alfexe

High Tide Inc. (NASDAQ:HITI) recently reported same-store sales growth close to 18% y/y, and management is delivering significant M&A activity. In my view, the market has not really considered future cash flow. In my opinion, if management continues to open stores besides acquiring new brands, the discount of future free cash flow results in a valuation of close to CAD3.34 per share. Risks from the new regulatory framework and failure of M&A operations don’t seem that significant.

High Tide

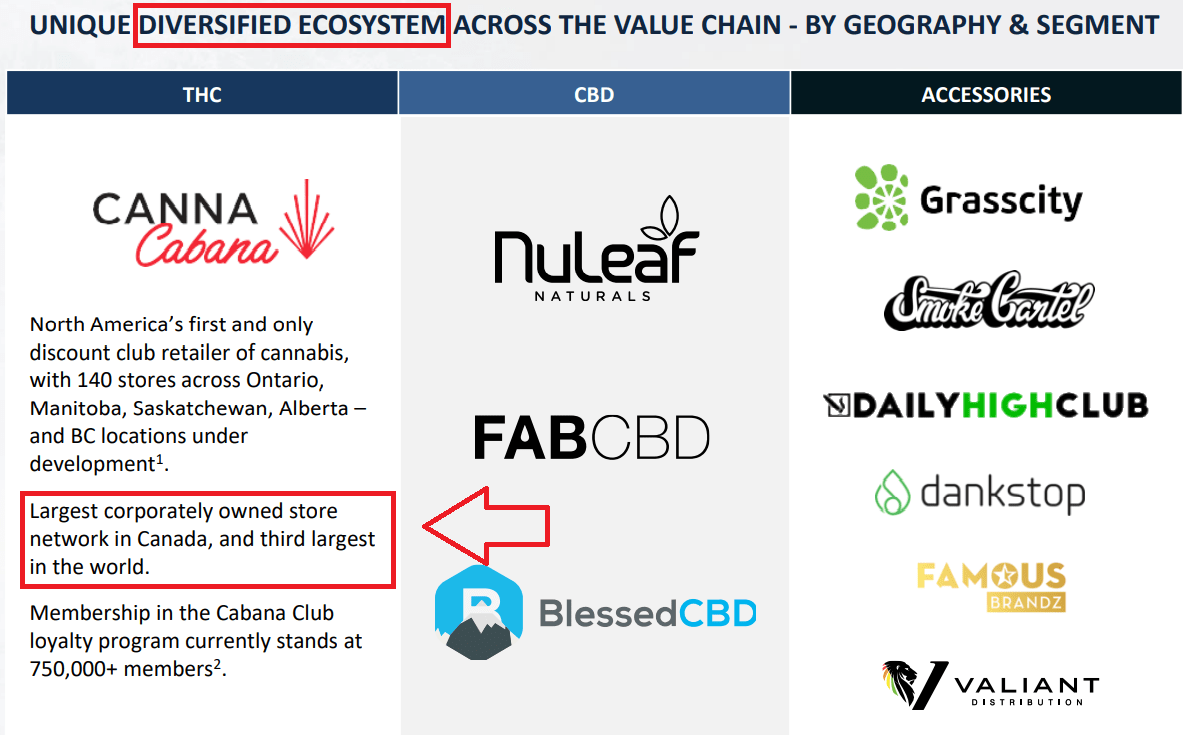

High Tide Inc. is a retail-focused cannabis company reporting bricks-and-mortar as well as e-commerce assets.

Considering the most recent quarterly report, I believe that it is a great moment for studying High Tide’s business prospects. The most interesting thing about High Tide, in my view, is that same-store sales growth continues to surprise. We are talking about same-store sales growth of close to 18% y/y driven mainly by the company’s discount model and diversified ecosystems.

