JHVEPhoto

Introduction

As a dividend growth investor, I constantly seek additional opportunities to increase my dividend stream. Sometimes I look at companies that I already own and existing positions. On other occasions, I expand my portfolio further to gain exposure to other sectors and industries and take advantage of opportunities.

The volatile market has created some opportunities for investors, as shares are trading for significantly lower prices than they did just months ago. However, this article will focus on a company that has performed exceptionally well in 2022 in the healthcare sector, McKesson Corporation (NYSE:MCK). I have shares in McKesson and am considering adding to my position.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows McKesson Corporation provides healthcare services in the United States and internationally. It operates through four segments: U.S. Pharmaceutical, International, Medical-Surgical Solutions, and Prescription Technology Solutions. McKesson Corporation was founded in 1833 and is headquartered in Irving, Texas.

Fundamentals

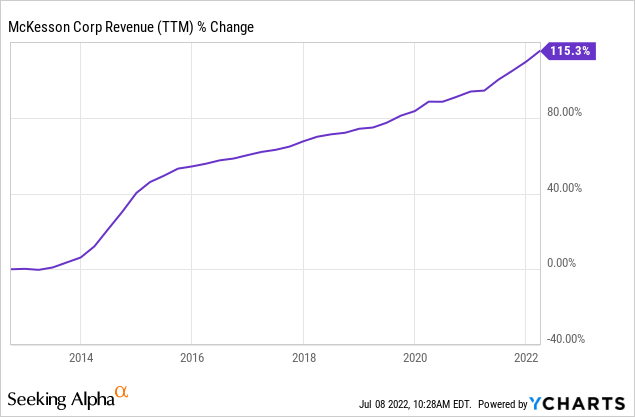

The revenues over the last decade have increased by 115%. The company more than doubled its sales as the volumes of medical supplies and drugs increased, and it developed additional services for clinics, hospitals, and doctors. The company combined M&A with organic growth to expand its portfolio of services and private labels. In the future, analysts’ consensus, as seen on Seeking Alpha, expects McKesson to keep growing sales at an annual rate of ~4% in the medium term.

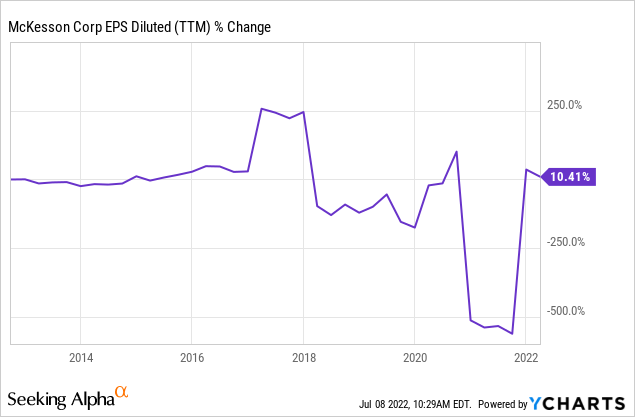

The company’s EPS (earnings per share) may be confusing. The graph below shows only 10% growth, which is highly disappointing. However, this is GAAP earnings, and McKesson, like many other healthcare firms, has many one-time expenses that do not affect the cash flow. In fact, during the last decade, free cash flow has increased by more than 130% and non-GAAP EPS by more than 300%. The growth is the result of higher sales together with aggressive buybacks. In the future, analysts’ consensus, as seen on Seeking Alpha, expects McKesson to keep growing EPS at an annual rate of ~7% in the medium term.

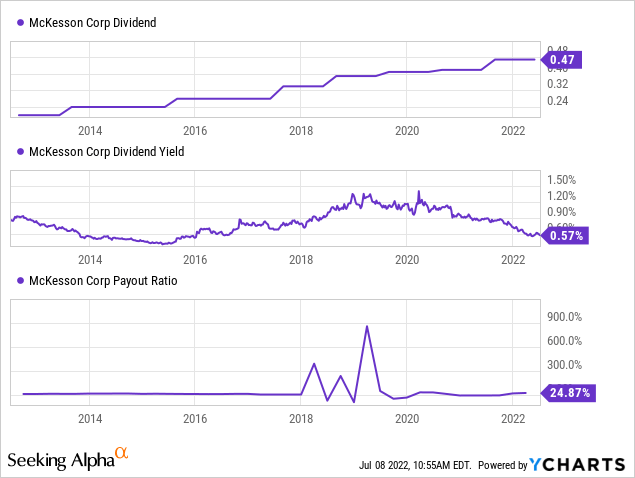

McKesson is a reliable dividend payer. Over the last nine years, the company has paid an increasing dividend. Before that, the company has not reduced its dividend payment for more than twenty years. The dividend yield is low at 0.6%, but that is due to the meager payout ratio. The company pays only 8% of its non-GAAP earnings and 25% of GAAP earnings in dividends. Investors can expect another high-single-digits dividend increase in the next payment.

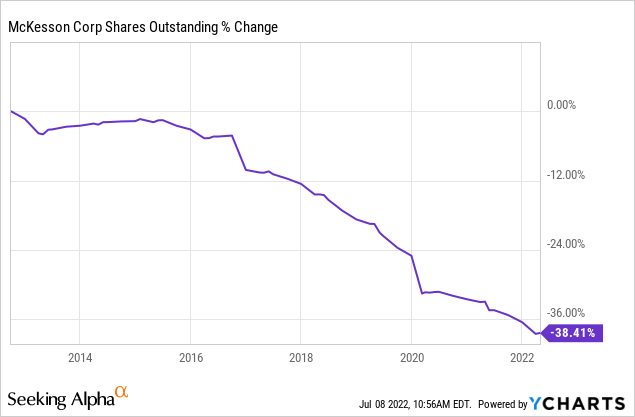

In addition to the dividends, McKesson is aggressively returning capital to shareholders through buybacks. When a company grows, buybacks are positive as they supplement the EPS growth and support a higher share price. Over the last decade, McKesson has repurchased almost 40% of its shares, significantly supporting its growth.

