Alexyz3d/iStock via Getty Images

Recently, Aerojet Rocketdyne was in the news as a possible acquisition target. Given the company’s product portfolio that does not come as a big surprise. In this report, I explain what makes Aerojet Rocketdyne attractive to acquire and I will discuss the company’s most recent quarterly results.

Aerojet Rocketdyne Is An Outperformer

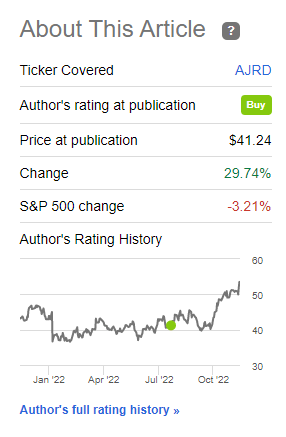

Seeking Alpha

In a report published in early August, I marked shares of Aerojet Rocketdyne a buy, and that call has worked out quite well so far. While the S&P 500 is down over 3%, shares of Aerojet Rocketdyne have skyrocketed nearly 30% though the actual performance as I am writing this report now is +31.2%. So, any investor who would have bought at the point would have seen their position in Aerojet Rocketdyne outperform significantly. It serves as a strong reminder that value is not only to be found in the bigger defense names.

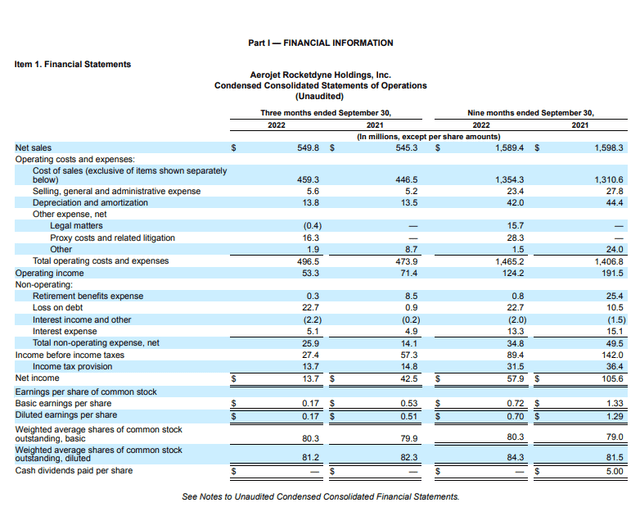

During the quarter, net sales grew by $4.5 million or almost 1%. Next Generation Interceptor and Standard Missiles sales carried the growth, but this was partially offset by lower Guided Multiple Launch Rocket System (GMLRS) sales and lower RL10, liquid-fuel cryogenic rocket engine, sales for space. A positive is that RS-25 sales continue ramping up sequentially despite supply chain issues. Excluding adjustments to cost estimates to complete projects, sales would have been up almost 3.5%.

Operating income declined by $18.1 million from $71.4 million to $53.5 million. A significant portion of that decline is driven by costs related to the proxy battle at Aerojet Rocketdyne. Adjusting for legal matters, proxy costs and related litigation and other expenses, Q3 2022 operating income would have been $71.1 million giving an adjusted operating margin of 12.9% compared to $80.7 million or 14.7%, so there is some margin pressure.

Aerojet Rocketdyne provides adjusted EBITDAP excluding Estimate at Completion or EAC adjustments. Last year, the provider of space and defense thrusters saw positive adjustments for the RL-10 and RL-68 programs while this year the Standard Missile program provided a headwind. It is important to keep these EAC adjustments in mind, but there is also value in stripping these adjustments to assess how the business is performing. By doing so, margins grew from 13.4% to 14% and from 12.5% to 13.6% for the nine-month period.

Positioning for Growth

In the third quarter, increased profitability for THAAD drove the margins. The targeted EBITDAP excluding EAC adjustments is 14%. That also means there is not much space (no pun intended) for earnings growth for margins. Previously, some production was concentrated in the Huntsville and Camden facilities to increase competitive strength, which equals better cost control. So, the growth has to come from attracting new business and increasing capacity.

Aerojet Rocketdyne is enjoying a concurrent uptick in space and defense demand. Not all demands such as Stinger and Javelin missiles have translated into the backlog and also for missile defense significant opportunities exist while Aerojet Rocketdyne plays an important role in US hypersonic missile development as well as the Ground Based Strategic Deterrent or Sentinel. So, the defense platforms offer long-term opportunities.

In space, Aerojet Rocketdyne plays an important role as well. On the Artemis program, for example, there are the RS-25 engines providing the thrust for the launch stage. The engines for the next launch have already been delivered to NASA and for the subsequent two launches, the engines are finished for the fourth mission and almost finished for the fifth mission. So, despite supply chain delays, the company is tracking rather well.

The number of job openings decreased from 400 to 250, which is another good thing. When historic events happen such as the Artemis launch that serves as an inspiration for young talented people and sparks interest to work in a respective field. At the time, I was going through my BSc in Aerospace Engineering years ago, SpaceX started doing what many thought was impossible, and it sparked interest for the MSc tracks in Space and Control & Simulation, because many young people aspired to work in the ranks of SpaceX eventually. Now, with the Artemis missions, we could see more people being interested in working in this field and the same holds for missile defense given the global impact the conflict in Ukraine has and that could provide Aerojet Rocketdyne with a tailwind to filling near-term positions, but also filling positions in the future.

Is Aerojet Rocketdyne Stock A Buy?

The short answer is “Yes”. We see significant opportunities in space and in defense, with new weapon capability and capacity expansion opportunities. These elements make Aerojet Rocketdyne attractive as an acquisition target, and therefore, should also be of interest to investors. Even more so, even as a stand-alone business, the company offers significant opportunities for growth, making it attractive to buy shares. Wall Street has a buy rating on Aerojet Rocketdyne stock, but its consensus target is 4 to 5 percent below current trading levels. That is caused by the fact that we haven’t seen any adjustments to ratings since April this year. So, items like the positives on capacity expansion, opportunities and positioning as an acquisition target as well as strength as a stand-alone company are not sufficiently reflected in the current price targets.

Conclusion: Positioning For Growth With Unique Development Capability Boosts Buy Rating

I believe that even though results continue to be impacted by supply chain issues, Aerojet Rocketdyne has a development pipeline as well as a sales pipeline that makes the company attractive for investors and also for companies looking to acquire it. We previously saw that a merger with Lockheed Martin was called off due to regulatory hurdles, and those challenges continue to exist when Aerojet Rocketdyne intends to combine with a bigger defense player that looks to diversify its portfolio rather than absorbing the company for vertical integration.

Be the first to comment