Our same-store sales have continued their upward trajectory, increasing by 46% year over year and 18% sequentially. This growth continues to be propelled by our innovative discount club model, which is specifically tailored to our Company’s unique position in the market through our diversified ecosystem. Source: Quarterly Report

Source: Quarterly Presentation

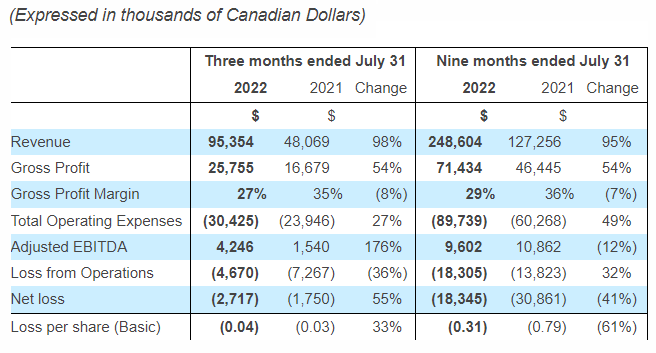

Quarterly Report Seems A Bit Less Beneficial Than The Guidance For The Next Years

In the three months ended July, 2022, High Tide reported revenue of CAD95.35 million with a gross profit margin of CAD25.75 million, together with a gross profit margin of 27%. In addition, High Tide included a total operating expense of CAD30 million with an adjusted EBITDA of CAD4.2 million. The EBITDA margin stood at 4%, which appears small. Analysts expect a significant EBITDA increase in the coming years.

