David Commins

AerSale Corporation (NASDAQ:ASLE) recently reported beneficial quarterly results thanks to higher flight equipment sales. Management also reports a significant amount of cash in hand, which it could use to open new facilities all over the country. In my view, AerSale holds sufficient expertise to offer more services and products to clients in more target markets in the United States. I do see certain risks from failed assumptions about the sale or lease of engines or components. With that, in my view, the stock price appears too cheap at this point in time.

AerSale Benefits From The Increase In Flight Equipment Sales

AerSale presents itself as a worldwide provider of aftermarket commercial aircrafts, engines, and parts.

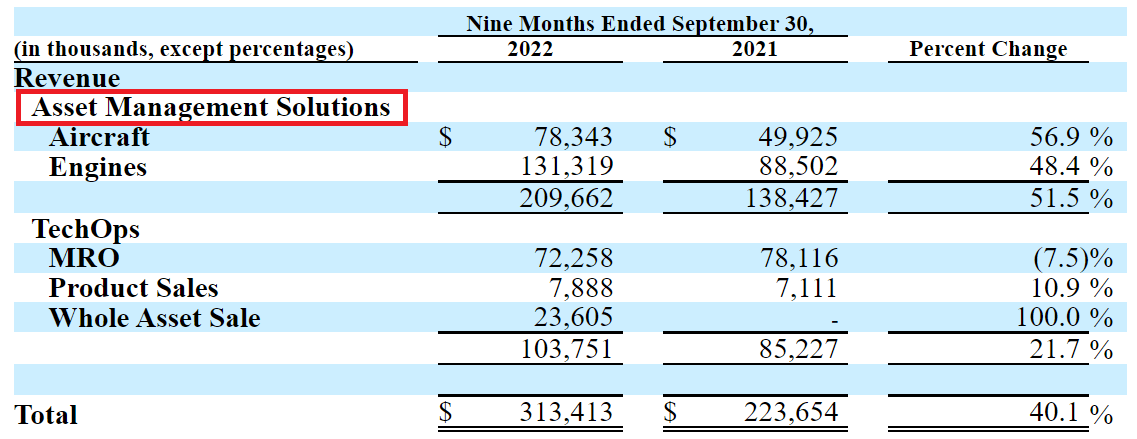

The company has two divisions: Asset Management Solutions, specialized in strategic asset acquisitions, and TechOps, composed of MRO activities for aircrafts and their components.

Source: 10-Q

In 2022, the Asset Management Solutions division appears to bring most of the company’s revenue. Management appears to benefit from higher flight equipment sales.

The increase in Engines revenues is primarily attributable to increased activity in the RB211 and CF6-80 product line as a result of higher Flight Equipment sales in the amount of $31.5 million, and higher leasing revenue in the CF6-80 product line totaling $7.4 million. Source: 10-Q

Balance Sheet: Substantial Amount Of Cash In Hand

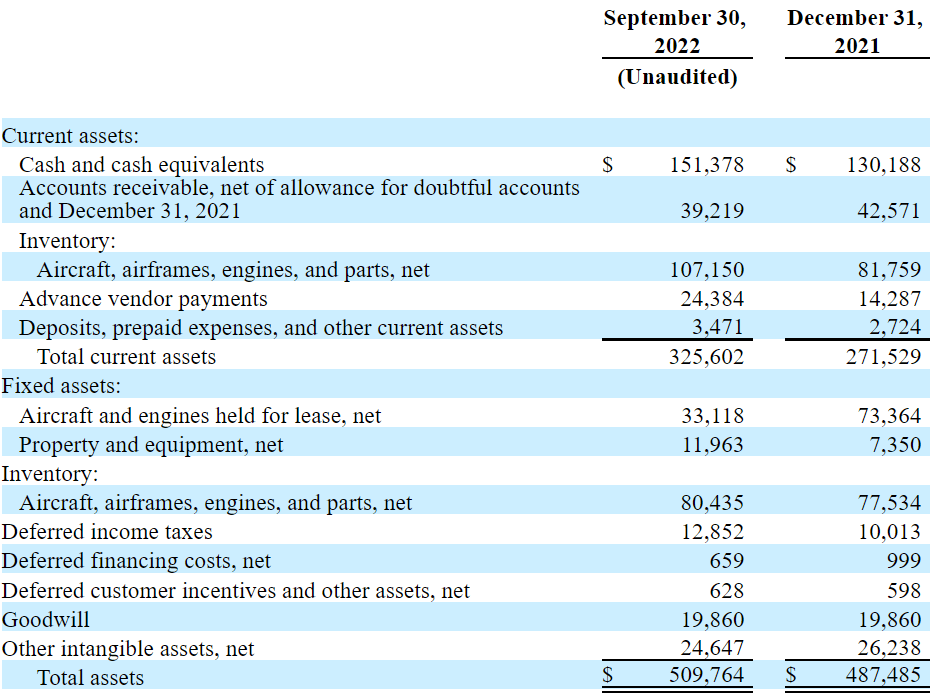

As of September 30, 2022, AerSale reported cash and cash equivalents of $151 million, accounts receivable worth $39.219 million, and aircraft, airframes, engines, and parts of $107.150 million. Advance vendor payments were worth $24,384 million. With a total current assets of $325.602 million and a small amount of current liabilities, I believe that the company will likely not face a liquidity crisis any time soon.

Non-current assets include aircraft and engines worth $33 million, and inventory, aircraft, and parts were worth $80.435 million with goodwill worth $19 million. Finally, total assets stand at $509 million, close to 10x the total amount of liabilities. I believe that the balance sheet stands in a very good shape.

Source: 10-Q

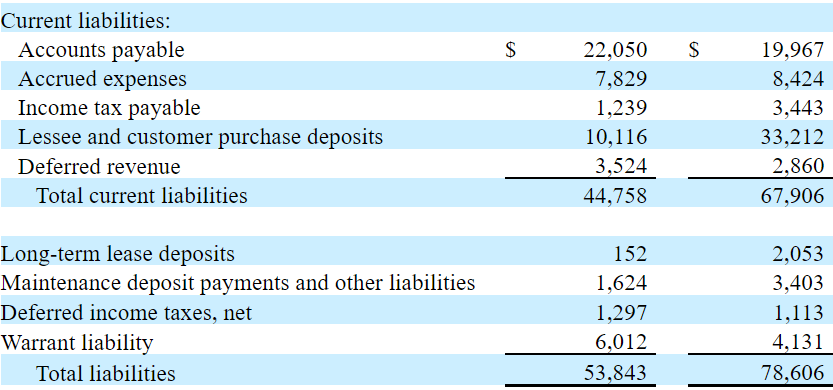

The liabilities include accounts payable worth $22 million and accrued expenses worth $7.829 million, in addition to a lease and customer purchase of $10.116 million. I only considered a warrant liability worth $6 million as debt, so total liabilities stood at $53.843 million.

Source: 10-Q

Great Figures Reported In 2022 And Beneficial Expectations From Analysts

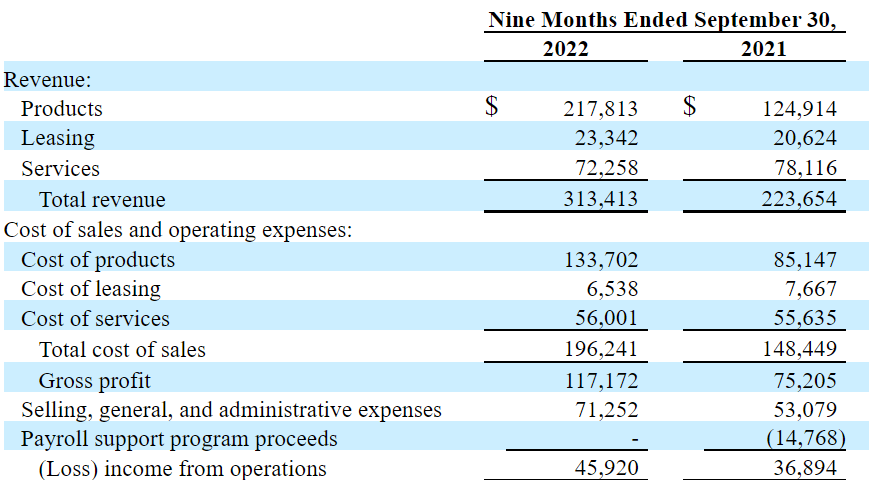

The numbers reported in 2022 were quite beneficial. In the nine months ended September 2022, revenue reported from the sale of products was equal to $217 million with leasing of $23 million together with services of $72 million. Total revenue was $313 million, close to 40% higher than what the company reported in the same period in 2021.

