designer491/iStock via Getty Images

Investment Thesis

Adaptive Biotechnologies Corp. (NASDAQ:ADPT) stock is down over 72% in the previous 52-weeks and 58.5% YTD. Since its inception, the company has been a loss-maker. Still, the revenues have been growing at a healthy pace, beating 7 out of 8 quarterly revenue targets in the previous 2 years, with 56.88% YoY growth to $154.3 million in 2021 and forward revenue growth of 37.54%.

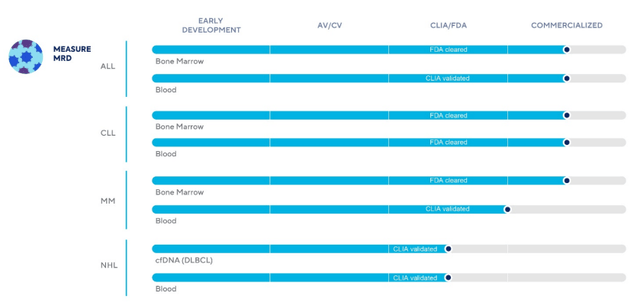

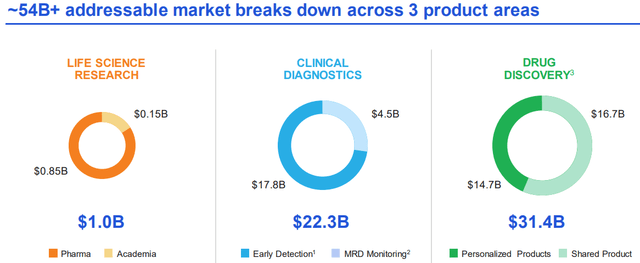

Adaptive biotech boasts a proprietary technology that could grant it a strong competitive edge among diagnostic stocks and is looking to address an over $54 billion market between its products. The company’s clinical diagnostic product, clonoSEQ, is the first FDA authorized test to detect minimal levels of remaining cancer cells in patients with acute lymphoblastic leukemia (ALL), chronic lymphocytic leukemia (CLL), or multiple myeloma (MM). While its immunoSEQ test, a pure research tool, currently assists over 175 biopharma partners, over 2,400 researchers, and over 650 clinical trials.

The company’s unique tech advantage and in-place agreements fueling its growth prospects make me bullish on ADPT stock.

Company Overview

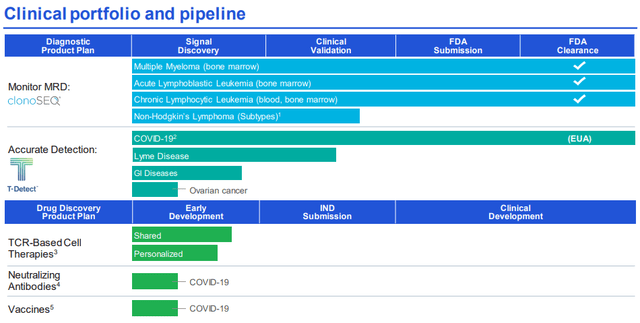

Adaptive Biotechnologies’ current portfolio includes commercial products and services in clinical diagnostics and life sciences research, with products and services under development in clinical diagnostics and drug discovery.

Its immune medicine platform applies its proprietary technologies to read the diverse genetic code of a patient’s immune system and aims to understand precisely how the immune system detects and treats disease in that patient.

The company’s dynamic clinical immunomics database captures these insights, underpinned by computational biology and machine learning, and uses these insights to develop and commercialize clinical products and services tailored to individual patients.

It has three commercial products and services and a robust pipeline of clinical products and services designed to diagnose, monitor, and enable the treatment of cancer, autoimmune disorders, and infectious diseases.

- ADPT’s core immunosequencing product, immunoSEQ, serves as the foundational R&D pillar, leveraging on collaborated R&D initiatives to fuel innovation while simultaneously generating revenue from academic and biopharmaceutical customers.

- Its first clinical diagnostic product, clonoSEQ, is the first FDA authorized test for detecting and monitoring minimal residual disease (MRD) in patients with MM, ALL, and CLL and is also available as a CLIA-validated laboratory-developed test (LDT) for patients with other lymphoid cancers.

