Justin Sullivan/Getty Images News

Adobe (NASDAQ:ADBE) uncharacteristically fell double-digits after releasing earnings, which on the surface appeared to be due to slowing growth rates, but may more likely simply be representative of the changing sentiment toward tech stocks. ADBE was previously one of the stocks that seemingly could not fall, but that has all changed with the recent crash in tech stocks. Investors have historically had to pay through the nose to invest in ADBE shares, but price compression has led to multiple compression, making the stock quite buyable here. I rate shares a buy and continue to view the stock as being one of the first to rebound due to its strong cash flows and share repurchase program.

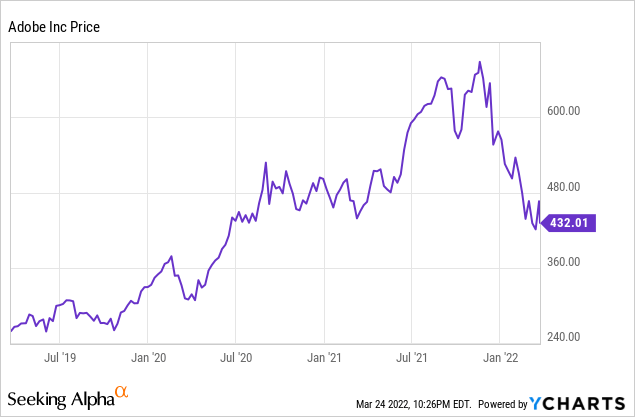

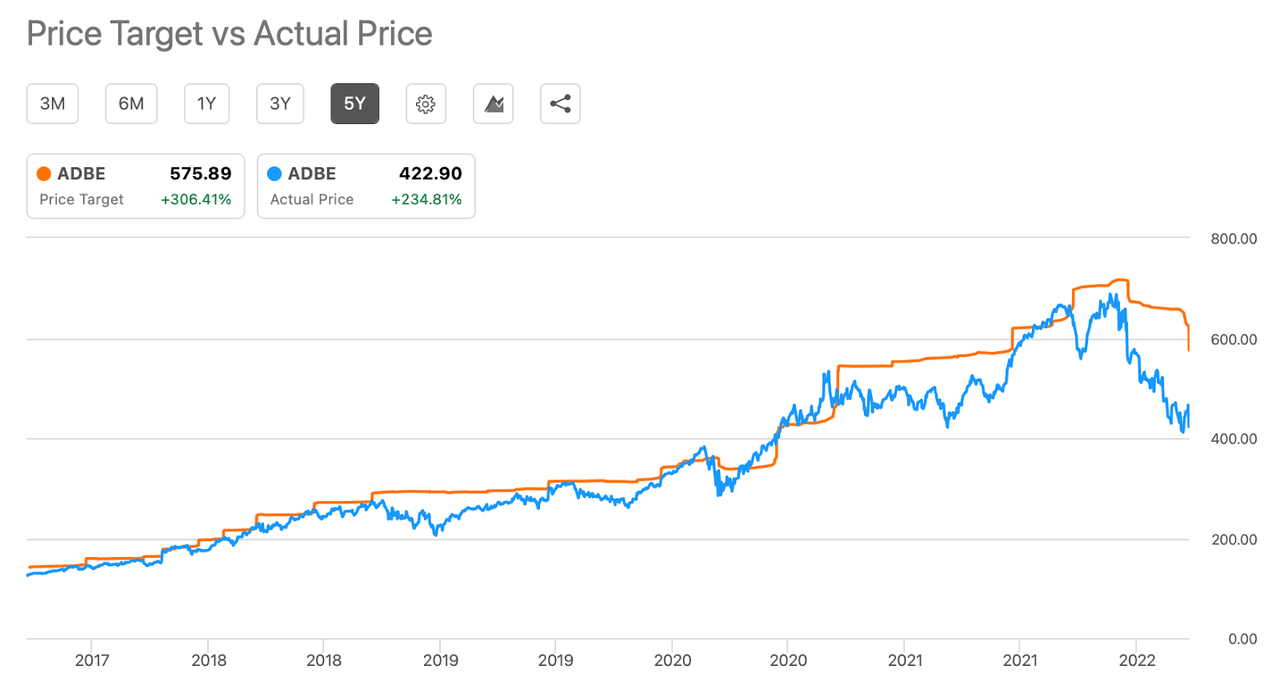

Adobe Stock Price

ADBE peaked just under $700 per share. How the mighty have fallen. ADBE has since fallen 38%.