In the same period, cost of products was $133 million in addition to cost of services worth $56 million. A total cost of sales of $196 million was obtained, which implied a gross profit of $117.172 million. Finally, operating income was equal to $45 million, 24% more than what the company reported on September 30, 2021.

Source: 10-Q

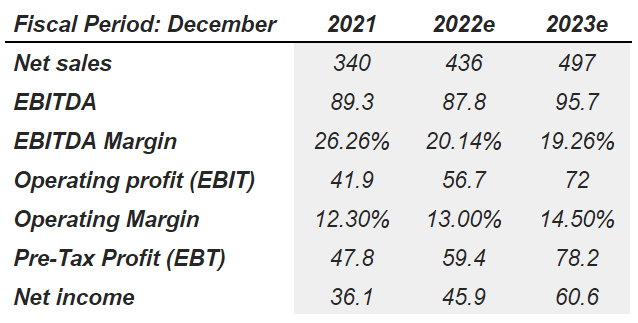

The expectations from analysts are also quite beneficial. Investors forecast, for 2023, a net sales of $497 million, in addition to an EBITDA of $95.7 million, with an EBITDA margin of 19.26%. Besides, estimates include an operating profit of $72 million with an operating margin of 14.50%. The pre tax profit is likely to be $78.2 million with a net income of $60.6 million.

Source: Marketscreener.com

My Conservative Scenario Resulted In A Valuation Of $23.71 Per Share

Founded in 2008, in my view, AerSale has built a beneficial reputation offering multiple service and product offerings for owners of mid-life commercial aircraft. In my opinion, AerSale will likely become even more efficient as more clients learn about the services offered.

Our mission is to provide full-service support to owners and operators of mid-life commercial aircraft who lack the infrastructure and/or expertise to cost effectively maintain such aircraft. Source: 10-K

By providing a one-stop shop that integrates multiple service and product offerings, we save our customers time and money, while providing value to our shareholders through our operating efficiency. Source: 10-K

Notice that management operates from facilities in a few cities in the United States. As the company receives more money from investors, the network of facilities will likely increase so that the company is closer to more clients. The target market will likely increase, which may bring revenue growth up.

At the individual component level, our facilities are located in Miami, Florida, Rio Rancho, New Mexico, and Memphis, Tennessee. Source: 10-k

Let’s keep in mind that the company holds an FAA unlimited repair station rating, which means that AerSale’s new facilities could be opened all over the country. In my view, this represents a competitive advantage over other actors in the industry in the United States.

We have a competitive advantage over most of our MRO competitors of being one of the select aviation aftermarket companies that has the necessary technical and operational resources to hold FAA “unlimited” repair station ratings for both our airframe and component MRO operations. Source: 10-k

Finally, under this case scenario, I assumed that management will likely be sufficiently smart to sign agreements with government contractors. In the last annual report, AerSale noted that these clients could be interested in the company’s USM parts sales in addition to MRO service opportunities:

We intend to increasingly focus on capturing additional USM parts sales in addition to MRO service opportunities, directly with these government customers, or through subcontracting arrangements with government contractors. Source: 10-k

Market experts believe that the commercial aircraft parts market could grow at close to 5% from 2022 to 2028. Under this scenario, I assumed that ASLE’s sales growth could grow at close to this figure.

According to 360ResearchReports provides you with historical and forecast data of Commercial Aircraft Aftermarket Parts market was valued at USD 30400 million in 2022 and is expected to reach USD 41440 million by the end of 2028, growing at a CAGR of 5.3% between 2022 and 2028. Source: Commercial Aircraft Aftermarket Parts Market [5.3% CAGR] 2022 Touching New Heights, Advancing Technologies Helps Prominent Players till 2028 – MarketWatch

