William_Potter

Investment Thesis

The explosive growth at Netflix (NASDAQ:NFLX) seems to be over, yet it is still traded as a growth stock on the markets. I believe we will see lower P/E valuations in the next few years as the stock slowly reverses to a value stock. This article is mainly about three risks that could come to the company in the next year but first, a bit more about the valuation.

Valuation

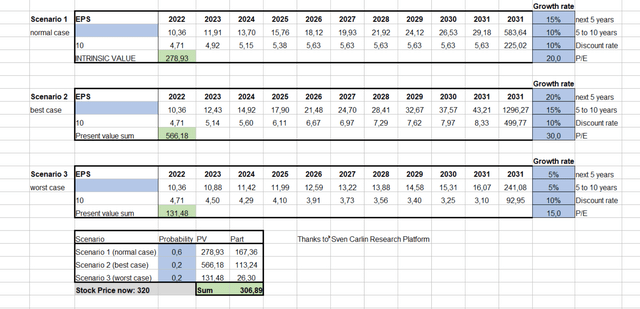

Using a discount cash flow model, I have created three distinct scenarios to establish the current fair value. The most probable course is referred to as the normal scenario. Of course, growth figures are roughly estimated; the calculation cannot be exact. Still, I find this approach useful, as it allows us to approximate a fair value. In other words, it could be seen if a share was enormously overvalued or undervalued. According to this estimate, the share is trading slightly above its fair value ($306 vs. $320 stock price).

Author

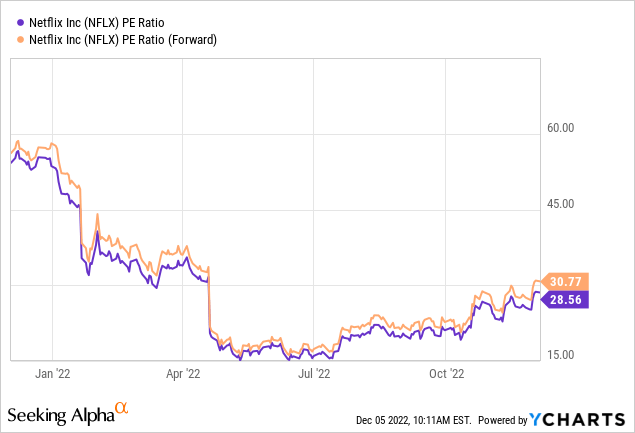

Another valuation option is the PEG ratio (= P/E ratio/growth rate). According to Peter Lynch, a fairly valued company’s PEG ratio should be 1. When a company’s PEG exceeds 1, it is considered overvalued, while a stock with a PEG of less than 1 is considered undervalued. According to analyst estimates, Netflix has a P/E of 31, negative growth this year, and only about 3% growth next year. This puts the PEG ratio at 10, which is exceptionally high. Typically, the PEG ratio is used for growth stocks, but many shareholders think that Netflix is still a growth stock. We may have to abandon this idea and recognize that the growth in the future will be more in line with that of a value stock. In this case, a P/E ratio of 30 would be significantly too high, especially since there is no dividend.

For shareholders, this means that nothing has been gained if the P/E ratio is still 30 at the end of 2023. For shareholders to make a profit next year, the P/E ratio would have to be even higher, which could happen but seems unlikely given the slow growth and more competition.

Recent results & financials

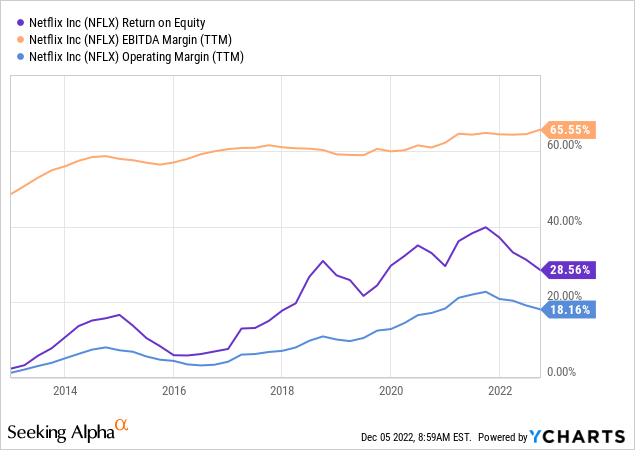

The company reported acceptable sales growth of 5.9% compared to last year. The revenues amount to $7.92B. However, the net profit is 3.6% less. The bottom line is a profit of $1.39B. The result is mainly due to the higher cost of sales, which increased by 13.8% compared to the third quarter of 2021. This significantly beat forecasts of $2.17 EPS but came in at $3.10.

The company is lowering its expectations for Q4. Sales are expected to decline by about 1.9%, and the operating margin could also see a noticeable drop. From a multi-year perspective, margins are steadily improving, but this is my transition to the risks in 2023.

1. Risk: Less and less revenue in USD

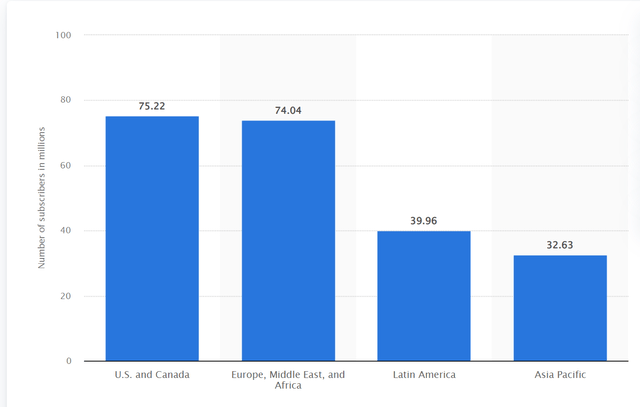

This year’s declining margin has a lot to do with a strong U.S. dollar. Netflix makes less than half of its revenue in the U.S. and is, therefore, more affected by currency fluctuations than many other companies. In percentage terms, subscriber growth in Europe and Asia has been stronger than in the U.S. in recent years. Given that the US market is quite saturated, future growth will have to come from elsewhere, which will probably reduce the proportion of the dollar even further.

Of course, this trend can also be reversed. However, Europe is essential for Netflix, and given the problems in Europe and the interest rate policy of the European Central Bank, it is likely that the Euro could remain at a reasonably low level for a long time. Due to the energy crisis, for which no solution seems to be in sight, Europe will be permanently weakened, and industry will migrate to the US. As a German, I have spent the whole summer intensively dealing with all the issues and am now a sad pessimist about Europe.

2. Risk: Consumers save money

Many people live from paycheck to paycheck and have hardly been able to save money in the past. This year’s inflation is exacerbating this problem and forcing more and more people to save on non-essentials. Netflix is more expensive than most of its competitors (ad-free version). A subscription doesn’t cost much, but when you’re already stretched to the limit, every dollar counts, and apparently, some people are even considering canceling their subscriptions.

A survey from Reviews.org, which featured 1000 Americans, found that as many as 1 in 4 US subscribers may quit the service in the next year.

The reasons are rising subscription costs for 40%, inflation for 20%, a lack of content for 22%, and spending more time with other services for 18%. That would be devastating for Netflix because the American market generates the most revenue per user. We know what has happened to the stock in the past when user numbers fall unexpectedly.

And that’s just the US market. As mentioned in the first point, Europe is also enormously important for Netflix and has grown strongly in recent years. But here, too, people with low incomes have problems financing their living costs. Electricity and heating costs have doubled for many people this year, and no one knows precisely how things will continue in the future. Europeans are more cautious about consumer spending, and Germans and northern Europeans tend to be more careful and save money in uncertain times. According to the Guardian, more than 900,000 homes have canceled their subscription this year (referring not only to Netflix but streaming services in general).

These are the subscriptions by region in 2021.

Statista.com

3. Risk: Netflix begins to prioritize short-term profits over long-term growth

Netflix has a section in its investor relations called Top Investor Questions; there, I found the following:

Question: Are you focused on membership or revenue maximization? Answer: We care about membership growth, but primarily focus on revenue maximization. As we work to monetize sharing, growth in average revenue per membership, revenue and viewing will become more important indicators of our success than membership growth. We seek to grow revenue because it allows us to invest in more and better content and to improve our service and deliver profits for our shareholders.

The upside is that they are finally addressing the unauthorized sharing of accounts, which should lead to a plus in subscriber numbers. Also, with other services like Spotify, we see something similar, family accounts are created between friends, decreasing the average revenue per user for Spotify. On Netflix something similar is happening.

Earlier in the year, they had already laid off 4% of their employees to cut costs. This spring, when subscriber numbers unexpectedly fell, it was also announced that budgets for productions would be reduced.

“We’re pulling back on some of our spend growth across both content and non-content spend,” Netflix’s Chief Financial Officer Spencer Neumann said in a pre-recorded interview on Tuesday. “We’re trying to be smart about it and prudent in terms of pulling back on some of that spend growth to reflect the realities of the revenue growth of the business”.

It is certainly a good thing to try to save money. Of course, there is still the danger that the quality or quantity of the own shows will suffer. We are in a phase where Netflix is no longer the only player in the streaming market, and trying to cut costs in this phase, even though they are now cash flow positive, seems like a risky strategy. The answer given in the first quote above could also indicate further price increases, not necessarily in North America but in other parts of the world, depending on where they see room for it. Sure it could be argued otherwise, but I don’t think that would be a good move.

Conclusion

I wanted to mention these three risks; of course, there are more. Growing competition is obvious, so I didn’t mention that. I don’t think the company deserves a P/E valuation of 30. In July this year, there was a window where the valuation was historically cheap. That was probably a good long-term buying opportunity, but those who missed that will find better options with lower risks in the current market.

Be the first to comment