Prykhodov/iStock Editorial via Getty Images

At the beginning of 2022, one of my goals for the years was to expand my watchlist and identify new companies that could be a great long-term investment. One of the companies fitting almost all the criteria I am searching for (i.e., high growth rates, wide economic moat, high and stable margins) is Adobe Inc. (NASDAQ:ADBE). Right now, Adobe is also one of the 50 largest companies in the world (ranked by market capitalization).

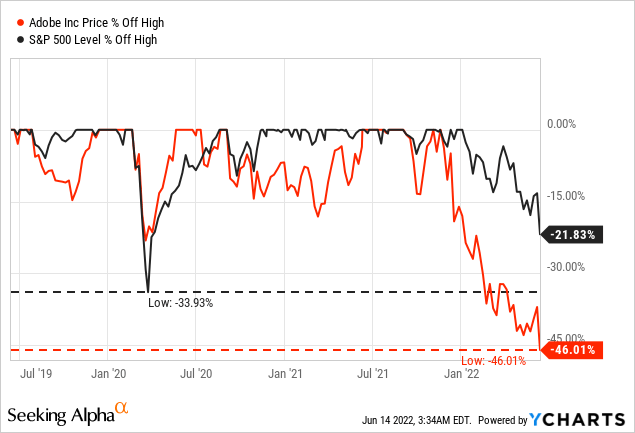

And especially as Adobe’s stock price has been declining almost 50% and was clearly underperforming the S&P 500 (SPY) in the last few months, the stock and company might deserve a closer look to determine if we might not only have a great business but also a great investment.

Business Description

Adobe Inc. is one of the largest computer software companies in the world. It was founded in 1982 and has about 26,000 employees today and is generating about $16 billion in annual revenue. Similar to many other software companies, Adobe is offering its products mostly via a Software-as-a-Service (“SaaS”) model. Adobe is offering software, especially for graphics, photography, illustration, animation, and multimedia/video. Its most popular products include Adobe Photoshop, Adobe Illustrator and Adobe Acrobat Reader as well as the Portable Document Format (PDF).

Adobe is reporting in three different segments:

- Digital Media: This segment provides products and services to create, publish and promote content and accelerate productivity. Customers include creative professionals like photographers, video editors, graphic designers, or game developers. In fiscal 2021, this segment generated $11,520 million in revenue (73% of total revenue).

- Digital Experience: This segment provides applications and services to create, manage, execute, and measure customer experiences that span from analytics to commerce. Customers for these applications include marketers, advertisers, agencies or publishers, but also scientists, developers, and executives across the C-suite. In fiscal 2021, this segment generated $3,867 million in revenue (24% of total revenue).

- Publishing and Advertising: This segment includes eLearning solutions, technical document publishing, web conferencing as well as web application development and high-end printing. In fiscal 2021, this segment generated $398 million in revenue and was only responsible for about 3% of total revenue.

And after Adobe changed its business model in the last decade – similar to many other software companies – the biggest part of revenue is now stemming from subscriptions ($14,573 million or 92% of total revenue).

Quarterly Results

When looking at the quarterly results reported on Thursday, Adobe can continue to grow with a strong pace. Revenue increased from $3,835 million in Q2/21 to $4,386 million in Q2/22 – resulting in 14.4% year-over-year growth. Operating income increased from $1,406 million in Q2/21 to $1,529 million in Q2/22 – 8.8% YoY growth. And diluted net income per share increased 7.3% YoY from $2.32 to $2.49.

While results are still solid, we can’t deny growth rates slowing down. And especially the guidance for fiscal 2022 should not make us optimistic. Adobe is now expecting total revenue to be $17.65 billion (instead of $17.9 billion in prior guidance) and non-GAAP earnings per share are now expected to be $13.50 instead of $13.70 in previous guidance.

Growth

And while quarterly and annual results are important, we must see these numbers only as dots, which are part of a bigger picture. As long-term investors, we are rather interested in long-term trends and the results from one single quarter don’t tell us much about these trends. Adobe is certainly optimistic that these high growth rates will continue and in the coming years, Adobe is not only focusing on creating and leading categories as well as delivering technology platforms, but it is also trying to expand its customer base. And these aspects combined could lead to high growth.

And in its annual report the company is writing:

In today’s digital world, design and creativity have never been more relevant, providing a significant market opportunity for Adobe in digital media. Everyone has a story to tell-from creative professionals, to communicators, to consumers, to first time creators-and they need the tools, services and capabilities at their fingertips to tell those stories on an ever-increasing number of canvasses. In a creator economy that is continually expanding, creators are looking for tools to help them easily make and share unique and beautiful content without complexity.

