John M. Chase/iStock Unreleased via Getty Images

Dear Readers/Followers,

The time has come for me to start looking at BAE Systems (OTCPK:BAESY). A bit late, one might argue – but it’s been a busy year thus far. I’ve recently had the time for new projects, and delving into this company was high on my list to see what the business can offer us.

BAE Systems is a multinational arm, security, aerospace, and defense business out of England. It’s by far the largest pure-play defense contractor in all of Europe, and it’s also the seventh-largest in the world ranking in terms of revenues. In Great Britain, it was the largest manufacturer in the nation back in 2017.

Let’s look closer at this company and see what we have.

BAE Systems – What does the company do?

So, from an operational perspective, the largest company operations are in the UK and USA where it owns a large subsidiary that, in terms of size, is one of the six largest suppliers to the US DOD. Other major markets and customers include the respective government and militaries of Australia, Canada, Japan, India, Saudi Arabia, Turkey, Qatar, Oman, and also Sweden. Saudi Arabia is high on the company’s list of recurring revenue contributors.

BAE systems’ roots go back to 1999 when British Aerospace a British munitions, aircraft, and naval systems company merged with the GE subsidiary for shipbuilding and defense electronics, known as Marconi Electronic Systems. Its roots include the Marconi company, A.V Roe and Company, de Havilland who manufactured the first commercial jet airliner, Hawker Siddeley, which manufactured the world’s first VTOL attack aircraft, and many others. The company is essentially what remains of the companies that built the Spitfire, the Royal navy’s first destroyers and Subs, and a few shipbuilding companies in the UK, all rolled into what is now BAE.

Not a bad group of companies all things considered – and since that time, BAE has grown organically and organically through M&A’ing things like United Defense and Armor Holdings.

The company is involved in several blockbusters/massive projects, including but not limited to:

- Lockheed Martin F-35 Lightning II

- Eurofighter Typhoon

- Astute-Class Submarine

- Queen Elizabeth-Class Aircraft Carriers

On a high level, BAE is exactly what you’d expect a defense play like this to be. What do we want? We want a well-filled order book, superb overall sales, solid underlying EBIT and margins as resilient as possible towards the current trend, a solid bottom-line FCF, and a good dividend paid from the company on an annual, stable, and historical basis.

With some small exceptions, BAE systems give us all of this.

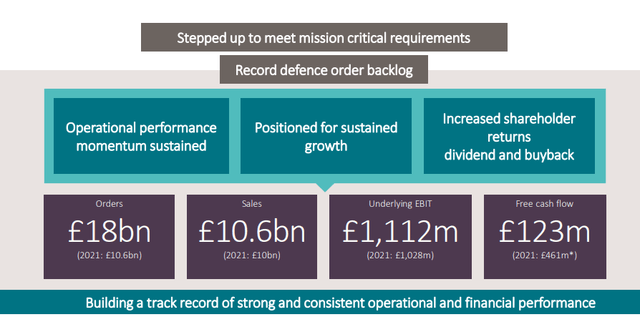

BAE Systems IR (BAE Systems IR)

Like many other defense companies, the current geopolitical trends and macro is giving the company some superb order flow, great trends, backlogs, and massive demands for its products and for new R&D for improvements to products. Various factions across the world, but particularly in the west, want to be ahead technologically in a new sort of arms/military race, and these companies are rushing to fulfill that need.

BAE is BBB+ rated and has a close to $30B market cap and conservative leverage. Its customer profile means that there are no delinquency or payment lapses.

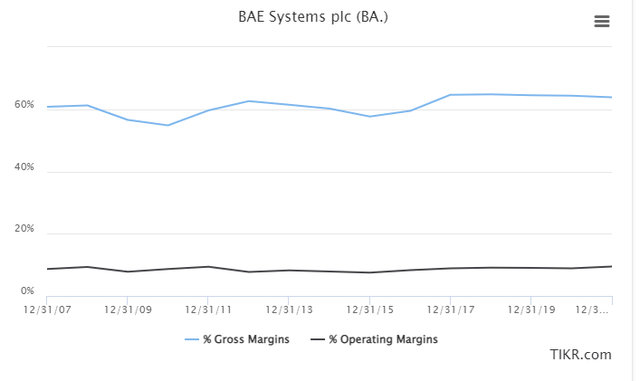

On a top-level margin side, the company has managed to improve a bit bouncy GM levels to stabilize to around 62-63% for the past years, which after COGS, SG&A, and other OpEx flows to a 7-10% operating margin, depending on the year and the company’s performance. This is a fairly good trend and has good numbers.

