SeanShot

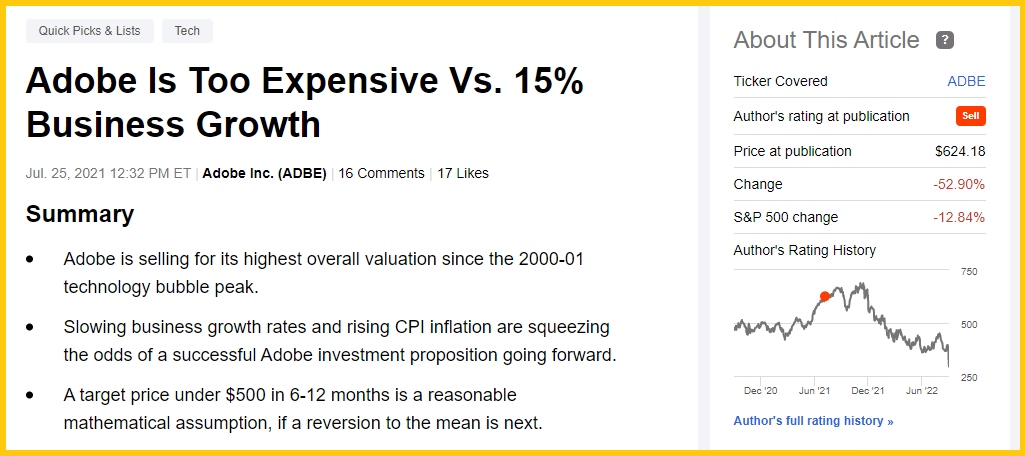

A year ago in July here, I made the valuation call Adobe (NASDAQ:ADBE) was too expensive at $625 per share, and would likely trade 30% lower into 2022. Well, the Big Tech bust from extreme overvaluations late in 2021 has arrived. With rising interest rates affecting what investors are willing to pay for a company and now a slowing economy dragging down almost every software company in price, including Adobe, it has become abundantly clear valuations do still matter.

Seeking Alpha – Paul Franke, Adobe Article July 2021

What I didn’t foresee was a debatable management decision to spend $20 billion in cash and stock on an acquisition of online design company Figma, announced September 14th. While it may take a few years to measure for sure if this takeover idea was a good one (I could argue either way), the initial investor reaction has been to club the stock price to death. Over the last several trading days, the quote has dropped -20%, for a total market cap drop of $35 billion (almost double the purchase value of Figma).

Figma Company Homepage – September 16th, 2022

So, here’s my bullish valuation argument, the opposite of last year’s sell article. Adobe’s valuation has imploded from a record high in November 2021 around $700 per share to between a 6-year and 9-year low number at $294 per share currently. The business is still extremely profitable, marketing an enviable lineup of online subscription products (SaaS), while the new asset acquisition will only drag down per share results in a very minor fashion for a few years. If you are looking for Big Tech exposure from the PDF file format creator, with must-have graphic design programs for businesses and consumers, now is a great time to contemplate adding Adobe to your portfolio.

Desirable High-Margin Business Model

The new Figma business with scant sales and earnings vs. the purchase price (but growing rapidly, holding quite complimentary software with Adobe) will not negatively affect overall profit margins, while reducing EPS by about 5% in 2023-24, by my calculations. You have to ask yourself if a 5% short-term downgrade to earnings potential deserves a 20% hit to the stock quote? My answer is absolutely not, all other variables remaining the same.

According to the company, Figma is expected to add approximately $200 million in net new [Annual Recurring Revenue] ARR this year, surpassing $400 million in total ARR exiting 2022. Figma sports best-in-class net dollar retention of greater than 150%, with gross margins of approximately 90% and positive operating cash flow. For buyout logic, the idea is a merger with Adobe’s product offerings will allow Figma’s millions of users to mushroom into tens of millions over the next 3-5 years.

