Kostikova/iStock via Getty Images

Investment summary

In the interests of owning a diversified portfolio made up from a selection of the highest quality health care companies, our findings show that AdaptHealth Corp. (NASDAQ:AHCO) isn’t there just quite yet. Fundamentals remain sound amid a weakening economic climate and operating metrics continue to stretch up as time goes by. However, we’ve taken issue with current valuations and note AHCO’s return on investment fails to comfortably beat the hurdle, compressing corporate value substantially. Here we take a hard data approach to analyse the investment opportunity by examining AHCO’s corporate value. With opportunity cost front of mind, we rate AHCO a hold with a $16-$18.90 valuation.

Exhibit 1. AHCO 6-month price action

Q2 earnings another solid display

Second quarter earnings were mixed with upside at the top-line relative to consensus, whereas earnings were a miss. Net revenue came in with a 17.9% YoY growth schedule to $727 million. The breakdown from payers was ~60% insurance, ~27% from Government and ~13% from patient pay. GAAP operating expenses lifted 21% YoY to $668 million which saw operating income narrow by 9.6% from the same time last year. The sleep segment also grew 16% YoY and has been buoyed by the recall of Phillips ventilators in June 2021.

Meanwhile, AHCO’s CAPEX schedule remained in-line with guidance at ~10.5% of turnover. This was backed by a 3-day reduction in days sales outstanding and reduction in accounts payable turnover. Moving down the P&L and GAAP net income printed at $14 million, down from $79 million in Q2 FY21, primarily due to a substantial change in fair value of warrant liabilities of $45 million YoY.

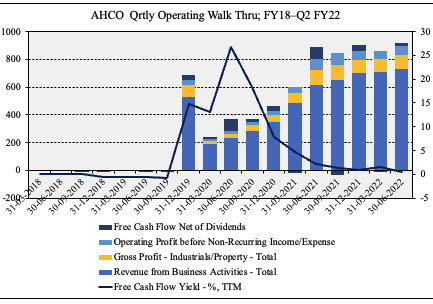

It brought this down to FCF of $26.3 million after earnings and investment, down from $85 million the year earlier. It also repurchased $3.4 million of its own shares during the quarter, whereas long-term debt also increased ~16% YoY [although, has been declining sequentially since]. As seen in Exhibit 2, quarterly operating trends have grown sequentially on average since FY19. In particular, gross and operating level margins have remained steady as revenues and variable cost inputs have risen during this time.

Exhibit 2.

Data: HB Insights, AHCO SEC Filings

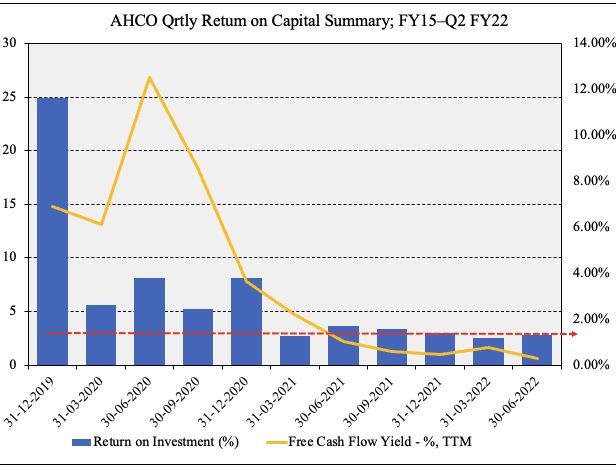

Noteworthy is that FCF has narrowed sequentially from previous high’s in FY20. FCF yield has followed suit and investors now realize a 60bps FCF yield at Q2 FY22, as seen in Exhibit 3. However, we also note that declining/negative FCF is acceptable and in fact desirable if the company’s return on investment surpasses the cost of capital and capital is readily available.

The company’ s quarterly return on investment of 0.6% [2.42% annualized] failed to beat the WACC hurdle of 5.76% however on a TTM basis it matches at 5.3%. In terms of liquidity, it has $118 million in cash, and just 1.4x cover over short-term obligations from liquid assets.

This challenges the view of AHCO’s profitability, in that it struggles to compound cash at a rate that beats the cost of capital, despite growing its top-line sequentially over the past 3-years. We keep this front of mind when considering valuation of the company below.

Exhibit 3.

Data: HB Insights, AHCO SEC Filings

Adjustments for accurate valuation

To accurately prescribe and derive corporate value, the question turns to one’s belief on the accounting for goodwill. Goodwill is recognized as an intangible asset, and is recorded when one company purchases another at a price greater than its fair value. “Overpaying”, essentially, except that the excess is actually tied to some form of intangible value or ‘assets’, but is not related to any business combination. Chief to the debate is that goodwill is not amortized – but must be tested annually for impairment. That means, a provision for goodwill can be recorded with each filing, so long as this test remains true. In that vein, the question then becomes just how to treat goodwill and adjustments to the same.

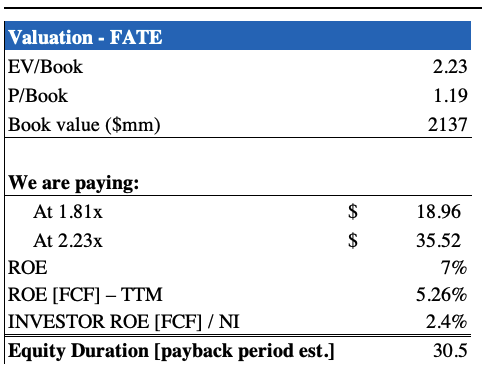

If investors believe this non-cash/non-tangible ‘asset’ is indeed part of the ‘investment’ portion of valuation, then it may warrant its inclusion into calculations. It doesn’t constitute earnings, and therefore can arguably remain. In that vein, shares look to be overpriced even trading at just 2.23x enterprise value (“EV”) to [unadjusted] book value, as seen in Exhibit 6. At this multiple, we’d be paying an implied $35, implying it could be overvalued by ~40%.

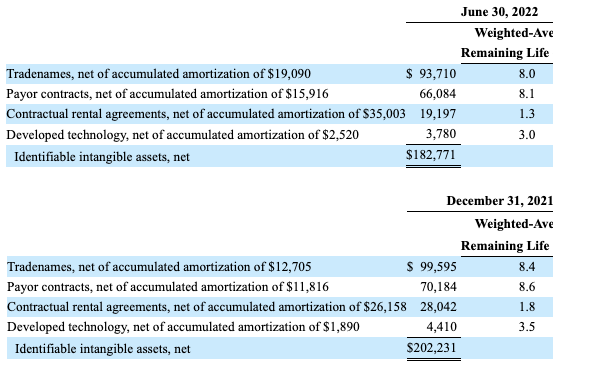

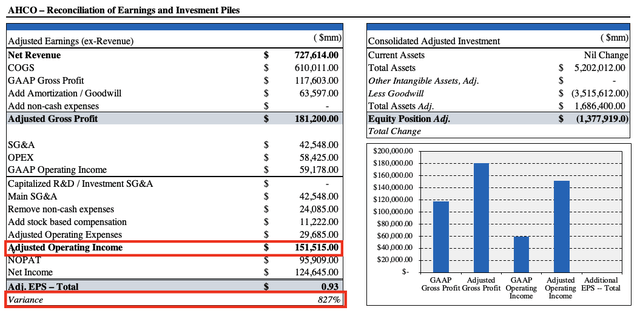

However, those who believe a reconciliation for goodwill must be performed, we note there is substantial impact to shareholder equity when removing this from the balance sheet. As seen in Exhibit 4, AHCO books goodwill of $3.5 billion. Exhibit 5 also shows AHCO’s acquired intangible assets, and is useful in understanding the capital structure of the company. Reconciling for goodwill on the balance sheet sees shareholder equity slide into the red to $1.37 billion after final adjustments, thereby eliminating the value proposition (we aren’t buyers of negative book value, except when caused from buybacks).

Meanwhile, after reconciling non-cash expenditures, including depreciation and amortization costs, fair value changes on warrant liabilities, plus stock-based compensation, operating income comes to $151 million, a far cry from the $59 million in GAAP operating income reported. This has a profound impact on earnings with EPS lifting to $0.93 from $0.10 and offering a tremendous amount of additional value whist strengthening bottom-line fundamentals markedly.

Exhibit 4. Adjustments for goodwill see a substantial change in shareholder equity and therefore book value

Exhibit 5. AHCO amortization of intangibles Q2 FY22

Data: AHCO 10-Q Q2 FY22

Exhibit 6. Valuations remain unsupportive even when accepting goodwill in calculations of corporate value.

Adding to this fact is that shareholder ROE measures are equally as sluggish and suggest the implied payback period to be tremendously lengthy

Data: HB Insights Estimates

AHCO looks to continue expanding operations to unlock long-term shareholder value. The question really becomes what are we buying today (versus the future) and what does this get us looking ahead? Whilst earnings continue to chug along nicely, we’ve flagged some question areas around AHCO’s corporate value after making some adjustments. When accounting for the $3.5 billion in goodwill on the balance sheet, the upside appears less attractive, and this dampens the investment case from an opportunity perspective. On these factors, we rate AHCO a hold and price the stock at $16-$18.90.

Be the first to comment