Source: Quarterly Press Release

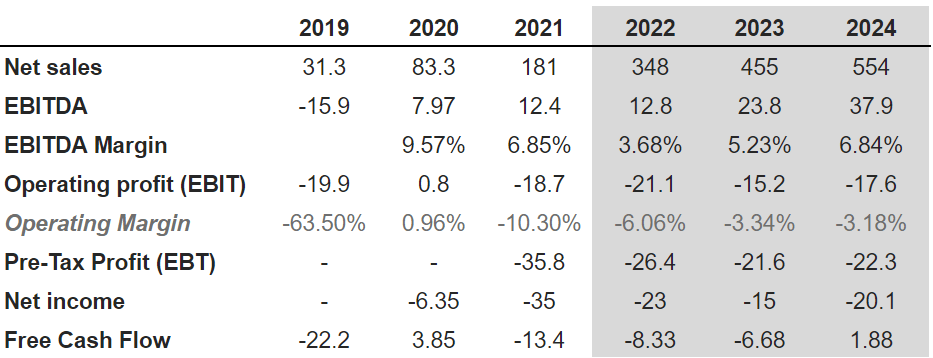

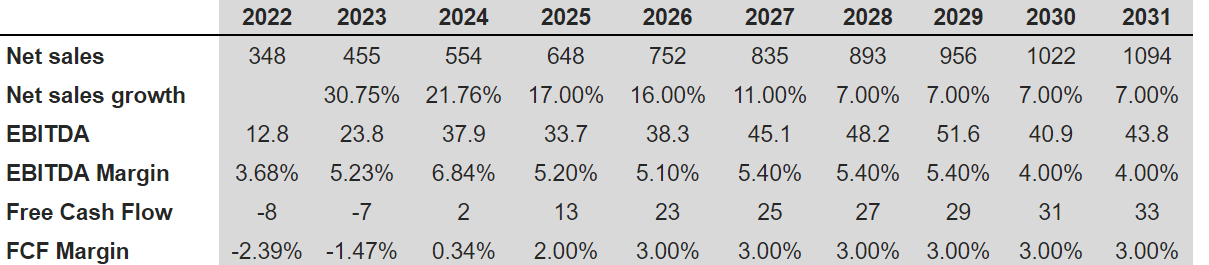

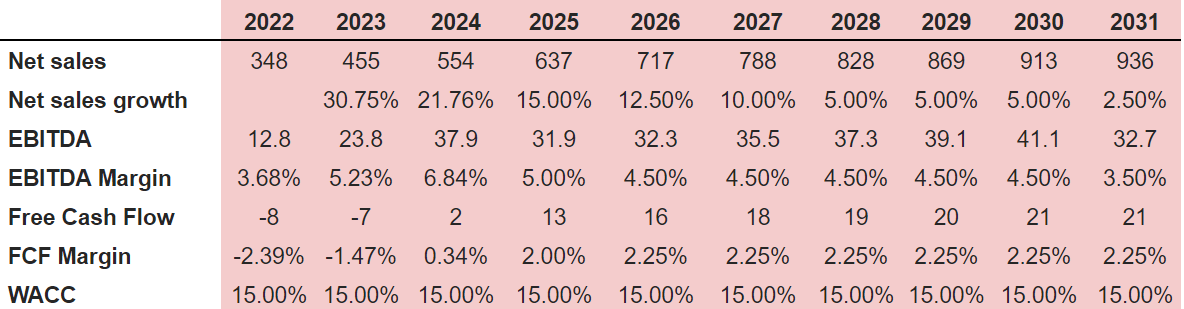

Market estimates include 2024 net sales of CAD554 million, together with an EBITDA of CAD37.9 million and an EBITDA margin of 6.84%. The operating profit is expected to be close to -CAD17.6 million with a net income of -CAD20.1 million. In my view, the most interesting thing is that the free cash flow is expected to be positive in 2024. I believe that further increases in the free cash flow could bring significant stock demand to the market.

Source: marketscreener.com

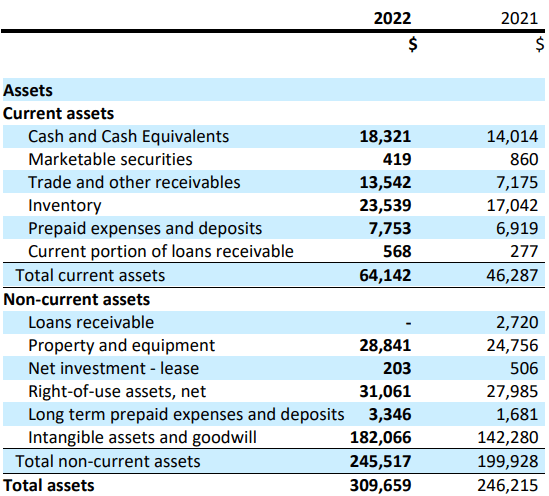

Balance Sheet

As of July 31, 2022, cash was equal to CAD18.321 million along with trade and other receivables of CAD13.54 million. Inventory was equal to CAD23 million with total current assets of CAD64.142 million. It is beneficial that current assets are larger than the current amount of liabilities. Liquidity does not seem to be a problem here.

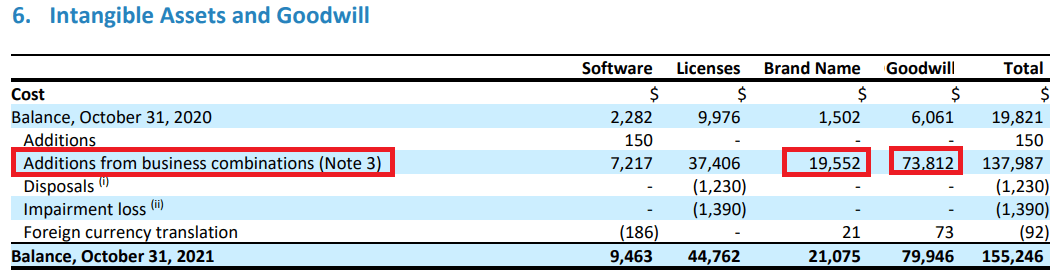

Non-current assets include property and equipment of CAD28.84 million, right of use assets of CAD31.061 million, and long term prepaid expenses of CAD3.346 million. The most relevant assets are intangible assets with goodwill worth CAD182.066 million. High Tide appears to have a lot of expertise in the acquisition of competitors. Additions from business combinations are quite significant, which certain investors may appreciate. It means that inorganic growth is a serious option.

Source: Quarterly Report Source: Quarterly Report

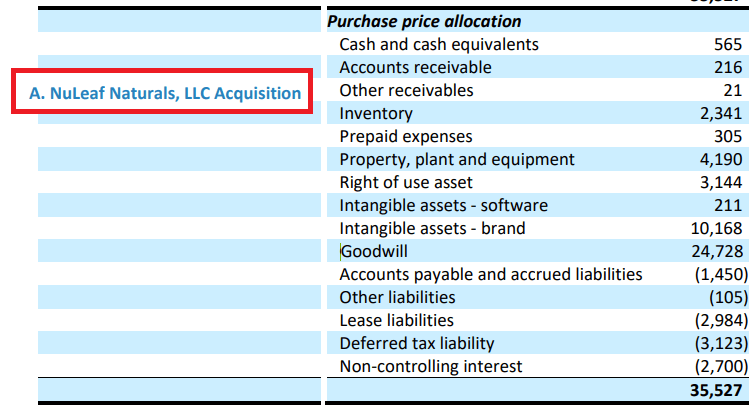

I wanted to note some of the acquisitions to understand what High Tide buys. For instance, the acquisition of NuLeaf Naturals included CAD24 million in goodwill, CAD10 million in intangible assets, and total assets worth CAD35 million.

