Ilija Erceg/iStock via Getty Images

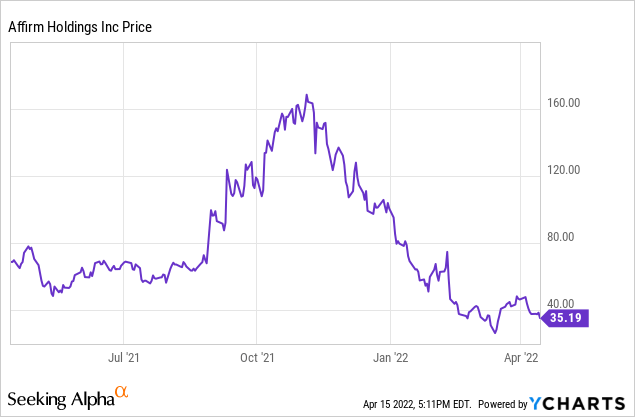

Leading American buy-now, pay-later firm Affirm (NASDAQ:AFRM) like many other growth companies in the fintech space has for some months now experienced a total collapse of its common shares to new all-time lows. The stock, less than a year ago, was trading high on its announced partnership with Amazon (AMZN) and had touched $176 per common share for a market cap that was just under $48 billion.

This has since been cut down by 80% to just over $35 and a market cap of $10 billion. The company sits at what has now become a toxic investing intersection of fintech and growth, seemingly catalysed by strong runaway inflation which has necessitated the FED to get significantly more hawkish on its timeline of raising interest rates. Hence, the future macro investment environment for Affirm’s common shares does not look entirely bright in the near term. This comes on the back of the growing demand for BNPL services as e-commerce sales in the USA increasingly grow to account for more of total retail sales.

When I last covered Affirm, I described the company as the antithesis of deferred gratification as BNPL fundamentally is built on the inversion of delayed gratification. In this, consumers sacrifice their future spending and saving powers for consumption today. The industry has grown virtually unregulated since the onset of the pandemic with the sight of BNPL options at checkout screens becoming ubiquitous. Analysts expect BNPL to continue to grow as more vendors adopt BNPL options and as e-commerce penetration of total retail sales continues to increase.

Critically, Affirm’s financing solutions when adopted serve as a tool for online vendors to convert abandoned shopping carts to sales and garner higher order sizes. From the vendor’s perspective, higher conversion rates are more than making up for the fees charged by Affirm.

Continued Financial Strength From The Rise Of Instant Gratification

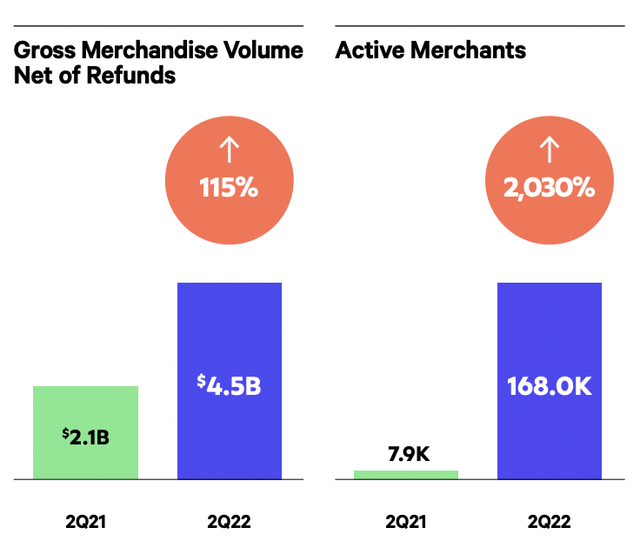

Affirm last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $361 million, an increase of 77% from the previous year and a beat of $27.93 million on analyst consensus. This growth was driven by a rapid upswing in gross merchandise volume which grew to reach $4.5 billion, an increase of 77% from the comparable year-ago period. Affirm’s exclusive partnership with Shopify (SHOP) has been instrumental to this growth with active merchants increasing to 168,000 from 8,000 as Affirm-powered Shop Pay Installments were increasingly adopted by merchants on Shopify’s platform.

Affirm FY Q2 2022 Earnings Infographic

Active consumers also grew by 150% to 11.2 million on a year-over-year basis and increased by 29% sequentially with transactions per active consumer increasing by 15%.

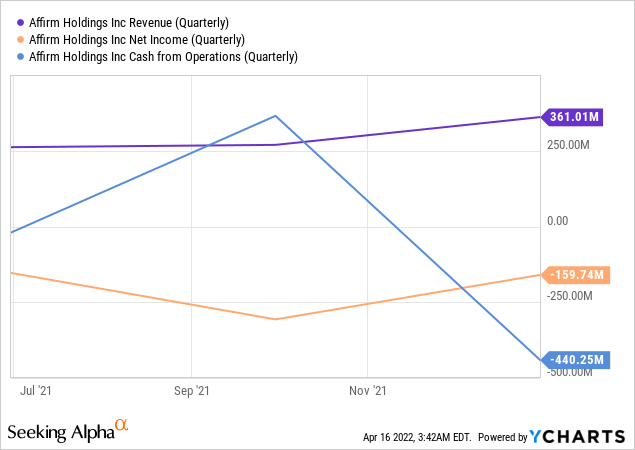

However, the company’s core profitability did not improve and instead remained in a negative state characterised by heavy operational cash burn.

A negative net income of $160 million was an improvement from the previous quarter but was a 6x increase from the comparable year-ago period. Cash from operations, a key metric for financial health, worsened to $440 million from a burn of $47 million in the year-ago quarter. Further, with a capital expenditure of $21.8 million during the quarter, Affirm’s total free cash outflow stood at $461.8 million.

Cash and equivalents closed out the quarter at $2.57 billion, so is more than enough to fund similar losses in the coming quarters. But this rate of cash burn at 127% of total revenue is not sustainable, especially against the guidance of $1,290 million to $1,310 million in revenue for fiscal 2022. Affirm also expects to close out the year with a GMV of between $14.58 billion to $14.78 billion with transaction costs of $705 million to $715 million. Using fiscal 2022 revenue, Affirm is trading at a price to sales revenue multiple of 7.7x. While this is a material decline from the heights it used to trade on, it is still somewhat high for a company not yet profitable in a new investment environment where these are set to be punished.

The Current Valuation With Growth Set To Continue Indefinitely

Affirm is a business at the convergence of two macro trends. This is the continued expected growth of e-commerce sales and the rise of alternative finance. The latter is being championed by the fintech companies that have now all mostly seen their stock price historically cut down to mere fractions of their previous glory. The brutal new investment environment has rendered their shares as far too risky in a world beset by war, inflation risk, and the spectre of a recession.

However, global retail is expected to continue the structural shift towards online channels. And as this is still in the early stages, Affirm’s runway for growth looks strong. The company’s current valuation when looked at from this perspective looks palatable. And were investor sentiment to return to what it once was, current shareholders would find themselves having bought alpha later.

Be the first to comment