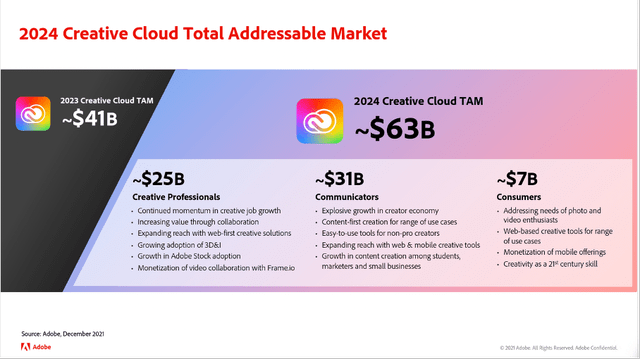

And Adobe is also seeing a huge addressable market for its different segments. The Creative Cloud TAM for example is expected to be around $63 billion in 2024 and is also expected to grow with a high pace from only $41 billion in 2023.

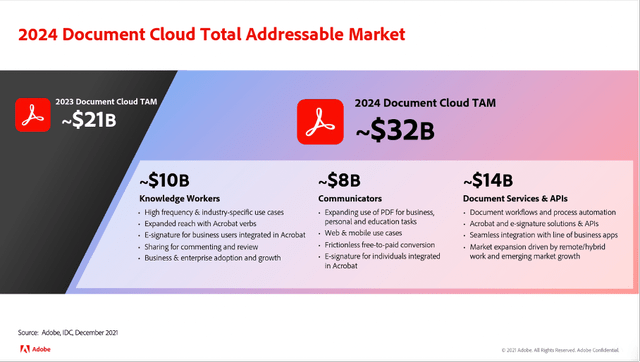

The Document Cloud segment has a total addressable market of $32 billion in 2024 with about $10 billion stemming from knowledge workers and about $8 billion stemming from communicators.

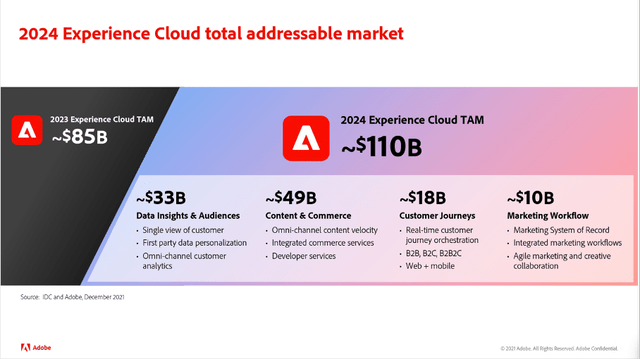

And especially the Experience Cloud TAM is expected to be around $110 billion in 2024 with “Data Insights & Audiences” being responsible for $33 billion and “Content & Commerce” being responsible for $49 billion.

And analysts seem also quite optimistic for the years to come. Between fiscal 2022 and fiscal 2026, analysts are expecting earnings per share to grow with a CAGR around 15%.

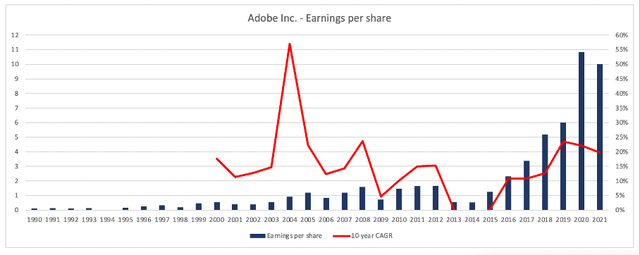

Recession

But analysts and management could be a bit too optimistic about Adobe’s growth rates for the years to come as well as the addressable market in 2024. And we can mention at least two reasons. First, we should not expect the current high-growth phase for Adobe to continue forever. Although Adobe could grow its earnings per share with a CAGR of 15.67% since 1990, there also have been times of stagnating or declining earnings per share. And while we have no clear hints for growth slowing down dramatically in the next few years, we should also not ignore such a possibility.

And that statement might not be entirely true. While we don’t have clear hints for Adobe slowing down, we have hints for the economy slowing down and the United States might enter a recession in 2023. We must be extremely optimistic about Adobe not to expect an impact on the business when the United States will tumble into a recession.