Source: Quarterly Report

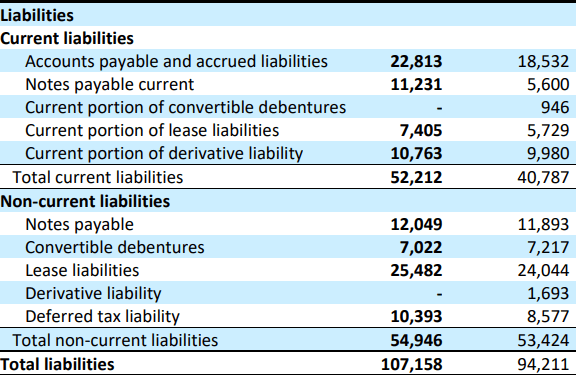

The liabilities include the payable accounts of CAD22.813 million with current payable notes of CAD11.231 million, in addition to the current portion of lease liabilities of CAD7.405 million. The current portion of derivative liability was CAD10.763 million, resulting in current liabilities of CAD52.212 million.

The notes payable were CAD12.049 million with convertible debentures of CAD7.022 million. The lease liabilities were CAD25.482 million with a deferred tax liability of CAD10.393 million. Finally, the total non-current liabilities were CAD54.946 million, and the total liabilities were CAD107.158 million.

Source: Quarterly Report

More M&A Activity And Internationalization Would Imply A Valuation Of CAD3.34 Per Share

Under normal conditions, I expect further M&A activities to bring further revenue growth. Notice that in the last report, the company noted more acquisition of stores from Choom Holdings Inc. Besides, management communicated that it continues to analyze new acquisitions. In my view, there are many reasons to be optimistic about future M&A operations.

On the mergers and acquisitions front, subsequent to the end of the quarter, we added nine stores from Choom Holdings Inc., and currently have many other prospects which are both accretive and strategic, that we are in the process of analyzing. Source: Source: Quarterly Report

It is also worth considering that High Tide’s international expansion will likely enhance future revenue. The company reports only a small amount of revenue from countries different from the United States and Canada. In my view, there is a world of opportunities as soon as other countries legalize cannabis in Europe or Latin America.

Geographically, in the third quarter of 2022, CAD80.7 million of revenue was earned in Canada, CAD12.7 million in the United States and CAD1.9 million internationally. Compared to the third quarter of 2021, revenue increased by 110% in Canada, 33% in the United States, and 1,486% internationally. Source: Quarterly Report

Besides, I would also expect new store openings to sustain sales growth as well as to bring certain economies of scale. In this regard, let’s note that High Tide expects to open 10 new stores by the end of 2022.

High Tide continues to be the largest non-franchised cannabis bricks-and-mortar retail chain in Canada, with 140 locations across the country and expects to reach its target of 150 by the end of the calendar year. Source: Quarterly Report

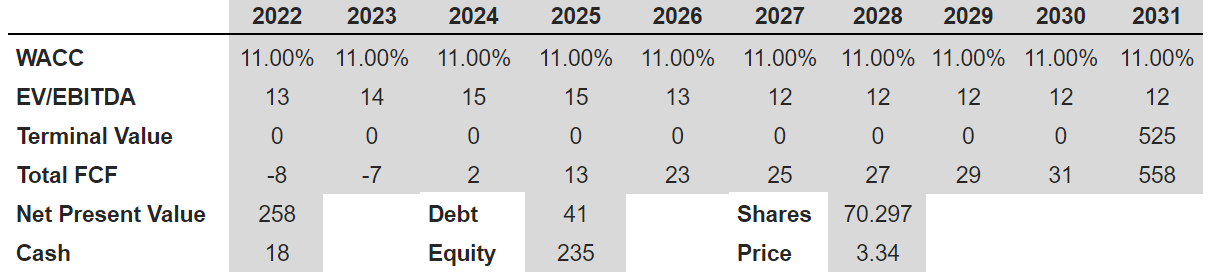

Under the previous conditions, I included 2031 net sales of CAD1094 million, net revenue growth of 7%, 2031 EBITDA of CAD43.8 million with an EBITDA margin of 4%. Free cash flow would stand at CAD33 million, and the FCF margin would be 3%.

