Rich Polk

An FTC problem

News outlet Politico just reported that the FTC could potentially file an antitrust lawsuit to block the deal with Microsoft (MSFT) and Activision (NASDAQ:ATVI). There’s no guarantee that a lawsuit will be filed, but if so, it could likely happen within the next two months and potentially put the July 2023 deal deadline at risk.

The debate remains whether Microsoft will bias the competition to its advantage after purchasing Activision. Microsoft is the owner of Xbox, the number 3 gaming console behind Sony’s (SONY) PlayStation and Nintendo (OTCPK:NTDOY) Switch, and will become the owner of some very lucrative gaming IPs including Call of Duty, World of Warcraft, Diablo and Candy Crush upon acquiring Activision.

Rival Sony has argued that the acquisition will leave consumers with less choice and developers with fewer platforms to publish their games, indicating that Microsoft could potentially pull Call of Duty out of PlayStation and drive players to Xbox. However, Microsoft has promised to make Call of Duty available on PlayStation and has recently offered keep the game on Sony’s platform for 10 years per New York Times.

Aside from the spat with Sony, this is the first time that Microsoft is dealing with the most regulatory scrutiny since overcoming antitrust issues in the 1990’s. The deal will have to be approved by 16 governments across the world, and so far only Brazil and Saudi Arabia have said yes, with Serbia expected to approve soon, according to Microsoft.

Thus far, the deal is still being investigated in 3 key markets including the EU, the UK and the US. Both Microsoft and Activision have until July 2023 to close the transaction without any deal renegotiations. So if the FTC does file a lawsuit in the US, this deadline could be in jeopardy and both companies may be forced to renegotiate.

Consequently, this may put the original $69 billion price tag on Activision at risk since market conditions are vastly different today vs. the beginning of 2022 when the deal was announced. In that scenario, shares of Activision are likely to suffer from negative price actions.

A China problem

As a standalone company for now, Activision is dealing some issues with its long-time partner NetEase (NTES) in China. On 11/17, Blizzard and NetEase announced that their 14-year partnership will come to an end by January 23, 2023, and Blizzard players in China will not be able to access a list of Blizzard games including WoW, Overwatch, and Diablo starting from 11/23. According to Activision, both parties are unable to reach an agreement that is “consistent with Blizzard’s operating principles and commitments to players and employees.”

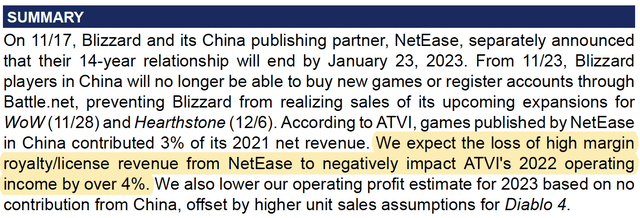

While games published by NetEase in China represented just 3% of Activision’s revenue in 2021, the high-margin royalty and license income from NetEase will likely impact Activision’s operating income by >4% in 2022, per Oppenheimer.

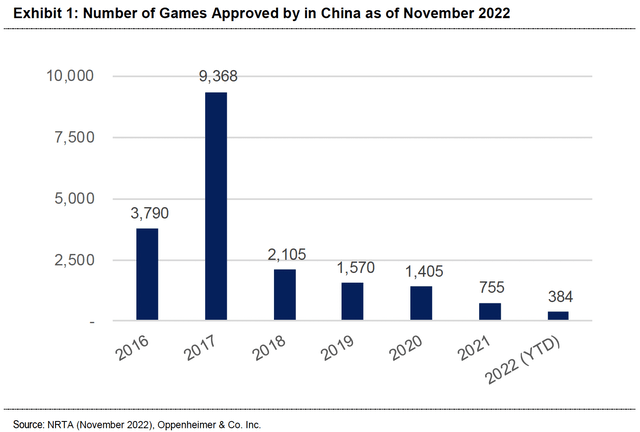

Going forward, if Blizzard wants to publish the 7 soon-to-be-suspended games in China, it will likely have to find a new partner. But China’s NPPA (National Press and Publication Administration) hasn’t been very fond of approving foreign games as of late. In fact, the last time a foreign game was approved was back in June 2021.

Conclusion

I own shares of Activision on the thesis that the deal with Microsoft is likely than not to go through despite some regulatory concerns, therefore the breakup with NetEase in China should not affect the stock price by much unless there’s clear evidence that Activision will remain a standalone company.

In my view, Microsoft’s acquisition of Activision is similar to Sony buying Bungie and AT&T (T) buying Time Warner (WBD). There’s nothing quite unique about games like Call of Duty that suggests Microsoft will end up having a monopoly (in the First Person Shooting game market?) where consumers will be forced to pay a higher price without other available alternatives.

More importantly, Microsoft has clearly indicated that it has no intention to make Call of Duty exclusive on Xbox. As a result, I remain a buyer on the 4% down move of Activision’s stock (29% spread based on Microsoft’s purchase price of $95/share), and would expect the deal to close once all regulatory hurdles have been cleared.

Be the first to comment