Douglas Rissing/iStock via Getty Images

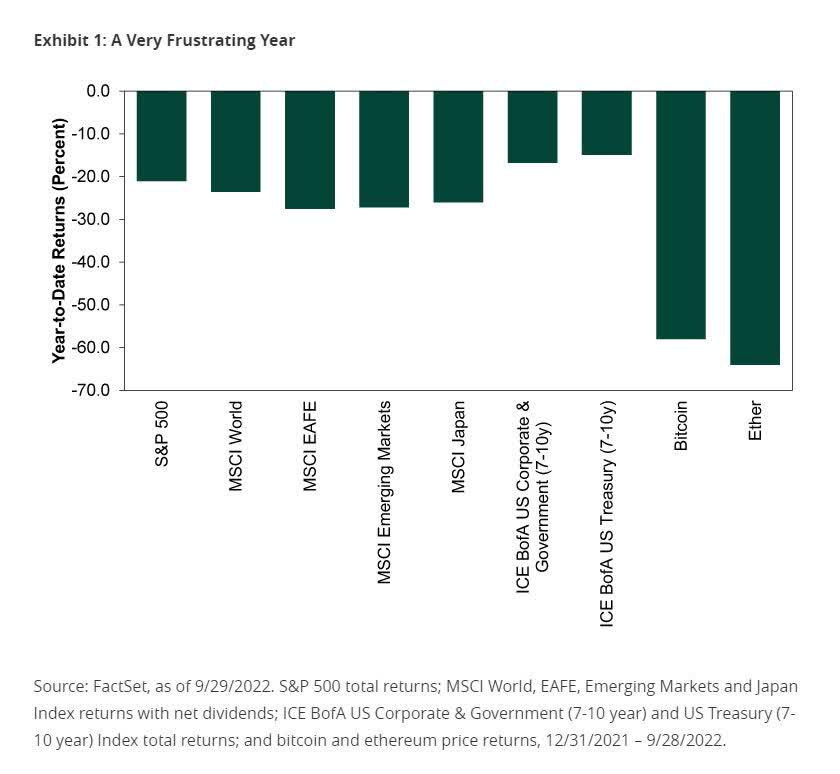

September was a cruel conclusion to another tough quarter for stocks. The S&P 500 and NASDAQ are experiencing three-quarter losing streaks for the first time since 2008. To make matters worse, international equities, bonds, and crypto have sold off simultaneously. The current environment is sparing no one and wreaking havoc on traditional 60/40 portfolios.

Source: Fisher Investments

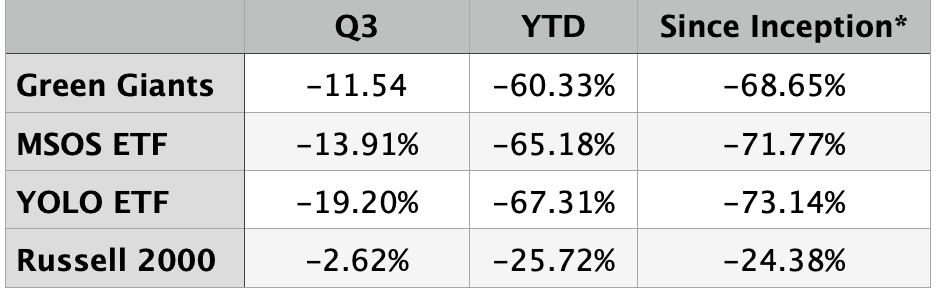

Although the Green Giants portfolio fell by -12.38% for the quarter, July and August were bright spots. Heading into September, we were up 32% quarter-to-date. This reversed sharply and we gave it all back, and then some, during September. Since its inception, the Green Giants strategy is beating benchmarks, but this is of little comfort when the absolute losses are so large.

* inception date of the Green Giants portfolio is 10/01/22 |

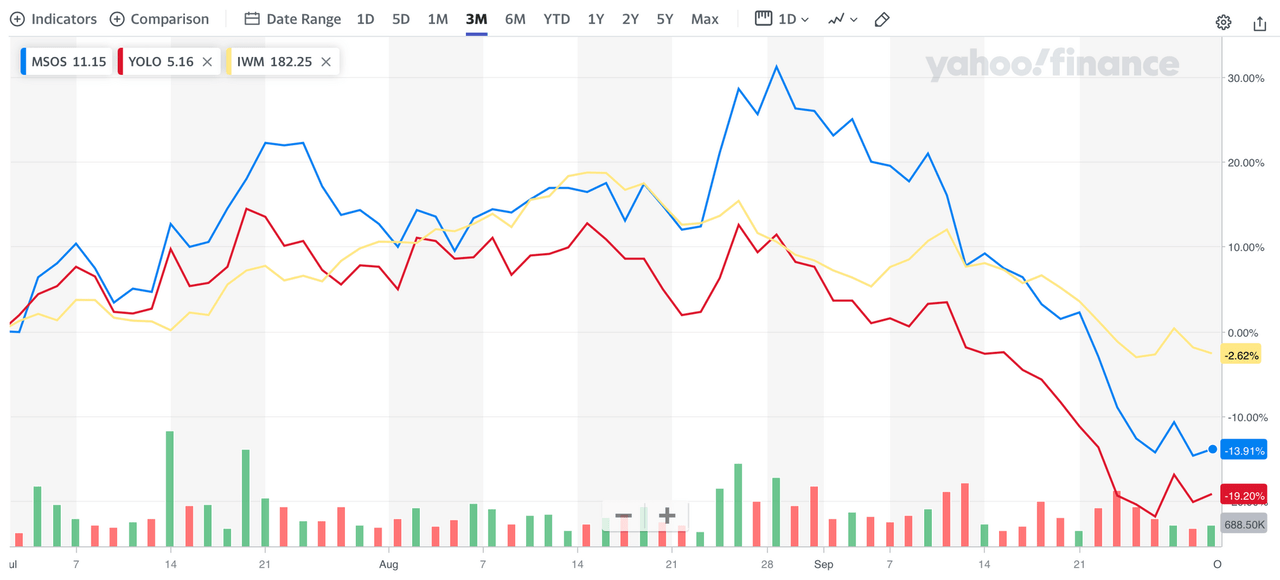

Below is a graphical illustration of how small caps and cannabis ETFs performed during the third quarter. You can see the sharp sell-off in all stocks starting in September. During these periods, less liquid and higher-beta names get hurt the most, which partially explains the decline in pot stocks.