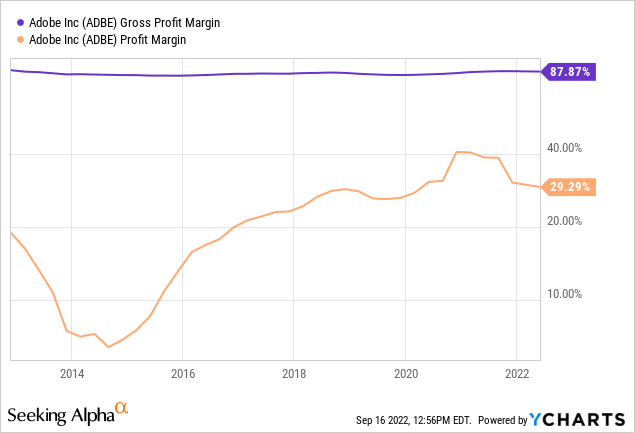

YCharts, ADBE Profit Margins – 10 Years

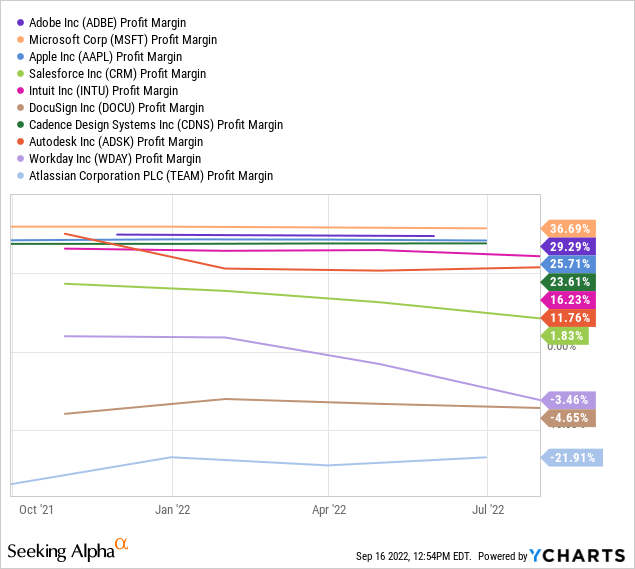

Adobe’s gross and final profit margins are some of the highest of any blue-chip company in America, including other Big Tech firms. Adobe is nearly the top performer on margins compared to application software peers and competitors like Microsoft (MSFT), Apple (AAPL), Salesforce (CRM), Intuit (INTU), DocuSign (DOCU), Cadence Design (CDNS), Autodesk (ADSK), Workday (WDAY), and Atlassian PLC (TEAM).

YCharts, ADBE vs. Peer Software Companies – Profit Margins Past 12 Months

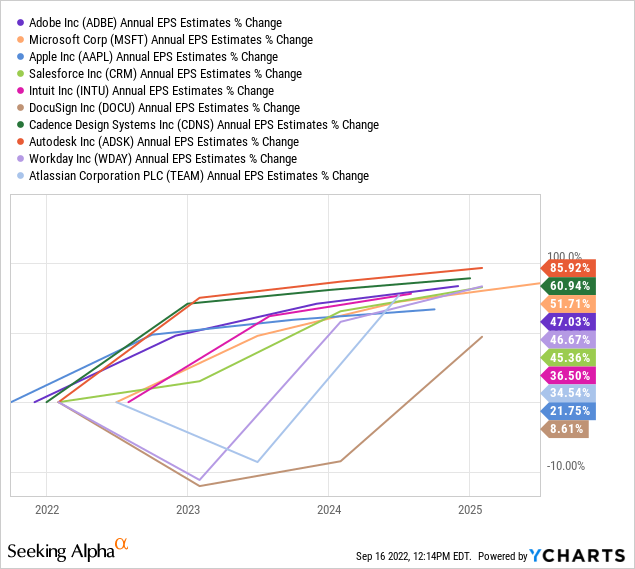

More good news, before the Figma headline and herd downgrade rush, analysts were projecting strong and steady EPS growth, similar to the leading software names as alternative investment choices.

