AmnajKhetsamtip/iStock via Getty Images

A Quick Take On ACI Worldwide

ACI Worldwide (NASDAQ:NASDAQ:ACIW) reported its Q2 2022 financial results on August 4, 2022, beating expected revenue and EPS estimates.

The company provides a range of payment processing services for clients worldwide.

I’m cautious on ACI given a rising cost of capital environment and increasing chances of a global recession over the coming quarters.

My outlook for ACIW is a Hold for the near term.

ACI Worldwide Overview

Coral Gables, Florida based ACI was founded in 1975 to provide software and digital payment services to banks, billers and merchants globally.

The firm is headed by Chief Executive Officer Odilon Almeida, who was previously an operating partner at Advent International and president at Western Union’s global consumer business.

The company’s primary offerings include:

-

Merchant acquiring

-

Digital payments issuing

-

Enterprise payments

-

Real-time low value & high value payments

-

SWIFT messaging

-

Omnichannel payment processing

-

Fraud management

-

Third party software

The firm acquires customers through various channel partners and through its direct sales team.

ACI counts more than 80,000 clients of its various service offerings, from large enterprises to middle market and smaller companies.

ACI Worldwide’s Market & Competition

According to a 2019 market research report, the market for payment processing services is expected to reach $62.3 billion by 2024.

This represents a forecast CAGR of 9.9% from 2019 to 2024.

The main drivers for this expected growth are a continued growth in the number of merchants seeking integrated payment processing solutions and the entrance of new market participants with new technology offerings.

Major competitive vendors include:

- Jack Henry & Associates (JKHY)

-

Paysafe Group (PSFE)

-

Naspers Limited (OTCPK:NPSNY)

-

Others

ACI Worldwide’s Recent Financial Performance

-

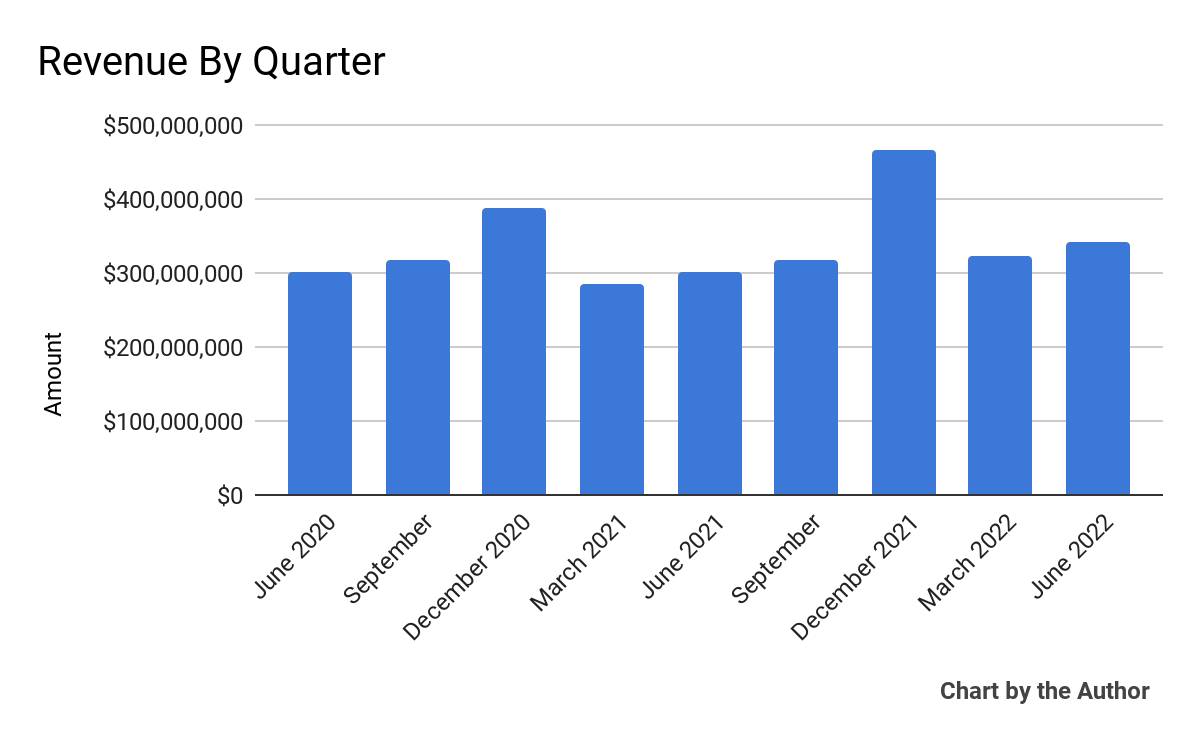

Total revenue by quarter has followed the trajectory shown below:

