These tower REITs keep making money for their investors.

Andranik Hakobyan/iStock via Getty Images

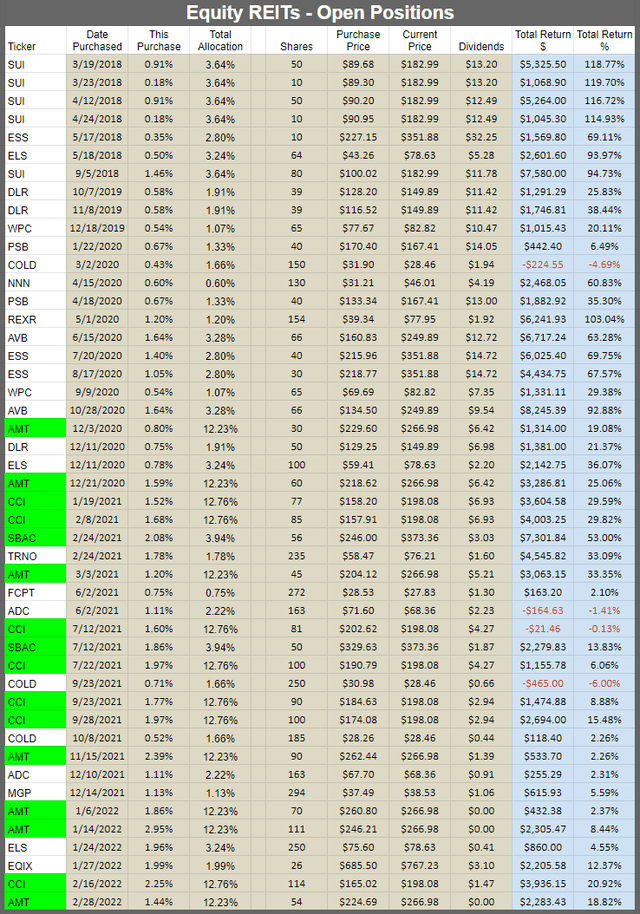

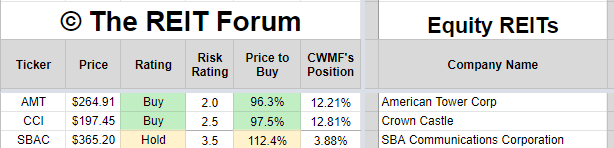

If you’ve been reading our work after the last few months, you may recall that we were pounding the table for tower REITs in response to the big decline to start the year. When it comes to equity REITs, our purchases since late 2020 show a clear emphasis on tower REITs (see green highlighting):

The REIT Forum

It’s clear that tower REITs became a core part of our equity REIT strategy. We own shares in each of the big three tower REITs:

- American Tower (AMT) 12.23% of the portfolio

- Crown Castle International (CCI) 12.76% of the portfolio

- SBA Communications (SBAC) 3.94% of the portfolio

Combined, these positions are about 29% of the total portfolio and slightly over half of our total equity REIT allocation.

So what brought about this huge rally since February?

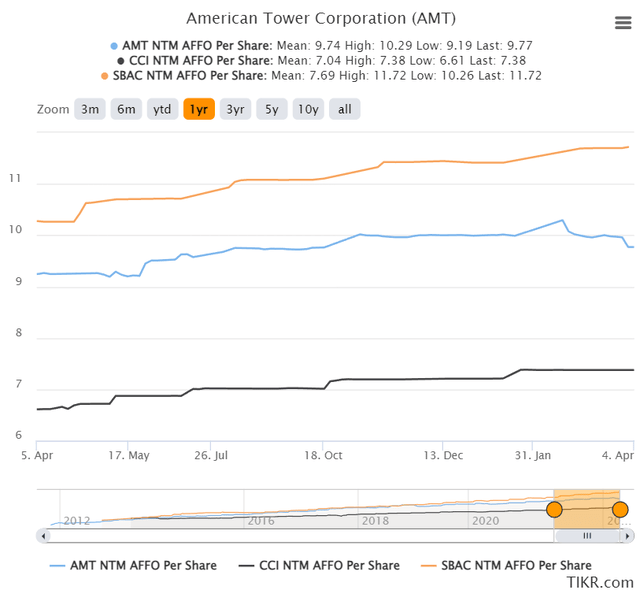

Surprisingly little. We have a nice shift in sentiment, but the biggest factor was that tower REITs were severely underpriced in late February. It’s not like the rally was a function of a large change in earnings estimates:

TIKR.com

Estimates for SBAC are up slightly. Estimates for CCI are flat. Estimates for AMT are down slightly. Should those estimates for AMT be down? It depends. If the estimate is down because they’re adjusting interest expense projections since AMT entered the year needing to fund part of their acquisition, then that makes sense. That would be a reasonable reflection of increased costs.

