piranka

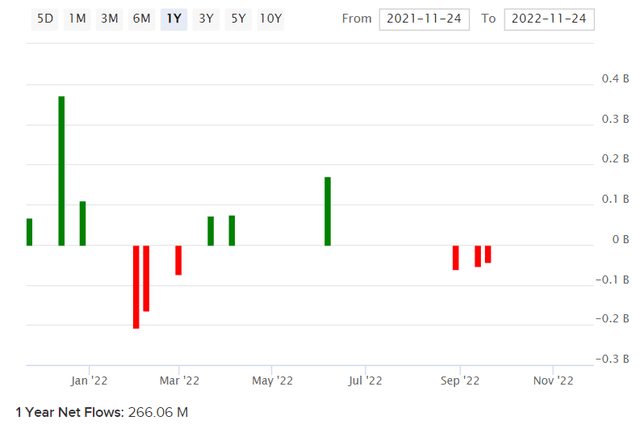

iShares MSCI ACWI ex-U.S. ETF (NASDAQ:ACWX) is an exchange-traded fund that invests in international developed and emerging market companies, which exclude the United States. The fund’s net expense ratio is 0.32%, and assets under management were exactly $4 billion as of November 25, 2022. Net fund flows into ACWX have been positive over the past twelve months; limited data is illustrated in the chart below, showing positive flows of +$266 million.

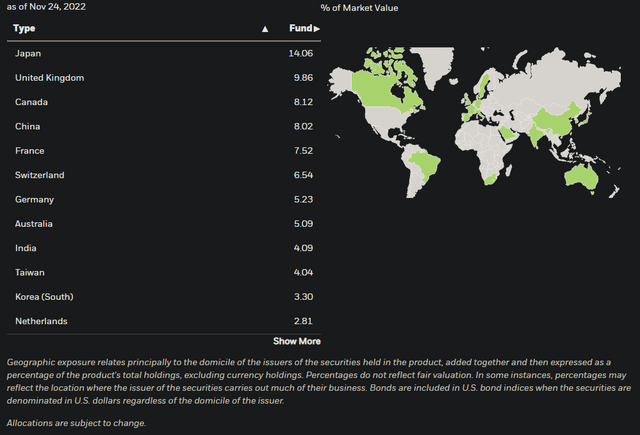

ACWX has many different ex-U.S. geographical exposures, with the largest being Japan (14% as of November 24, 2022), the United Kingdom (10%), Canada (8%), China (8%), and France (a further 8%). There are many exposures, with the largest illustrated below.

In aggregate, the fund had 1,849 individual holdings as of November 23, 2022, making ACWX very well diversified both geographically and across the portfolio. The top sector exposures emphasize Financials (20.5%), Industrials (12.41%), Information Technology (11.30%), and Consumer Discretionary (10.89%), all as of November 24, 2022. ACWX is one of the most diversified funds available, although it does not include the United States, making it an implicitly short-USD, international hedge against the U.S. equity market.

However, while ACWX does invest in emerging markets, these markets’ naturally lower combined market caps do give rise to an implicit bias toward developed markets outside the United States. Non-U.S. developed markets also typically generate lower returns than the United States, although there are some exceptions. The U.S. is simply a difficult country to beat when it comes to investing, and yet the higher-than-average earnings growth offered by emerging markets within ACWX’s portfolio also benefit from the lower-than-average risk-free rates and implied equity risk premia demanded by international investors with exposure to countries like Japan (ACWX’s top exposure). So, ACWX’s valuation should get a boost from both aspects, if we value the fund from an international, diversified investor’s perspective.

The historical beta for ACWX is 1.00x, given the high level of diversification. Given the high geographical spread, and 1.00x beta, as well as the U.S. listing of ACWX shares, I am inclined to use U.S. equity risk premia and risk-free rates to value ACWX. With a U.S. 10-year yield of 3.69% at present, and a target equity risk premium of 4.2-5.5%, we would carry through a cost of equity of 7.89-9.19%.