YCharts

While that isn’t nearly as much as the worst of it, the fall may have surprised long term investors who became complacent as the stock just kept going up and up and up. While ADBE’s growth rates were already slowing down heading into 2021, the stock nonetheless kept soaring at a similar pace with high-growth peers because the valuation multiples kept expanding. That made the stock quite dangerous at the peaks, but the valuation reset has helped bring the stock back to legitimately buyable levels.

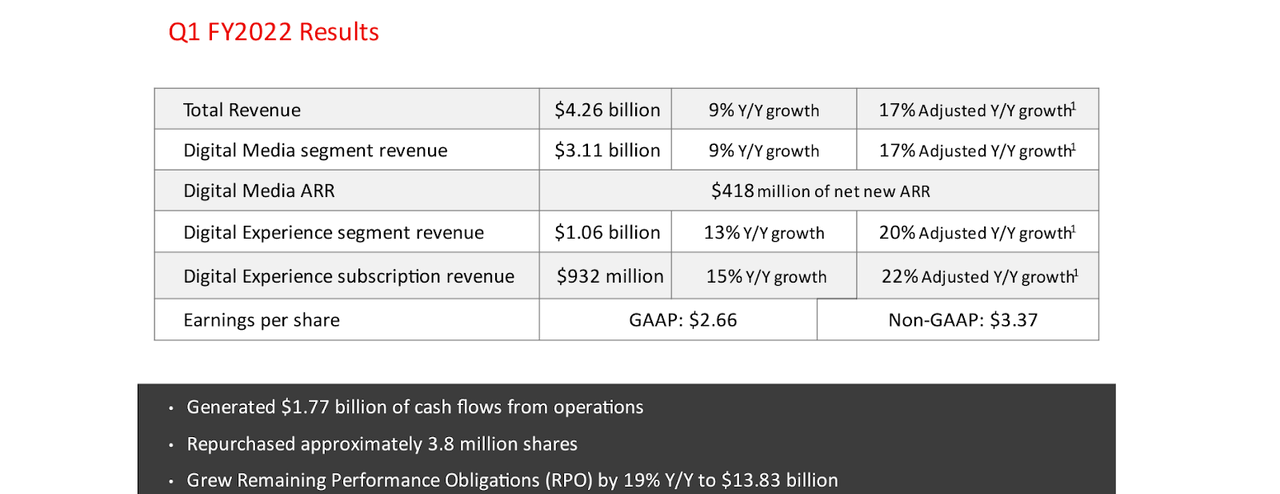

Adobe Stock Earnings

ADBE started off the year with what on the surface appeared to be disappointing results. Revenue grew only 9%, but on an adjusted basis grew 17%. The adjustments account for constant currency as well as the fact that the prior year’s quarter had an extra week.

ADBE 2022 Q1 Slides

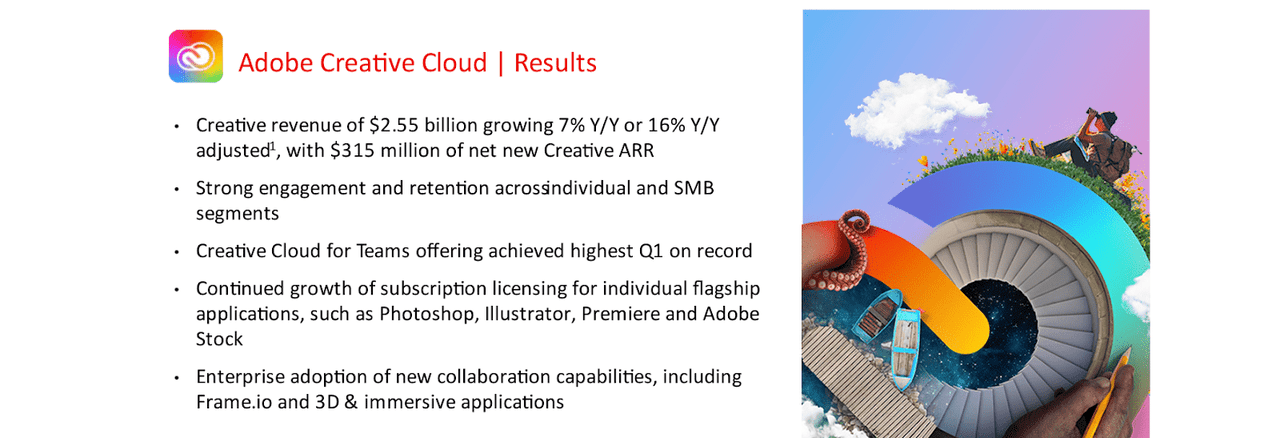

ADBE is most well known for its creative cloud segment which includes flagship products like Photoshop and Illustrator. It makes sense that this segment generated the slowest growth rate at 16% adjusted due to the fact that it simply is the largest revenue producing segment.

ADBE 2022 Q1 Slides

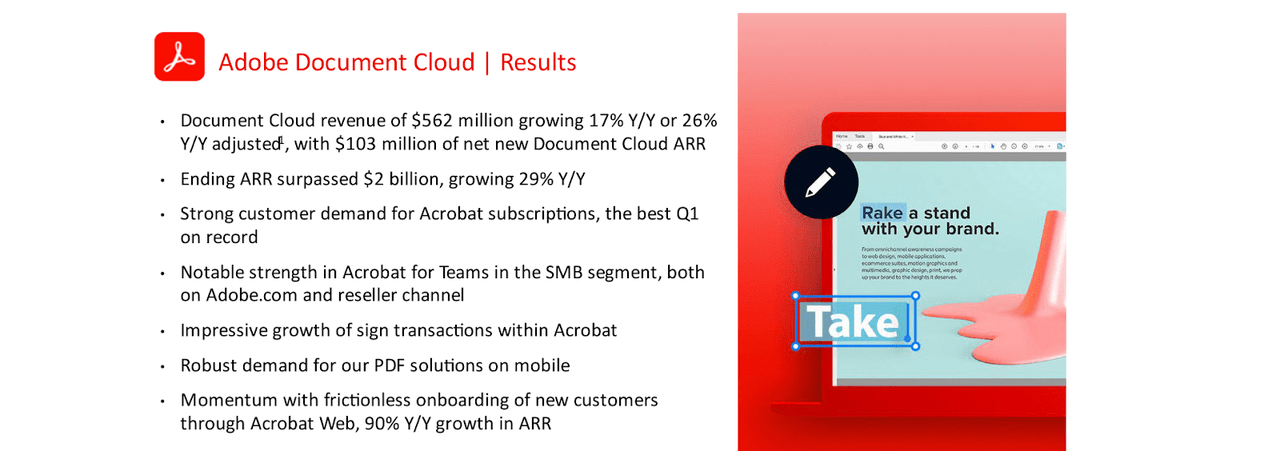

ADBE saw the fastest growth in its document cloud segment – it appears that ADBE is taking market share from more well known names like DocuSign (DOCU).