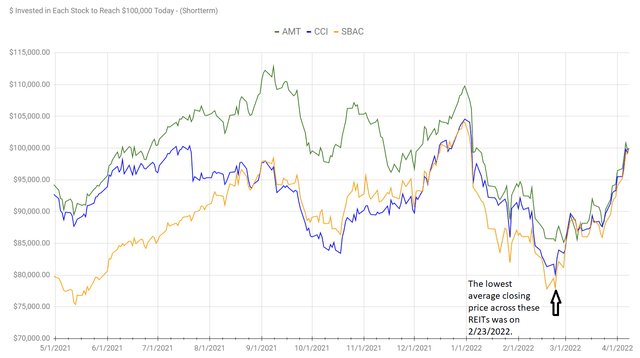

But we shouldn’t just accept it so quickly. The very peak of AMT’s earnings estimates comes on 2/24/2022. Funny timing, since that’s literally the day after prices for the sector bottomed out as shown in the $100k chart:

The REIT Forum

We can’t attribute the huge rally in the sector to increasing earnings estimates.

The Carriers Love Tower REITs

In 2021, tower REIT share prices bottomed out in early March. Why is it relevant that the bottoms were reached about 50 weeks apart? Investors get a reminder around the middle of March that tower REITs are great. Early March is when T-Mobile (TMUS), AT&T (T) and Verizon (VZ) tell investors about how excited they are to spend money on deploying 5G.

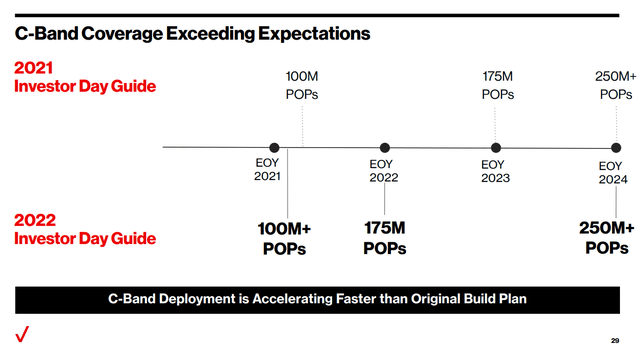

March 3, Verizon’s investor day slides lay out their plans. In this slide, they highlight how excited they are to be ahead of schedule on deploying spectrum:

Verizon

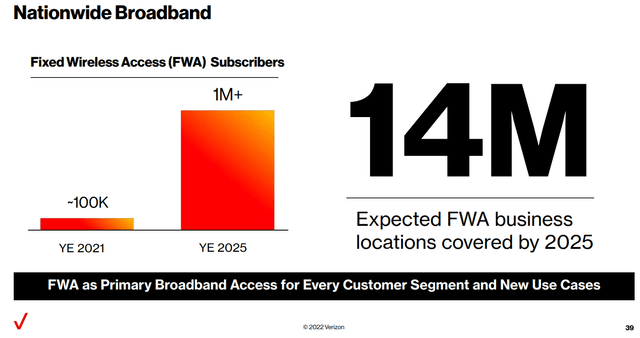

They go on to highlight the growth they expect to see in broadband access:

Verizon

They want to compete on offering more 5G coverage, unlimited premium data without speed caps, and more hotspot capacity:

Verizon

If you’re not familiar with hotspots, think about routing your internet traffic through your phone. It’s not that crazy. My phone’s Internet access is dramatically faster than the connection for my house.

