IURII BUKHTA

Investment Thesis

AFC Gamma, Inc. (NASDAQ:AFCG) is a leading lender of institutional loans to nationwide cannabis producers and distributors. AFCG is headquartered in West Palm Beach, Florida. In this thesis, I will be discussing about the company’s strong dividend yield. I will also be analyzing the second quarter results posted by the company and its future growth prospects. I assign a buy rating for AFCG after considering all the growth and risk factors.

Company Overview

AFCG is a mortgage real estate investment trust (REIT), primarily lending loans to high-quality cannabis cultivators, producers, and distributors in the United States. The company is especially known for having a well-balanced lending portfolio, safeguarding the company from volatile markets. The company provides secured loans backed by significantly higher in value collateral. It generally provides loans to well-established companies having considerable cash flows, limiting the company’s risk exposure.

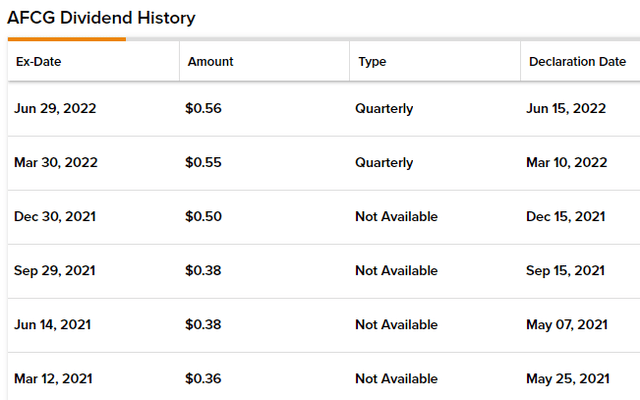

11.20% Dividend Yield

AFCG has a strong dividend yield of 11.20% at current share price of $18.22. As we can see in the chart above, the dividend payout has been consistently increasing since March 2021. The dividend per share has seen a 55% growth from $0.36 in March 2021 to $0.56 in June 2022. Along with the increased dividend payout, the dividend yield has also increased from 7%-8% in March 2021 to 11%-12% currently. I believe with the growing cannabis market and reduced uncertainties around the legalization of cannabis, the company is on a significant growth track with limited downside risk.

Solid Q2 2022 Results

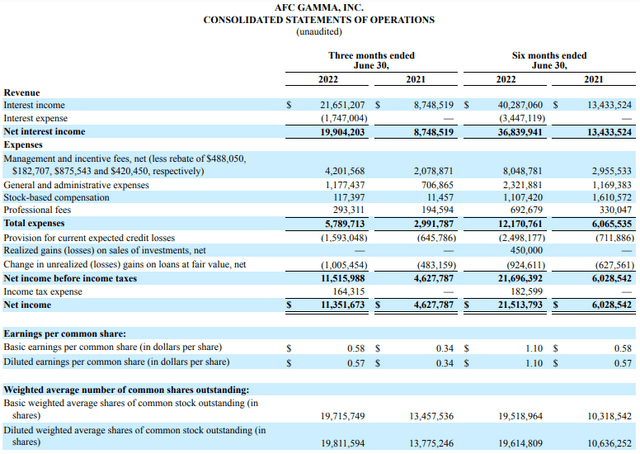

AFCG recently posted solid Q2 2022 results beating the market estimates. The company beat the EPS estimates by 20% and revenue estimates by 13%. It experienced improvement across segments with improved profit margins. I believe the company is on a significant growth track, and that is clearly reflected in the Q2 2022 results. The company is positive about the coming quarters and expects to expand its loan portfolio.

AFCG reported an Interest income of $21.6 million, a significant 148% jump compared to $8.7 million in the same quarter last year. As per my analysis, the expansion in the mortgage portfolio and well-balanced loan spread were the primary factors behind this increase. The company reported total expenses of $5.7 million, a 90% increase. I believe the increase in human resources and expenses related to human resource management were the main reasons behind the increased expenses. The total net income stood at $11.3 million, a solid 62% net profit margin. The diluted EPS was reported at $0.57 against the Q2 2021 EPS of $0.34, an effective increase of 67%. I believe the company will continue this performance in the coming quarters with continuous expansion and a well-balanced lending portfolio.