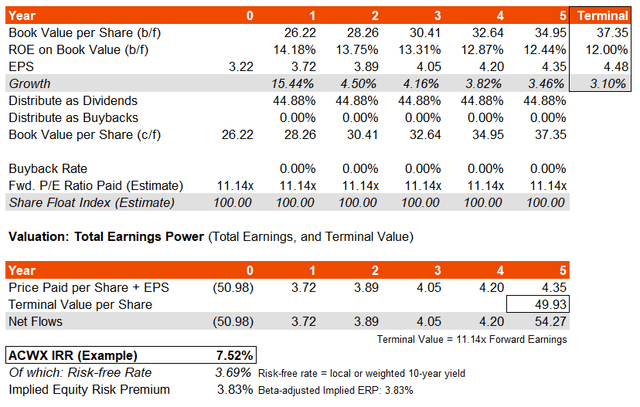

ACWX seeks to track the performance of its chosen benchmark index, which is the basis of its portfolio construction: the MSCI ACWI ex USA Index. “ACWI” means All Country World Index; ACWX’s index is part of this suite of MSCI indices. The benchmark, as of October 31, 2022, reported trailing and forward price/earnings ratios of 12.86x and 11.14x, respectively, with a price/book ratio of 1.58x and a trailing dividend yield of 3.49%. These figures imply a forward return on equity of 14.18% and a dividend distribution rate of 44.88%. The forward ROE is reasonably strong, but the dividend distribution rate is evidence of a mostly mature portfolio (and this is backed by the high allocation to developed-market geographies like Japan).

In addition to the above figures, Morningstar report a consensus average earnings growth estimate for the next three to five years of 9.88%. If I assume that the forward return on equity drops from 14% to 12% by year six, I get a three- to five-year average earnings growth rate of 6.18-7.91%, which is just below the consensus figure and therefore acceptable as an assumption. The end product is below; the implied IRR potential for ACWX over the next five years is 7.52%, with an implied equity risk premium in the region of 3.83%.

This actually suggests modest over-valuation. Our cost of equity previously mentioned should be in the range of circa 7.89-9.19%; we could say a minimum of 8%. The implied IRR is just below this figure at 7.52%. Having said this, the forward earnings multiple for ACWX is also low, at just 11.14x. One could argue that using a risk-free rate of 4%, and say a long-term earnings growth rate of 2%, and an equity risk premium of say 5%, would take one’s forward earnings multiple to circa 14.29x (that’s the inverted sum of the cost of equity minus the long-term earnings growth rate). Applying this to our model would elevate our long-term IRR to as much as 11.90%.

However, as markets are forward-looking, one should be more sceptical of projected changes in earnings multiples than projected earnings. At a portfolio level, one can assume that ACWX’s portfolio will continue to generate a broadly good return on equity, probably in the 12-14% range. What we cannot reasonably predict is the market’s rationale when it comes to ACWX’s long-run fair earnings multiple. It does not make sense, for instance, that the market is discounting its own future re-assessment of ACWX’s value in its own estimation of value. Therefore, as it stands, ACWX’s valuation is contingent on above-consensus earnings growth rates, which by definition makes the fund over-valued relative to consensus expectations.

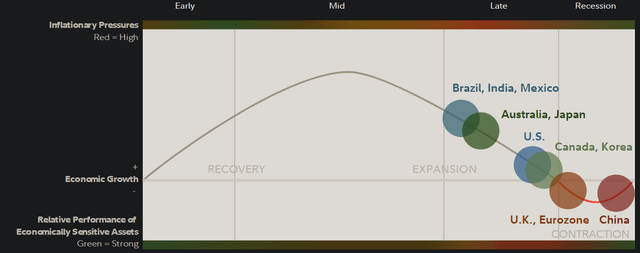

Meanwhile, the world is mostly heading into a recessionary phase (this is, in relation to the real economy and therefore likely for earnings growth too), as of Q4 2022 (see below).

Therefore, if anything consensus growth expectations may be under-whelmed. I think it makes sense to be neutral on ACWX at present, as a result. I have covered other funds recently, including SPTM, a diversified U.S. equity fund. This fund offers good return potential, and therefore one would not necessarily want to be ‘short’ funds like ACWX that appear modestly overvalued considering the historical 1x beta relationship with the S&P 500. That is, unless possibly as part of a long/short (market-neutral) strategy. ACWX will probably tick along at a modest and positive rate of return, but I definitely would not expect any medium-term out-performance, and on the contrary I think ACWX is probably positioned to under-perform the broader U.S. equity funds on a short- to medium-term basis.

Be the first to comment