I S/iStock via Getty Images

On October 6, 2022, I wrote an article: It’s High Time To Build A High Quality And SWAN Like Investment Grade Bond Portfolio. On October 28, 2022, I wrote a follow up piece: My Gift To Retirees: Sharing My Recently Constructed $300K Investment Grade SWAN Portfolio. Although my initial timing was far from perfect, and as an aside I would argue market timing in the broader sense is a bit of a fool’s errand, more on that later in the piece, this is shaping up to be sound advice. As way of background, I spent five years, on the institutional buy side, as an analyst working within a team that managed $45 billion of investment grade fixed income assets. I worked directly with Senior Analysts and Portfolio Managers. And as I noted in the October 2022 pieces, until October 2022, I’ve done absolutely nothing when it came to allocating capital to bonds, as I viewed the then all in yields as unattractive.

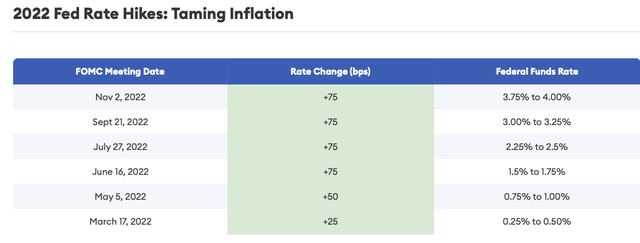

However, given the Fed’s arguably reactive and aggressive shift from uber dovish to uber hawkish, and as we find ourselves in one of the most aggressive Fed Funds Rate raising campaigns in its history (4 consecutive 75 bps hikes thus far), for the first time since 2008/ 2009, fixed income investors were able to construct a very high quality bond portfolio that yielded north of 5%. And, of course, the market is already pricing in at least another 50 bps increase, during its upcoming December 14, 2022 meeting.

Forbes (written by Taylor Tepper)

If you are blessed to have financial resources, at least in my simple mind, I would argue that 5% is the holy grail, when it comes to high quality and SWAN like income or yield.

If you are unfamiliar with my work, as you might be a retiree and a fixed income investor, therefore we might move in different circles, at least on Seeking Alpha, as I mostly write on small cap value stocks or special situation value stocks, I feel very strongly against retirees chasing yield. If I wasn’t so busy with my portfolio of equities (and all that that entails), I would spend a lot more time explaining and warning retirees not to chase yield.

The Elephant In the Room – The 10YR U.S. Treasury Yield

If you own financial assets that are very high quality such as investment grade bonds (and I’m talking bonds that have some duration, not two year bonds) or super high quality Blue Chip stocks, that pay steady and reliable dividends (so bond proxies), in the shorter term, the biggest driver of change in the value of the underlying securities tends to be major moves in interest rates. And just to clarify, when I’m talking about Blue Chips, I’m referring to companies such as Procter & Gamble (PG), Johnson & Johnson (JNJ), Kimberly-Clark (KMB), PepsiCo (PEP), or say Coca-Cola (KO). These are fantastic businesses and dividend stocks that tend to trade as bond proxies. That said, when it comes to Blue Chip stocks, during a bear market, especially like the present one, more often than not, these Blue Chip stocks tend to trade like gold, as they are viewed as safe havens due to their big moats and ability absorb inflation on the cost side and pass on inflation in the form of price increases, such that they maintain their operating margin integrity.

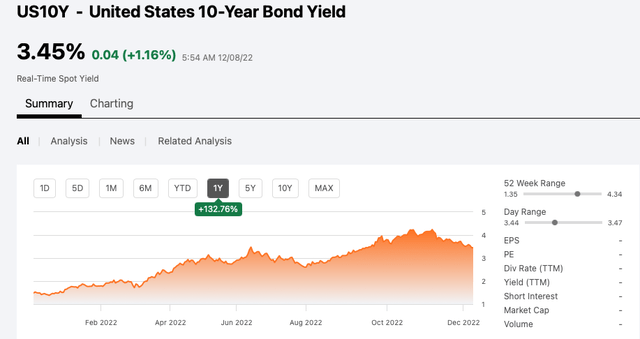

So when it comes to a portfolio designed for yield, in the short term, the biggest driver of the underlying change in the value of that portfolio is the 10YR U.S. Treasury and how the U.S. Treasury yield curve is positioned (TLT).

