Khaosai Wongnatthakan/iStock via Getty Images

Affirm Holdings, Inc. (NASDAQ:AFRM) reported Q3 results that were better than expected, with revenue and GMV both above expectations. However, with the macro environment starting to show some cracks, I believe investors should still remain patiently waiting on the sidelines for a better entry point.

In addition, increased competition may cause challenges for Affirm to grow much faster than their competitors and may also cause increased regulatory scrutiny on an industry that is largely unregulated.

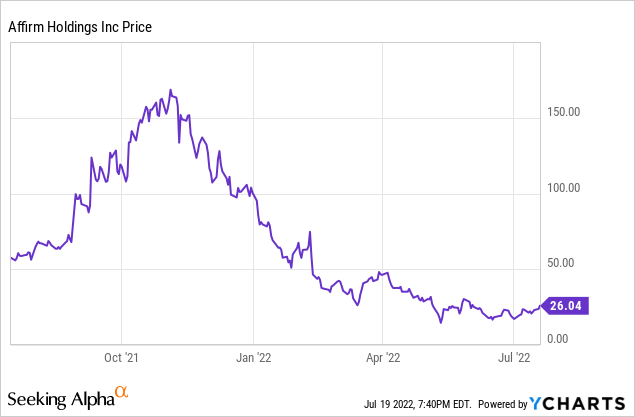

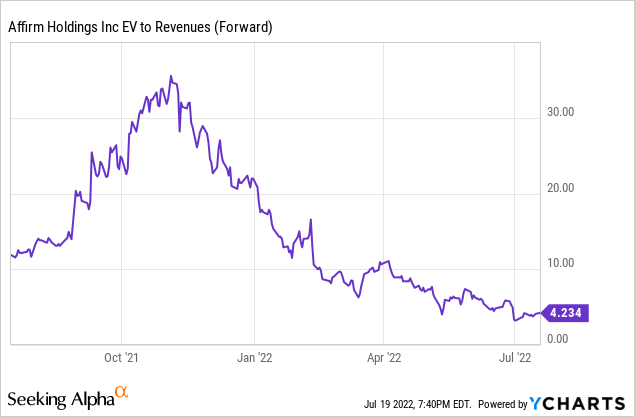

The stock does remain down over 85% from all-time highs, but valuation currently stands around 6.5x fiscal 2023 revenue less transaction fees, which does not appear to be overly attractive given the macro backdrop.

Fears around inflation remaining high, consumer spending slowing down, rising funding costs for buy now, pay later (“BNPL”) providers, increased competition, and a possible recession have continued to weigh on the stock. With Affirm not having previously been through a recession, it’s a little difficult to know how the company would hold up during a downturn.

For now, I continue to remain on the sidelines and believe there could be material downside to the company over the coming quarters as the macro environment slows down. In addition, if government bodies were to implement regulations on the industry, Affirm may see their revenue growth slow down and/or their margins squeezed even further.

Financial Review

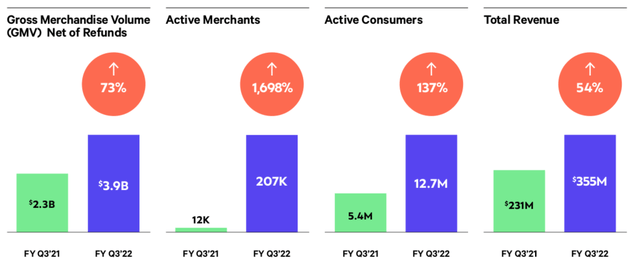

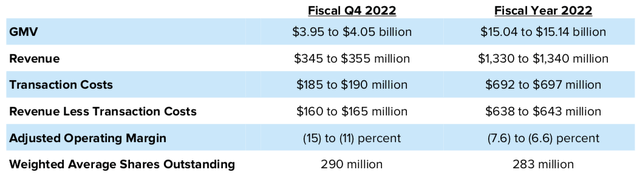

During the company’s Q3, revenue grew an impressive 54% YOY to $355 million, which handily beat expectations for $344 million. While revenue did decline sequentially from Q2, the underlying trends of the business held up pretty well.

GMV during the quarter was $3.9 billion and grew 73% YOY. Yes, the GMV declined sequentially, but Q2 included some benefit from the holiday season (also why revenue declined sequentially in Q3).

Interestingly, the number of active consumers at the end of Q3 was 12.7 million, with the number of transactions per active consumer coming in at 2.7, improving from 2.5 last quarter. I believe these two metrics are the most important for Affirm going forward.

Yes, the number of active merchants is important, as Affirm builds out their network, but what will drive more revenue for Affirm is increasing their consumer base and the number of transactions per consumer.

In my opinion, guidance for the remainder of the year was somewhat disappointing, with Q4 revenue expected to be $345-355 million, with the midpoint being slightly below expectations for $353 million. In addition, adjusted operating loss is expected to be 11-15%, which would be well below the operating loss of 2% so far this year.

Cautious Into Q4 Earnings (June Quarter)

While the company did not provide much insight into their fiscal 2023, the macro environment has remained pretty challenged in recent months, with higher interest rates increasing the funding for many BNPL providers. In addition, consumers have started to feel some pressure as stimulus-benefits fully wind down and consumer balance sheets are starting to return to more normalized levels.

Though I am not an economist, I do believe that a recessionary environment, that does not include any stimulus payments, may force consumers to taper their spending habits. BNPL does provide an interest-free outlet for some purchases, but an overall slowdown in consumer spending may challenge BNPL growth rates.

