FatCamera/E+ via Getty Images

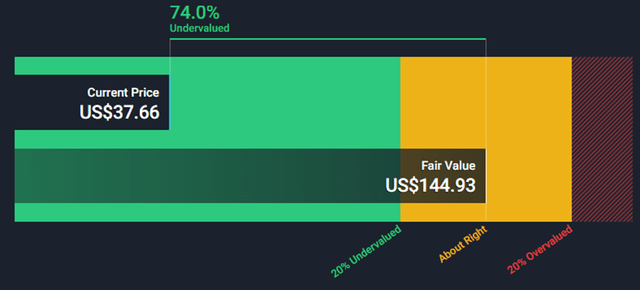

Adtalem Global Education Inc. (NYSE:NYSE:ATGE) stock price has been on a tear in recent months; on Feb 23rd, shares were at $19.74. By Aug 25th, they had reached a recent high of $41.12, a 108% rise in 6 months. With a fair value price of $145 per share and favorable ratio metrics compared to its peers, Adtalem looks set for continued growth. Adtalem is seeing improved demand for its nurse training and growing demand across the health care sector. It has developed many strategic collaborations and is benefiting from the increased margin from cost savings and synergies.

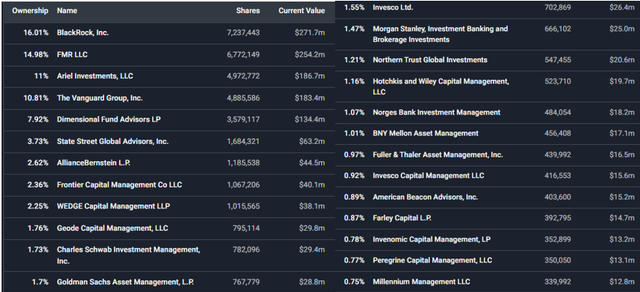

Currently, more than 95% of Adtalem’s stock is held by institutions, and 25 Companies own 90% of the stock. My Father, whom I often mention, would have described this as a smart money stock and is clearly being missed by the retail investor (dumb money, as my Father would have said).

Holdings in ATGE (Simplywallst.com)

The list contains many of the names we are all familiar with, and with this type of ownership profile and the recent stock price growth, the company is worth investigating.

Adtalem Strategy

Adtalem is a leading global education provider and has recently been through strategic refocusing. Intending to become the leading provider of talent to the health care industry, it has been steadily streamlining its portfolio by divesting non-core operating assets. In 2022 Adtalem completed this process with two final M&A deals. Firstly it purchased Walden University from Perdoceo (PRDO) for $1.48 billion (it paid in cash). Secondly, the disposal of its Financial Services segment, selling the division to a Wendel group consortium generating $1 billion in cash.

Having divested its none medical sector and replaced it with an online medical-focused university, these final two transactions leave Adtalem as the leading education provider to the US medical and health care industry.

After the Walden takeover, management spoke about saving $30 million in synergies during the first year of operations. The new CEO Stephen Beard said in the Q4 earnings call that they were on target to achieve this.

The succession process for the CEO seems to have been well managed, with the outgoing CEO Lisa Wardell becoming executive chairman after five years at the helm and Steve Beard moving from COO to CEO. I like this transition; it gives confidence that the board will continue in its direction and strategy; the company is at a crucial juncture. At this point, a loss of focus could be damaging for shareholders. The new streamlined focused company must not lose its way.

Cost Cutting

Adtalem has reduced its workforce and centralized many of its none teaching activities. Spending has been cut significantly on marketing and discretionary spending by using its central buying power. In the recent earnings call, the CEO said:

As the year progressed, we expanded operating margins through the rollout of our new operating model, and the realization of synergies from the Walden acquisition.

Adtalem management is confident in its ability to achieve the stated gain of $60 million in cost savings from cost-cutting and synergies following the Walden takeover.

Competitive Strategy

Key metrics : Adtalem is now strategically focused on the health care industry, a fast-growing sector. It is educating people at scale to fill the estimated needs of the industry; 500,000 nurses and 139,000 physicians in the next ten years.

Its Chamberlain University graduated more than 14,000 students in the year ending June 2022 and is the largest school of Nursing in the US.

Adtalem has three trading divisions. Chamberlain University, Walden University, and Medical & Vet. The division Medical and Vet includes:- the American University of the Caribbean School of Medicine, Ross University schools of Medicine, and Veterinary Science.

Adtalem’s medical schools account for more than 2.5 times as many active physicians as any other US-based medical school.

Only 2.5% of its students default on student loans against an average of 7% for public US universities and 13% at private for-profit universities. With first-time pass rates in licensing exams often higher than the national average and first-time residency slots higher than 90%, student outcomes at these institutions are as good or better.

Cooperation with industry stakeholders.

Adtalem is building effective relationships with other stakeholders in the industry. Its collaborations are numerous and look very effective. I counted 13 such initiatives by going through the investor section of the website. Here are three recent examples. 1) the recently announced partnership with HBCU Bethane Cookman university to expand access for aspiring medical students. 2) the agreement with Southern California University to increase the pipeline of physicians. 3) the recently awarded grant from the American Nurses Foundation to develop practice-ready specialty Nurses.