On January 1, 2022, the yield on the 10YR U.S. Treasury was only 1.51%. When I put to work 5/6th of the capital to build the $300K SWAN bond portfolio, the capital was deployed on morning of October 5, 2022. On that morning, the yield on the 10YR U.S. Treasury was about 3.77%. On October 21st, when the 10YR was near its peak, I put to work the remaining 1/6 of my available capital, in additional bonds, to round out the portfolio and add incrementally higher absolute yields.

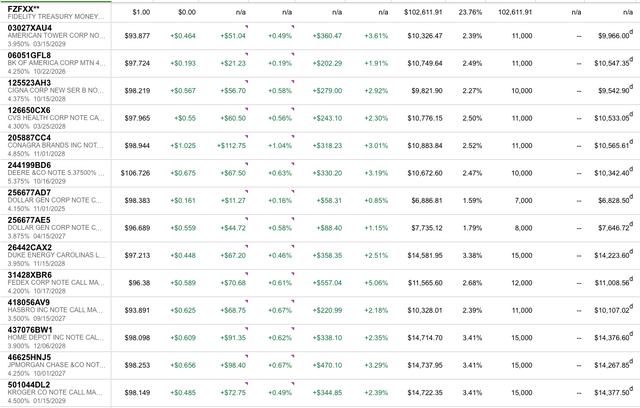

For example, note how the 4.20% 10/18/2028 FedEx Corp. (FDX) bond has increased by 5% in value. This is purely a function of when the capital was put to work in relation to the 10YR Treasury. As the underlying credit quality, and credit spread in relation to treasuries, which is based on the market’s perception of the credit risk, hasn’t materially changed in any way shape or form.

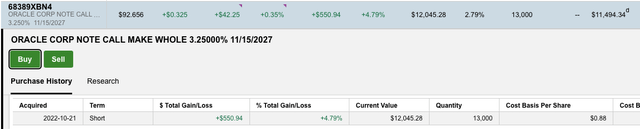

Or perhaps look at how the 3.25% 11/15/2027 Oracle Corp. (ORCL) bond has had a similar increase, of nearly 5%. Again, nothing has changed, from a credit quality perspective at Oracle. The movement in the bond price is largely a function of interest rates declining materially since October 21, 2022.

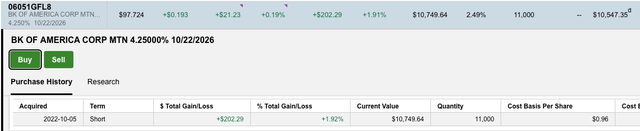

Whereas the 4.25% 10/22/2026 Bank of America (BAC) bond has only increased by 1.9% in value. This capital was put to work, on October 5, 2021, when the 10YR was yielding about 3.77%. Granted, the maturity date of this particular BofA bond is one year shorter.

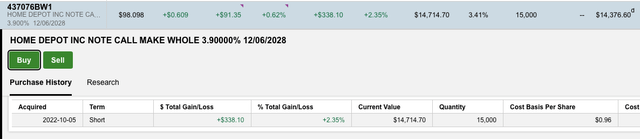

Or whereas the 3.90% 12/6/2028 Home Depot (HD) bond has only increased by 2.3% in value. Again, in the short term, the direction of interest rates are the main driver of short term price movements, of the bonds.

As this bond portfolio is super high quality, the underlying credit spreads, shouldn’t have changed all that much. Therefore, the biggest driver of short term volatility, in the underlying prices, is the direction of interest rates.

As it turns out, on October 5, 2022, putting money to work in bonds, was attractive, relative to the start of the year, as the 10YR was yielding 3.77% and not 1.51%. However, the 10YR yield peaked on October 20, 2022, at 4.33%. So from a market timing perspective, I looked really silly, for a two week stretch, as I proudly shared with SA readers that I just put to work $250K in bonds. Again, this was 5/6th of the would be available and allocatable capital, and rates moved against me by 55 Bps (the difference between 3.77% and 4.33%), at least out of the starting gate.

However, despite all of the mental gymnastics, to be crystal clear, this is purely a buy and hold with the expectation of holding the bonds to maturity. As I’m managing this portfolio on behalf of my parents, I have zero interest in trying to trade bonds as you are paying a small commission to buy or sell ($1 per bond at Fidelity), there is a bid/ask spread that can be $0.25 to $0.50 per bond, and you would have to pay taxes on the gains. The only reason the timing of when you put this capital to work matters is that you want to try and maximize the all in yields, such that you’re earning attract returns on capital.

Stop Trying To Time Markets (The Stock Market or Bond Market)

Within the commentary threads, of the prior two bond pieces, I was rather surprised to have only received mixed reviews. There were definitely some very positive and appreciative retirees that were thrilled to see a real and diversified portfolio of high quality of five to seven year investment grade bonds (inclusive of cusips). However, quite surprisingly, there was a fair amount of debate and concern suggesting that the 10YR yields would go materially higher (think 5%+, so think market timing) or commentary that 5% is an unattractive yield. As for the latter point, we can agree to disagree, as I think 5% is a fantastic yield for really high quality and really safe yield. As for the former point, I’ve learned through obsessively following markets, both on the buy side, and managing family accounts, for the better part of twenty years, that it’s a bit of a fool’s errand to pretend we can perfectly time markets.

To be crystal clear here, I’m talking about trying to time the broader stock market or trying to time the bond market (the absolute top or bottom of yields). Of course, I believe there is considerable alpha out there for people that can pick stocks and understand businesses and valuations. If I didn’t believe that then I wouldn’t be doing this as a career.

In terms of the concept of market timing, one of my favorite topics, there is quite a bit of good literature that more or less empirically proves that over the course of an investor’s lifetime, market timing is not the best course of action for the vast majority of people. That said, of course, there are always exceptions and people who somehow are the small percentage that seem to magically and perfectly high or low tick major market movements.

Incidentally, Pippa Stevens’ took on this very topic, and she wrote a good article highlighting Bank of America’s research going back and looking at empirical data since the 1930s.

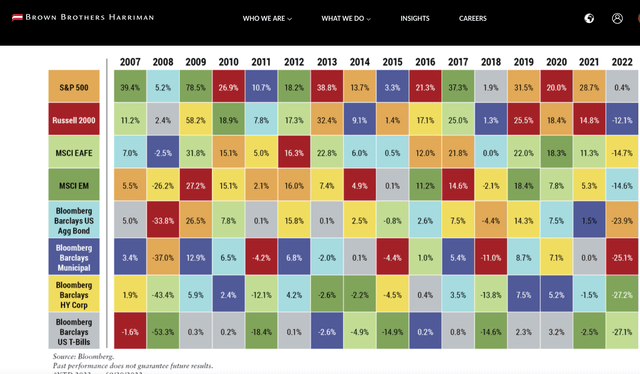

Here is a great chart within a very good article written by Brown Brothers Harriman’s Chief Investment Officer, Justin Reed (The Case Against Market Timing).

I could probably provide another dozen (or more) well written and thoughtful pieces, pieces that reference empirical data, to simply remind readers that market timing is at best very difficult and at worst tends to leads to worse returns.

How The Portfolio Has Performed

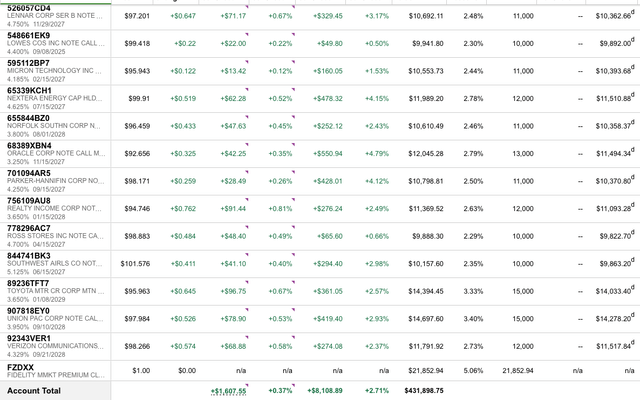

In case you are wondering, enclosed below is a snapshot of the portfolio. So far so good, despite stumbling out of the gate, during the first two weeks.

How I Selected The Portfolio

Incidentally, since writing the two bond articles, I’ve had some people, maybe a half a dozen or so, reach out to me to ask about how I selected the underlying companies and if I would consider spending a little more time explaining my thought process on the underlying bond selection. To that end, I will spend a few paragraphs discussing my thought process.

When it comes to investment grade bonds, setting aside duration, I would argue that money to put to work in this corner of the market is largely designed for income. If people want to bet on interest rates, then they would buy or short the long bond. So, again, the vast majority of investors fishing these waters, are looking for the safety and high quality underlying cash flow streams (from the bond income, I’m not referring to the cash flow of the underlying businesses per se, at the moment). Not to mention, most SWAN investors aren’t particularly looking for much volatility. In other words, if this is actually SWAN money, then I would much rather lock in a blended 5% portfolio yield vs. reaching for yield and even consider attempting to create a bond portfolio with a blended portfolio yield of 7%. The reason is that when it comes to bonds, at least investment grade bonds, I only want own bonds that are money good. Secondly, unless the 10YR Treasury got over 5%, it would be almost impossible to create a diversified and high quality portfolio of investment grades. High quality companies tend to trade at tight credit spreads of 75 Bps to no more than 150 Bps over treasuries, depending on the duration. There just aren’t enough BBB- or Baa3 bonds, in existence and readily available for purchase, such that you could even construct a diversified 7% yielding IG portfolio. Moreover, I definitely don’t want to mess around with questionable financial companies, such a Credit Suisse (CS) or other opaque and leveraged financial services businesses that are yielding 7%. Frankly, I would have a heck of a time explaining to my parents, sorry, we lost 50% of our principal on a few bonds, as I was reaching for yield. In a worst case scenario, on a portfolio containing 25 bonds, only one or two wipe outs could threaten the overall return and performance of the portfolio. The extra carry, in 200 Bps of more yield, simply isn’t worth it to me, as this is SWAN money. If I wanted to take equity risk, and I do that all the time, that is a different pool of capital.

As for the underlying companies, I intentionally want the companies to be super high quality. So I expressly weighted the best companies such as Toyota Motor (TM), Home Depot (HD), Union Pacific (UNP), Duke Energy (DUK), and Kroger (KR) the highest. These are all massive companies, measured in market capitalization, which provides an extra level of downside cushioning. As a bond holder, we sit higher up in the capital structure, and are much higher in the pecking order when it comes to operating cash flows, yet it is always nice to have $100 billion + in market capitalization as an added line of defense.

Secondly, I expressly weighted the lesser quality companies lower. Now don’t get me wrong, Ross Stores (ROST), Conagra Brands (CAG), Southwest Airlines (LUV) and Dollar General (DG) are all fine companies. However, of course, a Home Depot or Duke Energy is higher quality from a safety perspective. That said, we’re talking about degrees of safety, meaning the nuance between extremely safe to say just plain safe.

Lastly, in the middle of the portfolio, in order to achieve moderately higher yields, I blended in some high quality companies, with dominate market positions in their respective industries. These include Lennar Corp. (LEN), Micron Technology (MU), and American Tower Corp. (AMT), for example.

Also, in terms of added nuance, for perspective I don’t have to worry much about the difference in the yield to worst (or yield to maturity). As 26 out of the 27 bonds, contained in this portfolio, were bought at a discount to par. Therefore, I don’t have to worry about higher coupon bonds, getting called away early, at par or at $101.

Putting It All Together

This was the third and perhaps final installment in the very short mini series on bonds. The vast majority of my time is spent thinking about small cap value and special situation equities. However, and the reason why I alerted this observation to readers, was there an attractive window to put money to work in really high quality and SWAN IG bonds. Going forward, as rates have come down nicely, it might be better to wait to see if there is another uptick in yields, on the 10YR, if there is perhaps a retest of the 3.75% region. If that happens, and readers were slow on the draw, back in late October 2022, then I would argue it is better to put the money to work and build that IG bond portfolio. As we briefly discussed, market timing is really hard, and it is better to lock in attract yields than risk the window closing. After all, market timing, whether stocks or interest rates is actually really difficult.

Be the first to comment