YCharts, ADBE vs. Peer Software Companies – Projected EPS Growth to 2025

Lowered Valuation Worth Owning

In my experience, if you can buy a popular brand-name company on a steep price drop, technology related or not, it usually turns out to be a terrific opportunity for long-term capital allocation. In addition, buying a high-margin business with a P/E ratio closer to underlying growth rates (PEG analysis) is often a uniquely profitable proposition. With Adobe, you get both under $300 a share in September.

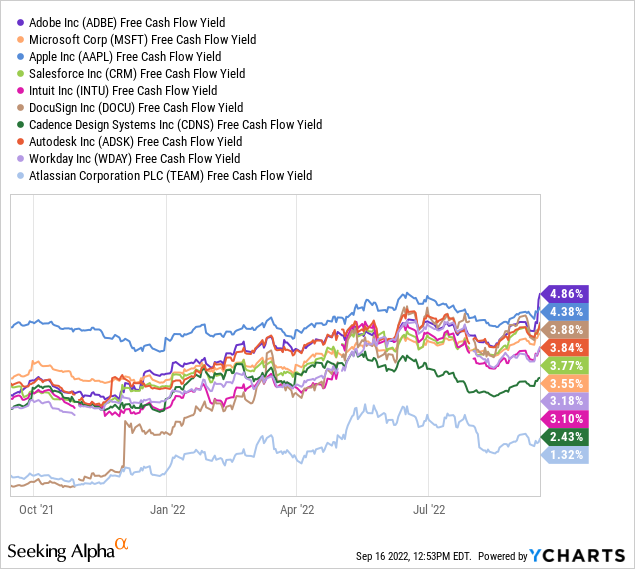

Free cash flow yield is approaching 5% (before Figma is thrown into the mix, when the deal is closed next year), which is the top spot in the major company, software sector. This number may be the best argument to get serious about an Adobe stake.

YCharts, ADBE vs. Peer Software Companies, Free Cash Flow Yields – Past 12 Months

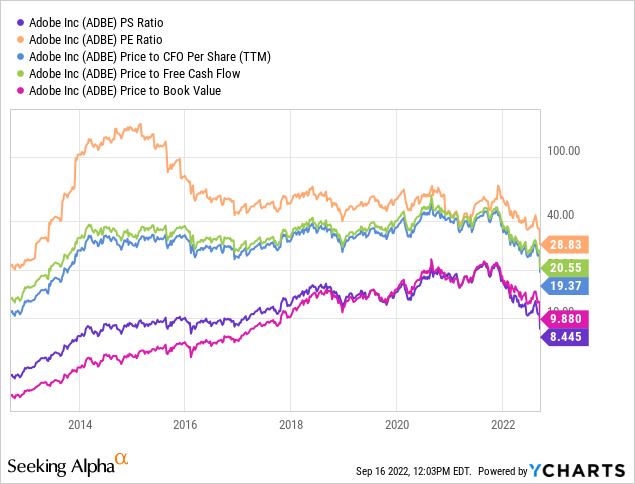

Looking at trailing 10-year ratio analysis of basic operating fundamentals, the valuation story has become compelling quickly in late 2022. On price to trailing earnings, sales, cash flow, free cash flow, and book value, Adobe is the least expensive for buyers since 2013-16, depending on which number you are researching.