Adtalem won an award from Forbes magazine for its diverse employment figures.

Business Performance Figures

The now streamlined Adtalem is performing exceptionally well. Results from the full year 2022 earnings call contained the following financial highlights

77,000 students enrolled

Margins increased by 230 basis points (primarily due to cost savings and synergies)

EPS increased by 40% over the prior year

Leverage significantly reduced

Revenue was up 53% in 2022, primarily due to the Walden takeover.

EPS guidance for 2023 from $3.95 to $4.20 represents another 26% improvement at the midpoint with little change in revenue. This kind of performance is excellent and justifies the investments of the hedge funds and institutions mentioned above.

Looking at performance by sector

Chamberlain University: revenue of $140 million (down 1%) operating income of $41 million (up 37%). Student enrolment is down 6%. Nurse training was hit hard by covid; nurses were too busy and stressed to consider additional training. This is likely to mean above-average growth in the next few years as Nurses return and complete the courses they intended to do. Pre Licensure enrolment continues to grow, and persistence improved (meaning fewer dropouts).

Walden had revenue of $137 million and an operating income of $13 million. Enrolment was again down (10%) due to post-licensure Nurse training programs.

Medical and Vet revenue $84 million (up 3%) operating income $14.5 million up 30%. Student enrolment was up 4%, driven by growth in new students and persistence.

Although the reduction in enrolment of post-licensure Nurses caused a reduction overall that can be attributed entirely to COVID, I expect the effect to dissipate quickly. The increased operating income shows the previously discussed cost-cutting and synergies to drive greater profits.

Valuing Adtalem

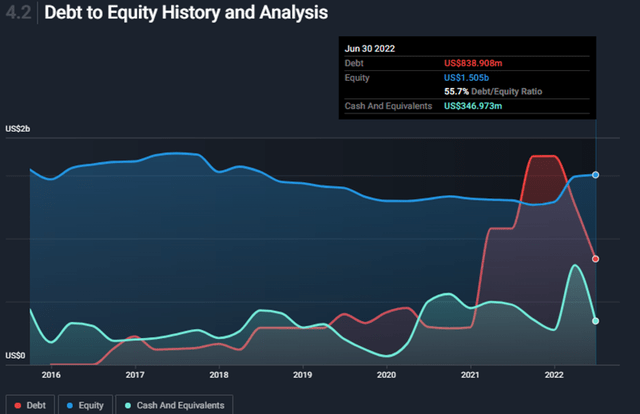

The recent M&A activity has impacted the balance sheet. In 2021 the debt to equity ratio was over 125%; however, it has dropped significantly this year as it repaid debt.

Debt to Equity with Cash (simplywallst.com)

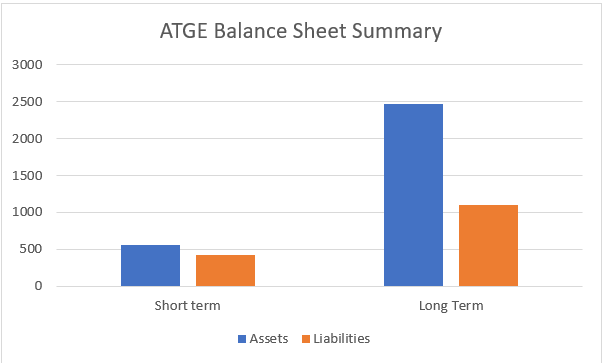

The balance sheet summary below is good for an established company.

ATGE Balance sheet summary (Author from SEC filings)

Adtalem is using this strong position to repurchase shares and reduce debt; approximately $450 million will be used to repurchase shares. $770 million of the cash generated by the sale of the financial services division was allocated to reduce debt.

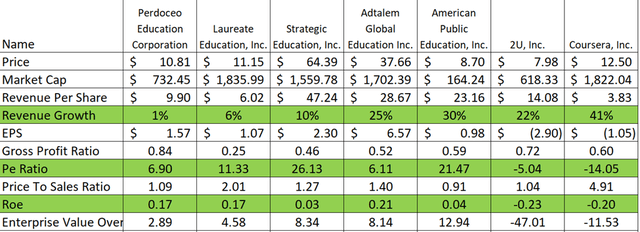

Comparing Adtalem with its immediate competitors suggests it is one of the better performing. (ATGE 2022 others 2021 due to dates)

Sector competition (Author, SEC filings)

I have highlighted three key measures where Adtalem is doing remarkably well. These measures suggest that the company is well managed and on a sound, profitable pathway.

As might be expected, Adtalem has extensive Analyst coverage, 31 in fact, and of those, 5 provide revenue forecasts. Those revenue forecasts give the following fair value based on a DCF model.

ATGE fair value (simplywallst.com)

Conclusion

Adtalem has positioned itself as a significant player in US healthcare education. It is educating Nurses and Physicians at scale through its three divisions and, with an excellent reputation, looks set to increase its revenue in the coming years.

Adtalem has used synergies and cost-cutting to increase its profitability significantly, reduce its leverage, and begin a share repurchase program.

Several metrics suggest that Adtalem is outperforming its competitors in key areas.

I think Adtalem is a solid buy, and I will add it to my portfolio.

Be the first to comment