BAE Margins (TIKR.com/S&P Global)

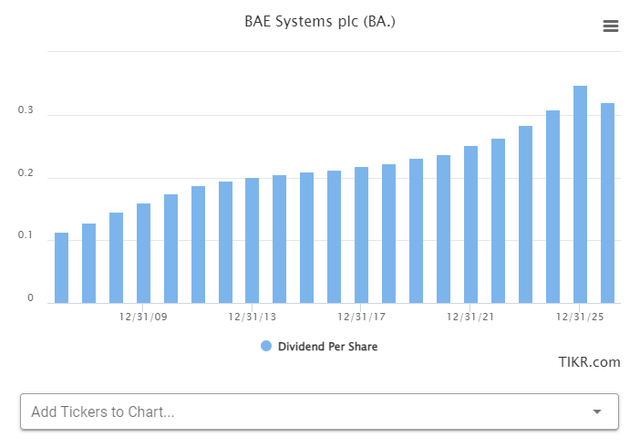

Dividends, when considering that we’re looking at a British company – take a look at the history.

BAE Systems Dividend (TIKR.com/S&P Global)

So, looking at the fact that dividend stability is solid, the company has good fundamentals, good historical margins, a nice set of customers, an attractive portfolio, and good margins, what more can you ask from a business in the space?

Because, even so far as the latest financials go, the trends look great – as they do for most defense businesses.

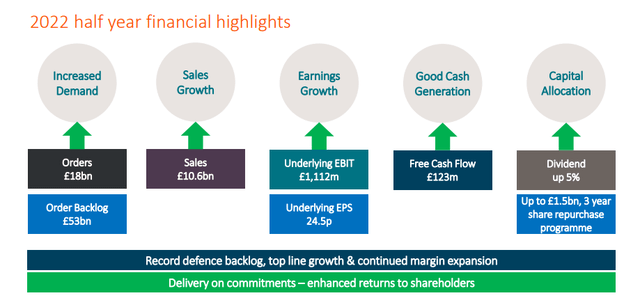

BAE Systems IR (BAE Systems IR)

With both sales and order intakes ahead of expectations, the company is seeing a very positive mix, with a heavy aerospace component and maritime order flow of £13B for the two segments alone – but combat vehicles and electronics are coming in at billions as well.

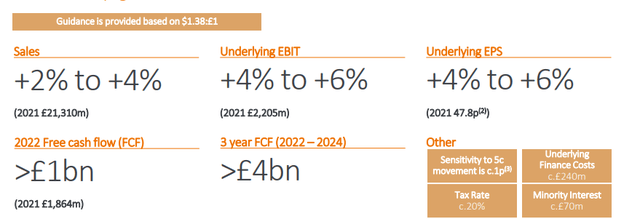

This is at the same time that the company, despite pressures, is delivering impressive margin expansion and is guiding for some very impressive overall trends for the full year.

BAE Systems IR (BAE Systems IR)

The company’s capital allocation priorities are on track with what we would be looking for in an investment, split between Dividends (covered at 2x by underlying earnings), M&A activities, and overall buybacks. The company has announced a £1.5B buyback programs at a length of over 3 years.

The visibility for these sorts of businesses is very good. Their characteristics include multi-year, sometimes even over a decade-long program with good visibility on value. BAE covers some of the leading defense franchises, and the proof of the company’s operational success lies in its historical results and the current macro.

Risks include the current inflation and supply chain characteristics. These are in no way easy to overcome – but BAE is mitigating impacts using long-term agreements, contracting terms, cost management, efficiency, global purchasing power and so forth – in short, everything that organizations of this size do to manage the current environment. BAE is no different.

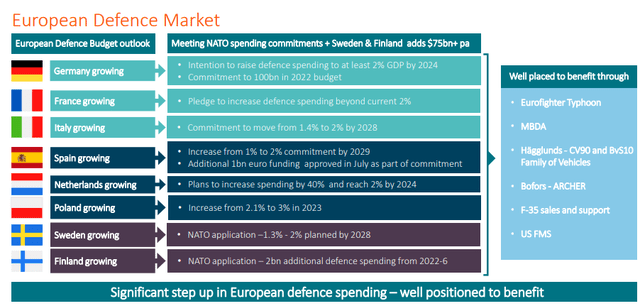

The company’s exposure to a very attractive set of customers guarantees BAE’s income for the next 5-10 years at the very least. Defense budgets are expected to grow, and there are plenty of opportunities for BAE to keep outperforming in this current environment. The broader European defense market, even without the core customers, is a growing sort of customer base – now including my home geographies planned, as we’re increasing our defense spending.

The main arguments for going for BAE, provided you buy at a good valuation, are its multi-year program visibilities, its portfolio, its fundamentals, and its future potential with things like Aerospace, Maritime, P&S, Electronics, and Cyber and intelligence contracts. Even with all the ongoing headwinds, nothing can really beat down the sort of upside this company has in its pipeline.

This brings us to perhaps the most important piece here, after presenting and establishing what sort of company BAE is. Once we’ve determined that the company is fundamentally sound – which it is, and the company’s near-term future seems secure (and it does), we need to look at company valuation.

And things here look better than you might expect.

