The United States of Weed are not so united indeed. Roman Barkov

Recent news of the first cannabis bill introduced in the new Congress follows a year of disappointment for cannabis proponents. Many hoped that broad scale reform at the Federal level would come to fruition under the Biden administration and Democratic majority in 2022, but this did not occur. With a now established Republican majority in the House it is even less likely.

Indeed a closer review of this first cannabis bill which is sponsored by a group of GOP lawmakers shows that it’s intention is to allow simultaneous gun ownership and medical cannabis usage. To me this reads more of a gun rights push for veterans who use medical cannabis rather than being pro-weed.

That leaves the cannabis industry still in a lurch. Traditional financial institutions are hesitant to provide funding to the nascent industry despite legalization in a growing number of states. The federal issues are a sticking point. But I think that leaves the AFC Gamma (NASDAQ:AFCG) and peers that I’m going to review today in a good first-mover position to make up for this lending gap.

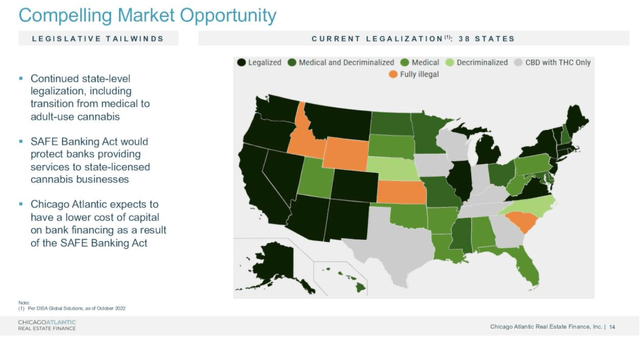

REFI Q3’22 Investor Presentation: US Cannabis Market Opportunity.

AFC Gamma Inc. is structured as a real estate investment trust or REIT along with peer Chicago Atlantic Real Estate Finance (REFI). The other company we’ll use for comparison today is Silver Spike Investment Corporation (SSIC), which I’ve written about before, and is structured as a BDC. All three are balance sheet lenders which focus on the cannabis sector formed within the last three years.

|

Name |

Ticker |

Structure |

Founded |

Market Cap (millions) |

|

AFC Gamma |

REIT |

2020 |

$322.80 |

|

|

Chicago Atlantic Real Estate Finance |

REIT |

2021 |

$268.80 |

|

|

Silver Spike Investment Corp. |

BDC |

2022 |

$59.10 |

Business and Structure of AFCG, REFI, and SSIC

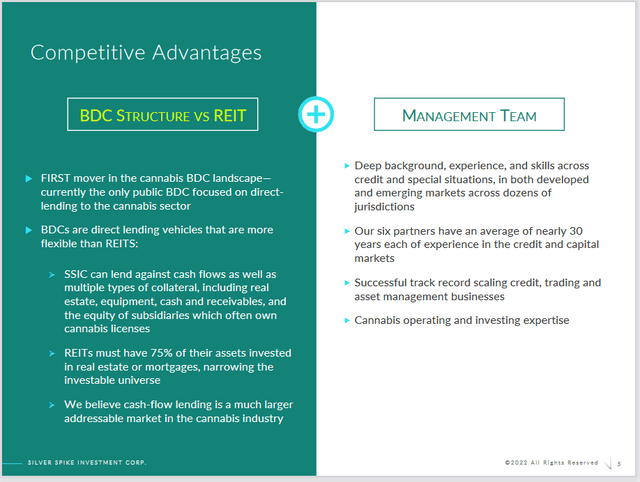

As balance sheet lenders these companies are providing secured loans to companies in the cannabis industry. The two REITs (AFCG & REFI) predominantly secure these loans with the underlying value of the real estate and they are required to have 75% of their assets invested in real estate or mortgages. Silver Spike Investment Corp functions somewhat differently as a BDC. It allows SSIC to lend against other types of collateral (cash flows, equipment, receivables) beyond just real estate, and they are not required to have xx% of their assets invested in it.

My read on this is that it makes SSIC more flexible as a structure. The company is able to invest in the exact same way as a REIT, but it is not required to. For a perhaps biased perspective on the matter we can look to this slide from SSIC’s Q2’23 earnings presentation:

SSIC Q3’22 Investor Presentation: BDC vs. REIT Structure.

