- GlaxoSmithKline is a fundamentally solid, but somewhat sub-par in terms of growth, pharma/vaccine company with a consumer health segment that’s bound to be de-merged in 2022. The company has both clear upsides and downsides, and while I consider both valid, I base my conservative view on the company’s historical performance.

- I see better investments out there with higher upsides, making GSK one of the more uninteresting potentials in the space.

- Based on the current valuation, I consider GSK overvalued to a $42/share price.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you, however, want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

GlaxoSmithKline is a “HOLD” here.

Thank you for reading.

Be the first to comment