AsiaVision

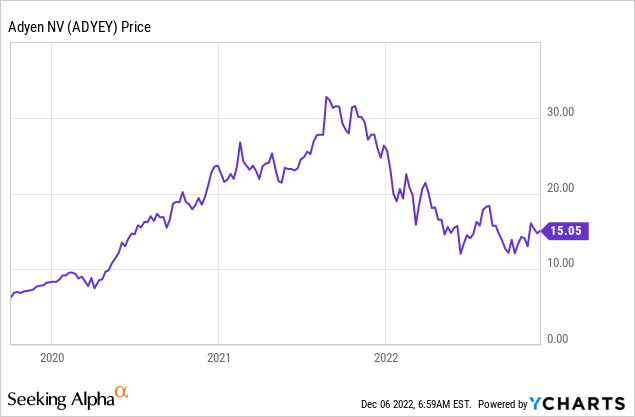

Adyen (OTCPK:ADYEY) [AMS:ADYEN] is a Holland-based fintech company that offers end to end payments, data, and financial management in a single solution. The company works with a range of reputable brands which include Uber (UBER), McDonald’s (MCD), Facebook (now Meta) (META), H&M, eBay (EBAY), Microsoft (MSFT) and many more. Management has continued to execute its strategy exceptionally well as the business has reported strong growth across all business segments. In this post I’m going to break down the company’s business model, financials, and valuation, let’s dive in.

Business Model Recap

In my previous post on Adyen, I covered its business model in great detail here is a quick recap. Adyen offers a single payments platform to collect payments, protect revenue, and control finances. Its products include the ability to accept payments online and in person. However, it also leverages the vast amount of payment data it collects on its customers to rapidly extend business financing/credit. In addition, the company offers card issuing which includes physical and virtual cards.

Adyen makes its net revenue from charging a “take rate” for its payment processing service and the company also charges fees for its point-of-sale hardware and other services.

Strong Financial results

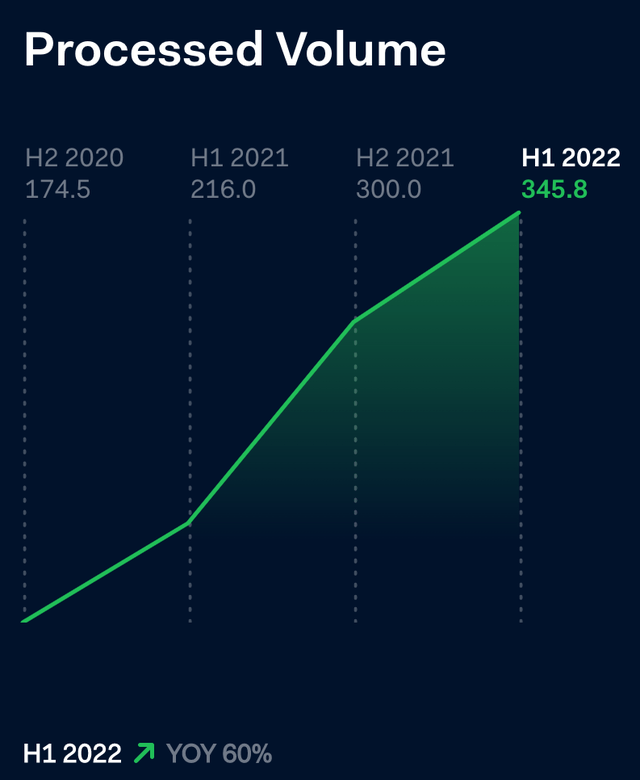

Adyen reported strong financial results for the first half of 2022. Overall Processing volume was €345.8 billion ($364 billion) which increased by a rapid 60% year over year. The vast majority (over 80%) of this growth came from merchants which are already on the platform. This is a testament to the beautiful business model of the company which effectively grows with its customers.

Processing Volume (Q3,22 report)

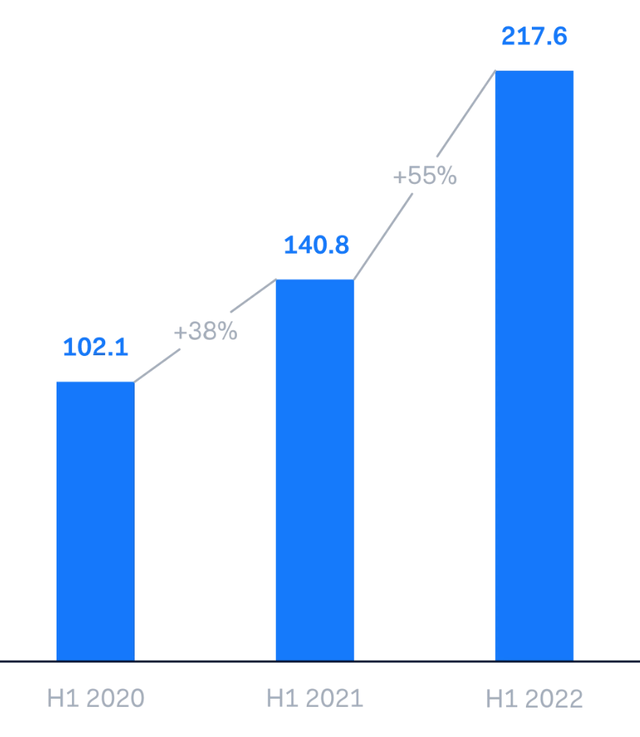

Breaking this processing volume down by segment. Its largest segment Digital payments processing volume, contributed 62% of the total volume. This segment increased processing volume by a blistering 55% year over year to €217.6 million. This was driven by strong e-commerce growth across its customers such as Samsung, Shopee (which is gaining traction in Latin America), and Monday.com.

Digital Payments Volume (H1,22 Report)

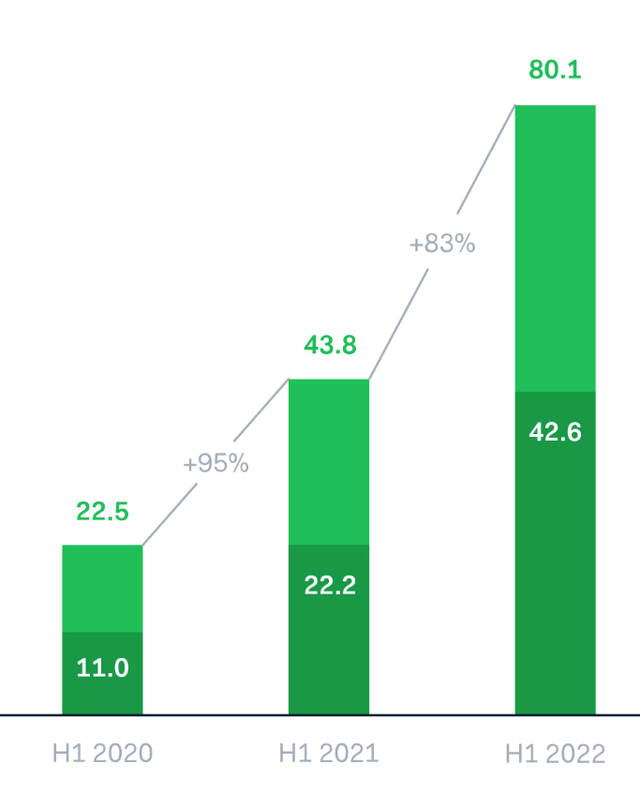

Unified Commerce contributed 23% of payment processing volume as it reached €80.1 million up a rapid 83% year over year. Unified Commerce effectively aims to bridge the gap between the online and offline worlds. Adyen has rolled out a series of new features in this space including its “Tap to Pay” terminals with Apple. In addition, to assisting with cashier-less stores, self-checkout etc. The company attracted new big brands to its offering which included All Saints, Dior, and UNIQLO.

Unified Commerce, POS volumes in shaded area (H1,22 report)

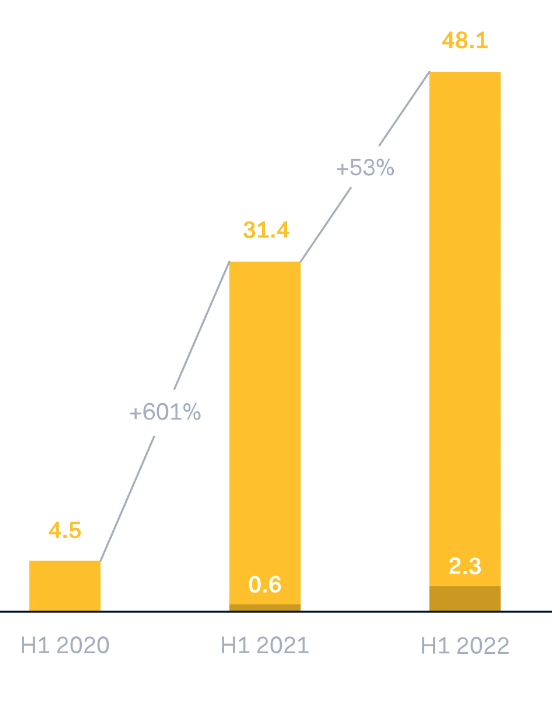

Adyen also works with a variety of platform businesses such as Data SaaS platform Crisp, Radial (e-commerce fulfillment provider), Go Henry (a prepaid debit card for kids), and Lovingly an on-demand flower provider. Its range of customers means Adyen is well-diversified to handle any economic volatility with specific industries. Its Platform segment increased processing volume by a rapid 53% year over year to €48.1 million.

