Julie Caron/iStock via Getty Images

Ares Capital (NASDAQ:ARCC) reported significantly higher core EPS and Net Investment Income Per Share quarter over quarter. Both lofted above estimates. The elevated story doesn’t end with this bullish report for this business development company (“BDC”). BDCs loan at significant premiums to middle market companies. So, grab the man-a-lift, one at time, please, and let’s head upward to the plateau and observe the whole kit and kaboodle.

The Quarterly Report

Advantages, both short and long-term, are popping up at Ares, but before we head to the scenic over-look, let’s stop at the last results for a review. Highlights from the report include:

- $0.46 core EPS up 10% quarter over quarter.

- Net Investment per Share at $0.52.

- NAV of $18.81 slightly lower due to unrealized losses from wider credit spreads.

- Largest holding equals only 0.2% (diversification).

- Average EBIDTA of its holdings are now at $179.

- Limited to 5%-10% in the higher risk category.

- Weighted average yield at 9.5% up 60 basis points quarter over quarter.

- $4.6 billion in liquidity.

- Leverage at 1.25 up significantly from 1.06 at March’s end.

- $3.1 billion in new investments during the quarter most of which were senior.

- Average investment grade of 3.2.

- Non-accrual equaled 1.6% up from 1.2% last quarter due to one additional investment.

Ares truly performed solidly within a marketplace of uncertainty. Management also made clear, more and stronger performance can be expected.

A Distance Long-term View

With the quarterly review finished, let’s step across the plateau to the edge for the panoramic view. Management noted, “We become incrementally more selective with our core deal flow to focus on the highest quality investments and to drive better pricing in terms.” In uncertain times, deals can and do become less expensive. Our skills don’t afford an estimate, but it’s a long-term positive.

Perhaps the most important announcement offered during the call came within this insightful statement. Penni Roll, Ares CFO, stated,

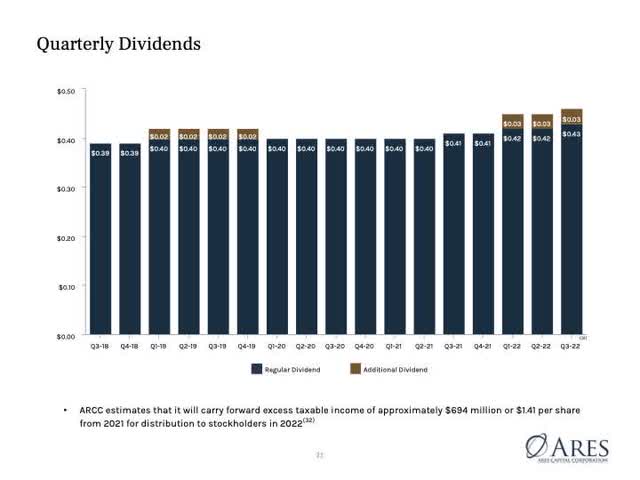

“Before I conclude, I want to discuss our undistributed taxable income and our dividends. We currently estimate that our spillover income from 2021 into 2022 will be approximately $694 million or $1.41 per share. We believe having a strong and meaningful undistributed spillover supports our goal of maintaining a steady dividend throughout market cycles . . . .”

The company isn’t paying out all of its earnings rather planning carry-over for future rainy days.

Visible Opportunities

As we view the scenic spectacle for closer details, the volatile environment is creating marketplace opportunities, opportunities not present under other climates. Management noted, the “leverage stance markets are experiencing significant spread widening, weak secondary liquidity and minimal primary issuance” with larger banks working out unsold committed financing many at significant losses. Ares’ approach includes building liquidity for the obvious advantageous adding of new discounted loans with both existing and new borrowers. Management clearly welcomes this volatile environment for its longer-term growth.

Immersed in Investment Beauty

Again, management discussed the value from increasing market interest rates and other natural circumstances created during rising interest rates. A summary of a few follows:

- Market rate increase of 100 basis points lifts core earnings $0.08 per quarter. (The company believes more impactful increases will appear in the 3rd quarter and beyond.)

- 150 basis point increase likely lifts “a weighted average interest coverage ratio in the portfolio of approximately two times.”

- With not all of the base rate effect realized in the 2nd quarter, that quarter actually should have been $0.05 higher or approximately $0.51.

Ryan Lynch, of KBW, asked:

“. . . when I look at the core earnings . . . and the potential increases in the future . . . earnings look like they’re going to be well above those combined when you kind of look at 2023 earnings potential. . . . can you remind us what are you guys thinking as far as dividend policies going forward?”

deVeer answered simply (emphasis added):

“As you look forward, we think that we’ve got a great positive earnings trajectory here with a much, much higher base rate. . . yes, we do pick up some very easy earnings going forward. . . . but we felt highly confident in our ability to increase the dividend this quarter. And I’ll couple that by saying we’ve also built a pretty substantial amount of spillover income, as you’re aware of the company. . . . So we feel good about the earnings trajectory, and we feel good about the dividend where it is today and potentially growing from here.”

The managements conservative analysis of its earnings projections offer investors thoughts to consider. Adding just a few of the delightful observations from the edge, Ares could earn between $0.54-$0.60. (We aren’t sure that the missing 2nd quarter earnings should be directly added with the likely 3rd quarter increase.) This excludes last year’s carryover. We included a slide from the last quarter’s presentation illustrating the dividend record showing its stability.

Dividends increases are coming. How much lies within management’s sleight of hand? What will appear in the sleight is still a guess. What we believe is that because most of the increase are come through higher fixed interest rates, most of the dividend increases will be administered through specials. It seems that at least $0.50 per quarter is coming incrementally over the next several quarters.

Risk & Investing

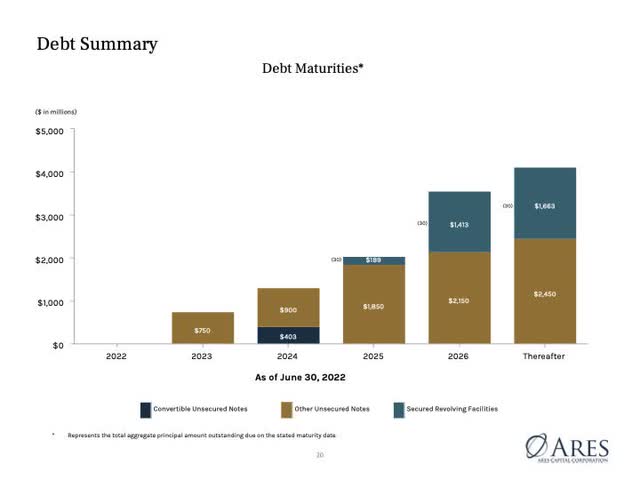

Risks must be considered alongside the growth observed with the encompassing view. First, we looked at the company’s debt structure shown below. In 2023, the first refinance appears, which continues in increasing amounts through 2026. What effect might that restructuring have on earnings isn’t quite known. But, Fed Chairman Powell, in his Jackson Hole convention remarks, stood clear in his stance that fighting inflation trumps economic growth. High interest rates will be around for awhile.

Not to forget, Ares and its management is also creating usual opportunities from the volatility present. Also remember, this isn’t the company’s first encounter with an unsettled interest rate market; it successfully navigated the prior. The company is generating cash, lots of it and will in time be forced to step up its investor returns broadening the smiles on our faces. The view at the edge is compelling, brilliant and inviting. Adding or entering a position on any weakness seems a like a lucrative action.

Be the first to comment