Pogonici/iStock via Getty Images CDX3

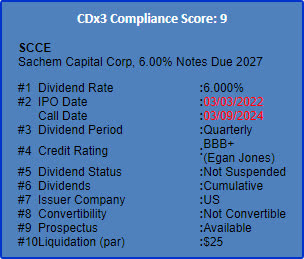

About the new issue

Sachem Capital Corp. (SACH) priced an offering of $50 million worth of new exchange traded notes due 2027, offering a fixed coupon of 6%. The company indicated that the proceeds will be used primarily to fund new real estate loans. Egan-Jones Ratings Company gave the new notes a rating of BBB+. The notes trade on the NYSE American exchange under symbol SCCE.

Source: Preferred stock table: CDx3 Notification Service database.

SEC filings: SCCE

Past preferred stock IPOs below par

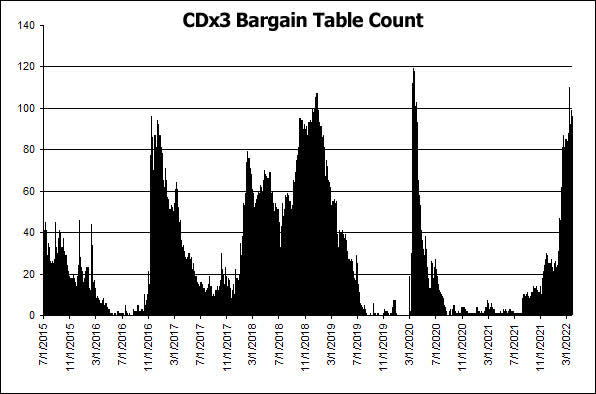

In our article last month, we mentioned that our proprietary preferred stock market index, the CDx3 Perfect Market Index, had previously exceeded a reading of 100 just three times over the past ten years; and as we closed out the month of February we were just touching 100. Ending March, we’re at a reading of 101 – so not much has changed – but worth noting is that the high reading of the month was 102 on 3/14/2022.

When a high quality preferred stock crosses below its $25 offering price, it shows up on our “CDx3 Bargain Table” page (for subscribers); the count of CDx3 Bargain Table stocks is another great indicator of the state of the preferred stock market, and as of this writing there are 96 choices listed, up from 79 a month ago. Eight of those sport stock prices below the $20 mark as of this writing:

CDX3 Bargain Table: Note: green font indicates exchange traded debt securities.

In the above table, MGRD and BEPH (shown in green font) are exchange traded debt securities. MGRD was issued by Affiliated Managers Group (AMG) as 4.20% Junior Subordinated Notes due 09/30/2061; BEPH was issued by Brookfield Renewable Partners (BEP) as 4.625% Perpetual Subordinated Notes. BEP is the flagship listed renewable power company of Brookfield Asset Management (BAM). VNO-O is a traditional cumulative perpetual preferred stock issued by Vornado Realty Trust (VNO).

And then the remaining five stocks in the above screenshot are all among the preferred stock series of Public Storage (PSA), one of the most prolific issuers of preferred stock among the companies we cover, with a whopping 14 presently-outstanding series of preferreds, issued between 2017 and 2021, with initial dividend rates (at offering) of as high as 5.6% and as low as 3.875%. And these various series issued at different rates really help illustrate how the stock prices within the preferred stock market will move in the opposite direction of rates. Since rates go up and down over time, prices go down and up, respectively. The differing dividend rate against par value is the main reason why we currently can observe two different pari passu series of preferred issued by the exact same company, trading above par and ~20% below par, respectively:

We’ve kept track since July of 2015 of the daily number of CDx3 Bargain Table stocks, and a year ago, as we closed out March of 2021, there were just 3. On the 14th of March 2022 – the high point of the month – there were 110. Here’s how our Bargain Table count history looks since 7/2015:

Internal CDx3 Notification Service data

With so many high quality preferred stocks trading today at 10-20% discounts to par, it is no wonder we have not seen a single new preferred stock issued during this month (we observed the issuance of just one 5-year exchange traded note, SCCE). Instead of looking at new offerings, preferred stock investors have been focused this month on looking at previous offerings, especially those where the market prices are now below par.

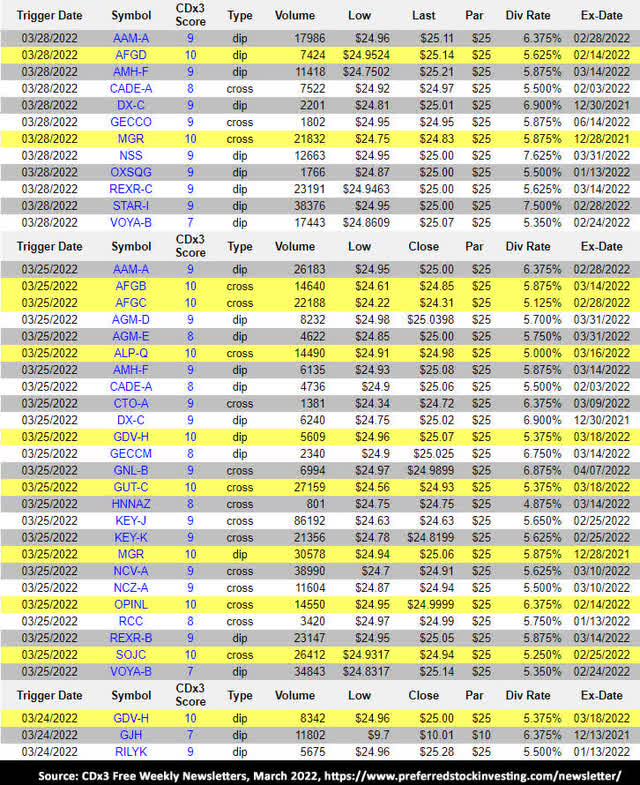

Here are some of the recent dips/crosses below par that our CDx3 Notification Service subscribers received email notifications about this month. (While the primary thrust of our subscription service is alerting about new IPOs and ranking them with a CDx3 Compliance Score, we also monitor past IPOs and offer email alert options when high-ranking past IPOs make crosses below par value):

CDX3 (Note: Yellow highlighted entries indicate eligibility for the “CDx3 Bargain Table” page (one of our most popular subscriber pages))

Until Next Time…

Here at CDx3, our typical articles will provide month-end preferred stock (and ETD) IPO summaries, plus a look at selected past preferred stock IPOs that are now trading below par. Often, the reward on offer for “imperfect” preferred stocks is very high relative to the fully CDx3-compliant professionally rated securities.

Whether you are the kind of investor who sticks with preferred stocks with a CDx3 Compliance Score rated 10 out of 10, or whether your portfolio has room for 9-score-and-lower securities, stay tuned for future articles recapping new IPOs and interesting preferred stock activity that we notice. Thanks for reading!

Be the first to comment