YCharts, ADBE Price to Fundamental Ratios – 10 Years

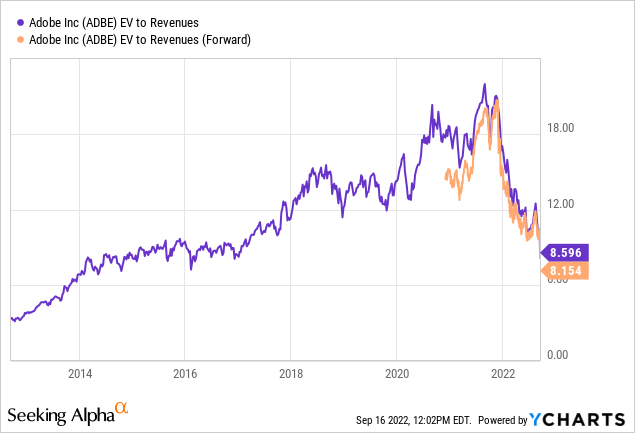

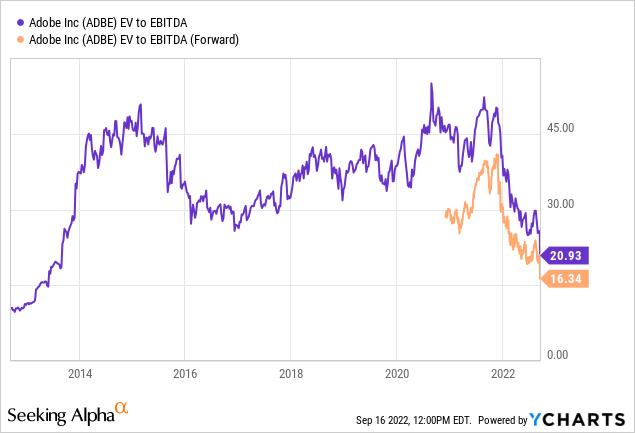

Taking into account balance sheet items like debt and cash, enterprise value calculations are just as cheap. EV to revenue is back to 2014 average levels. And, EV to EBITDA (earnings before interest, taxes, depreciation and amortization) is the same as 2013, a good nine years ago.

YCharts, ADBE EV to Revenues – 10 Years YCharts, ADBE EV to EBITDA – 10 Years

Final Thoughts

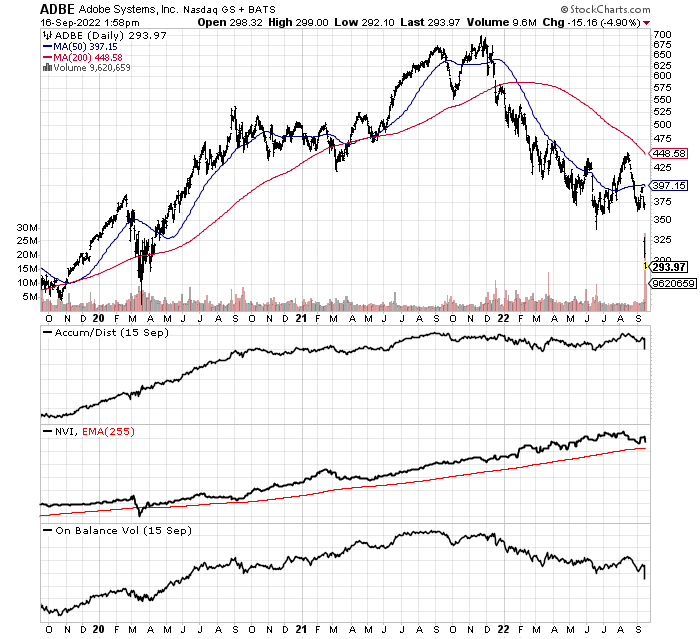

I am upgrading my Adobe rating to Buy. The stock represents a solid pick, with growth-at-a-reasonable price [GARP] characteristics. An equity price approaching the worst days of the COVID-19 pandemic shutdown in March-April 2022 is quite absurd. On the 3-year chart of daily changes below, you can review the bullish trend in a variety of momentum indicators over the last two and a half years.

StockCharts.com, ADBE – 3 Years of Daily Changes

I do not expect price to become much cheaper, even during a deep recession. The biggest risk is more immediate, the continued zigzag lower on Wall Street generally in all equities. However, if the Adobe price does fall another 10% to 20%, I would consider such as Strong Buy territory.

For now, opening a starter position, with an eye toward increasing your stake into early 2023 is a smart accumulation plan. A 5% free cash flow yield is much better than the recent past for Adobe, yet remains quite a distance from the prevailing 8%+ CPI inflation rate. In a bullish change of events (let’s hope), declining inflation rates under 4% by next summer could support a sizable +20% to +30% increase in Adobe’s quote. Nothing spectacular, but this projected increase will likely best a stock market churning its wheels, getting used to a slower economy with flatlining business growth rates.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment