Guido Mieth

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 14th.

I’ve written about the iShares 0-5 Year High Yield Corporate Bond ETF (SHYG), a short-term high yield corporate bond ETF, several times in the past, due to the fund’s strong value proposition. SHYG offers investors a strong, fully-covered 5.5% dividend yield and significant dividend growth, with little interest rate risk. SHYG is a fantastic investment opportunity, but credit risk is higher than average, and the fund could see important losses if economic conditions were to worsen. SHYG is a strong fund, but broadly inappropriate for more risk-averse investors, in my opinion at least. For these investors, the iShares 0-5 Years Investment Grade Corporate Bond ETF (NASDAQ:SLQD) might be a better fit.

SLQD offers investors diversified exposure to short-term investment grade U.S. corporate bonds. The fund currently only yields 1.9%, but dividends should grow until yields reach 4.5% – 5.0%, due to Federal Reserve rate hikes. SLQD is also a relatively safe fund, with very low interest rate and credit risk, a solid combination. SLQD’s safe holdings and good forward yield make it a reasonable investment opportunity, but one only appropriate for more conservative investors, in my opinion at least.

As an aside, I find SHYG’s broader value proposition more compelling, but SHYG is definitely riskier, and less appropriate for many investors.

SLQD – Basics

- Investment Manager: BlackRock

- Underlying Index: Markit iBoxx USD Liquid Investment Grade 0-5 Index

- Dividend Yield: 1.88%

- Expense Ratio: 0.06%

- Total Returns CAGR 5Y: 0.99%

SLQD – Overview

SLQD is a short-term investment grade corporate bond index ETF. It tracks the Markit iBoxx USD Liquid Investment Grade 0-5 Index, an index of these same securities. It is a relatively simple index, including all USD denominated investment grade corporate bonds with a maturity of at least five years. As with most indexes, securities must also meet a basic set of inclusion criteria, centered on liquidity, size, and similar metrics There are issuer and security caps, meant to ensure a modicum of diversification. It is a reasonable, broad-based index, with no significant negatives or oversights.

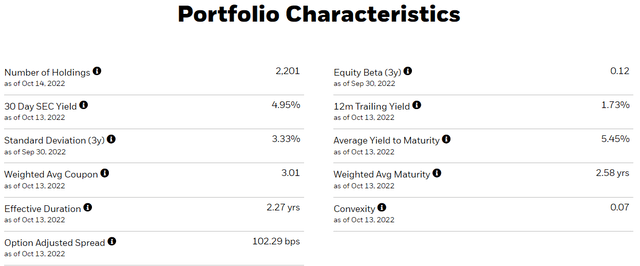

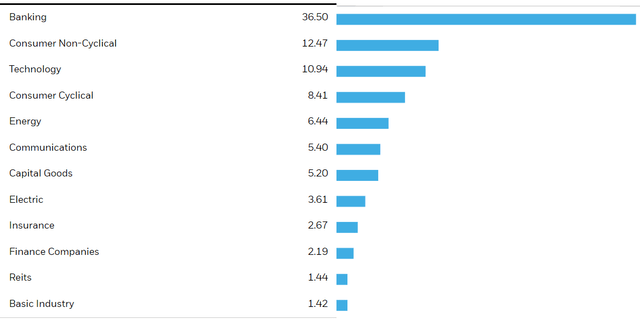

SLQD is an incredibly well-diversified fund, with investments in over 2000 securities, and with exposure to all relevant industry segments. The fund does lack exposure to most bond sub-asset classes, exclusively investing in investment grade corporate bonds.

SLQD

SLQD

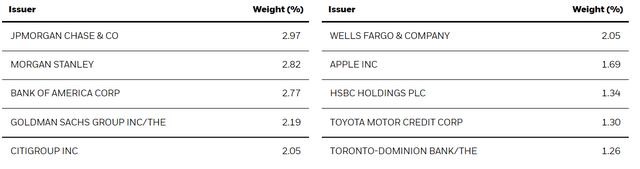

SLQD’s concentration is quite low, with the fund’s top ten holdings accounting for around 2% of its value, and with the fund’s top ten issuers accounting for just 20% of the same.

SLQD

SLQD’s diversified holdings reduce portfolio risk, volatility, and the possibility of significant losses from an individual bankruptcy, all benefits for the fund and its shareholders.

SLQD – Investment Thesis

SLQD’s investment thesis rests on the fund’s good forward dividend yield / expected dividend growth, and its low interest rate and credit risk. These combine to create a fund with moderate potential returns at a low level of risk, a solid combination, and one particularly appropriate for more risk-averse investors and retirees.

Let’s have a closer look at each of the points above.

Good Forward Dividend Yield / Expected Dividend Growth

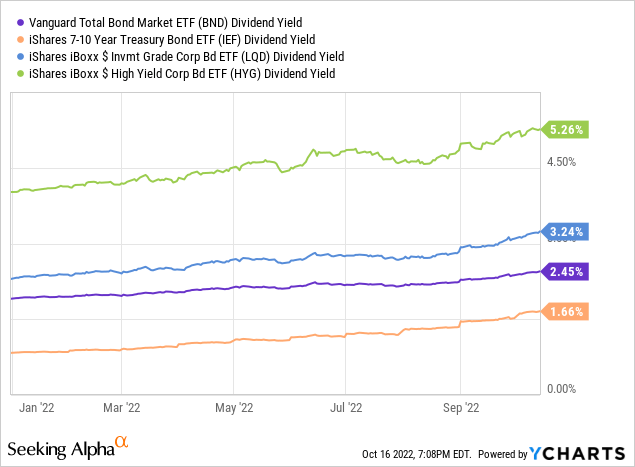

SLQD currently offers investors a relatively paltry 1.9% dividend yield. It is a relatively low yield on an absolute basis, and lower than the yield offered by most of its peers.

Although SLQD’s current yield is quite low, the fund’s forward or expected dividend yield is much higher, for a simple reason: Federal Reserve interest rate hikes. As most investors are well aware of, inflation has skyrocketed these past few months, reaching 8.3% this past August. The Federal Reserve has reacted by aggressively hiking rates. Rates have increased by around 3.0% points YTD, and further hikes are likely, at least until inflation is brought under control.

Higher interest rates mean higher bond fund dividends and yields, although the process takes time. In most cases, bond funds must wait until their older, lower-yielding bonds mature, to be replaced for newer, higher-yielding issues. Once bonds are replaced, funds must wait until these start to make their (higher) interest rate payments. Bond fund investors must then wait for bond funds to increase their dividends. The entire process could take several years to completely play out, but dividends should see some strong, significant growth immediately / in a matter of months. SLQD’s dividends should grow until the fund yields around 5.0%, equivalent to its SEC yield, a standardized measure of underlying generation of income.

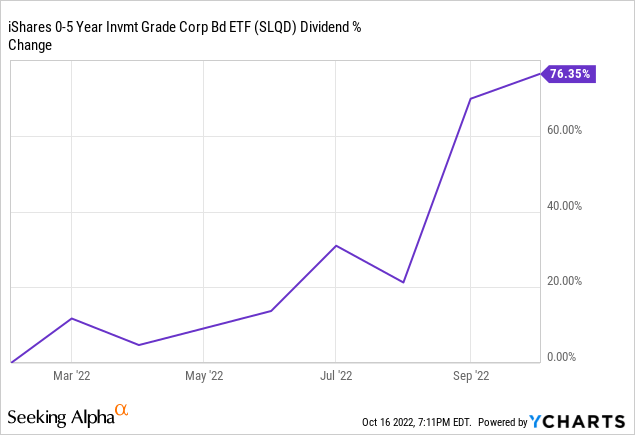

SLQD focuses on short-term bonds, with short maturity dates, and so should see significant benefits in a relatively short amount of the time. The fund’s dividends have grown by over 75% YTD, an incredibly strong figure, as expected.

SQLD’s strong dividend growth is at least partly the result of a very low starting yield: when a fund yields 1.9%, even a couple percentage points in extra income means significant dividend growth. In absolute numbers, the fund went from a $0.0563 dividend in January 2022, equivalent to an annualized 1.4% yield, to a $0.0993 dividend in October 2022, 2.5% annualized. So, the fund’s yield increased 1.1% percentage points in around 8 months, a solid pace of growth. At this pace, the fund should reach 5.0%, its SEC yield, in around a year and a half. Growth would likely stall afterwards.

SLQD’s good forward dividend yield and expected dividend growth are important benefits for the fund and its shareholders, and an important part of its investment thesis.

Low Interest Rate Risk

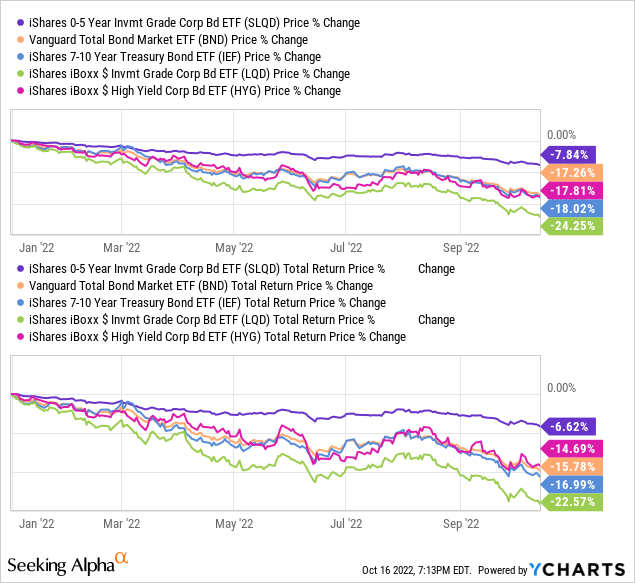

SLQD’s dividends have seen / will see significant growth as interest rates continue to increase, but the same is true for most other bond funds. What sets SLQD apart from its peers is the fund’s relatively low interest rate risk. SQLD focuses on short-term investment grade corporate bonds, with relatively low maturities and duration, and hence interest rate risk. These bonds tend to post comparatively low capital losses when interest rates increase, as has been the case YTD.

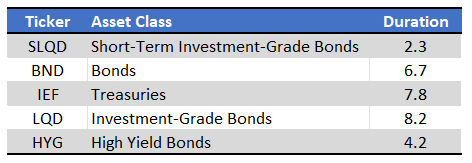

SLQD sports a duration, a measure of interest rate sensitivity / risk, of just 2.3 years. It is a relatively low figure on an absolute basis, and quite a bit lower than average for a diversified bond fund.

Fund Filings – Chart by Author

SLQD’s low duration significantly reduces interest rate risk, a benefit for the fund and its shareholders. Low interest rate risk is particularly important right now, due to elevated inflation, and due to the risk of further, unexpected rate hikes. Expect SLQD to experience below-average losses, and to outperform, if interest rates see further hikes, as has been the case YTD.

Low Credit Risk

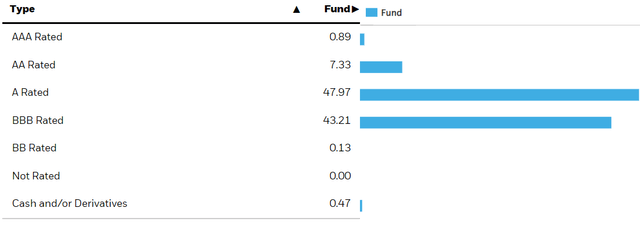

SLQD exclusively invests in investment-grade bonds with strong credit ratings, and with an average credit rating of A.

SLQD

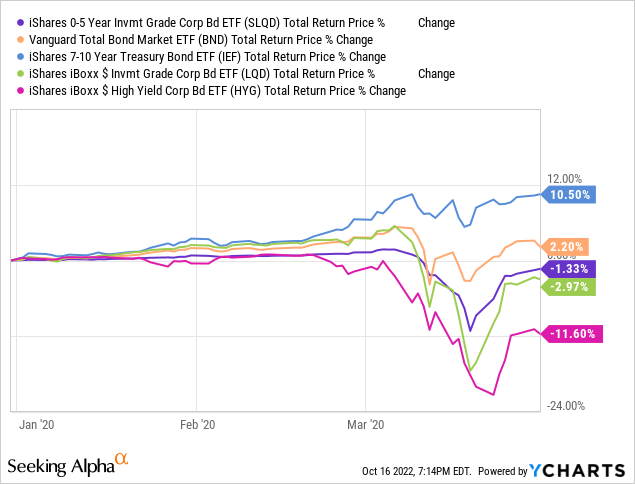

SLQD’s underlying bonds were all issued by comparatively safe, strong companies, with more than sufficient capacity to meet their debt obligations. As such, these are relatively safe bonds, with low default rates, and with little exposure to economic conditions. Expect very low, below-average losses during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic.

SLQD’s low credit risk would almost certainly lead to relatively low losses during any future downturns and recession, a benefit for all investors, and one which is particularly important for more risk-averse investors and retirees.

Low credit risk is particularly important during periods of weakening economic fundamentals, especially recessions. Although economic conditions remain, let’s say adequate, conditions are worsening as inflation remains excessively elevated, and as the Federal Reserve seems committed to hiking rates until inflation normalizes. Sufficiently high interest rates would crush demand, leading to a recession, as occurred during the 70s stagflation. SLQD would see some losses if this were to happen, but these should be quite small, and lower than average, an important benefit for the fund and its shareholders.

As a final point, SLQD’s low credit risk is the fund’s main benefit vis-a-vis SHYG, which focuses on short-term high yield corporate bonds. SHYG does yield quite a bit more, with a 5.5% yield, but is significantly riskier in turn.

Conclusion – Buy

SLQD’s safe holdings and good forward yield make the fund a buy, and one particularly appropriate for more conservative income investors and retirees.

Be the first to comment