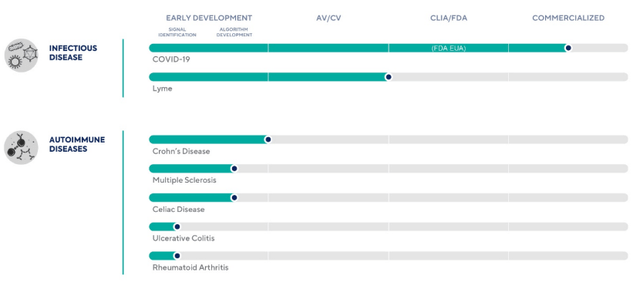

- The company is also creating a map of the interaction between the immune system and disease (TCR-Antigen Map) in collaboration with Microsoft (MSFT), using this map to develop research solutions for diseases called immunoSEQ T-MAP and a diagnostic product for many diseases from a single blood test called T-Detect. T-Detect COVID, the first indication for the T-Detect product line, received Emergency Use Authorization (EUA) to confirm the SARS-CoV-2 infection in March 2021, with over 30,000 tests ordered.

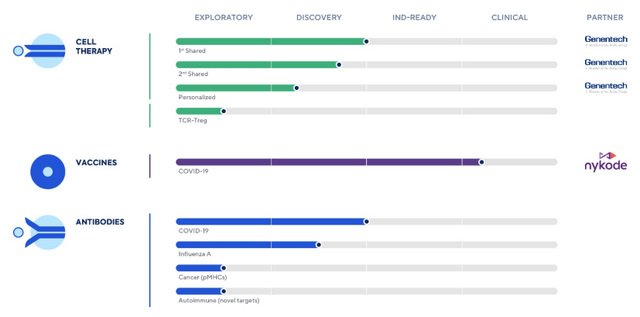

ADPT also extended its platform to inform vaccine design and development across multiple disease states through its licensing agreement with Vaccibody AS (OTCPK:VACBF), now known as Nykode Therapeutics AS.

The company has sequenced a subset of pre and post-vaccination patient samples from clinical trials sponsored by several top-tier vaccine developers, including Moderna (MRNA), Johnson & Johnson (JNJ), AstraZeneca (AZN), University of Oxford, and the Bill and Melinda Gates Foundation, among others.

Without going into too much depth, it’s safe to say that the company sports a top-of-the-class tech that can transform the loss-maker into an industry leader with vigorous development and deployment of its clinical portfolio and pipeline.

Competitive Advantage

The biotechnology and pharmaceutical industries, including life sciences research, clinical diagnostics, and drug discovery, are characterized by rapidly advancing technologies, intense competition, and a strong emphasis on intellectual property. Although the growth in the global biotechnology industry has neared double-digits since 2020, the threat of entry into the market is weak due to high barriers to entry.

Still, Adaptive faces substantial competition from life sciences tools, diagnostics, pharmaceutical and biotechnology companies, academic research institutions, governmental agencies, and public and private research institutions across various components of its platform, products, and services.

Adaptive’s local competitor Juno Therapeutics has publicly acknowledged ADPT’s strength and said, “The technology the folks at Adaptive have is an incredibly important window into understanding responses and non-responses (to drugs).”

ADPT is at the forefront of competition with its 471 filed patents, most of which are already in effect, that have granted the company an edge, as stated in its SEC filings:

We have developed a platform that is capable of reading and translating the massive genetic diversity of the adaptive immune system and its selective response to disease. Specifically, our platform sequences immune receptors and maps them to antigens for diagnostic applications, pairs receptor chains and characterizes antigen-specific, paired receptors to identify optimal clinical targets for therapeutic use. We are the only company that can perform all of these functions-and we do so at an unprecedented scale to develop novel clinical diagnostic and therapeutic products.

Further, the company has signed multiple agreements with industry movers like Moderna, Amgen (AMGN), AstraZeneca, Microsoft, etc., which testifies boldly to the company’s superior strides.

These factors significantly contribute toward enhancing the company’s reputation and goodwill among its customers and play out in the company’s favor to garner a positive market sentiment.

Financial Performance

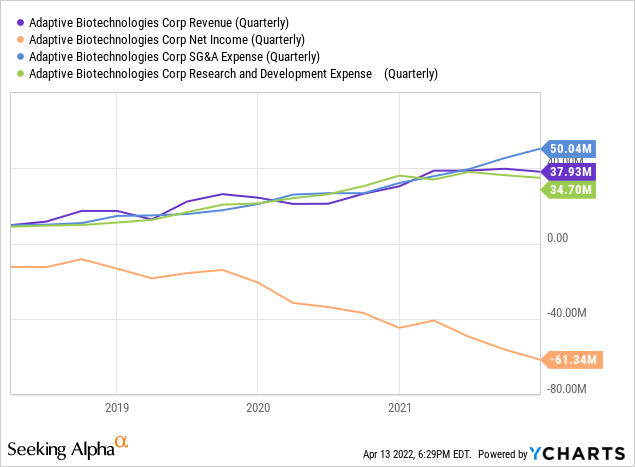

Adaptive has been growing consistently, with an almost 57% YoY revenue growth in 2021. Its Sequencing revenue of $78.9 million represented a 90% YoY growth, and its Development revenue of $75.4 million represented a 32% YoY growth.

Despite the strong revenue growth, its bottom line has declined because of its high SG&A and R&D expenses to improve future performance. Similarly, the company’s YoY CapEx growth of over 228% and CapEx to sales ratio of over 40% also indicate where the company is directing its resources.

ADPT is investing in commercial initiatives to increase awareness and usage of its products & services in the clinic by expanding its revenue center to target key customer segments, including academic centers, integrated health networks, and community clinicians, in a tiered manner based on patient volume. Resultantly, clonoSEQ is now being used clinically at all 31 National Comprehensive Cancer Network (NCCN) institutions.

In 2022, ADPT is expecting to significantly invest in supporting its sales force, including providing enhanced selling direction, data, and training and the process of ordering malignancies clonoSEQ testing and obtaining test results, aiming to continue enhancing its customer-facing software interface and user experience. With the sales team almost doubled, the company is expecting the topline growth momentum to increase further by penetrating toward new call points and adding to existing customers.

Consequently, the company’s income statement is expected to improve gradually but not become profitable in the coming quarters. Its stock price will be primarily dictated by core tech development and deployment, swaying the market sentiment, and expenditure focused on improving revenue is deeply embedded in cultivating a positive market sentiment.

Genentech Agreement

In December 2018, ADPT and Genentech signed an agreement to develop, manufacture, and commercialize novel neoantigen-directed T-cell therapies to treat a broad range of cancers. The company is responsible for screening and identifying T-Cell Receptors (TCR) that can most effectively recognize and directly target specific neoantigens. At the same time, Genentech is responsible for clinical, regulatory, and commercialization efforts.

In February 2019, the company received a $300 million upfront payment from Genentech. It may be eligible to receive approximately $1.8 billion over time, including payments of up to $75 million upon the achievement of specified regulatory milestones, up to $300 million upon the achievement of specified development milestones, and up to $1.4 billion upon the achievement of specified commercial milestones.

Genentech is also bound to pay tiered royalties at a rate ranging from the mid-single digits to the mid-teens on aggregate global net sales arising from the strategic collaboration, subject to certain reductions, with aggregate minimum floors.

The agreement accounts for a major portion of the company’s sustainable revenue with 41.3%, 53.7%, and 40.2% of ADPT’s revenue in 2019, 2020, and 2021, respectively.

Risks & Challenges

Early-stage biotechnology companies like Adaptive are not generating that much revenue but need to pour plenty of resources into R&D. The only places the company can source the cash is by issuing public offerings, diluting shareholders’ ownership, or raising debt, increasing the company’s leverage. Even though Adaptive’s liquidity position is solid, its cash position needs to be closely monitored.

Investors often invest in the biotechnology sector with the same expectations as other sectors. However, the sector is heavily regulated. A product created by a manufacturing company can be sold immediately, and revenue is earned. However, even when a product has been produced and approved in the biotechnology sector, it may still take a while to come to the market and be accepted by the market. Any issues with the product’s malperformance will seriously tank the company’s share price. So despite there being several products in the pipeline, investors should stay informed about their progress.

Small-cap biotech stocks are usually volatile because of small market capitalization, low volume, liquidity, heavy regulations, and a dependency of the stock price on positive news and sentiment, leading to wild swings in stock prices.

Conclusion

ADPT’s one-of-a-kind immune medicine platform uniquely supports clinical products capable of reading and translating the massive genetic diversity of the adaptive immune system and its selective response to disease.

With the tech advantage, growing revenues, and a strong balance sheet with over $570 million in liquid assets, an 18.5% total debt to equity ratio, and a strong 9.14 Altman-Z score, the company’s fundamental strength is solid and shouldn’t be a cause of concern for potential investors.

Even though the stock is likely to generate meaningful investor returns with a consensus analyst target price of $32 (an upside of over 166%), short to mid-term investors will experience high volatility throughout the holding period, so investors should consider their risk appetites before jumping into the stock.

Investors with a time horizon of at least 5 years are likely to benefit from the company’s long-term financial performance substantially.

Be the first to comment