9 Quarter Total Revenue (Seeking Alpha)

-

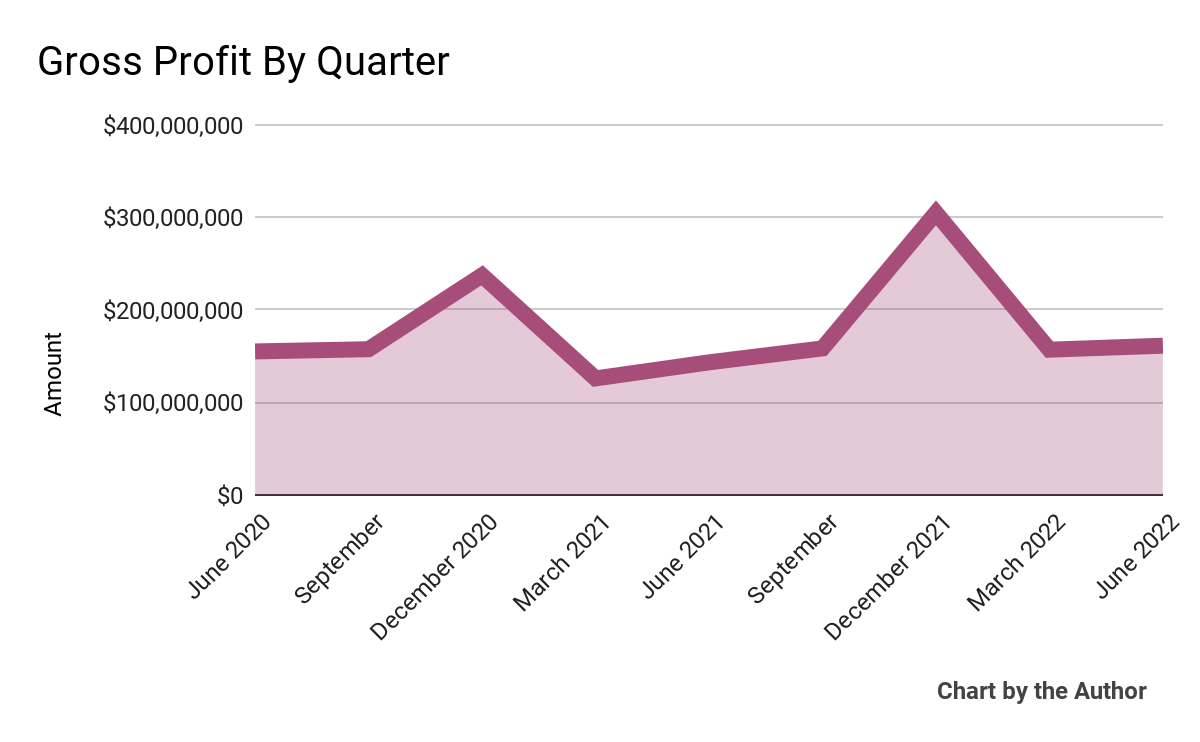

Gross profit by quarter has produced roughly the same trajectory as that of total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

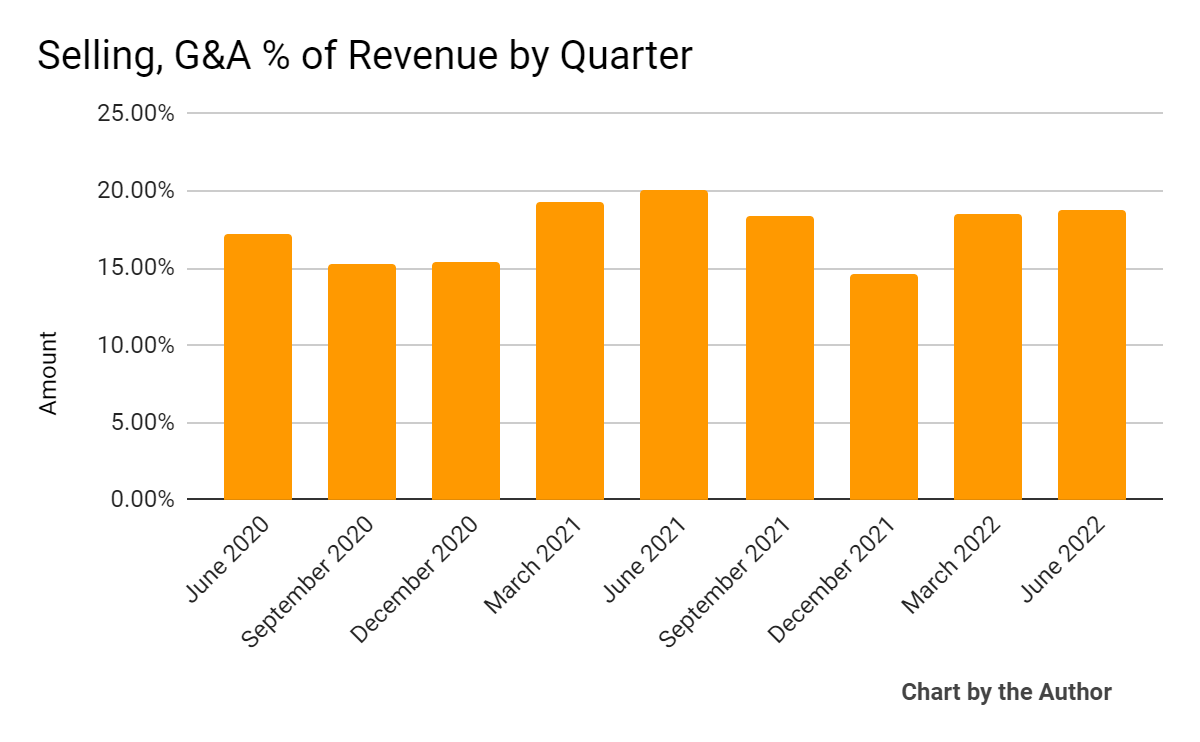

Selling, G&A expenses as a percentage of total revenue by quarter have varied within a range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

