Hispanolistic/E+ via Getty Images

The less you know about business, the more likely I think you are to envision a business as something that services consumers. But at the end of the day, the more you grow as an investor, the more you come across companies that are dedicated to providing goods and services to other companies. A great example of this can be seen by looking at a firm like ABM Industries (NYSE:ABM). According to management, this enterprise provides janitorial, facilities engineering, and parking services for its clients. Clients include those spread across the aviation space, education, data centers, healthcare facilities, entertainment venues, and more. Recently, financial performance achieved by the company has been mixed but largely positive. This, combined with the fact that shares of the business look fundamentally attractive, is why the stock of the enterprise has outperformed the broader market in recent months. Absent that picture changing for the worse, I actually believe this trend is likely to continue. And because of that, I have no problem keeping the ‘buy’ rating I had on the stock previously.

Attractive growth

Back in early August of this year, I wrote an article that took a bullish stance on ABM Industries. In that article, I talked about how well the company had done over the prior few years. I have found myself particularly impressed by how well fundamental performance held up during the COVID-19 pandemic. In addition to that, the firm was staging a robust recovery from the pandemic years and shares were trading at levels that looked fundamentally attractive. All combined, this led me to rate the business a ‘buy’ to reflect my opinion that the stock should outperform the broader market for the foreseeable future. So far, that call has played out well. While the S&P 500 is down 1.5%, shares of ABM Industries have generated a return for investors of 5.2%.

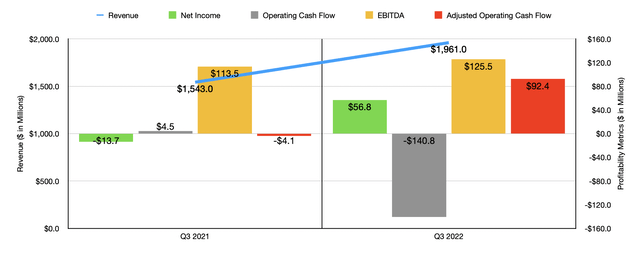

To understand exactly why this return disparity exists, I would urge you to look at the most recent data provided by management. When I last wrote about the company, we only had data covering through the second quarter of the company’s 2022 fiscal year. Fast forward to today, and we now have data through the third quarter. During that time, revenue came in strong at $1.96 billion. That’s 27.1% higher than the $1.54 billion the company generated the same time last year. Unfortunately, organic growth was only 7.1%. Most of the growth, accounting for the rest of the increase, came as a result of acquisition activities. The most notable acquisition involved Able, which contributed $286.9 million to the company’s year-over-year increase in the third quarter.

With the rise in revenue, the company also saw profits improve noticeably. Net income went from a negative $13.7 million to a positive $56.8 million. This was largely driven by a few different factors. For instance, the company did not have any legal costs or settlements attributed to the legal reserve for its Bucio case in the third quarter of this year compared to the costs that it did have in the third quarter of last year. The increase in the volume in the company’s business because of its acquisition and because of organic growth also proved instrumental. And finally, the company experienced the absence of a non-cash impairment charge for work regarding its enterprise resource planning system implementation. This is not to say that everything was great. Talent acquisition costs rose, as did certain expenses related to the aforementioned acquisition. The company also suffered from a decrease in favorable self-insurance adjustments on a year-over-year basis. Not every profitability metric for the company improved though. Operating cash flow went from negative $4.5 million to negative $140.8 million. But if we adjust for changes in working capital, the metric would have gone from a negative $4.1 million to a positive $92.4 million. Over that same window of time, we saw a very modest increase in EBITDA, with the metric climbing from $113.5 million to $125.5 million.

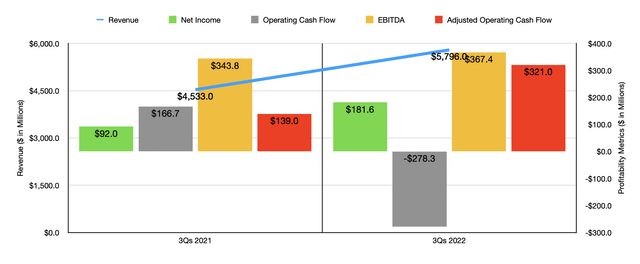

If you recall my prior article on the firm, you would likely remember that the company has had an all-around positive year so far. The results from the third quarter were instrumental in furthering this. As a result, revenue for the first nine months of the company’s 2022 fiscal year came in at $5.80 billion. That’s 27.9% higher than the $4.53 billion generated the same time last year. Most profitability metrics for the company also improved. Net income, as an example, roughly doubled from $92 million to $181.6 million. Once again, operating cash flow has worsened, dropping from $166.7 million to negative $278.3 million. But if we adjust for changes in working capital, it would have risen from $139 million to $321 million. Meanwhile, EBITDA I also managed to improve slightly, growing from $343.8 million to $367.4 million.

When it comes to the future, the picture for the company is a bit odd. For starters, there is some uncertainty regarding its latest acquisition of a company called RavenVolt that was just completed. The firm paid $170 million in cash for the business and expects annual EBITDA of between $17 million and $19 million from the enterprise. On the other hand though, there is the opportunity for the sellers of the firm to get up to another $280 million over the next few years. But to get there, they would need to see cumulative EBITDA from 2023 through 2025 of at least $150 million. As for 2022 as a whole, management does now expect earnings per share of between $3.20 and $3.30. This compares to the prior expected range of between $2.91 and $3.11. On an adjusted basis, earnings per share should be closer to $3.60 to $3.70.

Generally speaking, I am cautious to use adjusted earnings when valuing a company. But it all depends on what adjustments are being made. The ones involved in this particular scenario center around acquisition activities and restructuring initiatives. These are truly one-time in nature. Based on this, the company should generate adjusted net income of around $241.5 million. Using the company’s other historical data, I estimated adjusted operating cash flow of $473.4 million and EBITDA of $486.2 million for the current fiscal year.

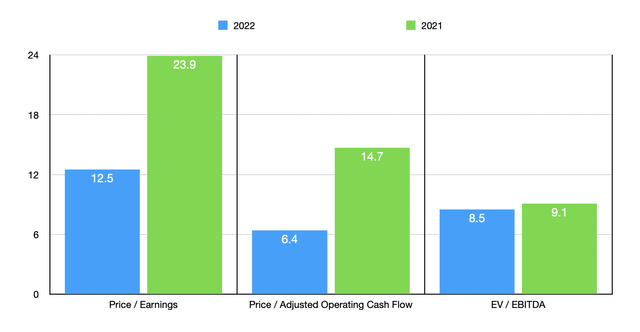

Based on these figures, the company is trading at a forward price-to-earnings multiple of 12.5. The forward price to adjusted operating cash flow multiple is considerably lower at 6.4, while the EV to EBITDA multiple should be near the middle at 8.5. As you can see in the chart above, all of these are cheaper than if we were to use the data from the 2021 fiscal year. Also as part of my analysis, I compared the business to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 16.6 to a high of 145.2. And when it comes to the EV to EBITDA approach, the range should be between 8.7 and 36.2. In both cases, ABM Industries was the cheapest of the group. And finally, using the price to operating cash flow approach, the range was from 6.1 to 39.9. In this case, only one of the five companies was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| ABM Industries | 12.5 | 6.4 | 8.5 |

| Casella Waste Systems (CWST) | 80.2 | 21.4 | 22.4 |

| Clean Harbors (CLH) | 16.6 | 11.8 | 8.7 |

| Stericycle (SRCL) | 145.2 | 34.7 | 27.4 |

| Montrose Environmental Group (MEG) | N/A | 39.9 | 36.2 |

| BrightView Holdings (BV) | 39.7 | 6.1 | 8.7 |

Takeaway

By means of acquisition activities and organic growth, ABM Industries is doing quite well for itself. Growth continues and shares are priced at levels that I would consider to be fundamentally appealing. Of course, if the economy does weaken, it could prove painful for the business. But given how cheap shares are today, it’s difficult to imagine the situation deteriorating to the point that the stock looks overvalued. Due to this favorable risk-to-reward trade-off, I do still believe the company warrants a solid ‘buy’ rating despite rising nicely in the months leading up to this.

Be the first to comment