Leonard Tannenbaum, AFC Gamma’s Chief Executive Officer, stated,

Given the current market environment with operators experiencing pricing pressures and longer lead times to raise equity, we continue to act disciplined in our approach towards deploying capital. We are focused on supporting existing operators as well as new operators with strong track-records in the industry. Despite the slower than expected pace of originations, we have the capacity to do more deals and expect to close some in the coming quarter. We look forward to continue supporting the industry as it expands and matures.

Overall, AFCG posted strong quarter with improved margins and increased lending portfolio. The company has not provided any guidance for the future quarters but I estimate the FY22 EPS to be in the range of $2.26-$2.32. The company is well positioned in the industry to capitalize on the growing cannabis market and we can witness a significant upside in the stock price in the near future.

Key Risk Factor

Interest Rate Mismatch: The company utilizes borrowings dependent on LIBOR to support a sizable percentage of its lending fund. The interest rates on these assets could be fixed or linked to LIBOR or another index rate. As a result, any rise in LIBOR will typically lead to an increase in interest rates that won’t be offset by an equivalent rise in fixed-rate interest profits and might not be offset by an increase in floating-rate interest earnings. Any such interest rate discrepancy can have an adverse effect on the company’s profitability and consequently on dividend payments to owners. The manager’s estimations, models, and assumptions are used to analyze risks. Models that use estimations of fair value and interest rate sensitivity are used in these investigations. Actual economic conditions or the management team’s execution of decisions could lead to outcomes that drastically deviate from projections and forecasts based on the models’ calculations and underlying assumptions.

Valuation

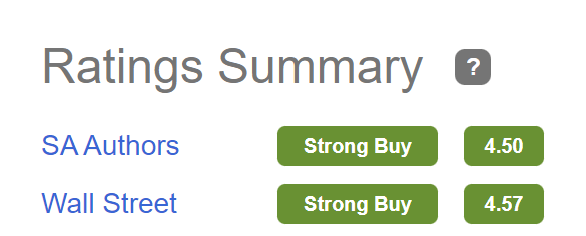

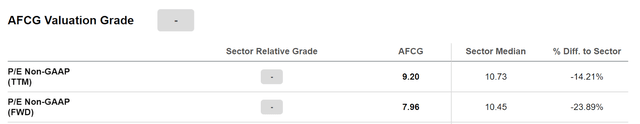

Seeking Alpha

AFCG has a strong buy rating according to the SA Authors and Wall Street, which I believe is correct; let me explain why. Currently, the company trades at $18.22 with a market capitalization of $361.81 million. According to seeking alpha, the company has a trailing PE multiple of 9.21x while the sector median is 10.73x, which shows that currently, the company is trading 14.21% below the median. The seeking alpha has estimated the full-year EPS of $2.29, which gives the leading PE multiple of 7.96x, which is 23.89% lower than the sector median of 10.45x.

I believe the full-year EPS estimate of seeking alpha is accurate. After analyzing both the metrics, I think I can clearly say that the company is undervalued and well positioned in the industry as compared to its competitors. I believe the company might trade at a PE multiple of 10x with the full-year EPS of $2.29, which gives the target of $22.90, representing a 25.6% upside. The company is trading at a share price of $18.22 against the book value of $17.03, this reflects that the company is not trading at a higher premium against its book value and there is still scope for a considerable upside in the stock price.

Conclusion

The company has a solid dividend yield of 11.20% and has posted strong Q2 2022 results with improvement across segments. I believe the company is currently facing selling pressure due to the volatile interest rates in the market, which has significantly decreased the share price of the company, but on the positive side, it has created a good entry point for the risk-averse investors to earn a stable and robust dividend. The company is on a growth track with a well-balanced lending portfolio. After considering the 25.6% upside in share price from current levels and 11.2% dividend yield, I assign a buy rating for AFCG.

Be the first to comment