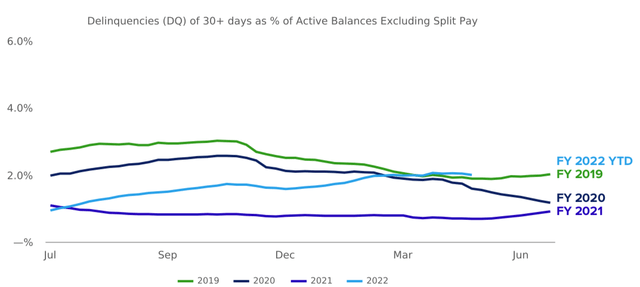

The chart above does a great job depicting the delinquencies of 30+ days as a % of active balances. Clearly, consumers benefited throughout Affirm’s fiscal 2021 as stimulus payments filled the pockets of many U.S. consumers. I believe fiscal 2019 and 2020 were more normalized levels of delinquencies, and while this current fiscal year started off very low, delinquencies have slowly risen throughout the year.

If the macro environment continues to deteriorate, driven by both high inflation and consumer spending possibly slowing down, I believe Affirm may soon start to face higher delinquency rates. While Affirm may be able to withstand higher delinquency rates, investors may be more cautious in an uncertain environment with higher delinquency rates, thus the stock could remain under pressure for some time.

With inflation eclipsing 9% in June, consumers are facing very high prices for everyday transactions, which may start to place some pressure on the underlying demand. If we were to enter into a recession, discretionary spending areas will come under pressure even more.

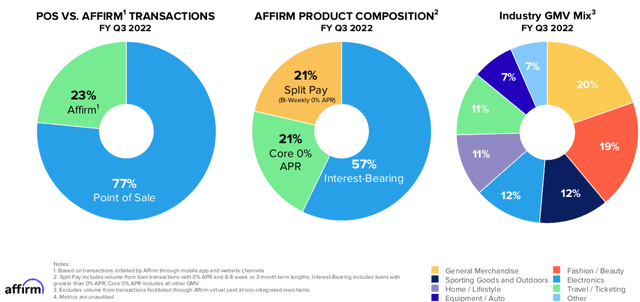

Affirm’s largest verticals based on their GMV are general merchandise, fashion/beauty, sporting goods/outdoors, and electronics. These verticals are largely discretionary and the combination of consistently high inflation and fears of a recession could cause a slowdown in coming quarters.

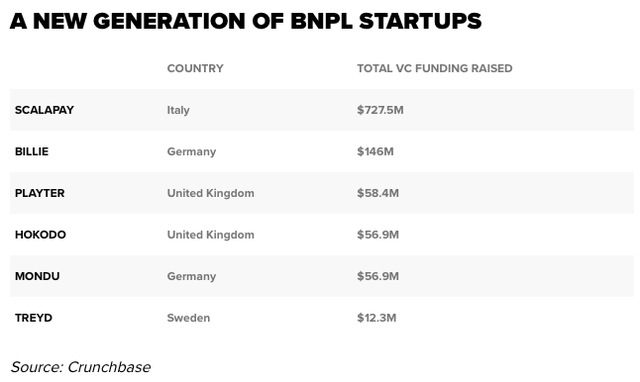

Finally, while Affirm may be one of the more popular BNPL platforms on the market, there are many other competitors growing. CNBC recently put out an article that went through some of the competitive dynamics within the BNPL industry. Aside from the larger BNPL providers such as Affirm, Klarna (KLAR), and Afterpay (SQ), there have been increases in the competitive landscape with new players such as Scalapay, Billie, Payter, Hokodo, Mondu, and Treyd that are growing in popularity.

Aside from the obvious point that increased competition may dilute the growth rates of all companies, I believe increased competition may also draw more scrutiny from regulatory bodies. The BNPL regulatory landscape has largely been undefined since BNPL rose to fame in recent years, though the combination of rising interesting rates, consumer credit slowing, possible recession, and increased competition may cause regulatory bodies to better define the industry.

Typically, regulation around the financial system benefits the consumers and can often result in lower transaction fees, thus potentially placing pressure on BNPL providers, such as Affirm. Thus, I believe the potential for increased regulation likely causes a sentiment overhang over Affirm for many quarters to come.

Valuation

Even with the stock down over 85% from all-time highs, I don’t believe the company is in the clear yet. Investors continue to have negative sentiment around a possible slowdown during a recession and potential regulatory bodies getting involved in the BNPL landscape. With no historical reference for how BNPL providers perform during a recession, investors seem to be placing a “recession discount” on the stock, which continues to pressure Affirm.

The company currently has a market cap around $6.8 billion and with around $0.6 billion of net cash, the company has an enterprise value of $6.2 billion.

For fiscal 2022, the company is expecting revenue of $1.33-1.34 billion, though we are only one quarter away from the end of the year. Thus, investors should start to look out towards fiscal 2023 and beyond for valuation purposes.

Currently, consensus estimates fiscal 2023 revenue of $1.9 billion, per Yahoo Finance. Using this as a reference point, Affirm is currently trading around 3.3x fiscal 2023 revenue. In my opinion, the $1.9 billion of revenue seems like a good starting point, as it represents around 45% revenue growth for the year.

While Affirm continues to grow rapidly, I do believe the combination of the law of large numbers and a potential economic slowdown could weigh on revenue growth.

In addition, investors should also look at revenue growth less transaction costs, since that represents the true “net revenue” Affirm actually sees. Fiscal 2022 revenue less transaction costs are guided to $638-643 million and even if we were to assume a 50% growth, this results in $960 million for fiscal 2023, representing a ~6.5x revenue less transaction fee multiple.

For now, I continue to remain on the sidelines and wait for a better entry point.

Given the challenging macro factors discussed throughout this article, a ~6.5x revenue less transaction fee multiple is not overly attractive. Especially when considering the BNPL industry may eventually face increased regulatory scrutiny, I continue to believe Affirm could see more downside ahead in the coming months and quarters.

Be the first to comment