marchmeena29

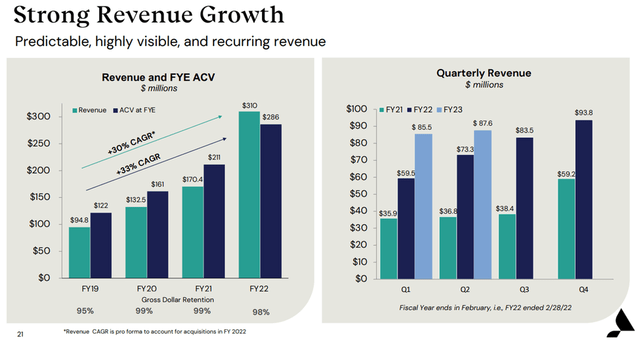

Personalized health and benefits solution platform Accolade’s (NASDAQ:ACCD) earnings momentum continued on the back of another solid Q2 2023, underpinning a positive outlook into the selling season ahead. With revenue growth in the double digits % as well, the upbeat guidance commentary for annual recurring revenue to exceed last year came as no surprise.

The key to near-term upside will be execution – in particular, management’s progress in clearing customers/RFPs outstanding (predominantly greenfield opportunities) will be worth keeping an eye on. In addition, FY24 could also benefit from timing issues related to when certain benefits go into effect (recall this was the rationale behind the upper end of this fiscal year’s guidance remaining unchanged). As for the mid to long-term, the broad-based strength across the different product lines bodes well for the company’s outlook, as customers increasingly recognize the value of ACCD’s full suite of solutions.

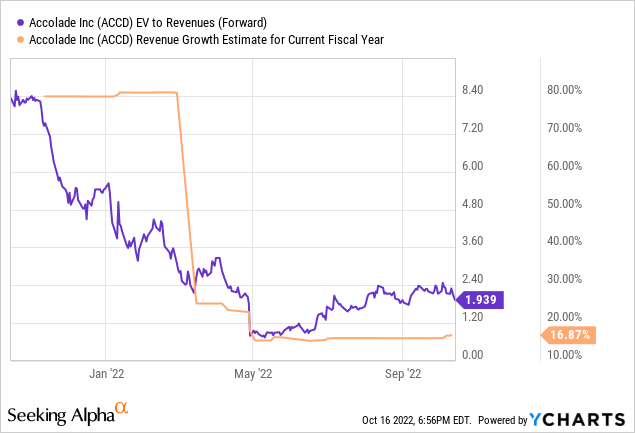

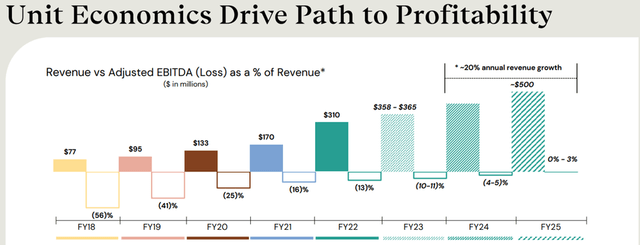

Net, ACCD looks well-positioned to weather the headwinds, delivering wins through a tough macroeconomic and competitive environment. Assuming ACCD makes good on its profitability targets (full-year adj EBITDA positive in FY25), the stock should quite easily grow into its undemanding 1-2x EV/Revenue valuation.

A Strong Q2 2023 Earnings Performance

ACCD saw another strong quarter of growth, led by revenues of $87.6m (+19.6% YoY) and a gross margin expansion of ~380bps. Its adj EBITDA loss also narrowed to -$13.7m (excluding ~$3m in non-recurring severance expenses) – a significant improvement from -$19.4m in Q2 2022. This led to a similarly improved net loss for the quarter at -$46.5m (vs. $62.4m in the prior year). The cash buffer remains strong as well at $330.6m (down slightly from the $335.6m in the previous quarter and $384m last year). Against an ending debt balance of $281.5m (flat QoQ and modestly higher YoY), ACCD’s net cash position remains intact.

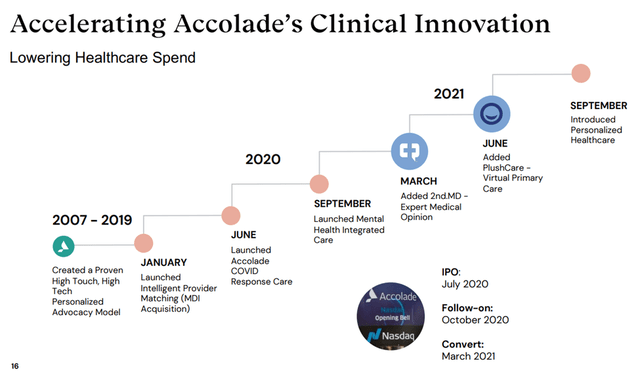

Driving the earnings outperformance was a combination of solid revenue growth and cost discipline across key segments and cost line items. This reflects not only the growing momentum in all of the business units, but also that recent acquisitions like ExpertMD and PlushCare have progressed well on their post-acquisition integration timelines. Importantly, management also indicated on the call that customers are recognizing the value-add of its total solution (including virtual primary care and second opinion services) in generating cost savings and an improved ROI for clients. The ACCD offering will be targeted at small to medium-sized businesses (<1k employees) looking for incremental cost savings and better staff retention.

Updated FY23 Guidance Highlights Progress Toward Mid-Term Targets

For Q3 2023, ACCD is guiding for revenues to be within the $86-88m range and for an adj EBITDA loss range of $11-13m, representing a ~14% EBITDA loss margin at the midpoint. While this is still a net upgrade from the prior guidance numbers, the extent of the raise (the upper end of next quarter’s revenue guidance is intact) was a tad surprising. Given there was a ~$1.5m pull-forward of some revenue contribution to Q2, though, this was largely a timing issue rather than a signal of near-term weakness. In particular, some of the wins for ExpertMD/Care, which will start off-cycle, are contributing. More importantly, management commentary on the call suggests a strong selling season remains intact, potentially driving upside to these numbers.

On a full-year basis, the revenue guidance was raised to a $358-365m range (above the $355-365m prior), although the EBITDA guidance was unchanged at a loss of $35-$40m, representing a ~10% EBITDA loss margin at the midpoint. The latter was a surprise, given another strong quarter of growth, positive commentary on the upcoming selling season, as well as positive EBITDA trends. Most likely, management is incorporating some buffer here in case of a significant macro downturn in the coming months, potentially leaving room for upward revisions ahead. That said, the long view is important, as the company continues to make good progress on its path to achieving EBITDA-level profitability by FY25.

Underlying Fundamentals Point to Brighter Long-Term Prospects

Testament to its underlying strength, ACCD has noted that demand this year is up YoY despite the current macro headwinds. While there could be some deceleration in the near term, the employment environment, where employers are looking to balance employee retention with lower costs and higher engagement, is supporting the company’s growth. Of note, the shape of revenue for FY24 is guided to be similar to FY23, although there could be some upside here, given the company disclosed some wins would only flow through in later periods.

More broadly, the company is building a more diversified revenue stream across its three major divisions, two of which were acquired last year and integrated since. Plus, the move to package its solutions, including core navigation benefits services, ExpertMD for second opinions, as well as direct-to-consumer and PlushCare for virtual primary care and behavioral health, could yield revenue synergies down the line. As the company increasingly leverages its sales force across its business/product segments, expect increased sales and cost synergy benefits to boost earnings over time.

Inching Closer to Profitability

All in all, it was a very good Q2 2023 for ACCD. The company’s underlying metrics exceeded consensus expectations and prior guidance numbers across all the key P&L lines (revenues, adj EBITDA, and non-GAAP EPS) despite the challenging macro backdrop. Management commentary indicates more of the same going forward, as its cost-saving value proposition resonates across its key business segments. With good execution, the company should continue on its path to turning full-year adj EBITDA positive in FY25, leaving ample upside to the current 1-2x EV/Revenue valuation (a wide discount to the historical trading range).

Be the first to comment