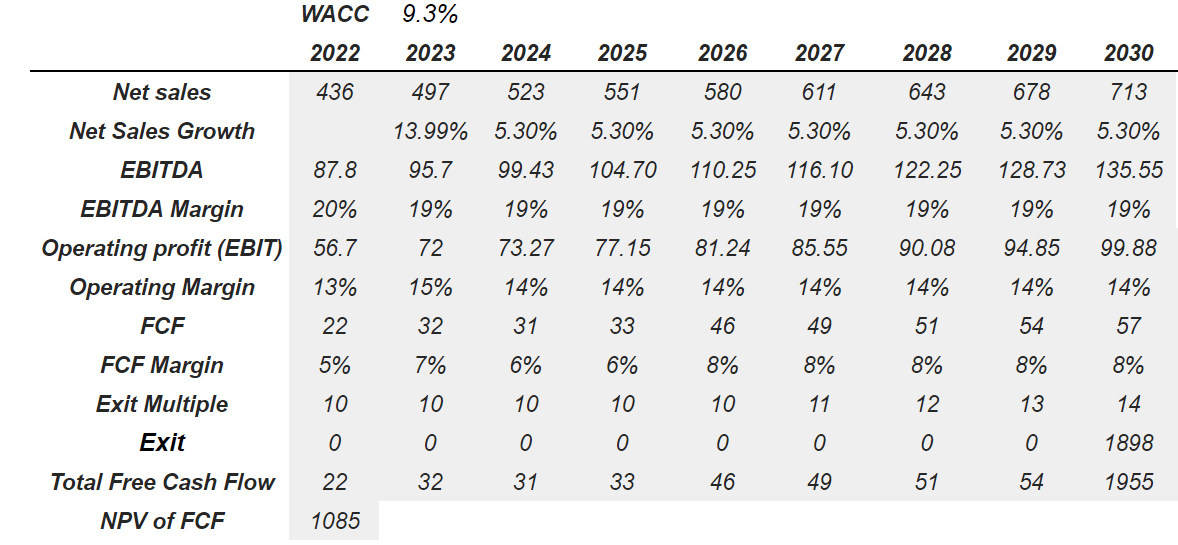

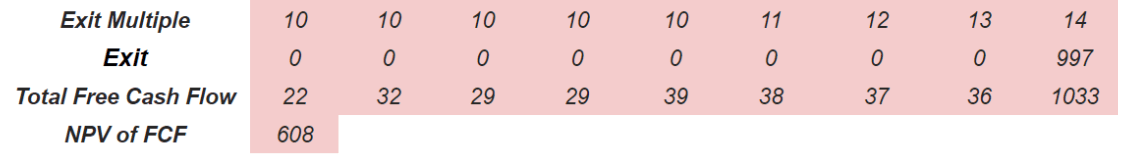

My assumptions included 5.3% sales growth from 2024 to 2030, an EBITDA margin of 19%, operating margin close to 14%, and growing FCF margin. I assumed that the 2030 FCF margin would be close to 8%, which would imply 2030 FCF of $57 million. If we also include an exit multiple of 14x 2030 EBITDA, the exit would stand at $1.9 billion, and the sum of future FCF may stand at close to $1.08 billion.

Source: Bersit’s DCF Model

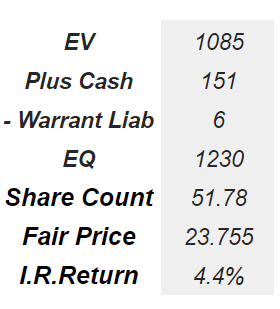

Now, if we sum cash close to $151 million, and subtract warrant liabilities of $6 million, the implied equity valuation would be $1.2 billion. With a share count of 51.7 million, the fair price would be around $23.75 per share, and the IRR would be 4.4%.

Source: Bersit’s DCF Model

Under Very Bearish Conditions, My Implied Valuation Would Be $14.55 Per Share

There are many external factors which may drive the company’s revenue growth down. In the last annual report, AerSale reported that an eventual increase in the oil prices or a general decrease in the economic conditions would lower sales. Besides, it is also worth noting that the bankruptcy of certain clients may have an impact on the company’s financial statements.

The commercial aviation industry is historically cyclical and has been negatively affected in the past by geopolitical events, high fuel and oil prices, lack of capital, and weak economic conditions. As a result of these and other events, from time to time certain of our customers have filed for bankruptcy protection or ceased operation. Source: 10-k

In line with the previous lines, management may suffer from tight credit markets, which may damage the business model of airline customers. If they decide to buy less parts, or there is a consolidation in the industry, AerSale’s revenue growth may suffer significantly.