Valuation

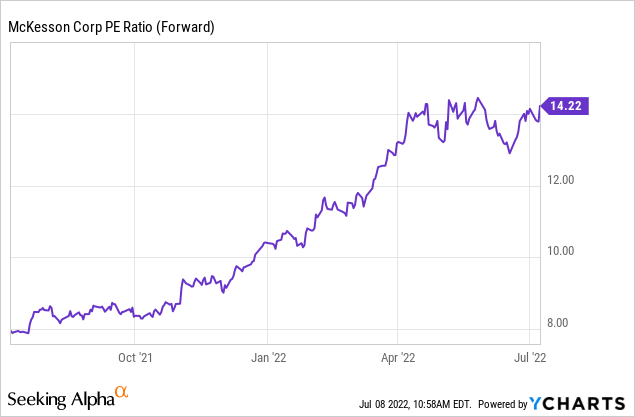

The shares of McKesson are trading for a P/E (price to earnings) ratio of 14.2 when considering the forecasted earnings for 2022. The chart below shows that the company has been trading for the highest valuation in the past twelve months. However, the shares are still reasonably valued, in my opinion. Paying 14 times for a company that enjoys healthy top and bottom-line growth is fair.

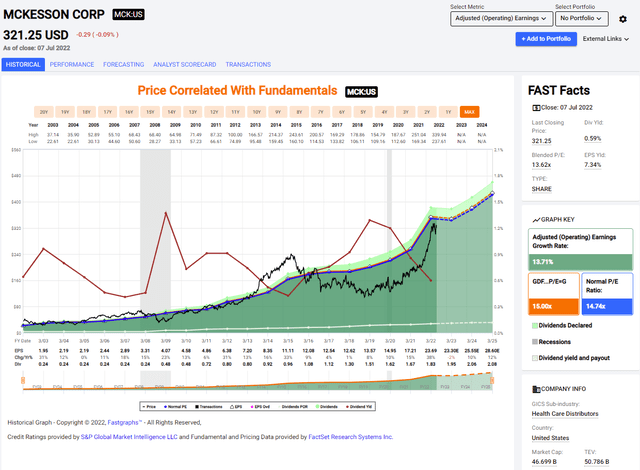

The graph below from Fastgraphs emphasizes that McKesson is still reasonably valued and somewhat attractively valued. The current P/E ratio is lower than the average P/E ratio we saw in the last two decades, which was closer to 15. The growth rate forecast for the medium term is close to the historical growth rate. Thus, McKesson is fairly valued with a little margin of safety.

McKesson is a fairly valued company with excellent fundamentals and execution. The company grows both the top and the bottom line, and they support dividend growth and aggressive buybacks. The management is focusing on returning capital to shareholders and investors. This package comes at a valuation that is lower than the average valuation in the past twenty years.

Opportunities

The first opportunity is the company’s extremely low debt. In the current business environment, low debt levels have two advantages. Firstly, the higher interest rates will have a more negligible effect on the company’s free cash flow. Secondly, the company will be able to take advantage of the lower valuation of startups and peers and acquire them for a more comfortable price, thus expanding its offering.

The opioid crisis is almost over for McKesson. McKesson, its peers, and pharmaceutical companies had to pay fines for their involvement in the opioid situation. McKesson has agreed with 48 of 49 eligible states and the District of Columbia. This significant burden was removed as the company put this dark chapter and the legal expenses behind it.

Another growth opportunity for McKesson is its Prescription Technology Solutions segment. This segment is growing at a double digits rate. Revenues are up 34%, and operating income is up 26%. McKesson is trying to expand its offering to added-value services to biopharma and life sciences clients to improve the margins of the distribution segment.

Risks

The first risk is the business model of drug distributors. The company must deliver sensitive products very efficiently and in a seamless way. It has to do so for an attractive price and to take advantage of the company’s scale. Therefore, the company must deal with razor-thin margins. The operating margins are 1%-2%, which means that the profitability is sensitive to market changes.

Inflation and competition are two main risks that McKesson is dealing with at the moment. Inflation is increasing the price of labor and energy, two primary ingredients in the logistics business. In addition, the company is competing with peers on clients. Therefore, the company may see higher expenses, and with its razor-thin margins, it may have to increase prices or suffer from shrinking profitability.

The covid-19 pandemic has boosted the sales and EPS of McKesson in the last two years. The world is finally managing to put the pandemic behind us. However, it also means that the increased volume associated with the pandemic will subside. McKesson may be a challenge this year, and the next one to replace that income. It is a short-term risk, as McKesson has significant growth routes.

Conclusions

McKesson is a great company. For almost two hundred years, the company has managed to create value for shareholders despite the changes in the world. The company offers strong fundamentals accompanied by great growth opportunities as the demand for healthcare is only increasing with time, and the logistics challenges will always surround transferring drugs.

The company deals with several risks, mainly in the short and medium-term, due to the changing business environment. While the share price has increased in 2022 against the market sentiment, the shares are still reasonably valued, and there is enough margin of safety. Investors should consider buying shares in the company gradually.

Be the first to comment