ADBE 2022 Q1 Slides

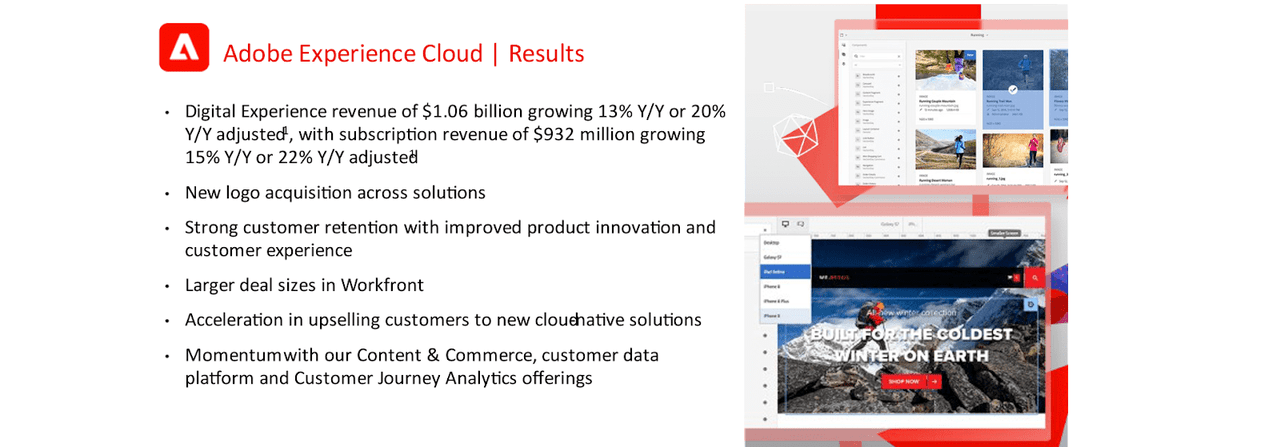

Lastly, ADBE saw 20% adjusted revenue growth in its experience cloud segment.

ADBE 2022 Q1 Slides

Besides these operational results, the company repurchased $2.1 billion worth of stock in the quarter. With the stock price still struggling, I expect ADBE to use its free cash flow to continue buying back stock at these lower prices.

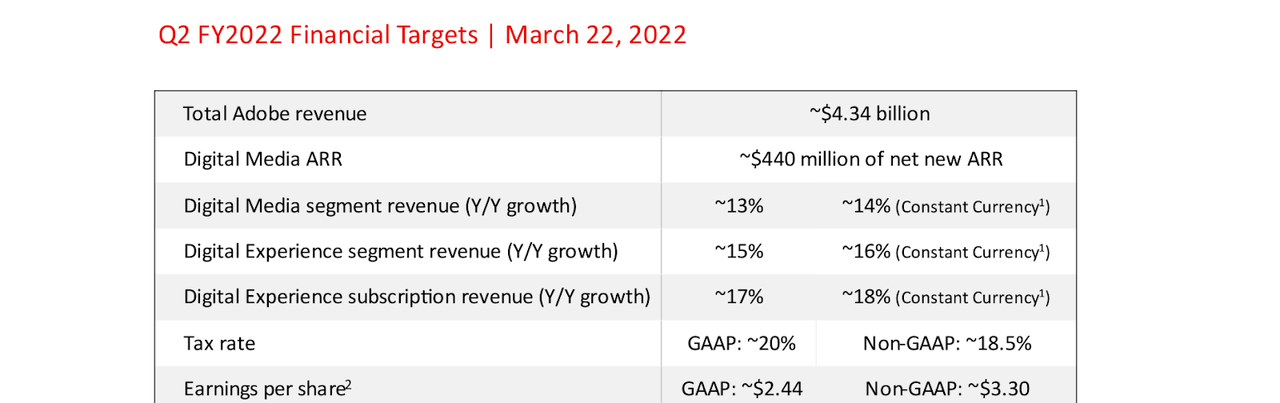

ADBE gave the following guidance for the next quarter.

ADBE 2022 Q1 Slides

That represents revenue growth of 13% year over year and non-GAAP earnings per share growth of 8.9%. That reflects some improvement from the first quarter, but still represent an “un-tech-like” growth rate.

On the conference call, management iterated their expectation for growth to accelerate in the second half of the year.

“As we look towards the back half of the year, we expect quarterly sequential revenue and EPS growth in Q3 and Q4. In Digital Media, we expect strong second half ARR performance across Document Cloud and Creative Cloud, including continued strength of emerging businesses like Acrobat Web, Frame.io, Substance and Creative Cloud Express. In addition, we expect ARR contributions to increase sequentially in Q3 and Q4 from a new offering and pricing structure which starts late in Q2.”

Still, investors seem skeptical and in general have not been giving tech the traditional benefit of the doubt that they used to give in the past. Between executing on accelerating growth and continuing to buy back stock, there are clear paths to upside for the stock price.

Is Adobe Stock Undervalued?

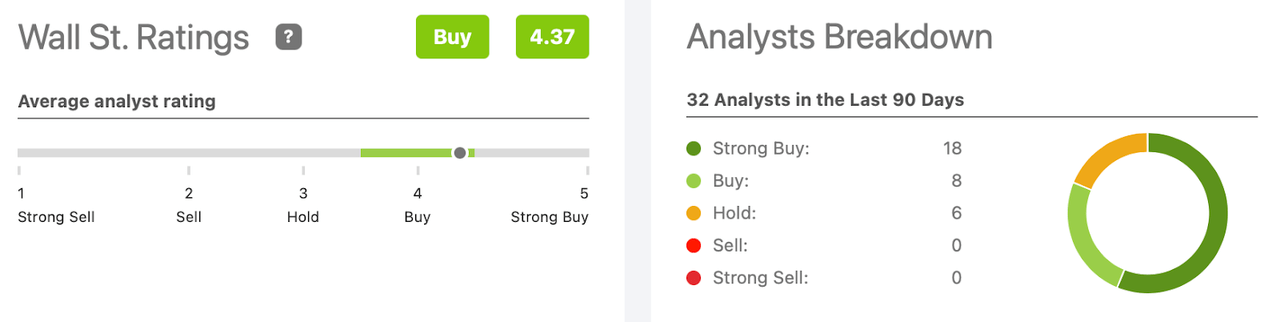

Wall Street seems to think so, with the average rating being 4.37 out of 5.

Seeking Alpha

It is worth noting that the average price target of $575.89 represents 33% potential upside, and the stock has not typically traded so far below consensus price targets.

Seeking Alpha

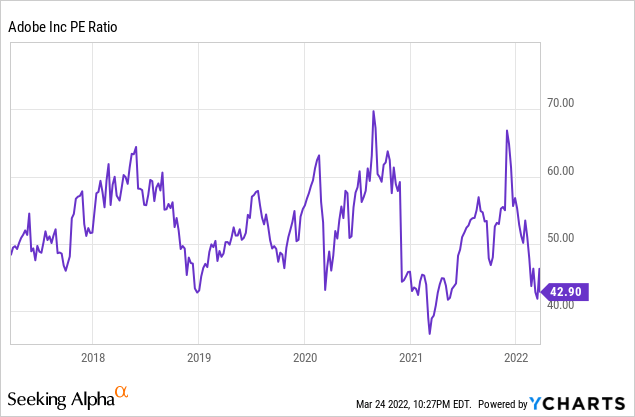

That disconnect makes sense considering that ADBE is now trading at the low end of its historical PE ratio.

YCharts

Is Adobe Stock A Buy, Sell, or Hold?

At recent prices, ADBE is trading at less than 32x consensus earnings estimates.

Seeking Alpha

It is worth noting that consensus estimates are not taking into account significant operating leverage. Earnings are expected to grow 49% over the next 3 years while revenue is expected to grow by 47%.

Seeking Alpha

The lack of operating leverage is not representative of the business model but instead likely reflects the expectation the company will continue to aggressively invest in forward growth. The company shouldn’t be punished for that, as it has historically realized a very high return on investment (as evidenced by the high profit margins). ADBE will eventually scale back its growth aggression, which will allow earnings to grow significantly faster than revenues. The company has $1.1 billion of net cash and an apparent willingness to take on debt to accelerate share repurchases. If the company can realize accelerated growth in the second half of this year, then I expect the stock price to follow with a sizable re-rating. I could see the stock trading at 40x 2024e earnings, representing a stock price of $743 and 72% upside over the next 2.5 years. That multiple would represent 2x my projected 20% long term earnings growth rate for the company. This price target reflects a recovery in sentiment toward tech stocks though ADBE could arguably take matters into its own hands if it gets more aggressive about its share repurchase program. The risk to this thesis is twofold. It is possible that growth actually decelerates moving forward and if that were to occur, then the stock would be unlikely to achieve the expected multiple expansion. While I view the stock to be of lower risk due to the strong profit margins of the company, the stock might still present downside risk in the near term in the above scenario. Because I expect growth to return within a few quarters, I still rate shares a buy (though not a strong buy) as there are too many catalysts to keep the stock down here for long.

Be the first to comment