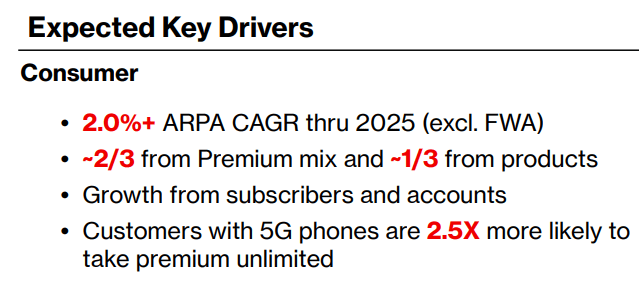

Verizon was even kind enough to point out that customers using a 5G phone are 2.5x more likely to take “premium unlimited” so they can use more data:

Verizon

Like last year, the market is realizing that all this 5G growth is going to require towers.

Shifting our focus to AT&T (T), on March 11 AT&T told shareholders:

As part of this strategy, AT&T plans to double its fiber footprint to 30-plus million locations, including increasing its business customer locations by 2x to 5 million. In doing so, the company expects to add 3.5 million to 4 million customer locations each year. The company also expects to enhance the nation’s best and most reliable 5G network by deploying 120 MHz of mid-band spectrum to cover more than 200 million people by the end of 2023. Enabling faster speeds, increased capacity and lower latency, this valuable mid-band spectrum complements the company’s existing 5G footprint, which covers more than 255 million people in more than 16,000 cities and towns.

Not a Treasury Yield Story

Treasury yields have increased substantially since late February. Anyone who thought tower REITs couldn’t thrive amid higher rates was ignoring that the tower REITs are growth stocks. They provide a moderate dividend yield today, but they are driving dramatic growth.

Potential Adjustments?

With tower REITs driving such a massive rally and reaching about 29% of the total portfolio, I’ll have to consider reducing our allocation moderately. We went dramatically overweight by continuing to buy shares in response to a falling price. This is the same strategy we usually use when fundamentals remain solid while share prices fall. Since we have several other attractive opportunities as well, there’s a chance of reducing allocations to fund other purchases.

We generally approach equity REITs as long-term investments. I prefer not to close out the positions unless the fundamentals weaken or we are swapping for a very similar investment. However, given the large weight of these positions, I may choose to reduce the position and reallocate.

The REIT Forum

This is complicated a bit because SBAC is furthest from our target range, but the weight is under 4%. It’s AMT and CCI that are huge positions (over 12%), but I also see their valuations as more attractive. That makes the decision more difficult. Either way, I want to disclose in advance that we may reduce the positions to free up some of our capital for other investments.

Fundamentals Still Solid

When the share price was falling in January and February, the fundamentals were still solid. When the price rallied back, the fundamentals were still solid. Today, the fundamentals are still solid. So what happened? The market got into another period of irrational fear and offered us a great entry point. We capitalized on it multiple times. It’s really that simple.

Our long-term outlook is unchanged. We expect significant growth in same-property revenue to drive leveraged growth in same-property NOI as revenue growth exceeds expenses. We expect that growth to lead to strong growth in AFFO per share, which enables the REITs to also deliver significant dividend growth.

Prior Articles

We shared our investment thesis for CCI publicly on February 23rd, 2022:

Seeking Alpha

That’s a pretty nice entry point.

We also wrote about AMT a few times, as seen by multiple ratings:

Seeking Alpha

We’ve been sticking to our thesis and it has been playing out as expected. We have more subscriber pieces and alerts that didn’t get to the public side, but we do strive to share some of the research while it is still highly actionable.

Congratulations

Finally, we want to congratulate all the readers who joined us in going overweight on AMT/CCI. It was a great opportunity to scoop these shares up so investors could build the growth part of their portfolio with a lower cost basis. It’s been rare for us to go so dramatically overweight in one stock or one property type, but it paid off yet again with a huge unrealized gain.

Ratings: Bullish on AMT / CCI, but no longer a strong buy. Now it is back to a regular buy rating.

One more important disclosure: On rallies, we might reduce our allocation since our position became so heavily concentrated. We continue to like the stock, but such massive weights are still unusual. Given that shares are still within our bullish range, it’s even more important to hammer in the disclosure that we may reduce our huge allocation.

As an analyst, it’s my duty to eat my own cooking and to go overweight in shares when I’m pounding the drums. For most investors, such a large allocation to tower REITs would be too little diversification. However, analysts should be willing to stake their portfolios on their ratings. I have a term for analysts who don’t buy their own ratings: Jokers. The key is just to be right most of the time, especially when you’re going in heavy.

Be the first to comment