guvendemir/iStock via Getty Images

Summary

Abraxas Petroleum (OTC:AXAS), is a delevered nanocap company, operates in the oil and gas industry. This pure-play Permian/Delaware Exploration & Production Company emerged from a pre-arranged bankruptcy on January 2, 2022 that helped to prevented a complete wipe out of equity holders. Management last reported net developed acreage assets were about 11,000 after having reserve engineering firm DeGolyer and MacNaughton (D&M) analyze their proved reserves. With a revamped board which has former creditors further participating in the upside valuation, I believe AXAS offers equity investors, able to participate in this nanocap, an opportunity to gain significant capital appreciation in the event of a sale of the company in the next 6 months to a year. My most conservative deal outlook would provide investors with an expected aggregate return of 25% on an announced deal given current AXAS stock pricing $1.70 as of 6/24/2022. This puts my conservative calculated deal range between $200M and $260M.

Company Overview

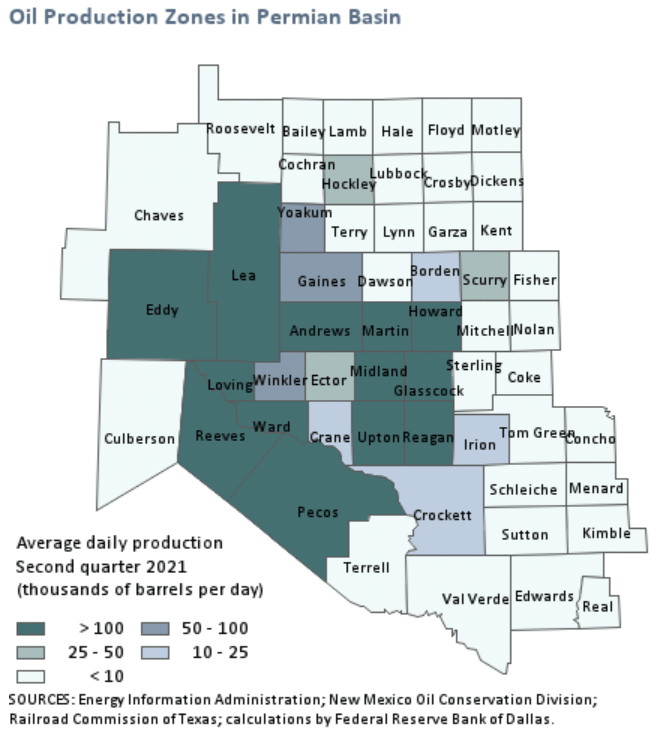

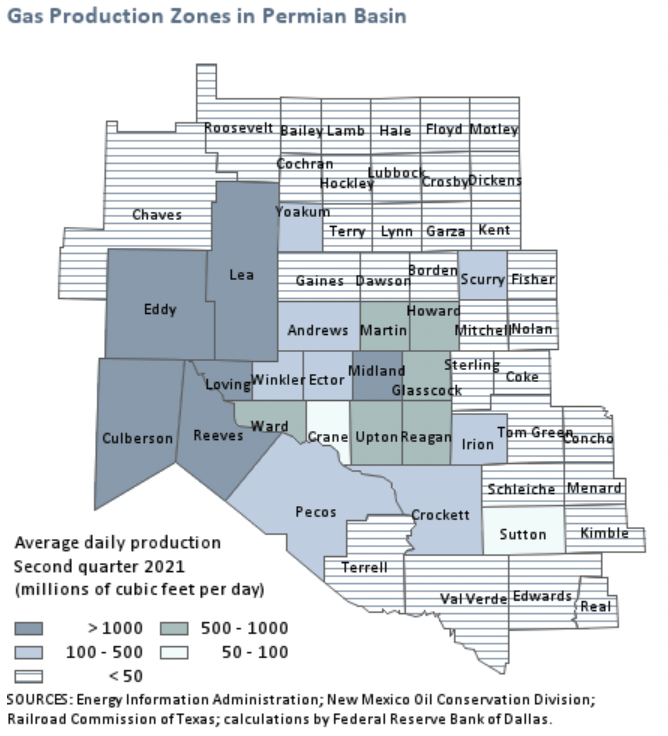

AXAS properties in the Permian/Delaware Basin region are primarily located in Ward and Winkler Counties, Texas and produces oil and gas primarily from the Bone Spring and Wolfcamp formations. They have total proven oil reserves of 24 million barrels. With a total of 8.43 million shares outstanding, the market price of the shares value the company for less than $.60 per proven barrel of oil reserves. According to D&M analysis on December 31, 2021, the company had $229.3 million, using 2021 average prices of $66.55/bbl of oil and $3.64/mcf of natural gas. Average daily production during Q1 2022 was 2,168 barrels of oil equivalent per day with a 56% cut of oil production mix at the quarter end March 31, 2022. The last