BAE Valuation

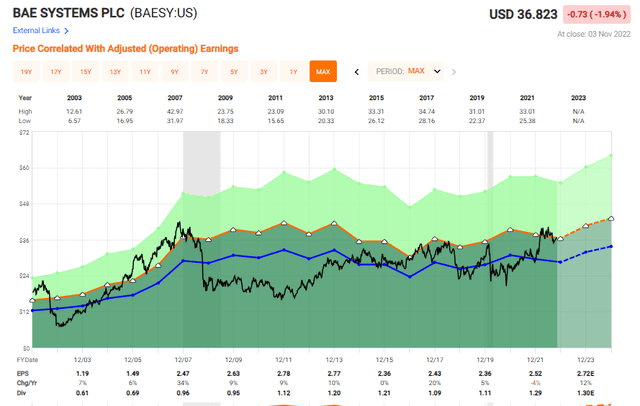

BAE Systems isn’t perhaps as cheap as you might think, and it does have a bit of a volatile EPS history. Nonetheless, its long-term RoR is positive, if not straight-down market beating. However, if you pay attention to valuation and buy only when the company is actually cheap based on the longer term, you’re able to make some good RoR here. At least if we view things historically.

BAE Systems RoR (F.A.S.T Graphs/S&P Global)

There’s a fair bit of up and down, and long periods of time when the company really isn’t performing in a stellar manner. This is very similar to US defense stocks, where we can see several years of doldrums depending on how defense budgets and spending is looking. Peers like Lockheed Martin (LMT) and General Dynamics (GD) saw fairly similar trends as we see here.

Also, the company’s normalized P/E highly depends on what timeframe you look at. For the 5-year period, it’s close to 11.5x. For the longer term, it’s sometimes lower, or higher, depending on the years you look at.

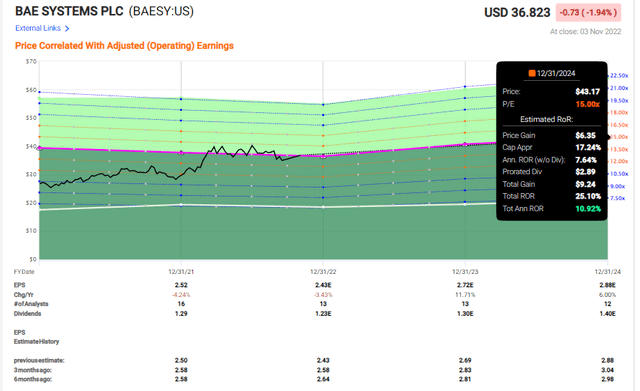

What can be said at this time is that the company is trading at around 15x P/E, which is high for this particular business. The company is expected to grow earnings by around 4% per year until 2024E, which would, on a 15x forward P/E basis, come to around an 11% annualized RoR.

This isn’t terrible – it’s even market-beating, but it’s also not the greatest out there – because these forecasts from FactSet are include some of that defense-related upside we’re currently seeing.

BAE Upside (F.A.S.T graphs/FActSet)

With a 3.16% native yield, the yield upside is there, but not significantly better than any of its closest peers. 2-4% is sort of what you can get from the defense industry.

I forecast BAE systems largely according to these numbers, expecting the company’s scale pricing actions and efficiency advantages to largely outpace inflation and supply chain issues – but these issues and their depth result in no more than around a 2-3% annual growth rate in terms of earnings.

Because of this limited growth rate combined with the historical relative instability, I see no reason to go higher than a 15x P/E on a forward basis here – I’d even prefer going lower.

14 S&P Global analysts cover the company, assigning it a native range of £7 to £10.20, with an average of around £9. That’s around a 9.5% upside from today’s share price, with 9 analysts either at a “BUY” or “Outperform” rating here.

These analysts are more positive than I personally would be about the company. By that I mean they’re essentially assigning it a premium that this company has never really held for any period of time. At £10 for the native, I would be looking at rotation. At £9/share, I would be “HOLD”ing but that’s about it. I certainly wouldn’t be buying.

I can’t say often enough how crucial it is that we focus on valuation as a core part of our investment strategy. Far too many people, and investors, miss out on looking not just at great businesses, but also at making sure they’re getting them at great prices.

I believe BAE Systems, like many defense players here that are covered, including others like L3Harris (LHX) and Raytheon Technologies (RTX), is a great business. I own all of the peers that I’ve mentioned here, and I’ve owned them since they were disliked by the street – not loved as many of them are now.

But I don’t believe you’d be buying the company at a great price if you went “in” or “all in” here. There are far better upsides out there today.

In fact, there are better upsides out there in this very sector – defense, if you’re willing to go beyond market leaders. All of the market leaders I’ve mentioned here are currently trading at massive premiums due to their interest based on defense budgeting.

BAE systems trading where it is right now is the equivalent of it trading at a premium. For that reason, I’m on a “HOLD”.

My introductory share price for BAE comes to around £7.5/share, which is the most expensive I’d be willing to pay for the company at this particular time.

Thesis

Here is my thesis on BAE systems:

- The company is a solid international defense contractor with a presence among many attractive markets. It has a solid portfolio and a great long-term product upside. As a company, this business is as solid as it gets, with a well-covered dividend and great fundamentals.

- The valuation is absolutely core when you’re looking to invest in a company like this – and the current valuation just isn’t “there”.

- Because of this, I consider the company a “HOLD” here – not a “BUY”.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment