David McNew/Getty Images News

Big oil versus little activist

A tale as old as time – a big oil company versus a scrappy little activist with the audacity to take on the company’s board and management to… drill for oil and gas in order to enrich its owners?!?!? WT…H? Who are these guys? The activist, Strive, manages Strive U.S. Energy ETF (DRLL).

Strive

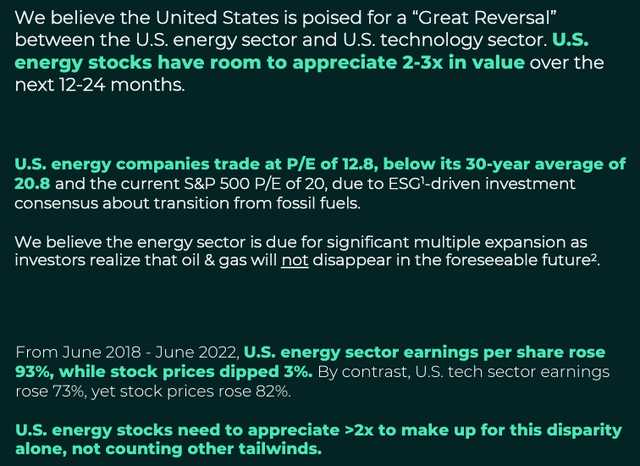

Strive sees the key for American energy is liberation from ESG constraints holding it back.

Strive

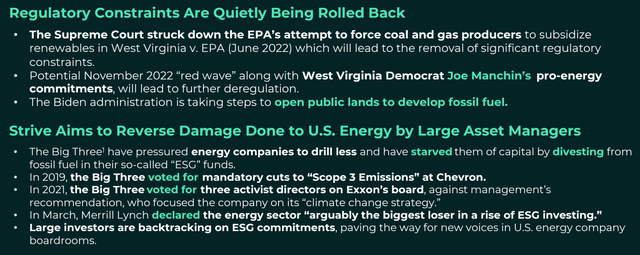

While BlackRock (BLK) and other woke asset managers want oil companies to focus on global warming and an intermittent energy future, Strive wants to maximize their clients’ wealth. That means oil and gas companies doing oil and gas company stuff. Strive’s Vivek Ramaswamy thinks that now is the time to invest in energy and that oil companies getting back to basics will pay off for shareholders and help America.

Strive

Anti-oil and gas woke ESG activists have had a big impact on supply without being able to control demand. Consumers, including those with woke politics in theory, in practice like the lights to turn on, to be warm in the winter, and for their cars to drive places (whether those are gasoline powered or electric/coal fired). So global energy consumption continues to grow by several percent a year over the past decade and 82% is from fossil fuels. We talk about energy transition but we burn oil and gas.

At the same time, ESG efforts have ravaged oil and gas capital expenditure. Exploration and production peaked at over $700 billion in 2014, but collapsed to a range of $350-450 billion each year since. That is far more than ESG activists want but far less than consumers demand. For Chevron (NYSE:CVX), this is a terrific opportunity! The American energy sector’s earnings rose 179% over the past four years but stock prices rose only 7%. Chevron’s earnings rose 234% but their price rose only 30%. This multiple compression resulting in part from shareholders seeking more-ESG friendly sectors such as technology could be a prospective opportunity for both Chevron and the Strive U.S. Energy ETF.

Chevron has tried to appease the woke mob with countless offers. They held firm on “Scope 3 targets” to assume responsibility for emissions targets from their suppliers and customers. But they seem to have expended all of their courage in that effort. Immediately after foregoing those costly targets, they announced $10 billion in new intermittent energy projects, triple earlier plans. Shortly thereafter, Chevron announced a ”net zero aspiration” on carbon emissions. Perhaps most concerning, they announced their support for a carbon tax. It is unclear how a company can benefit its owners by calling for a new tax on itself.

Conclusion

Compared with some of its peers, Chevron has raised some hope that they will stand up for their shareholders. With the arrival of Strive as a shareholder activist, they might stiffen their spine. This new holder will offer a counterweight to the countless voices calling for Chevron to drill less. Strive’s message: drill more; it is the right thing to do for your shareholders. Other groups and individuals can pursue their own political agendas on their own time with their own balance sheets.

TL; DR

If you’re an investor and in it to profit, buy CVX and DRLL. If you’re an oil and gas company, drill for oil and gas. When the activists complain, remind them that they should be grateful for these companies – before we drilled for oil and gas, we harpooned whales.

Be the first to comment