few years saw AXAS executing two sales with the more recent being its Wiliston Basin assets to Lime Rock Resources for $87.2MM. AXAS has been able to pay down and restructure into a favorable capital structure that does not leave equity holders with nothing. This new capital structure complexity has made it difficult for investors to see through and properly analyze potential deal valuations.

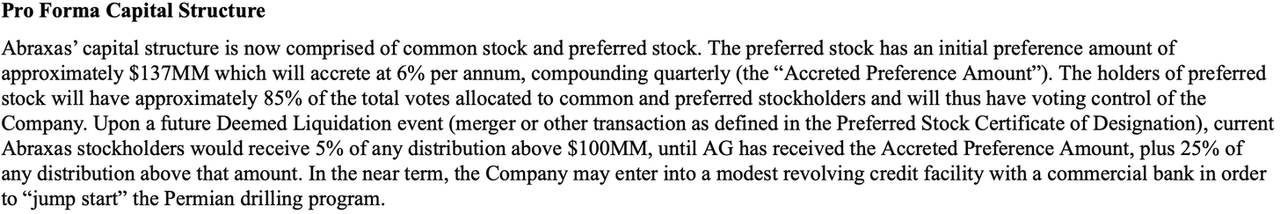

As an emerged pre-arranged bankruptcy situation, AXAS capital structure is now comprised of common stock (8.43 million (MM) shares outstanding) with a market capitalization of ~$14.33 million and preferred stock with par amount of $137 million. The preferred stock came about from its indebtedness resolution with its creditor converting the term loan into preferred equity emerging the company out of this bankruptcy with only $2.4 million in debt against $9.4 million in cash, for an enterprise value of $155.4 million. Earnings before interest, taxes, depletion, depreciation, amortization and exploration (EBITDAX) was $24.4 million for the TTM from Q1 2022. Free cash flow was $100 million for the same TTM period. The enterprise value to EBITDAX ratio is therefore 6.14, and the free cash flow yield is 22%. The company trades at just under a quarter of book value based on the full cost method of accounting. The price/earnings ratio is just over 1x the adjusted 2022 run rate earnings of $1.30. All these numbers are not so bad at all, especially when one considers the high inflationary period for oil and gas companies and oil prices’ continuous move higher, inspite of the rise in FED interest rates to curtail these inflationary price spikes. More on the language nuances regarding “Deemed Liquidation event” as the catalyst to unlocking intrinsic value but it is important to understand why we are afforded this opportunity.

Opportunity Set

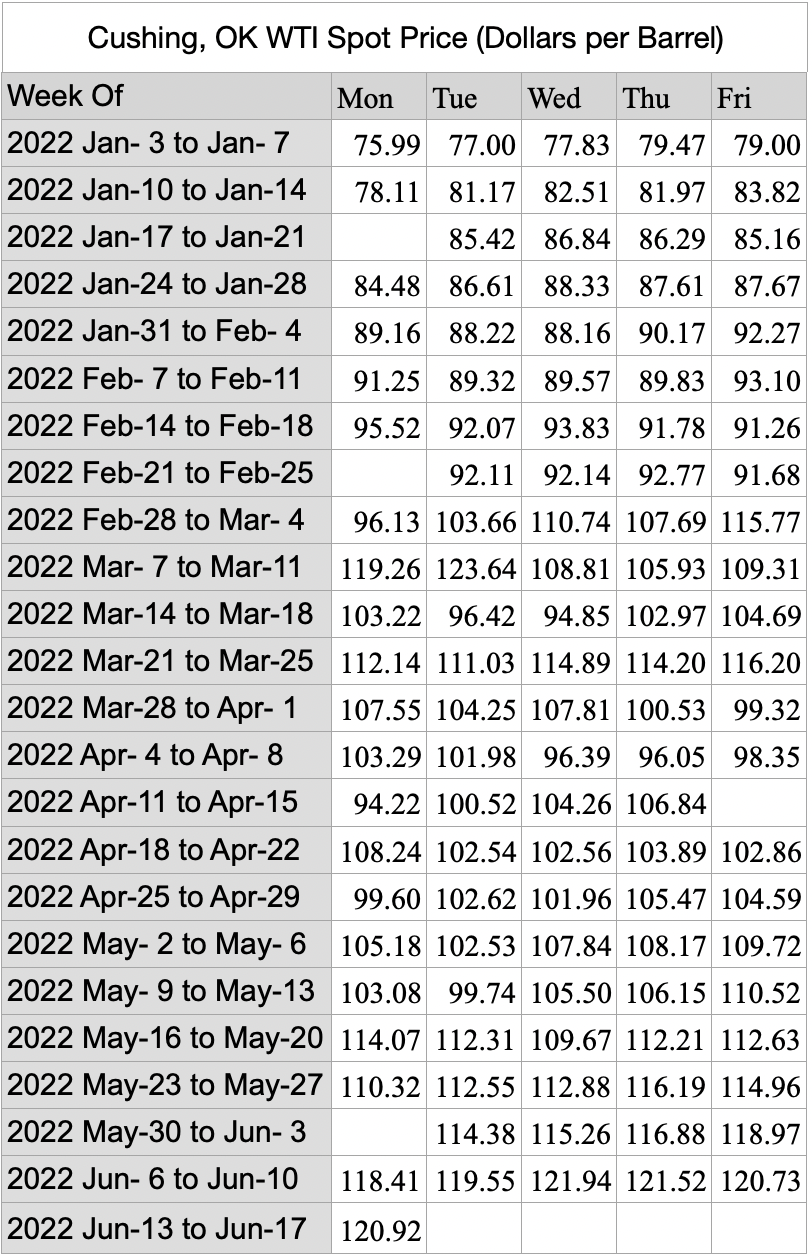

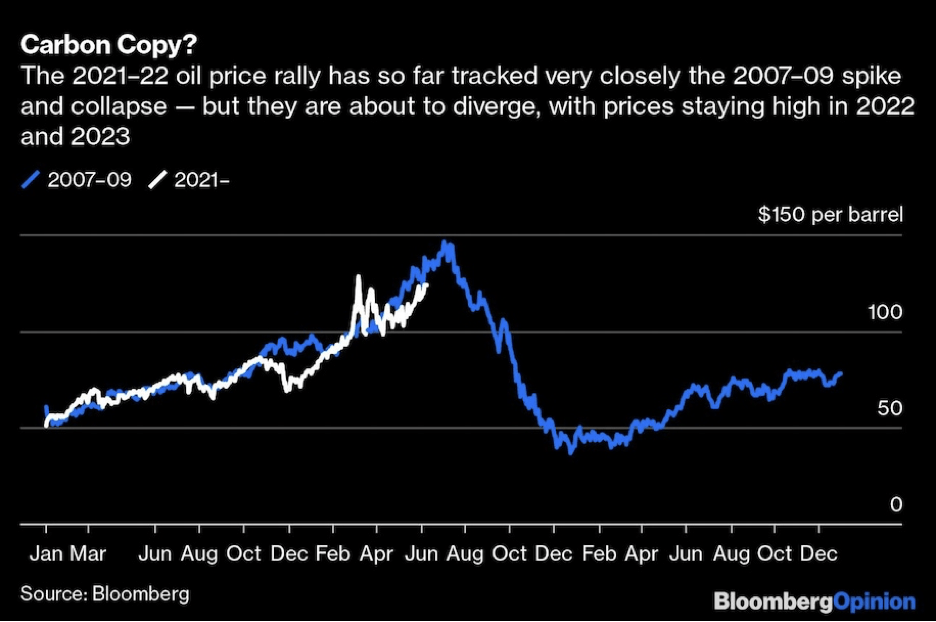

The stock market might be of the mindset that oil prices are akin to the 2007 – 2009 price spike therefore attempting to discount the entire upstream E&P industry in anticipation of an upcoming price fallout. There a plethora of reason specific to AXAS as to why the stock price is so undervalued. AXAS was suspended and ultimately delisted from the Nasdaq since August 4, 2021. Company commentary has gone quiet since February 2022 and the last investor presentation was December 2019. But let’s not forget that we have been here before with AXAS announcing “strategic alternatives to unlock shareholder value” due to the weight of their massive debt load. But industry hurdles may be the biggest rationale for low stock prices in this sector.

Further there is a lot to be fearful about M&A in the energy industry. Regulatory approvals precedents can no longer be relied upon to assess outcomes, national security interest of energy reliance and the increase of environmental, social and governance (ESG) mandates are major concerns for investors and large financiers which E&P CEOs have expressed per the Dallas FED Energy survey. This has led many of these leaders to search for an exit from their respective companies. For larger institutions like Continental Resources (CLR), they are most likely intent on going private where they are able to mitigate some regulatory burdens. As per Harold G Hamm and the Hamm family who own 83% of CLR stated,

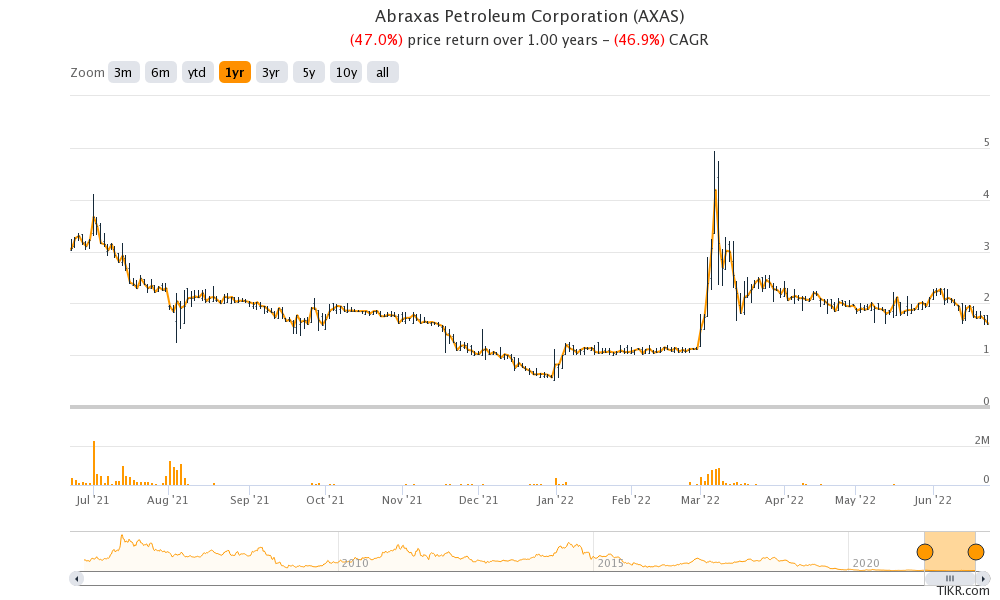

All this paints the understanding as to why AXAS stock is so undervalued. There is virtually little to no interest from the investment community. Over the past year the stock experienced a low of $0.52 a share and a high of $4.94. At the beginning of the year with the announcement of multiple catalysts we saw the stock climb from its year low to a trading range of $1.00 & $1.20 up until the FED March 2022 announcement raising interest rates by 50 basis points (bps). The stock seemed to have spiked and then we watched the decline which is where we are today.

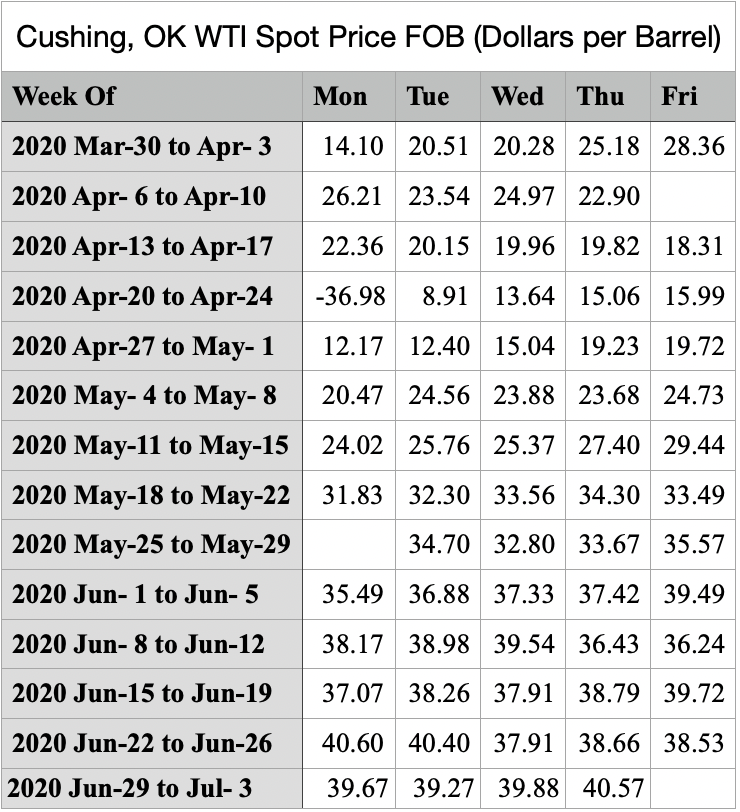

Historically, oil pricing have been extremely volatile and a need to exit is highly important in the case of AXAS. There are plenty assumptions having been made that claimed oil prices couldn’t go any lower prior to the COVID pandemic. Then we all saw the sequence of events as we watched the economic shutdown crush oil pricing for the U.S. E&P industry. At its lowest production quarter where we saw oil prices setting negative pricing in the 2nd quarter 2020, average daily production for AXAS went down to 1,718 barrels of equivalent oil per day (Boepd) with an oil cut of 60% for their Permian/Delaware basin operations.

To pile onto the disparity of AXAS, low stock pricing against any actual M&A deal announcement that could fetch a much higher price, AXAS reports its unaudited 10Q assets using the full cost accounting method. The key importance to that is should oil prices decline for what ever reason the earnings will not look artificial versus what would happen if using the other method called the successful efforts account method.