Platform Processed volume (H1,22 report)

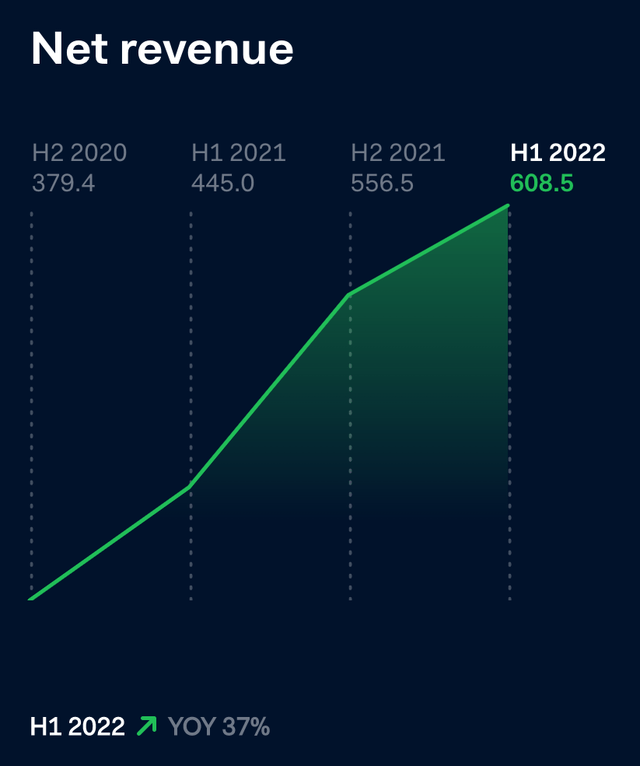

Net revenue increased by 37% year over year to €608.5 million. This was driven by the aforementioned growth in payment processing volume and the continued execution of its “land and expand” strategy across verticals.

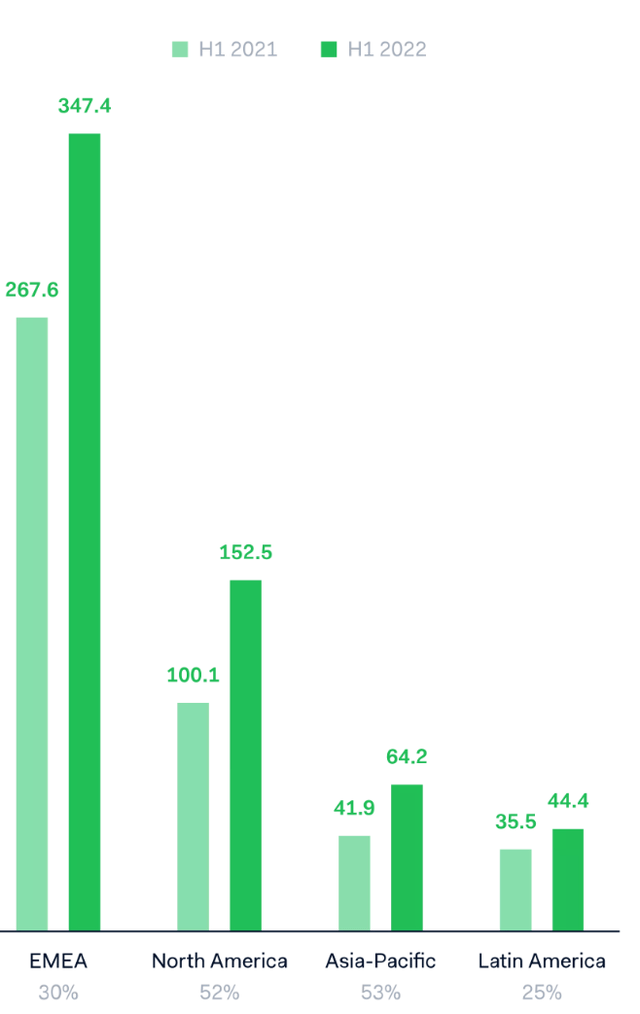

By region, EMEA contributed to 57% of net revenue and grew by 30% year over year. The company has also continued its expansion into North America as revenue in this region increased by 52% year over year to 25% of the total. The APAC region also reported solid growth up 53% year over year and contributes to 11% of total revenue. Finally, the LATAM region generated 25% year-over-year revenue growth at 7% of the total. The vast diversification across regions means the company’s revenue is likely to stable if economic troubles hit a specific region. I would like to see North America-based revenue continue to grow at the current trajectory and reach at least 50% of the total, for greater diversification away from Europe, due to war in the region.

Revenue by region (H1,22 report)

Profitability, Expenses and Cash Flow

The company reported a slight decline in its “take rate” which is the percentage of payment volume the business takes for its processing service. In the first half of 2021, this take rate was 20.6 bps and dropped to 17.6 bps by the first half of 2022. This reduction was driven by the company’s tiered pricing strategy which charges existing customers less the more they grow on the platform. This trend was most widely since in the airline industry as travel booking boomed in the first half of 2022, thanks the economic reopening.

The business reported €356.3 million in EBITDA which increased by 31% year over year. Free Cash flow was €308.9 million which increased by a rapid 25% year-on-year.

Adyen has a strong balance sheet with €5.6 billion ($5.9 billion) in cash and short-term investments. In addition, the company has minimal debt of just €174 million ($184 million).

Advanced Valuation

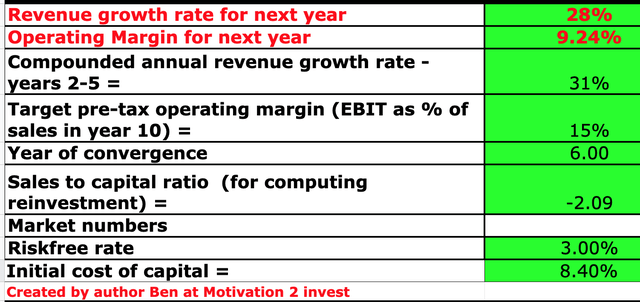

In order to value Adyen I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 28% revenue growth for next year, which is slower than the prior growth rate of 37%. I expect this to be driven by the recessionary environment as consumer spending is likely to fall (more on this in the Risks section). However, in years 2 to 5, I am forecasting a rebound in revenue growth to 31% per year.

Adyen stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted the company to grow its operating margin to 15% over the next 6 years, as it continues to scale and drive down costs.

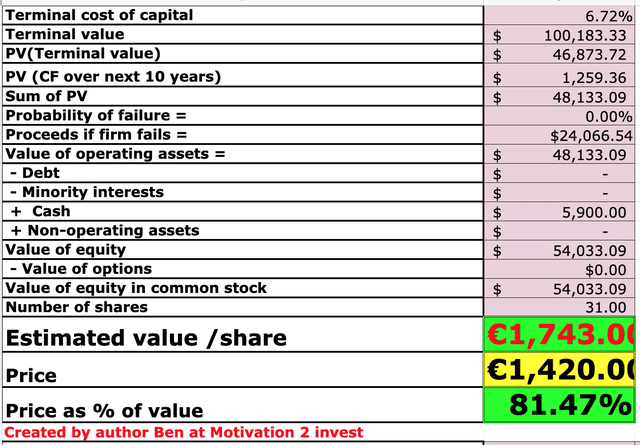

Adyen stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of €1,743 per share, the stock is trading at €1,420 per share at the time of writing and thus is ~19% undervalued.

Note: Ignore the dollar signs in the model as the currency has been converted at output. The share price in the model based on the Amsterdam exchange [AMS:ADYEN].

As an extra data point, Adyen trades at a PS ratio = 6, which is more expensive than PayPal which trades at a Price to Sales ratio = 3 and Block which trades at a PS ratio = 2.

Risks

Recession/lower payment volume

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Even if a recession doesn’t occur, the psychological damage is still done, as consumers aim to save and curb unnecessary expenses. For a company which makes its money from payment processing volume this means less revenue.

Final Thoughts

Adyen is a tremendous fintech company that has been executing its “land and expand” model extremely well. The company has reported solid growth across all business segments despite tough economic conditions. The stock is undervalued intrinsically and thus it could be a great long term investment. Although I do expect some volatility in the short term as a recession will likely curb the enthusiasm of shoppers.

Be the first to comment