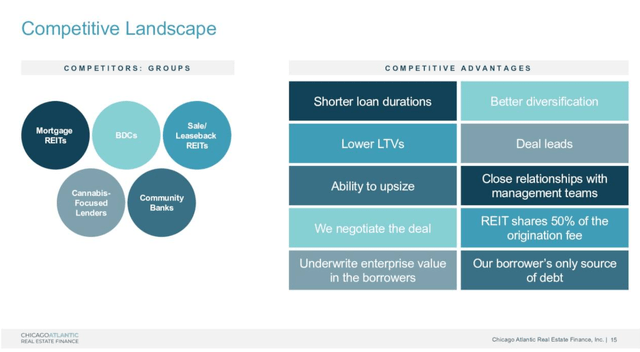

We can look to this slide from REFI for some competitive advantages overall and the other types of business that play in the area. Of particular note is that REITs like AFC Gamma share 50% of the origination fee which may make them more attractive as a lender.

REFI Q3’22 Investor Presentation: Competitive Landscape.

All three of these companies are positioned to benefit as first mover lenders. With or without federal legalization huge amounts of money are being made already in legal cannabis. Sales in the US were expected to grow from $25 billion in 2021 to $27 billion in 2022 (8%). And a number of states are just opening their retail markets providing continued growth opportunities.

Those projections came from a report by BDSA which is a cannabis data company. Another space for legal revenue growth, which CEO of BDSA Roy Bingham highlighted in the above article, is that “the illicit market will make up roughly 55% of total cannabis dollar sales across U.S. markets.“

The sector is not without issues. A national weed surplus is causing prices to decline putting margins and businesses at risk. AFC Gamma and peers are all impacted by this trend. Consider these data points from a recent Politico article:

-

Michigan has enough cultivation capacity to supply three times as much weed as the state’s consumers are buying – and that doesn’t include the huge illegal market that by all accounts commands a large share of sales.

-

In Colorado, prices have dropped by 51 percent over the last two years, according to BDSA.

-

The price of a pound of weed has plunged by 36 percent in Massachusetts and 46 percent in Missouri in just the last year, according to LeafLink.

-

The price drop is even more extreme in Michigan. Over the last two years, the price of weed in the recreational market has plummeted about 75 percent – from nearly $400 an ounce to less than $100.

A cannabis farmer in Northern California’s famed Emerald Triangle said, “We are witnessing massive insolvency, especially on the West Coast.“

This dynamic is expected to drive a wave of mergers and acquisitions in the sector during 2023 since there are so many struggling businesses. There likely will be ones that survive and consolidation should strengthen the survivors.

Many expect the scale of vertically integrated multi-state operators or MSOs to help the largest succeed over the long term. Our three companies today all seem to believe this too and are invested in many of the largest operators currently in the US.

The long-term growth trends remain intact for the sector despite the setback of federal inaction in 2022. High tax rates and higher financing costs for these companies eat into their profit, but these might come down with further legal changes in the future.

Good operators are likely to not only find a way through this, but will benefit. These operators will need partners from time-to-time for financing. And that’s where our three companies play their role in the ecosystem. Buying their stock gives access to a portfolio of secured loans in this growing sector which is perhaps a more conservative approach to investing in weed.

Strategy and Portfolio Analysis

In each of the company’s filings they describe their strategy. Below is a table which includes each company’s description.

|

Key elements of our strategy include:

|

Key elements of our strategy include:

|

Consistent with our business strategy, our Adviser has identified the following general, non-exclusive criteria and guidelines that we believe are important in evaluating prospective investment opportunities. We intend to focus on businesses that we believe:

|

The first thing I noted with this is that AFCG and REFI have almost the exact same language. The only difference is that REFI looks for loans greater than $5 million whereas AFCG looks for loans greater than $10 million. Since AFCG was founded first, it seems likely that REFI used the same language.

SSIC’s stated strategy gives a bit more differentiation and nuance. I particularly like the focus on institutional-level operations with free cash flow generation. With the headwinds in the sector currently businesses with these two characteristics seem most likely to benefit from continued growth while maintaining stability.

AFCG has focused their loan book on states with limited license jurisdictions which helps to limit competitors in these new markets. This gives the portfolio a bit more protection from the decline in wholesale prices in my opinion.