Source: Author’s Work

With a WACC of 11% and an EV/EBITDA of 12x, the terminal value would be CAD525 million. The net present value of future FCF would be CAD258 million, the implied equity would be CAD235 million, and the fair price would be CAD3.34 per share.

Source: Author’s Work

New Regulatory Changes, Emerging Competitors, And Stock Dilution Could Help High Tide’s Stock Price Go To CAD1.5 Per Share

High Tide will likely have to comply with new regulatory changes in the United States and Canada. The new regulatory framework may bring additional costs, which may make the company’s business model unprofitable. It is also worth noting that regulars may close the company’s businesses under certain extreme circumstances. Management discussed these risks in a recent prospectus.

Achievement of the Business objectives is subject to compliance with regulatory requirements enacted and enforced by governmental authorities and obtaining and maintaining all required regulatory approvals. The Corporation may incur costs and obligations related to regulatory compliance. Failure to comply with applicable laws, regulations and permitting, licence or approval requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Source: Prospectus

I also believe that stock dilution may be harmful. High Tide is issuing equity warrants to pay for many of the acquisitions executed. If these acquisitions are not profitable, warrants holders may exercise their positions, which would lead to an increase in the share count. As a result, the fair price could diminish.

High Tide is operating in a young industry, which means that sales growth could be significantly volatile in the coming years. High Tide may also suffer from the emergence of new competitors, or may lack expertise in the sector. In this regard, management provided the following lines to investors.

The CBD industry is in its infancy. Companies will compete with established competitors who may have more resources and/or a more recognizable brand presence in the market. The Corporation’s success will depend upon the Board’s ability to manage the Business and to identify and take advantage of further opportunities which may arise. While the Board believes that they have the experience and connections to ensure that the business is able to compete with established rivals and take advantage of market opportunities they have identified, there is no guarantee that they will be able to do so. Source: Prospectus

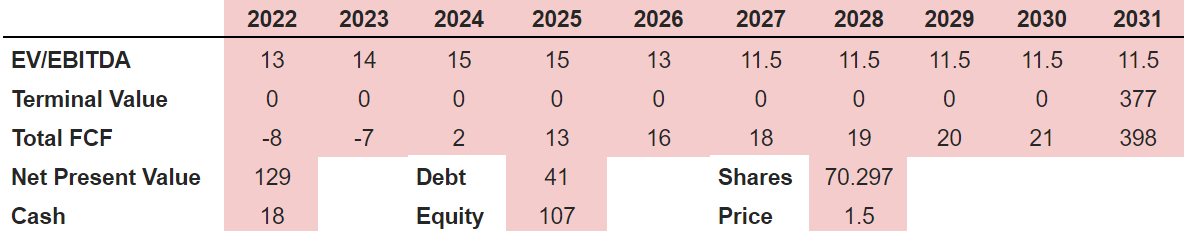

For 2031, the net sales would be CAD936 million, together with a net sales growth of 2.50%. In addition to an EBITDA of CAD32.7 million and an EBITDA margin of 3.50%, Free cash flow could be CAD21 million with the FCF margin of 2.25%.

Source: Author’s Work

I also forecast, for 2031, a total 2031 FCF of CAD398 million, and a net present value close to CAD129 million. Finally, the equity would be CAD107 million, with a fair price of CAD1.5.

Source: Author’s Work

My Takeaway

With same-store sales growth close to 18% y/y and a lot of expertise in the M&A markets, High Tide appears to be a must-follow stock. In my view, if management continues to open stores, and new brands are added or created, free cash flow will likely grow north. Under my conservative discounted model, I believe that the fair price for the stock could be close to CAD3.34 per share. There are risks coming from new regulatory frameworks or failed M&A, however I don’t believe that they pose significant trouble.

Be the first to comment