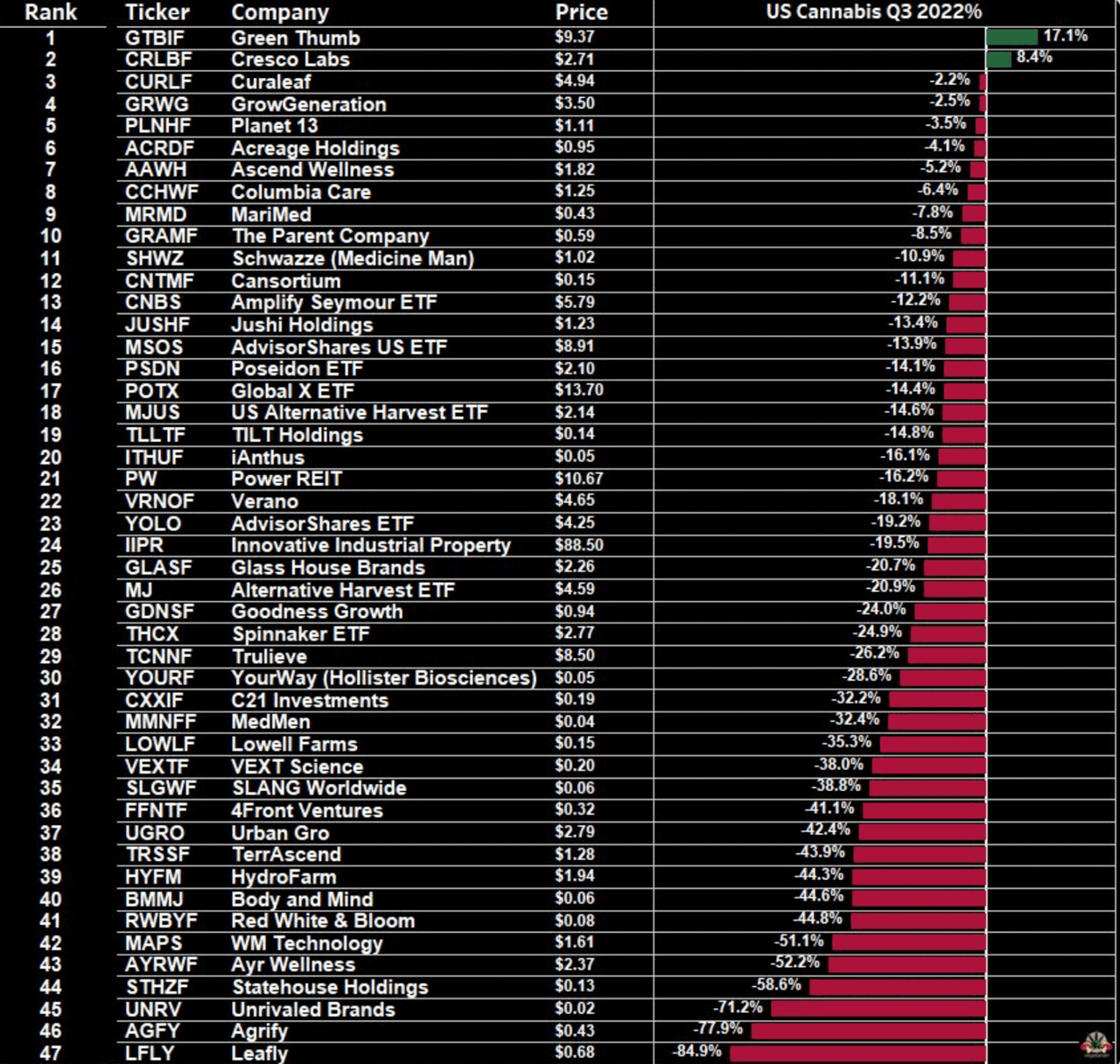

Here’s individual cannabis stock performance for the third quarter.

@thecannelorian on Twitter.

What Happened?

July and August were strong months in cannabis. This was partially fueled by a broader beta rally, but there was a period where pot stocks went up as the market started to slide. This was driven by a handful of factors that were ultimately not enough to lure new long-term investors and shift sentiment.

Political progress is the biggest near-term driver of prices. All eyes are on SAFE Banking, which would allow cannabis businesses to access basic banking services, accept credit cards, provide lower lending rates, and ease compliance and custody concerns that prevent fresh capital from entering the space.

We have heard “soon” from Schumer and “in the days ahead” from the White House, but ultimately nothing gets introduced and nothing changes. Cannabis is still Schedule One, federally illegal, trades on the OTC Exchange, and businesses can’t access basic banking services. Over time, these challenges turn into catalysts, and value is unlocked, but investors will only wait so long before losing confidence and entering “show me” mode. That is where we stand today.

One of the positives for US cannabis stocks during the third quarter came from changes to ETFs. While US cannabis stocks are relegated to the OTC Exchange, the ETFs trade on higher exchanges that are accessible on more brokerage and custody platforms. Consequently, ETFs have an outsized role in the near-term pricing of cannabis stocks.

AdvisorShares MSOS ETF is the largest cannabis fund and in August they launched a 2x version under the ticker MSOX. This will increase the dollars coming into US cannabis and the MSOS portfolio during bullish times. On the flip side, it will also magnify the downside if investors sell during drawdowns. MSOX launched into an initially favorable environment, which helped fuel the run in August.

The second-largest cannabis ETF is MJ and it added US multi-state operators to its portfolio. This resulted in consistent buying of tier one names like Curaleaf (OTCPK:CURLF), Green Thumb Industries (OTCQX:GTBIF), Trulieve (OTCQX:TCNNF), and others during August. While the initial rebalancing catalyst has faded, this is now another source of inflows for US cannabis when we finally get a sustained run. On the flip side, there is also the potential for more selling during drawdowns. However, so far, the ETF investors have been sticky (no pun intended) and we have seen little to no redemptions from the large cannabis ETFs.

Finally on the positive side, on August 23rd hedge-fund manager Doug Kass wrote a bullish article, “10 Reasons Why I Plan to Substantially Increase My Cannabis Holdings“. His timing (so far) has been bad on this call, but it’s worth reading to hear positive points from a respected voice.

Then There Was September

While July and August were a welcome relief, September took us back to the woodshed. We saw a sharp sell-off in equities (the Russell 2000 and S&P 500 fell approximately 10% in September) and MSOS dropped over 32%. Sentiment shifted sharply negative and all the reasons for optimism were gone and the new narrative is that the combination of inflation, falling cannabis prices, and unfulfilled political promises are too much to overcome.

Bottom line is that we are deep into a bear market for all stocks and cannabis stocks are getting hurt more than most, if not all. If this is a normal bear market, history suggests we should be nearing the end—an average bear market lasts 289 days and would conclude in mid-October. Stock prices discount things in advance, so the market may bottom months before we start seeing economic improvements. I’m not saying the bear market is almost over. I don’t have an edge in short-term market calls. But history suggests we may be approaching the end.

Moving Forward

When I started this website one year ago, my thesis was simple: over the next 3-5 years, US cannabis is a state-led growth story with a series of hard-to-time political catalysts – SAFE Banking, descheduling/rescheduling, legalization/decriminalization, 280 removal – and uplisting somewhere along the way.

To date, we have seen slow state rollouts and no political progress. In addition, we have experienced a sharp uptick in inflation (which is especially challenging to highly leveraged cannabis operators that don’t have access to traditional lending sources), falling wholesale prices, and the worst macro environment since at least 2008. These circumstances have put us on the left tail of the expected returns distribution curve.

The top five US cannabis companies (aka tier ones) trade at 2x 2023 sales and 6.6x 2023 EV/Adj EBITDA (FactSet data as of 10.03.22). These metrics are roughly 50% below more traditional CPG companies. We need a catalyst to unlock the value and that may come in the form of SAFE Banking late this year.

All Eyes on the Lame Duck

Our best shot at SAFE is after the November elections in what is called the lame duck session. Below is a note from Pablo Zuanic of Cantor Fitzgerald summarizing his thoughts on the potential for SAFE happening during this period.

In meetings with cannabis CEOs, I’m hearing similar bullish sentiment on SAFE getting done this year. To quote Curaleaf Executive Chairman Boris Jordan, “we are closer than we’ve ever been.”

If we get some form of SAFE, 63% of the respondents to the poll below believe MSOS will rise 50% or more, with 44% thinking it will at least double.

If we don’t get SAFE, 72% expect MSOS will fall during the fourth quarter.

Given my longer time horizon, I’m not panicking about what happens this fall, but there is no doubt that the focus is on the senate and SAFE is the biggest (known) catalyst for our beleaguered sector.

Five New States Vote on Adult Use

On November 8th, Arkansas, Maryland, Missouri, North Dakota, and South Dakota will vote on adult-use cannabis. These states total approximately 17 million people and the flip to adult-use (versus medical) typically leads to a 3-5x increase in sales. Nebraska is also voting on allowing medical sales. New states not only expand the total addressable market but usually have higher initial margins. We are seeing this in New Jersey right now.

Hirsh Jain pointed out that today only four GOP senators represent states that have legalized adult-use cannabis sales. After the midterm elections, there is the potential for twelve GOP senators to represent adult-use states. This is a big shift that may bode well for further political progress.

Here’s What I’m Doing

The Green Giants portfolio is focused on the top five US multi-state operators – Curaleaf, Green Thumb Industries, Verano (OTCQX:VRNOF), Trulieve, and Columbia Care (OTCQX:CCHWF – to get access to the combined Cresco entity) plus a smaller allocation to TerrAscend (OTCQX:TRSSF). This gives me meaningful exposure to New Jersey, and the scale and balance sheets to continue to get access to restrictive credit markets.

If we don’t get SAFE, credit conditions will continue to tighten. For perspective, tier ones raised money last year at around 8%. It is rumored that the next tier one deal will be as high as 16%, double the last round of raises. This means smaller operators will be borrowing at 20-25%, or even higher for lower-quality credits. If you want to fish around in smaller stocks, focus on names like Schwazze that are generating free cash flow and don’t rely on borrowing to succeed.

If we get SAFE, money will flow into the space. Because the ETFs are listed on higher exchanges, while the underlying stocks trade on the CSE or OTC, most of the money will flow into MSOS, PSDN, MJ, CNBS, and others. These funds are all overweight the top-five US multi-state-operators. For example, MSOS has over 70% in these names.

SAFE or no SAFE, tier ones present the best risk-adjusted reward.

Wrapping Up

These are tough times for all investors and few are having it worse than the cannabis community. It’s been a humbling 600-day period. We are in an 80% drawdown in an illiquid sector that no one cares about. But things can change quickly. If we get a political spark, sentiment will shift and I expect a strong fourth quarter. Absent progress, performance may be lackluster with smaller, high-debt businesses becoming increasingly risky.

We will also be at the mercy of the broader macro picture. If the stock market rallies, we may bounce regardless. On the flip side, we could get SAFE while equities are selling off and the reaction will be more muted. I don’t have an edge in making these short-term predictions, so I remain focused on the businesses that have the best long-term prospects in a variety of scenarios.

Thank you for your continued interest and I’m excited to see how things play out this fall.

|

The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting, or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors, or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your financial adviser prior to making any investments, including whether any investment is suitable for your specific needs. The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Green Giants reserves all rights to the content of this newsletter. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion of the publication or any release of specific investment recommendations, is strictly prohibited. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment