Scott Olson

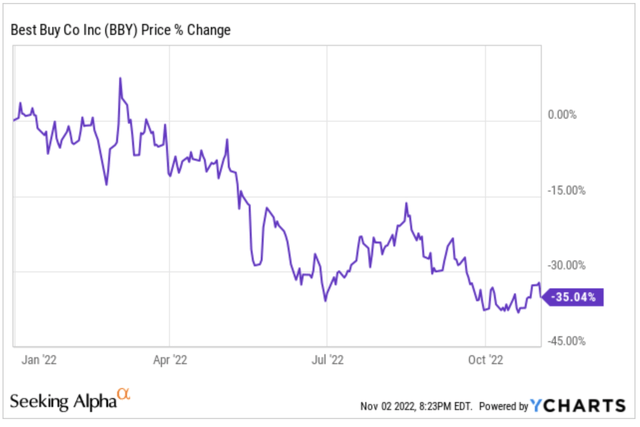

Best Buy (NYSE:BBY) is a stock that has been battered in 2022 and really over the past 12 months, as the stock is down 35% year to date and down over 50% from their November 2021 highs.

Best Buy for much of the past decade has been a turnaround story. I remember the days when BBY was left for dead, as many described the company as nothing more than an Amazon (AMZN) showroom.

As you know, Best Buy is a big box retailer heavily dependent on a strong consumer. After all, many of the products the company sells at their store are more wants more than needs. Heading into a potential recession, a company selling big screen TVs, home and audio equipment, and appliances could have a rough go during a slowdown in the economy combined with a weakening consumer.

Recent financial data came out showing signs that the US consumer could be breaking down. The total US credit card balance hit $916 billion in September, as consumers turn to credit to help deal with high inflation. In addition, the boom in the personal savings rate that we heard about during the pandemic, is all but gone. In fact, the US personal savings hit $555.7 billion, which was the lowest levels seen since 2009.

A weakening consumer means that larger purchases, like big screen TVs, new appliances, and home/audio equipment could be put on the back burner.

This is not something Best Buy wants to hear heading into a holiday season that is expected to be weak. After all, consumers are already dealing with record high inflation.

Expectations Still Too High

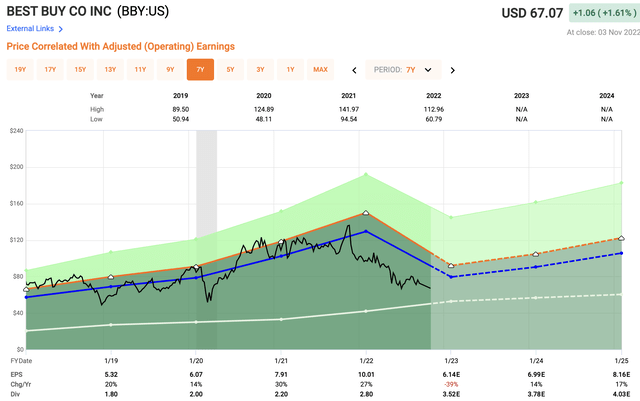

Shares of BBY, although trading below their 5-year average multiple of 13x. Currently, shares trade at an earnings multiple of 10.9x.

Looking ahead, analysts are expecting 2023 EPS of $6.99 per share, meaning they expect earnings growth of nearly 15%. A year in which some are expecting an economic slowdown as a result of a recession, analysts still believe Best Buy of all places can produce earnings growth of nearly 15%?

It is common during periods of high inflation, like we are going through now, for balance to come by way of supply falling below demand, not vice versa. Demand has been high for a few years now when we had a loose monetary policy, but that has all changed, and we have gone through a year in which the Fed has raised interest rates, bringing the terminal rate to a range of 3.75% to 4.00%. These hikes are expected to approach 5.00% in 2023.

All of this does not bode well for retailers like Best Buy, which is why I am taking the position that expectations still need to come down and BBY shares need to be re-rated.