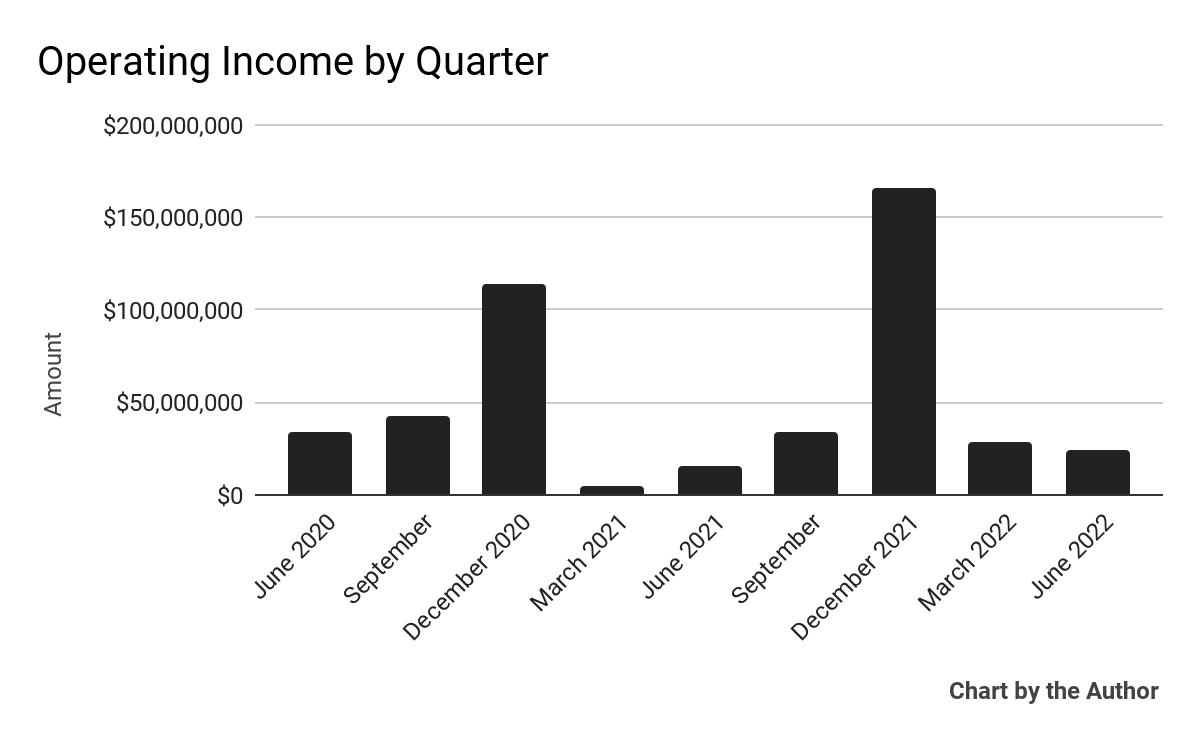

Operating income by quarter has fluctuated seasonally as follows:

9 Quarter Operating Income (Seeking Alpha)

-

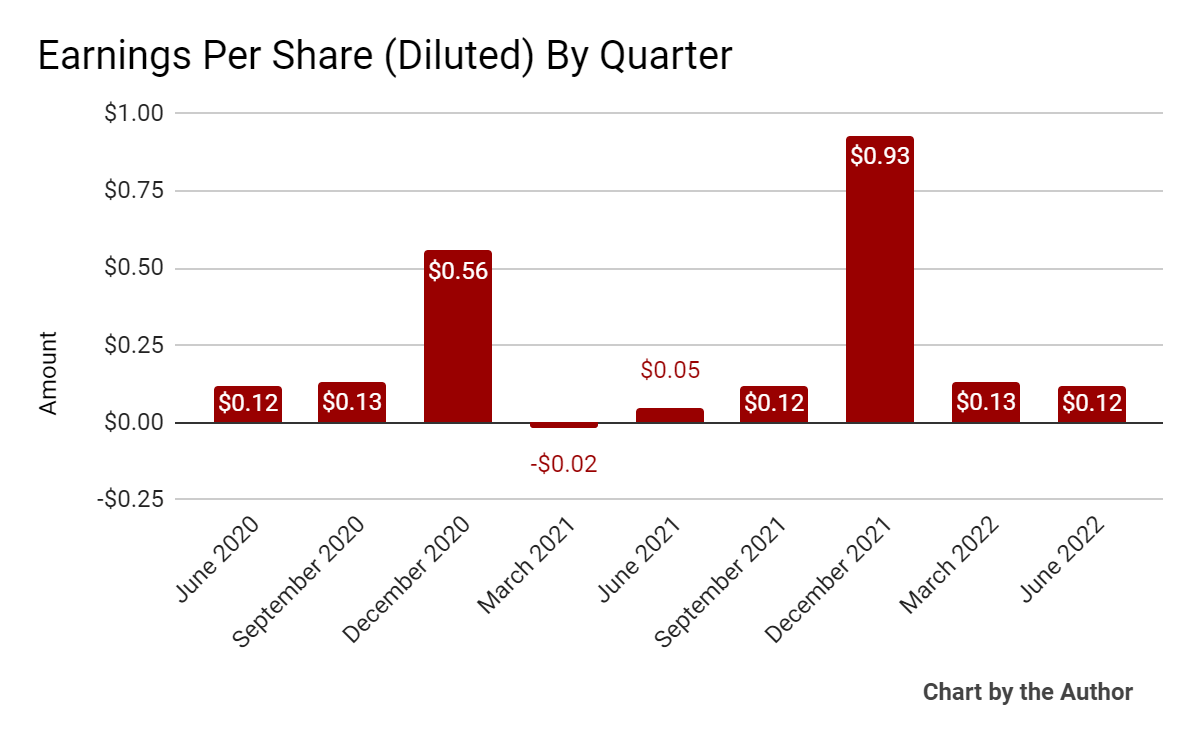

Earnings per share (Diluted) have produced some seasonal growth, as shown here:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

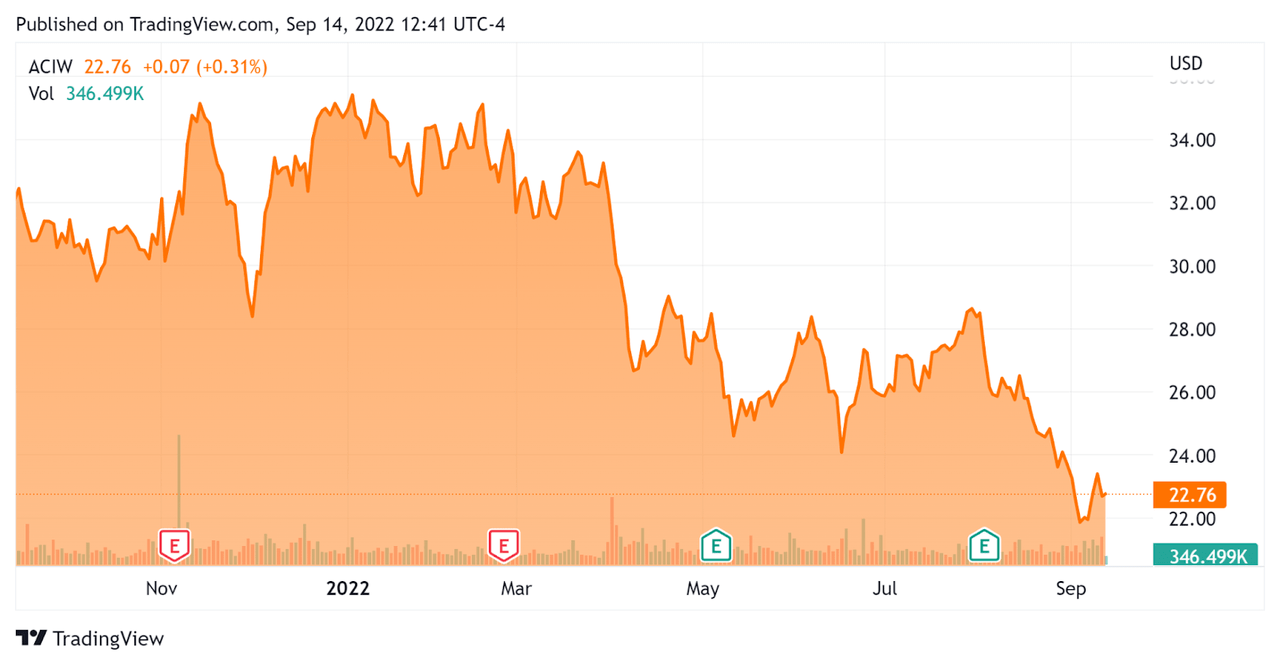

In the past 12 months, ACIW’s stock price has fallen 29% vs. the U.S. S&P 500 index’s drop of around 11.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For ACI Worldwide

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.56 |

|

Revenue Growth Rate |

12.2% |

|

Net Income Margin |

10.5% |

|

GAAP EBITDA % |

21.5% |

|

Market Capitalization |

$2,670,000,000 |

|

Enterprise Value |

$3,710,000,000 |

|

Operating Cash Flow |

$183,250,000 |

|

Earnings Per Share (Fully Diluted) |

$1.30 |

(Source – Seeking Alpha)

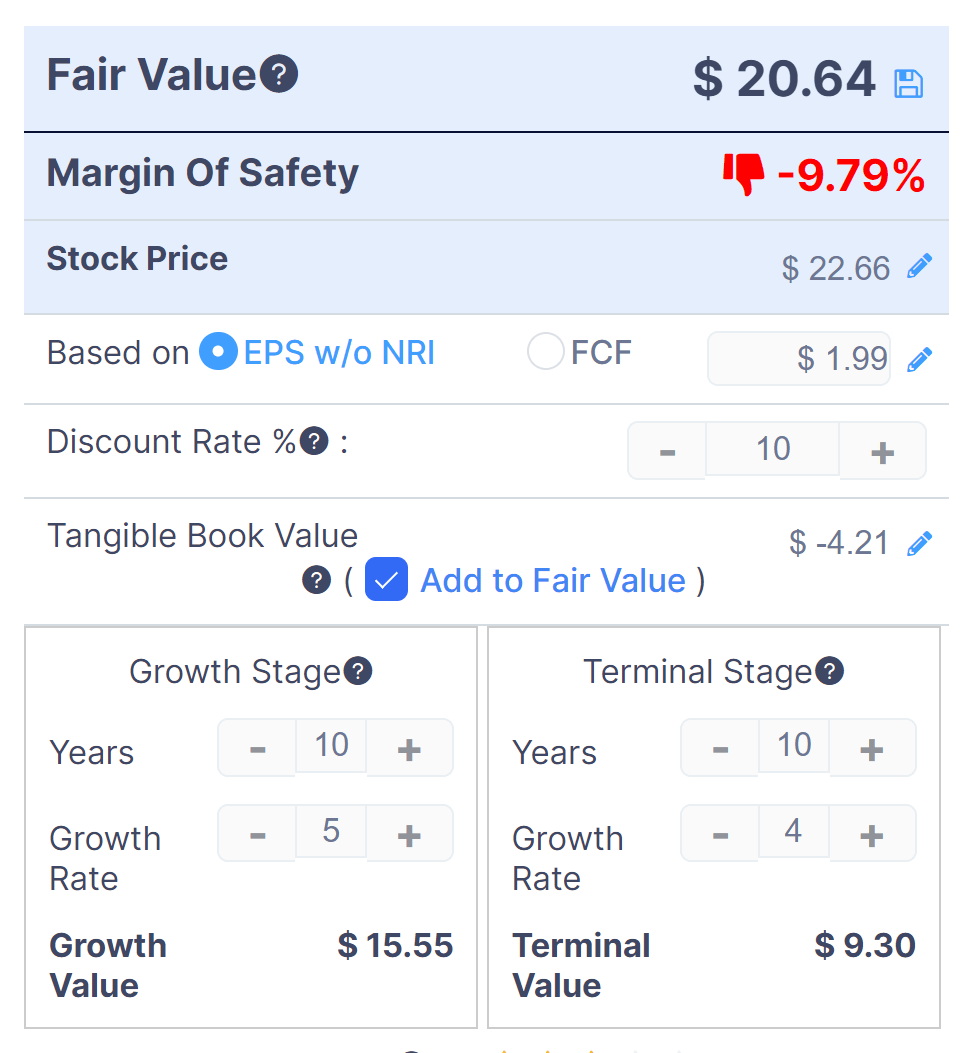

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

ACIW Discounted Cash Flow Calculation (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $20.64 versus the current price of $22.66, indicating they are potentially currently overvalued, with the given earnings, growth and discount rate assumptions of the DCF.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

ACIW’s most recent GAAP Rule of 40 calculation was 33.7% as of Q2 2022, so the firm needs some improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

12.2% |

|

GAAP EBITDA % |

21.5% |

|

Total |

33.7% |

(Source – Seeking Alpha)

Commentary On ACI Worldwide

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted that it is working on its ‘next-generation, real-time payments cloud platform, and we expect the release of the minimum viable product in the first quarter of 2023.’

The company has learned that central governments have increased prioritization of improving financial and payment infrastructure.

ACI also recently launched its mobile engagement platform, improving the ability for merchants to ‘offer goods and services directly to consumer smartphones using location, voice and image recognition technology.’

As to its financial results, revenue rose 13% year-over-year on an as-reported basis, while adjusted EBITDA was up by 10%. Adjusted figures typically remove stock-based compensation and one-time items.

ACIW’s Rule of 40 results have been close to acceptable, although I would like to see a higher topline revenue growth figure.

Notably, the company’s Merchant segment revenue decreased 2%, while its bank segment increased 24% and its biller segment rose by 8%, on an as-reported basis.

The firm continued to repurchase its shares, acquiring 900,000 shares during the quarter for a total repurchased amount of $63 million to-date on its current repurchase authorization, which has an additional $154 million authorized.

For the balance sheet, the firm ended the quarter with cash on hand of $119 million and $1.1 billion in debt. The company generated free cash flow over the trailing twelve months of $167.1 million.

Looking ahead, management reaffirmed full year forward guidance of revenue growth ‘in the mid-single digits on a constant currency basis’ and adjusted EBITDA of $407.5 million at the midpoint of the range.

The primary risk to the company’s outlook is a looming global economic slowdown, which would reduce customer payment processing volumes and slow new customer wins.

An upside catalyst would be a ‘short and shallow’ downturn, with the global economy returning to growth in 2023.

My discounted cash flow analysis indicates the stock may be slightly overvalued at its present level, although I’ve used conservative assumptions.

The stock has been beaten down over the past several months, so for some investors it may present a value opportunity.

I’m more cautious given a rising cost of capital environment and increasing chances of a recession over the coming quarters.

My outlook for ACIW is a Hold for the near term.

Be the first to comment