In addition, certain of our airline customers have in the past been impacted by tight credit markets, which limited their ability to buy parts, services, and Flight Equipment. Source: 10-K

Considering the ongoing Russia-Ukraine conflict, AerSale already noted that the U.S. government and the EU have already established controls over some of the company’s products. Sanctions may lower the company’s activity:

The U.S. government has imposed enhanced export restrictions and controls on certain products and technology, as well as sanctions on certain industry sectors and parties in Russia, Belarus and parts of the Ukraine. The governments of other jurisdictions in which we may conduct business, such as the European Union, have also implemented sanctions or other restrictive measures. Source: 10-Q

The company makes some assumptions with respect to the profits to be made from the sale or lease of assets. If management fails to predict the demand of certain products, or the assumptions are too optimistic, AerSale could suffer losses and a decrease in the company’s free cash flow margins. The company talked about these risks in the last annual report:

Reductions in demand for these assets or declining market values, as well as differences between actual results and the assumptions we utilize in determining the recoverability of our Flight Equipment could result in impairment charges in future periods, which may have a material adverse effect on our business, financial condition, liquidity and results of operations. Source: 10-K

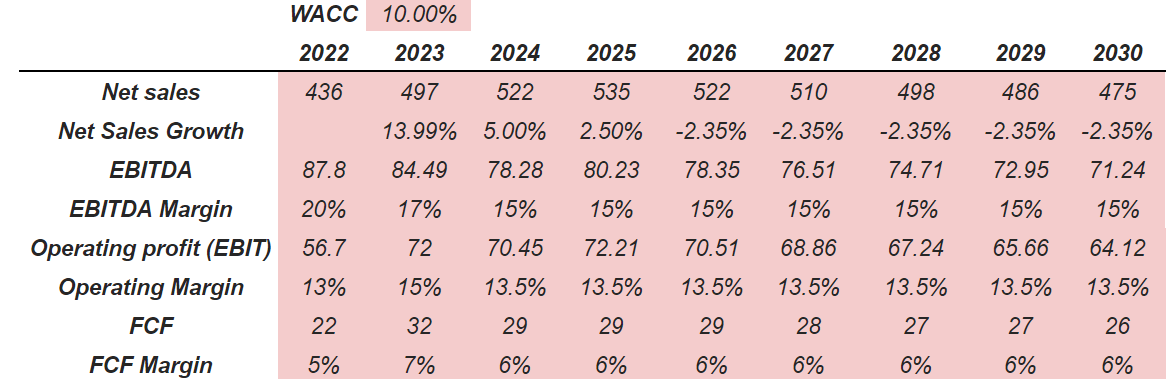

With sales growth around 5% and -2.35% from 2024 to 2030, an EBITDA margin of 15%, operating margin of 13.5%, and FCF margin close to 6%, the results include free cash flow close to $22 million and $26 million as well as 2030 EBITDA of almost $71.5 million.

Source: Bersit’s DCF Model

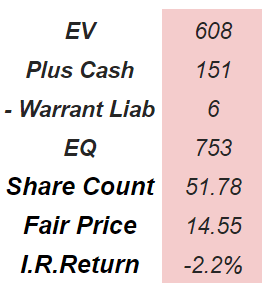

I obtained an exit valuation close to $995 million, and the NPV of future FCF would stand at $608.1 million.

Source: Bersit’s DCF Model

My results would include an equity valuation close to $755 million, a fair price of $14.55 per share, and an IRR of -2.21%. In my view, my numbers are quite pessimistic and perhaps a bit unlikely.

Source: Bersit’s DCF Model

Conclusion

AerSale reported beneficial quarterly results, and the company’s balance sheet includes a lot of cash and little liabilities. Besides, analysts are quite optimistic about the years 2023 and 2024. In my view, if management successfully opens new facilities all over the country, and maintains the FAA unlimited repair station rating, revenue growth will likely trend north. Yes, there are some risks from an eventual increase in the oil price or failed assumptions with respect to the sale or lease of products. With that, in my view, the current share price could be higher.

Be the first to comment