Stated strategy is one thing. Let’s see what these portfolios look like. Below is a table with high level details:

| Ticker | P/B Valuation | Value of Portfolio (millions) | Gross Portfolio Yield | Debt/Equity | Active Pipeline (millions) | % of Deals Funded by Count | # of Loans |

| AFCG | 0.96 | $426 | 20.00% | 27.91% | $368 | 4.40% | 13 |

| REFI | 1.03 | $348.90 | 18.30% | 19.62% | $800 | 9.80% | 22 |

| SSIC | 0.7 | $50.73 | 15.70% | 0.00% | $1,100 | 1.72% | 5 |

| Average | 0.90 | $275 | 18.00% | 15.84% | $756 | 5.31% | 13.33333333 |

We can see that we are not looking at very large portfolios in terms of value nor in terms of quantity of loans. This can make these companies a bit easier to value and interpret for those who dig deeper. From the data on this table here’s what stands out to me about AFCG:

- AFCG has the largest portfolio size and this scale may help benefit the company during this time of pressure in the sector.

- Their portfolio also has the highest implied gross yield at 20%. If their underwriting holds up this could provide material upside.

- Debt-to-equity ratio for AFCG is nearly double the peer average.

- With the smallest announced pipeline size, AFCG may experience pressure finding new deals moving forward.

- They are trading just below book value and just above peer averages.

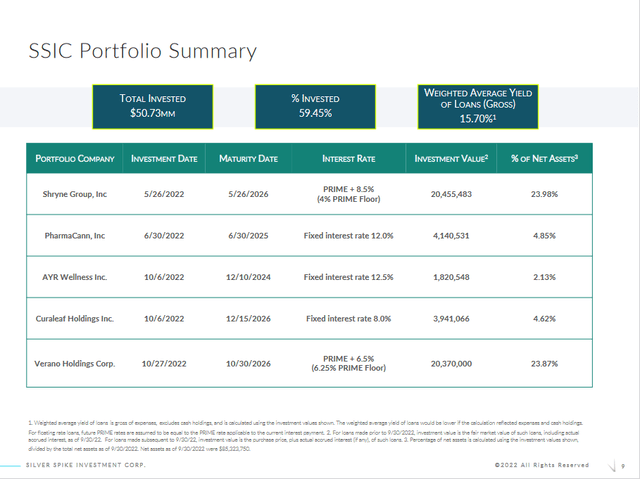

SSIC stands out as having no debt, a huge pipeline, and incredible selectivity having funded less than 2% of deals reviewed. And they trade at the lowest valuation.

Part of what is creating this divergence is that SSIC is the newest and smallest of these issues. Its stock hasn’t even traded for a full year yet. Because it’s so new the company hasn’t even fully deployed its cash yet and as of their last quarterly report they were 59.45% invested. That leaves ~$34 million in cash.

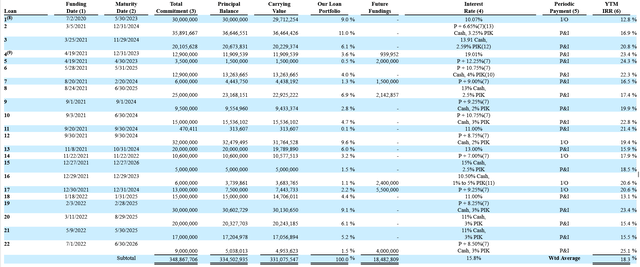

SSIC Q3’22 Investor Presentation: Portfolio Loans.

While AFCG and REFI are using leverage to increase their profitability, SSIC is cash flow positive with only ~60% of their portfolio built. These details point to a possible pricing inefficiency here.

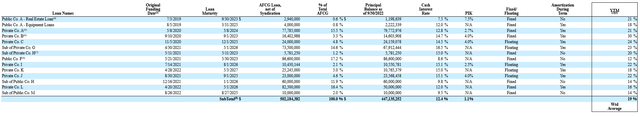

Let’s turn to details for AFCG and REFI’s portfolios.

AFCG Q3’22 10-Q: Portfolio Loans. REFI Q3’22 10-Q: Portfolio Loans.

Across these portfolios we can see the impact of federal laws reflected in the high interest rates borrowers are charged. Lenders need to keep a mindful balance here that while they are in a unique position to charge higher rates, ultimately the sector must survive for them to truly make money.

AFC Gamma has five different loans which make up greater than 10% of their portfolio. Trouble with any one of these loans would likely be enough to adjust book value down to the current 0.96x P/B valuation. A note is that subsequent quarter end they were refinanced out of their $86.6 million position.

This was a loan with Verano. The refinancing that Verano did was a whopping $350 million and was led by REFI. Silver Spike also participated in this contributing a chunk of $21 million. So it looks like AFCG’s competitors may have siphoned this relationship away.

More broadly, we can see from the current expected credit losses or CECL reserves that so far there is not an expectation of mass defaults so far. If we consider all three of the companies together, among their portfolios they only have two loans rated above a risk rating of 3.

|

Loan Value |

$426 |

$348.90 |

$50.73 |

|

CECL Reserve Amount |

$6.16 |

$1.55 |

$0.00 |

|

CECL % |

1.44% |

0.44% |

0.00% |

Both of those loans are with AFCG and explains them having the highest CECL percentage currently. The two loans have a carrying value of $33.4 million or about 7.8% of their portfolio. Adding these to the large loans we noted earlier which could impact book value, that means that six out of their twelve loans should be monitored closely.

Expense Fees

All three of these companies are externally managed so we should review the fees management is charging. Here’s a table with the baseline data.

|

Ticker |

Management Fee |

Incentive Fee |

Hurdle Amount |

|

1.52% |

20% |

8% |

|

|

1.50% |

20% |

8% |

|

|

1.75% |

20% |

7% |

Base management fees for SSIC are materially higher than the other two with a lower hurdle required to hit their incentive fee. What this means is that more money will be coming out of an owner’s pocket at SSIC than at AFCG or REFI. This could be a component driving relative undervaluation of SSIC.

The incentive fee percentage is not an exact amount as they each have a bit of a complicated way of calculating this bonus. I think these fees are actually on the high side overall.

AFC Gamma discussed on their last earnings call a potential move to internalization. Many view external management as being generally shareholder unfriendly so the move may help the stock down the line reduce expenses. A shareholder vote would be required to make this change though so owners should be kept abreast of progress in that way, at the least.

Dividend Yield

The two REITs have generous payouts which accompany their high yielding portfolios. AFCG yields 13.73% and REFI yields 12.04% on a trailing-twelve month basis, attracting the ever-longing gaze of dividend investors.

Since its founding in 2020, AFCG generated distributable earnings in excess of their dividend each quarter. Additionally the company has rollover income of around $0.29 per share outstanding. This reflects positively on their dividend management process.

SSIC has not established a dividend at this point but is likely to do so. Management was asked about this and said they should have a better answer to this question in the upcoming quarter. In all likelihood they will need to announce a distribution given they are required to payout a certain percentage of profits as dividends. And they’re profitable.

AFC Gamma Inc. is Fairly Valued

A review of peers here seems to suggest that AFC Gamma is fairly valued. The cannabis industry faces continued headwinds after a year of federal legislative inaction. But these headwinds can also create opportunities for well capitalized operators, and the lenders that support them.

With AFCG trading right around book value and six individual loans which could quickly require a book value adjustment, I don’t think there’s much margin of safety here. Overall, I think a P/B valuation of 1x is likely fair value for these companies moving forward. It does not provide a high premium given the level of risk still inherent with cannabis, but it at least assumes some value in the book.

I also particularly noted that industry leader Verona chose to not re-partner with AFCG in their recent round of financing, instead turning to its biggest public REIT rival REFI. That decision seems to reverberate along the same warning frequency as AFCG’s relatively small pipeline.

My review here seems to suggest that a swap trade from AFCG or REFI into SSIC would likely be a smart move here for anyone bullish on the sector as a whole. All three of these companies still have a complicated path to tread amidst a changing legal landscape, but it is not an impossible one. And earnings so far from these companies demonstrate profitability and no serious losses.

Reversion to the mean will work across these three companies to bring their valuations closer in line. So either AFCG and REFI will come down or SSIC will go up. This earnings season will likely serve to catalyze this change.

So again, I’d say each of these companies deserves a 1x P/B multiple. If so far none of my argumentation has made sense to you, perhaps this table will.

|

Ticker |

P/B |

Target Valuation |

Implied Return |

Price Target |

|

0.96 |

1.00 |

4.17% |

$16.47 |

|

|

1.03 |

1.00 |

-2.91% |

$14.76 |

|

|

0.70 |

1.00 |

42.86% |

$13.59 |

Another alternative is to avoid these businesses completely. The track records of these companies over the long-term has yet to be proven even as their management teams bring lots of experience. We also do not yet know if these structures (REITs & BDCs) will thrive with a cannabis focus. That gives plenty of pause for investors.

So in all, I think AFCG is fairly valued if at risk of being overvalued. With continuing pressure in the cannabis sector there may be more money lose than make with AFCG. Even with that 13% dividend.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment