Khaosai Wongnatthakan

Buy Now Pay Later (BNPL) Affirm Holdings, Inc. (NASDAQ:AFRM) reported yet another disastrous quarterly earnings in Q3, as Seeking Alpha has covered here. The results included a flurry of bad news, including:

- Wider than expected loss, as EPS came in at -$0.86 with consensus being -$0.78.

- Revenue beat slightly by $1M, but in the punishing mood that the market is in for companies losing money, this has had no positive effect on the stock as expected.

- More importantly, the company guided Q2 revenue down by at least $16M, as it projected a range of $400M to $420M while the consensus was $436 M.

No wonder the stock fell 15% after hours, on top of the 90% it has lost from all time highs over the last 52 weeks. We tend to look at the positives even when things look done and dusted. However, it is hard to be optimistic about Affirm any time soon. Despite a 93% fall from its 52-week highs, Affirm does not seem to have found a bottom yet. This article presents a few reasons why things are likely to get worse for the stock before there will be any hopes of a turnaround, along with a section that argues it is not all gloom and doom.

Worsening Macro and Fundamentals

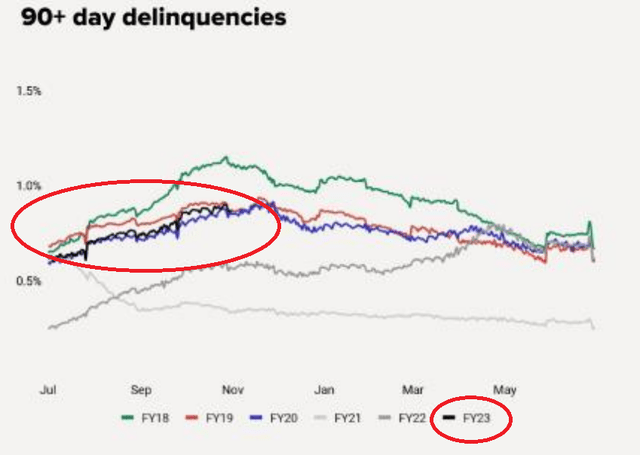

When interest rates are high, defaults and delinquencies increase. This hits firms like Affirm in the gut, as shown in the chart below. The 90+ day delinquencies are off to their worst start in Q1 since FY 2018. Affirm indicated in its earnings release that the pandemic-induced tailwind in consumer savings abated in FY 2022 and has now pretty much left the scene.

Afrm 90+ Delinquencies (investors.affirm.com/)

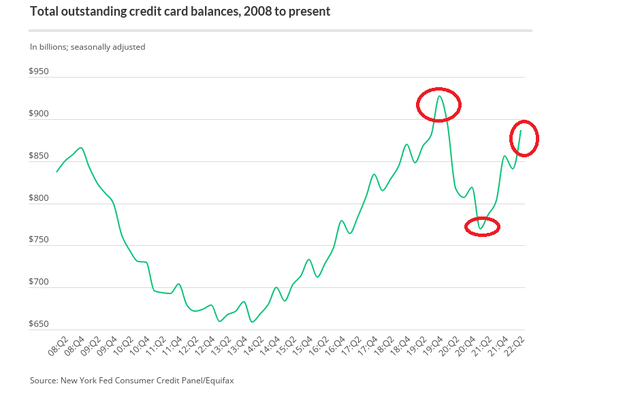

It is not just Affirm that is reporting this trend. Below is a chart from Lending Tree, and you can see almost exactly the same trend. Consumer credit card balances peaked pre-COVID and were at the lowest point in 2020 and 2021 due to the Fed’s surplus and higher savings rate. However, the reopening boom along with Fed tightening has resulted in higher balances and delinquencies, and if this trend continues, 2023 will see a higher peak than pre-COVID.

Credit Card Balance (www.lendingtree.com)

The company’s frequent visits on Jim Cramer’s Mad Money show after each quarter’s drubbing reek more of desperation than a planned action. The advertised target of “Marching towards profitability” by the end of FY 2023 remains a lofty goal, with more pressure expected due to a worsening credit situation, Fed’s policies, and Gross Merchandise Value (GMV).

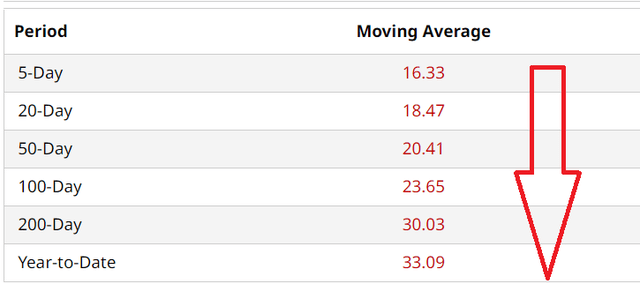

Bottomless Technicals

Even before earnings, Affirm stock was making lower lows as shown by the moving averages below. The 5-day average is lower than the 20-day average, which is lower than the 50-day average, and so on. This shows a stock with no support or bottom in sight yet. And with the after-hours price going below the teens, this will only get worse.

Afrm Moving Avg (Barchart.Com)

Forgotten Lesson Relearnt

Peter Lynch’s classic One Up on Wall Street presents many practical lessons for the retail investor. One golden rule we knew for years but did not follow with Affirm was assuming that just because a stock had fallen heavily, it cannot fall much further. We did not buy Affirm anywhere close to its highs. We bought where we thought it was a massive bargain in the $50s (and averaged down a few times) after the stock had fallen nearly 75%. The biggest reason when buying the stock was the thought: “It has fallen this far, how low can it go?” Well, we know the answer now. Almost.

Not All Gloom And Doom

To present a balanced view to our readers, we wanted to highlight a few reasons to be optimistic for the long term.

- Borrowing is going nowhere. Most U.S. consumers have been innately fine-tuned to borrow to buy things they don’t need to impress people they don’t like or even know. In an improving economy, what’s there to not like about buying now and paying later? Sure, things are ugly right now but inflation won’t stay high forever, nor will the Fed retain its stance as a result.

- Affirm has quietly joined the long list of companies laying off workers to cut expenses. The reported cut is just 1%, but it is far more likely to just be the start than the end of more cost-cutting attempts.

- CEO Max Levchin breathes Fintech, and being the cofounder of what is now known as PayPal (PYPL) lends credibility to that.

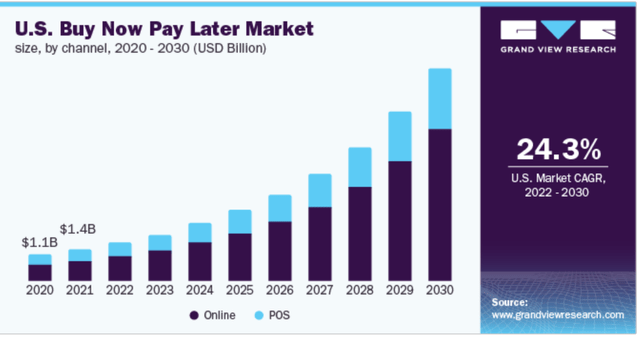

- Finally, speaking of PayPal, the hideous fall has made Affirm an attractive acquisition target for larger Fintech companies like PayPal and Block, Inc. (SQ). As gloomy as things look now, the BNPL market’s CAGR is still projected to be around 25%.

BNPL Market (www.grandviewresearch.com)

Conclusion

With no bottom in sight and the slew of headwinds, it is hard to recommend Affirm Holdings, Inc. here. The continuing downtrend is likely to accelerate with the earnings disaster, especially if the Fed takes the centerstage over the next few days.

In conclusion, our recommendation is not BNPL, but BLPN: Buy Later, Patience Now.

Be the first to comment