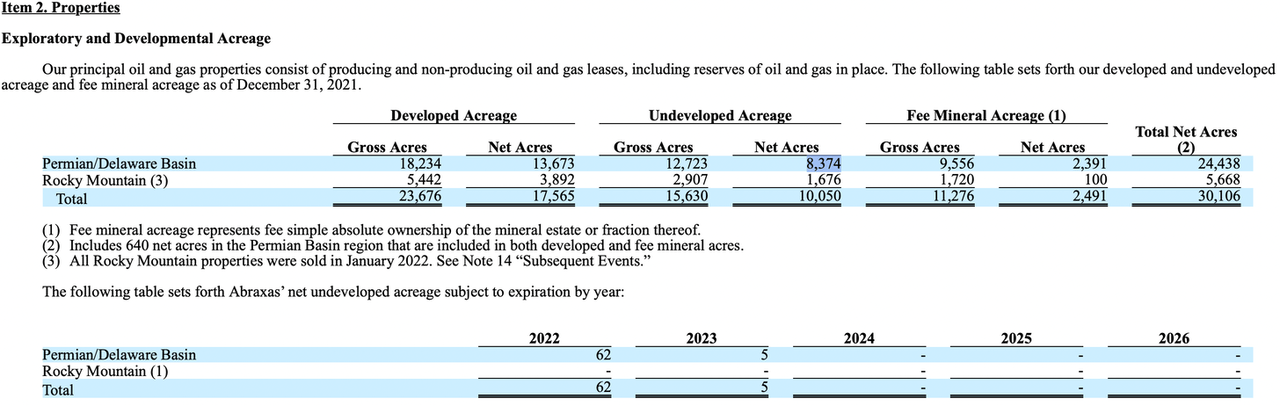

One other aspect to AXAS is that due to their lack of liquidity to conduct exploration and development activity, all of their proved undeveloped reserves have been removed from their books. This is an unaccounted piece of valuable assert the market is effectively missing out of its valuation for AXAS in determining what acquisition price AXAS can obtain. The acreage of this asset is reported annually by way of a valuation assessment which AXAS does not report in its quarterly 10Qs therefore we can only gain an update annually from their 10K on their activity. According to AXAS 2021 10K annual report, the company has net undeveloped acreage of 8,374 and net developed acreage of 13,673 when oil prices were trading around $70. The key question is understanding what this hidden asset of net undeveloped acreage is worth.

Valuation

So why would anyone want to buy this stock at this time. As I have mentioned previously about the capital restructuring, the language assumes there will be an upcoming liquidating event or sale of the company.

Upon a future Deemed Liquidation event (merger or other transaction as defined in the Preferred Stock Certificate of Designation), current Abraxas stockholders would receive 5% of any distribution above $100MM, until AG has received the Accreted Preference Amount, plus 25% of any distribution above that amount. In the near term, the Company may enter into a modest revolving credit facility with a commercial bank in order to “jump start” the Permian drilling program.

Valuing AXAS hidden assets based on announced deals like CLR’s $25.41 billion deal to go private, AXAS assets of the Permian/Delaware Basin net undeveloped acreage of 8,374 acres is worth about $110 million using pricing $13,077 an acre valuation analyzing CLR’s Permian basin net undeveloped acreage of 65,756 acres. If we use AXAS management’s asset sale where they were able to fetch $15,385 an acre for the 1,676 it owned, the same AXAS Permian/Delaware Basin could be valued at about $130 million. I call into question CLR’s per acre $13,077 valuation as an extremely cheap amount due to the significant appreciation in oil pricing but using these values AXAS’ Permian/Delaware basin 8,374 net undeveloped acreage value range is between $110 million and $130 million.

Using the price per flowing barrel metric to value the net developed acreage, the value for CLR is $107 million for its 40,200 daily average production in barrels of oil equivalent on the Permian and AXAS was able to sell the Wiliston basin daily average production for $60 million for its 2,168 daily average production in barrels of oil equivalent (again this is based on oil pricing from December 2021. This gives a relative valuation range for current Abraxas Petroleum, based on an announced deal on June 2022 and an asset sale deal when prices were 40% lower December 2021 ending, between $200 million and $230 million, net of cash and receivables. Again I see these numbers as highly conservative.

According to Neal Dingmann when discussing CLR’s takeover/go-private, he stated the below:

“We would not be surprised if a process ultimately resulted in a sale given our forecast that the company is worth at least our $95/share price target,” Neal Dingmann, an analyst at Truist, wrote in a note to investors.

Based on anticipation of increased AXAS average daily production to by 5% barrels of oil equivalent to generate 2200 barrels daily and expectations. of higher oil pricing above the company’s PV-10 valuation, the company used 2021 average prices of $66.55/bbl of oil and $3.64/mcf of natural gas, any strategic buyer will be high motivated to acquire AXAS operations and assets. Cash flow can easily be in excess of $45 million annually even after exploration costs but before financing cost. Calculating higher equity investment requirements would give a valuation in an announced M&A for AXAS to be +$260 million.

Due to the capital restructuring, equity holders only receive 25% (this is for simplicity but adding in the tier 2 threshold does not meaningful change the per share valuation) of the process above $137 million threshold + accrued dividends from the preferred stock. We will call this amount $142 if a deal is done in the next 6 month or $146 million if a deal is done in the next year. With 8.43 million shares outstanding, a $200 million deal worst case scenario based on oil and gas pricing below its 2021 average and deal taking a full year, stockholders would receive $1.60 a share. A $260 million deal, I consider to be conservative base case scenario based where a deal is closed in less than six months and management grow daily production by a modest 5%, stockholders would receive $3.50 a share.

There are scenarios looking at a leveraged buyout even with high equity interest showing the stock per share value to be much much higher. What is important is to know that this stock is extremely cheap and considering all probabilities the downside is limited with normal position sizing.

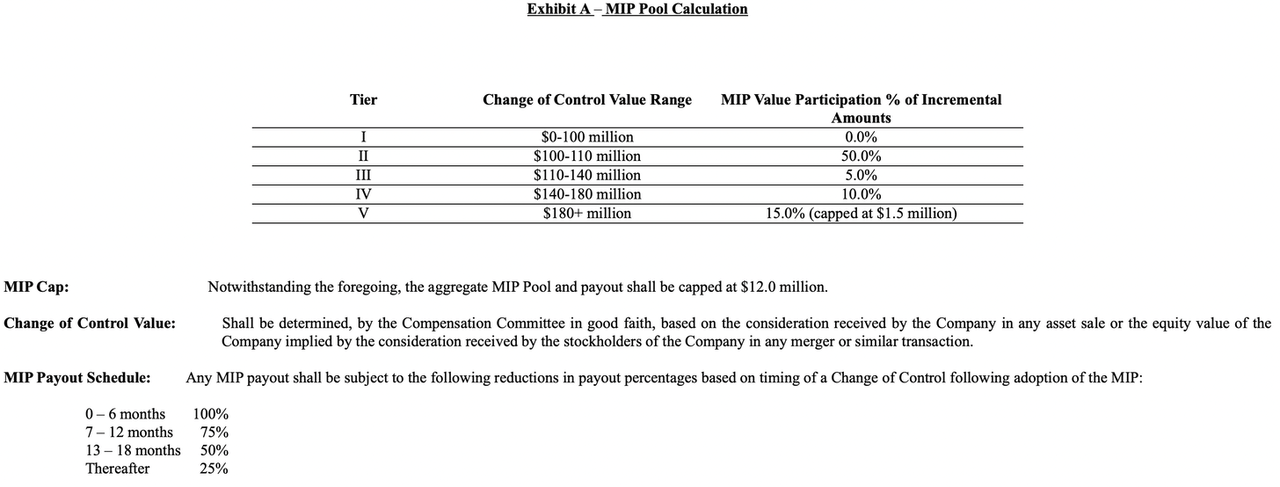

What is different because I have said we have been here before with management trying to do something in terms of potentially selling the company in previous years. On May 12, 2022, the new board of directors controlled by AG, the former creditor, has developed a new management incentive plan intent on incentivizing the current management and an Oaktree Capital board member in finding and consummating a deal resulting in a “change of control.” I believe it’s not a matter of “if” a deal is done. It’s a matter of “WHEN”.

Be the first to comment