Weakening Trend

During the company’s most recent quarter, Best Buy saw their sales drop 12.1% year over year, with computing and consumer electronics dropping the most. Appliances held on strong during the quarter, but even that division fell 1%year over year.

Online sales continue to be a bright spot for the company, as that segment saw 31% growth during the quarter.

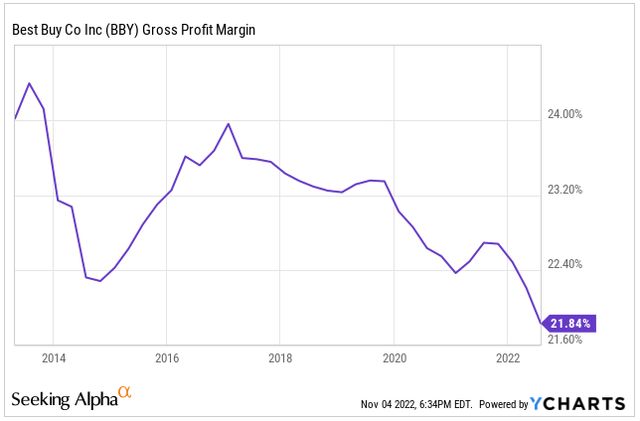

Weakening profit margins continue to be an issue for the company, as competition increases from not only Amazon (AMZN), but also the likes of Walmart (WMT), Target (TGT), and Costco (COST).

Profit margins in the most recent quarter have fallen below 22%, which is the lowest level seen in the past decade. Just a year ago, margins were at 23.5%.

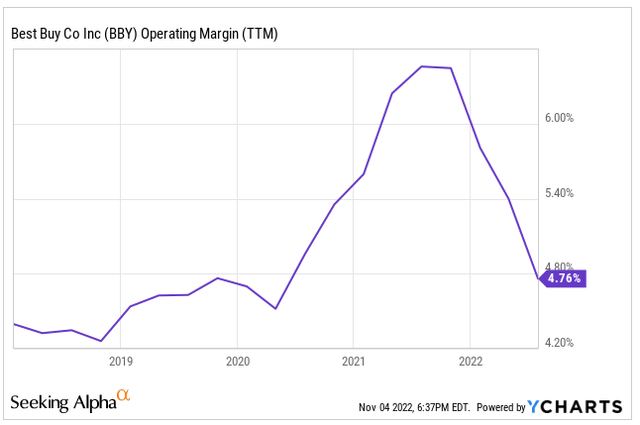

Already operating with very slim margins, operating margin has fallen from 6.5% down to 4.7% just in the past year.

Due to its low operating margin, the room for error is very little. If supply costs rise or wages rise, as they have, we see how it can have a major impact on shares of Best Buy.

A weakening consumer, could realistically end up meaning sales decline for the retailer, which would not put negative operating margins out of the picture for BBY.

Are Shares of BBY a Buy, Sell, Or Hold?

I rate shares of BBY as a Sell.

For me and my portfolio, I believe the risk far outweighs the reward at this point. If we do in fact fall on tough times and a recession hits, if we are not there already, a company like Best Buy is going to struggle mightily. We saw it in 2009, and I believe we will see it again.

Amazon and other competitors are not going to stop turning up the pressure, and when I look at a company like Best Buy, I struggle to see where their competitive advantage is.

The company does have a great history of dividend growth, but investing blindly on yield and dividend growth alone can be a recipe for disaster.

Over the past five years, BBY has increased their dividend at an average annual rate of 21%, and they have increased the dividend for 11 consecutive years.

As we have seen in the past few years, the dividend growth has remained strong, but this could be the first sign of trouble ahead is when we see the dividend growth rate begin to slow and the company move to a cash preserving strategy. Best Buy usually announces their dividend hike in late February.

As such, even with the multiple where it is at right now, I still cannot find a reason to hold the stock in my portfolio, which is why I rate the shares a Sell.

Let me know your thoughts on BBY down in the comments below.

Disclaimer: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Be the first to comment