Nick England

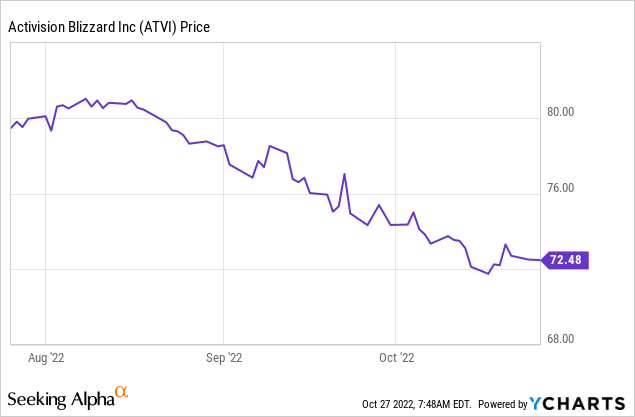

Activision Blizzard (NASDAQ:ATVI) is trading at around ~$72. Microsoft (MSFT) has a merger agreement to acquire the company at $95. There’s a ~32% upside to the deal price. The deal is expected to close in under nine months (it could fail and close earlier, though). The spread has blown out recently as U.K. regulators started looking into the case, in addition, I believe hedge funds have been deleveraging as markets have been weak and the Fed continues to issue stern warnings.

I’ve discussed more in-depth why I believe an Activision-Microsoft tie-up should be allowed by regulators in my previous note. This seems the kind of big tech deal that still has a good chance of passing muster with regulators.

The U.K. regulator seems to focus on Sony’s (SONY) worry about having the PlayStation console platform being able to offer Activision’s Call of Duty.

The CMA decision to enter a 2nd stage investigation focuses on how amazing Call of Duty is and in what dire straits Sony would be without access. The issue seems a bit overblown to me, but if this were true to the extent the merger needs to be blocked, it speaks to the value of Activision’s content… If I were Activision management, I’d put Sony over a barrel to continue licensing this content that’s life and death to its console platform.

There is also concern raised about vertical integration and what this may mean for the burgeoning cloud gaming market:

Although the console gaming market is highly concentrated, the CMA believes that the shift to cloud gaming services and multi-game subscription services is opening a window of opportunity for new entrants. To succeed, these new entrants will need to offer a strong gaming catalogue that will attract users. Cloud gaming service providers will also need access to cloud infrastructure and an operating system (OS) license (especially Windows OS, which is the operating system for which most PC games are designed).

If this gets blocked based on potentially anticompetitive forces in the emerging cloud gaming space, I would be quite surprised. There are many strong competitors in this space like Alphabet (GOOG) (GOOGL) and Amazon (AMZN), to mention just two giants.

Microsoft has promised Sony 3 year of access past their current deal. They’re not eager to give up more. But I believe if regulators demand it (which IMHO would be overly protective), Microsoft CEO Nadella won’t hesitate a second to ensure further access to that or additional titles. Nadella has a track record of pushing for more open ecosystems. He’s said he thinks Activision will play a role in Microsoft’s metaverse plans and it’s not just about building out the X-box platform. Metaverse plans are not particularly loved by the market right now. I’ve doubted Nadella’s LinkedIn acquisition as well and it seems to have worked out alright.

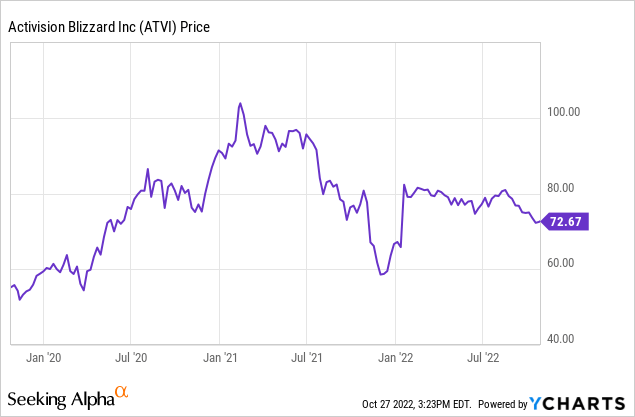

What I like about this deal is how the downside may not be as pronounced as you’d think. As everyone knows by now, there has been misconduct at Activision by some of its executives. Initially, these issues were swept under the carpet. This resulted in outrage among employees and fans of the games. It tanked the stock price, and Nadella is a white knight who can remove the spotlight from the company while scooping up these assets for cheap.

I do think Activision could drop to $50 or $60 if the deal breaks. But, arguably, it would likely start appreciating back up over time.

ATVI earnings estimates (Seeking Alpha)

The company has almost $13 per share in cash. Around ~$10 in net cash because the company has a little bit of debt. If you look at an ex-cash basis, the stock would be trading at less than 10x forward earnings. Substantially less if you were to look out to 2027.

I would like to add some ATVI shares for around $73. There’s a substantial upside toward $95. I expect the deal will ultimately win over regulators in the U.K. and elsewhere. Interestingly, there could be a little bit of near-term upside as the Twitter (TWTR) deal is closing tomorrow. A lot of arbs, that like widespread deals with a lot of challenges, will have fresh capital to deploy next week. Microsoft/Activision is a natural target.

Be the first to comment