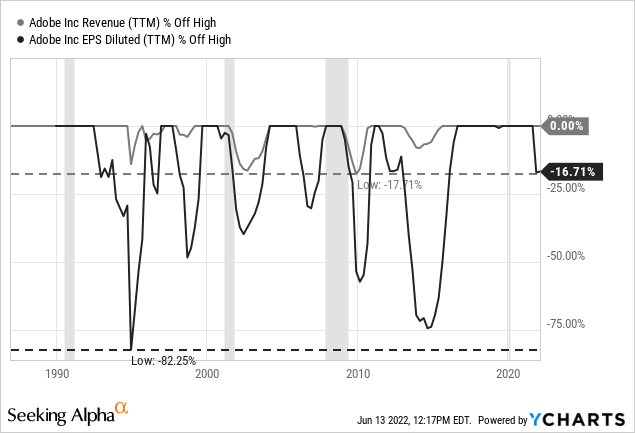

When looking at Adobe’s performance during the last recessions, we can see revenue as well as earnings per share to decline in the quarters following a recession. We can also see that Adobe could recover again within a few quarters, but I would not call the business recession-proof.

And the recession could put an end to the extremely high growth rates Adobe saw in the last few years. Adobe could also grow with a high pace before the Great Financial Crisis and the recession in the years 2008 and 2009 also put an end to Adobe growing with a high pace and the next few years were rather mediocre. One could argue right now that Adobe is a different business today than it was back then due to the subscription business, but I don’t know if that will make a huge difference.

Wide Economic Moat

When trying to identify companies that qualify as long-term investment, we must look out for an economic moat around the business. An economic moat will protect the business against existing and potential new competitors and will ensure stability and consistency for revenue.

For starters, Adobe has a similar competitive advantage as Alphabet (GOOG) (GOOGL). Similar like “to google” has become a verb, “to photoshop” has also become a verb and has been added to the Merriam-Webster dictionary. And while this is not a classical moat, it certainly adds to the company brand name. In my first article about Alphabet I wrote:

According to NfX, language is one of the five main network categories. Language is a powerful network as millions or even billions of people speak a certain language and the network between the different speakers is very strong and hard to attack. If a company can manage that people use the company’s name as verb, it can create a very powerful network effect – even when it is just one single word people use sometimes.

Additionally, Adobe is also on the 21st spot on the list of most valuable brands in the world. And the brand name is without much doubt a valuable asset for Adobe.

But much more important for the wide economic moat than the brand name are the switching costs, which were created over time. While many of the products are creating switching costs, this can be demonstrated quite well when looking at Photoshop. Not only does it take a lot of time to “learn” Photoshop and become very experienced in working with the program, but it is also the industry standard and is already part of design curriculums at universities. And this is generating extremely high switching costs for everybody. Companies will continue to work with Photoshop when students are already familiar with the program. Companies will also think twice about switching to the product of a competitor when hundreds or thousands of employees must be trained to use a new program.

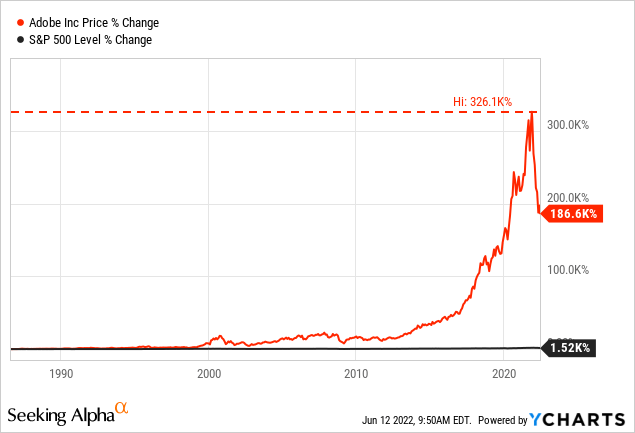

And the economic moat of Adobe is also visible when looking at some numbers. We can start by looking at the extreme outperformance of the stock in the last 4 decades. While the S&P 500 gained 1,520% since the mid-1980s, Adobe could increase 18,660% in the same timeframe.

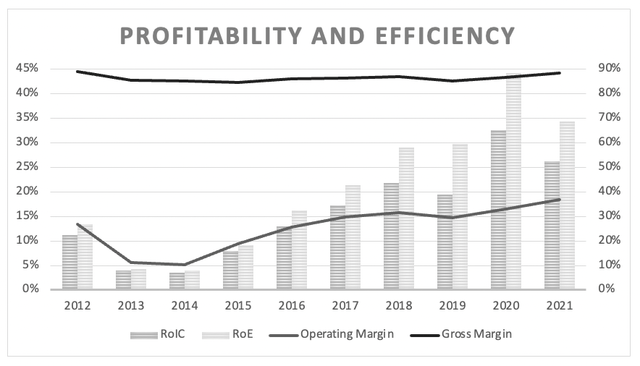

Aside from the stock performance, we can also look at the company’s margins. Not only does Adobe have extremely high gross and operating margins. Especially the operating margin could improve in the last few years, which is a good sign. Additionally, Adobe is reporting a high return on invested capital and in the last six years, Adobe reported a return on invested capital above 10%. And the average RoIC in the last ten years was 15.68%.

It is also worth mentioning that Adobe is an extremely profitable business and Adobe has extremely low capital expenditures (in the last five years, Adobe had to spend only 6.6% of its operating cash flow as capital expenditures).

Intrinsic Value Calculation

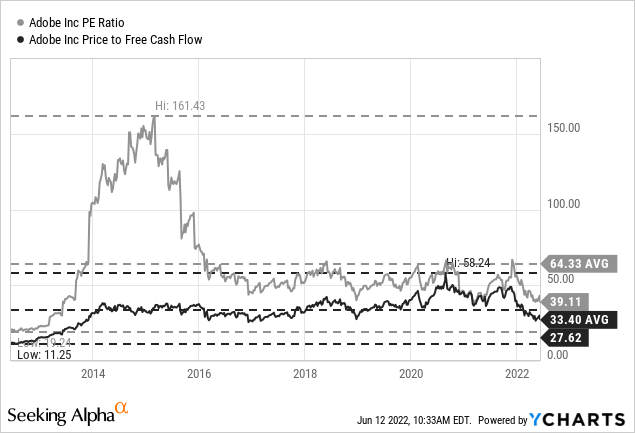

Right now, Adobe is trading for 39 times earnings, which is clearly below the 10-year average of 64.33 and actually one of the cheapest P/E ratios of the last few years. However, a P/E ratio of 40 is still not cheap in my opinion. When looking at the price-free-cash-flow ratio instead, Adobe is trading only for 27.62 times free cash flow, which is also below the 10-year average of 33.40.

If the current stock price and valuation multiples are justified is depending a lot on the expected growth rates for the next few years. For companies growing with a high pace, valuation multiples of 30 to 40 could be justified. And to take growth rates into account, we usually use a discount cash flow calculation to determine an intrinsic value. And similar to past articles, I will offer three different calculations again.

In my base case scenario, I will take the free cash flow of the last four quarters as a basis and will assume a recession in fiscal 2023 and free cash flow declining by 20%. In fiscal 2024, we assume free cash flow increasing 20% again. In the years between 2025 and 2031, I will assume 10% growth for Adobe, which is lower than the growth rates in the recent past, but I would be a bit cautious and assume growth being lower as it seems rather unrealistic that Adobe will grow with an extremely high pace for two decades. For perpetuity, I would assume 6% growth. When using these numbers (and a 10% discount rate), we get an intrinsic value of $377.64.

However, when considering the possibility of a steep recession we should also calculate a bear case scenario with more cautious assumptions. In this case, we assume free cash flow declining 20% in fiscal 2023 followed by 10% decline in fiscal 2024 as we expect a recession that will last longer. In fiscal 2025, business will improve again, and free cash flow can increase 20% in fiscal 2025 followed by 10% increase in 2026. But from 2027 till perpetuity, we assume only 5% growth, and this will lead to an intrinsic value of $225.34.

In my opinion, there is not much to be bullish about in the next few years. Nevertheless, we can also calculate a bull case scenario and assume that Adobe won’t be affected by a recession in the next few years. We assume, that Adobe can continue to grow with an extremely high pace, and we calculate with 15% growth for the next 10 years followed by 6% growth till perpetuity. This will lead to an intrinsic value of $677.23 for Adobe and only in this scenario the stock would really be a bargain and undervalued.

And while there is little reason to be so bullish about Adobe, we should also be careful about the current free cash flow. In the case of Adobe, the free cash flow is much higher than net income. And while this is not unusual for growing subscription businesses (as subscriptions are often paid in advance), we should also keep in mind that free cash flow might be much lower when growth is slowing down or if the business should actually decline.

Conclusion

After losing close to 50% of its value, the stock might be more or less fairly valued right now. But in my opinion, Adobe is not a bargain, and I would also not describe the business as completely recession-proof. And considering that a recession in 2023 is a scenario with an extremely high probability I would not invest in Adobe right now – especially as growth rates are slowing down and it is difficult to estimate what growth rates to expect.

Be the first to comment