David Tran

The following segment was excerpted from this fund letter.

ADOBE (NASDAQ:ADBE)

We added to our positions in other current holdings and we also started a new position in a company we have known for decades: Adobe Inc.

Adobe is a software company that has been around for nearly 40 years. We are intimately familiar with the company. Andvari’s own founder and Chief Investment Officer started using Adobe products over 25 years ago. Adobe is also one of several companies featured in an Andvari white paper about business lessons learned from the evolution of the desktop publishing software industry.

There are many reasons why Adobe is a high-quality company, but let’s first outline what the company does. The company divides its offerings into two groups: Digital Media and Digital Experience. The Digital Media segment contains the products with which most people are familiar, such as Photoshop for photo editing, Illustrator for digital illustrators, and Acrobat for creation, editing and signing of documents in Adobe’s own ubiquitous PDF file format.

Adobe’s Digital Experience segment is the smaller of the two and thus the one with greater potential. Digital Experience offers software applications that enable large enterprises to manage, execute, measure, monetize and optimize customer experiences across different sales channels and different devices. Companies like BMW, Nike, Prada, Verizon and Walgreens are Digital Experience customers.

Andvari admires how most of Adobe’s tools in Digital Media have market shares exceeding 90%. The content creation industry has standardized on Adobe products and thus the cost to switch to a competing product is extremely high. Content creators have spent their entire careers using Adobe products. The time to learn the ins and outs of another piece of software, and the loss in productivity that would result in doing so, prohibits the creative professional from switching. On the Digital Experience side, we believe Adobe has dominant and growing share when it comes mid-sized and large enterprises. Switching costs are also high.

Adobe has even more attractive attributes. There is little to no customer concentration. This contributes to Adobe’s ability to raise prices and maintain high margins because there is no customer large enough to negotiate significantly on pricing. Next, regulatory risk is decidedly less compared to our former investment in Liberty Broadband. The cable and telecom industry has always faced extraordinary scrutiny from the Federal Communications Commission, Justice Department, and Congress. To our knowledge, no executive at Adobe has been hauled in front of a Congressional committee to be grilled about charging excessive prices for Photoshop.

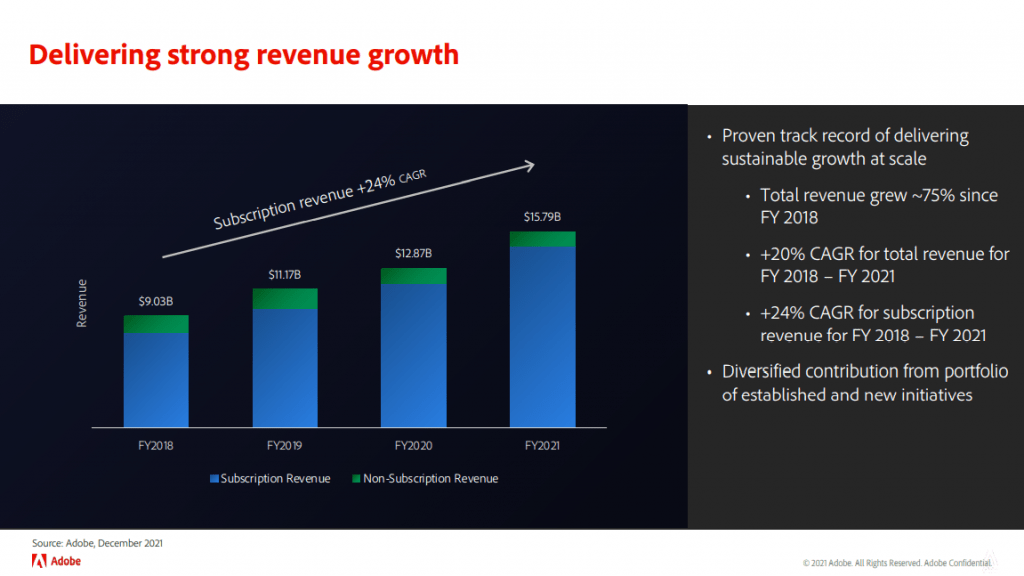

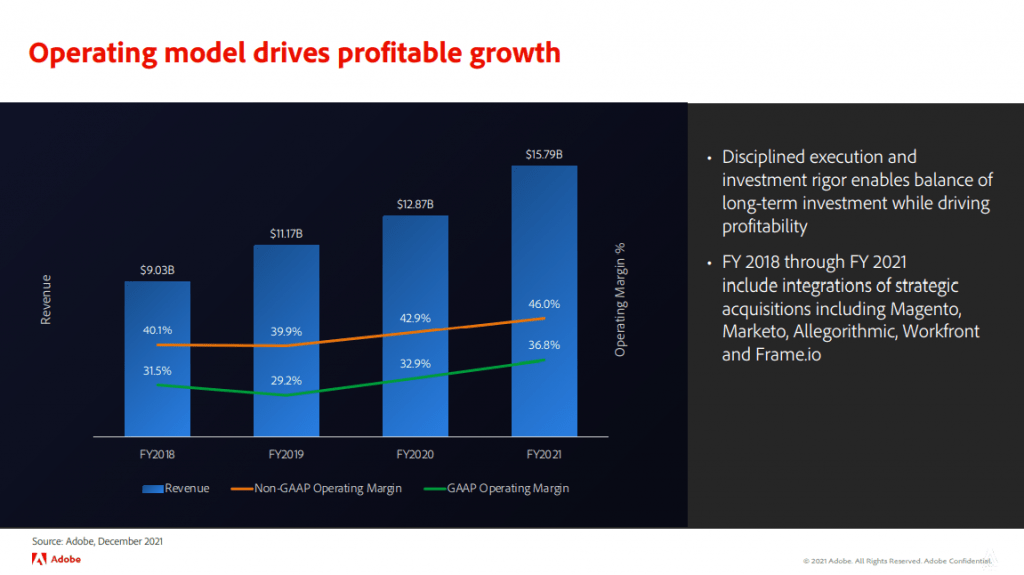

Finally, Adobe’s financial profile is outstanding. Total annual revenues will be ~$17.7 billion this year and subscription-based revenues make up 90%+ of that. Revenues have been growing at mid-teens in recent years and will likely continue at low double-digit rates. Margins are high, working capital is negative, and annual capital expenditures are very low at 2%–3% of revenues. Free cash flows are copious and Adobe has returned 57%–68% of them to shareholders in the form of share repurchases over the last three fiscal years.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment