Alejandro Correa/iStock via Getty Images

Most stocks have lost at least 15-25% of their value this year as higher interest rates, inflation, and lower economic growth lower the valuations and profitability of most companies. Of course, a small handful of firms have shown resilience against the market’s declines. One notable example is the insurance company Aflac (NYSE:AFL), which has risen around 24% in value this year and is currently trading at an all-time high.

Aflac’s strength this year is not attributable to the economic trend or secular improvements within the life insurance sector. Most of its peers, Prudential (PRU), Manulife (MFC), and Sun Life (SLF), have fallen this year – though MetLife (MET) has risen similarly to Aflac. While Aflac’s TTM EPS is near its peak, most of its peers are seeing their profits decline. Aflac’s sales have fallen by around 8.5% over the past year, but its earnings have improved on the back of more substantial margins.

Many investors appreciate Aflac’s decent growth rate over the past decade and relatively low valuation with a forward “P/E” of 13.5X. Of course, AFL’s forward valuation is slightly higher than its peers following its outperformance this year. Further, when we look closer into the company’s business and its financial metrics, it appears there are some risks investors may want to consider, such as its falling revenue, assets, and cash flows.

A Closer Look At Aflac’s Business Risks

Aflac operates in two of the largest insurance markets, the United States and Japan. The company’s Japanese business is now a bit larger than its US segment, with total adjusted Japan revenues of $2.9B last quarter compared to $1.6B in the US (10-Q pg. 16). Japan is a robust insurance market and, with an aging population, demand for its various insurance products has been quite strong over the past decade. Today, Japan has a huge “demographic bubble” in the 65-75 age range, which naturally has had higher demand for Aflac’s cancer and medical insurance products. The company is trying to market products to the (smaller) younger generation, but if it fails over the coming years, it may see a sharp rise in claims without a strong basis of healthy customers.

The same issue exists in the US, where population pyramid inversion exists, though not as significantly as in Japan. Aflac is trying to increase its market among younger Americans by using a “Direct-to-consumer” approach toward younger “gig economy” workers that would not automatically enroll in its products via a W2. If this effort works, then Aflac’s future will be ensured by more younger clients that have significantly lower payout risks than older ones.

While Aflac actively offset the demographic transition, investors should be mindful of its potential long-term consequences. In the US, this risk factor is potentially elevated because fewer younger (<40 years old) Americans work in traditional jobs where supplemental coverage is offered automatically. Although Aflac has created platforms to expand market share among the younger generations, the “direct-to-consumer” approach likely results in higher customer acquisition and overhead costs. I believe these factors may inhibit Aflac’s growth, lower its margins, and dent its sales over the coming years. However, its exposure may be lower than life insurance firms facing record-soaring payouts.

What is Aflac Worth Today?

Aflac’s risk profile appears moderate and higher than five to ten years ago due to demographic changes and falling demand for insurance. That said, Aflac benefits from having lower direct economic exposure since the demand for its products is less cyclical than most. The company has risen significantly in value this year during an otherwise bearish period for the equity market. It has strong momentum but may be overvalued on a fundamental basis.

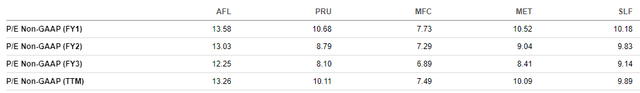

Firstly, the firm’s Non-GAAP forward “P/E” valuations and TTM “P/E” is well-above most of its peer group. See below:

Peer Valuation Metrics – AFL to Peers (Seeking Alpha Financial Metrics – AFL)

Based on these metrics, AFL appears around 36% more expensive than its peers. Aflac benefits from diversification into the Japanese market, and its business model is slightly different because it offers specifically supplemental insurance policies. That said, AFL does carry a relatively significant premium today, particularly given its long-term business risks and immediate pressures from interest rate and currency volatility.

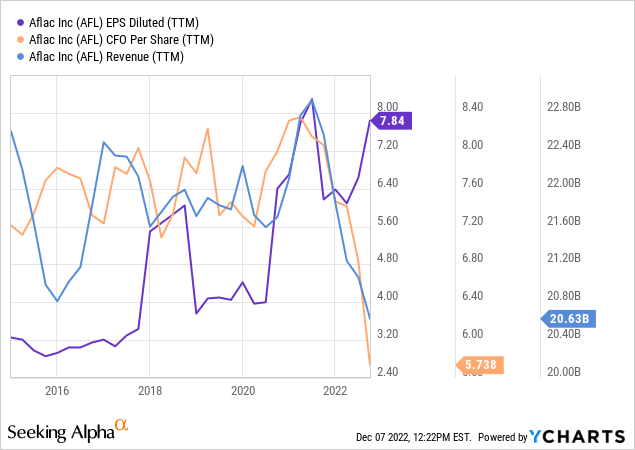

Aflac’s EPS has risen dramatically this year, but its operating cash flow and sales have collapsed at a rapid pace:

The primary reasons for the discrepancy between Aflac’s income and operating cash flow include unrealized investment gains ($885M), changes in income tax liabilities ($536M), and “other” ($572M). The company’s profit margin soared to around 25% this year, well above its average level of ~12-15% and far above its peers’ level. Aflac’s sales decline is attributable to the lasting effects of the pandemic, which harmed its broker producer pipeline, and currency effects from the falling Japanese Yen.

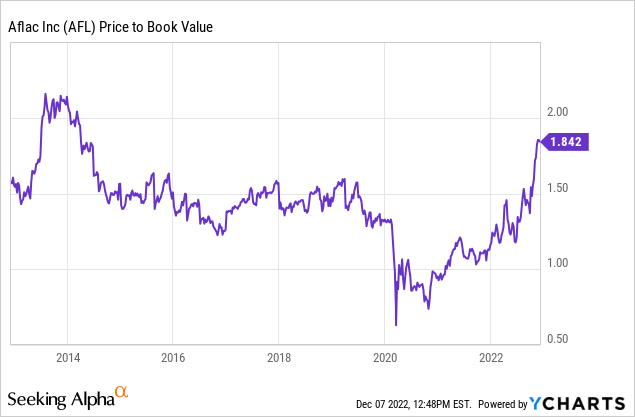

Additionally, Aflac is trading around 27% above its average price-to-book ratio over the past decade. See below:

Overall, Aflac’s financial position is not abnormal but does imply the stock may be a bit overvalued. Aflac’s core business is decent and has continued to see growth in premiums this year, with the record decline in the Japanese Yen being the primary cause of its sales decline. Still, it is around 25-35% more expensive than its peers and its historical valuation range and, in my view, faces more significant challenges over the coming years that could upset its profitability.

The Bottom Line

Aflac benefits from having lower direct, cyclical risks than many stocks, allowing it to outperform in a challenging economic environment. Its short-term performance is decent and its long-term growth over the past decade is stellar. However, it faces an uphill battle over the coming years as more customers reach senior years and fewer young people are in the pipeline. The number of COVID cases and deaths in the US is extremely low, mitigating that risk factor, but it is rising again in Japan, with reported deaths reaching spring peak levels. That factor could hamper AFL’s margins over the coming quarter or two.

I am moderately bearish on AFL and believe it is fundamentally overvalued by at least 20 to 30% based on its deviation from peer valuations and its historically average price-to-book ratio. High valuations warrant strong growth, but to me, Aflac does not appear to have a decent growth outlook and likely faces more significant challenges over the coming years than it has over the past decade. That said, I would not bet against the stock since the only strong bearish catalyst is rising COVID cases in Japan, and the firm has thus far been resilient against that risk. Still, I believe AFL offers a generally low reward-for-risk opportunity at its current valuation.

Be the first to comment