Jose Luis Gallego Aviles/iStock via Getty Images

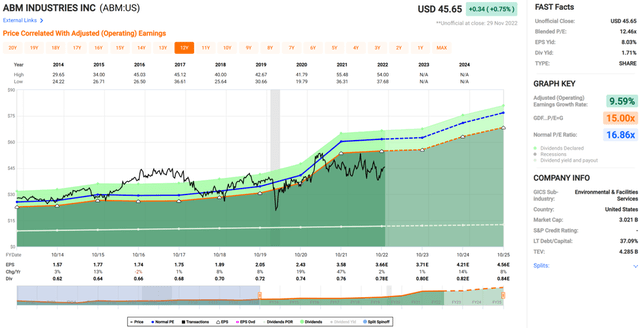

It’s been a while since I last visited ABM Industries (NYSE:ABM), an under the radar dividend king that has a 50+ year track record of consecutive annual raises. ABM’s stock hasn’t really done much of anything over the past 12 months, declining by just 1.6%. This is, however, far better than the 15% decline in the S&P 500 (SPY) over the same timeframe.

A stagnating share price is not necessarily bad, as it gives investors the opportunity to layer into a stock over time. This article highlights why ABM deserves a hard look at its current price for value investors, so let’s get started.

Why ABM?

ABM Industries is a leading provider of facilities solutions to businesses and institutions around the world. Its services include janitorial, electrical & lighting, facilities engineering, HVAC, and parking, to name a few. ABM employs over 100K people, serving everything from businesses, to school, hospitals, factories, and airports, and generated $7.5 billion in total revenue over trailing 12 months. Notably, this sits $1 billion above where it was prior to the pandemic at the end of its fiscal year 2019.

Meanwhile, ABM’s stagnating share price belies strong underlying fundamentals, with revenue growing by an impressive 27% YoY and 7.4% organic growth in the third quarter. This contributed to record adjusted EBITDA of $126 million, up 11% over the prior year period. This was supported by new client wins and a robust consumer summer travel season, which benefited ABM’s vast parking and transportation offerings across airports. Moreover, business travel is also improving, although at a more measured pace.

Potential headwinds for ABM include a decline in higher margin disinfection cleaning services, as concerns around COVID are generally easing. Moreover, while office occupancy rates are improving, many workers have become accustomed to working from home over the past two and half years, and a full return to office may not be realistic at least in the near term. Additionally, labor shortages continue to affect certain parts of the company, namely in Education and Aviation.

However, I see current headwinds as being overshadowed by positives, as ABM’s manufacturing and distribution segment continues to be solid, especially as e-commerce continues to grow at a robust pace. This is reflected by online Black Friday and Cyber Monday sales hitting records of $9 billion and $11.3 billion this month.

Moreover, this post-Thanksgiving Sunday was the busiest day for U.S. airports since before the pandemic, boding well for ABM’s Q4 results. Technical solutions is also a bright spot, as management expects continued strong demand with the support of the passed Infrastructure Bill, as noted during the recent conference call:

In Technical Solutions, we continued to experience robust demand for our e-mobility charging solutions, where revenue tripled over the prior year period. We expect Technical Solutions to have strong growth again in 2023, aided by the U.S. infrastructure bill and the recent passage of the Inflation Reduction Act, which allocates an incremental $7 billion for electric vehicles, EV infrastructure and other energy efficiency investment activities. We also expect a number of bundled energy solution projects to commence in the fourth quarter. On top of that, our new microgrid business is poised for strong growth. In all, Technical Solutions is very well positioned to benefit from long-term secular trends.

Lastly, ABM carries a strong balance sheet, with a long-term debt to capital ratio of 37%. While ABM’s 1.7% dividend yield isn’t particularly high, it does come with a very safe 21% payout ratio and over 50 years of dividend increases.

Turning to valuation, I find ABM to be attractively priced at $45.65 with a forward PE of 12.4, sitting well below its normal PE of 16.9 over the past decade. While analyst estimate relatively flat EPS growth next year due to the aforementioned headwinds, earnings is expected to resume meaningful 10 – 12% annual growth starting in 2024.

As such, I view now as being a good opportunity to layer in the stock while the market isn’t paying much attention to the stock. Analysts have a consensus Strong Buy rating on the stock with an average price target of $58, equating to potentially strong total returns.

Investor Takeaway

In conclusion, I believe ABM is an attractive investment proposition due to its strong fundamentals and attractive valuation. The company has a solid balance sheet, and with the recent passage of the U.S. Infrastructure Bill, it should be well positioned to benefit from long-term secular trends in the Technical Solutions space. As such, I view now as a good opportunity to layer in the stock while the market is seemingly over-rotated on near term headwinds.

Be the first to comment