Nuthawut Somsuk

Thesis

Aberdeen Income Credit Strategies Fund (NYSE:ACP) is a closed end fund investing in high yield debt from North America, UK and Europe. The fund’s primary objective is current income. Credit risky “CCC” and “B” credits account for over 90% of the portfolio in this fund. Given effective all-in yields for “CCC” bonds now are north of 15%, the fund is able to pay high, true dividend yields. Add to that the significant leverage the CEF is running (46% currently) and you will get the picture of a very credit risky fund, but one that is able to pass to investors a true yield, based on underlying assets’ cash-flows.

Effective yields in the junk bond space are very high now due to the Fed’s aggressive monetary tightening policy. We have not seen rates this high for almost a decade (with 2-year Treasuries about to breach 4%) which coupled with high credit spreads result in today’s favorable environment for dividend yields. New issuance in the space is now forced to offer very attractive yields, yet it does not always price due to the current market risk-off sentiment, as we have seen with Tellurian, an LNG darling.

ACP is a high risk, high reward vehicle. The CEF offers a very high true cash-flow yield, but this yield comes along with volatility. We do not believe the current recession is going to see an outsized increase in default rates, hence we are of the opinion that long credit risk positions offer attractive risk/reward profiles. The downside to going long ACP is the on-boarding of substantial volatility. A retail investor needs to have an investment horizon of at least two years if buying ACP now, and be able to stomach -10% to -15% drawdowns in the name in the short term. Can credit spreads go wider? Absolutely. Can the fund’s premium to NAV compress in a risk-off environment? You bet. Will ACP provide an investor with a 30% net return in two years if the fund is held as a buy and hold? Yes, we are strongly in that camp.

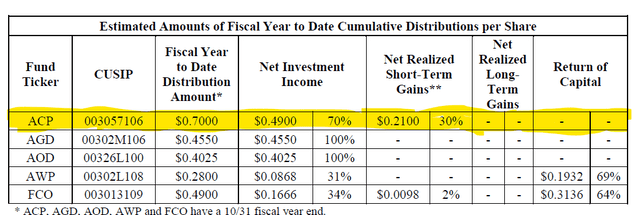

ACP is currently not using any ROC from the available data we have, and that marries up nicely with the very high all-in yields currently available in the market. Investors have realized the value inherent in this high true yield and have bid-up the CEF to a 10% premium to NAV. Expect this vector to fluctuate and go back to flat to NAV during a risk-off bout. ACP is a high risk / high reward play and is to be bought only with a long time horizon in mind and with the ability to withstand significant bouts of volatility.

State of the High Yield Market

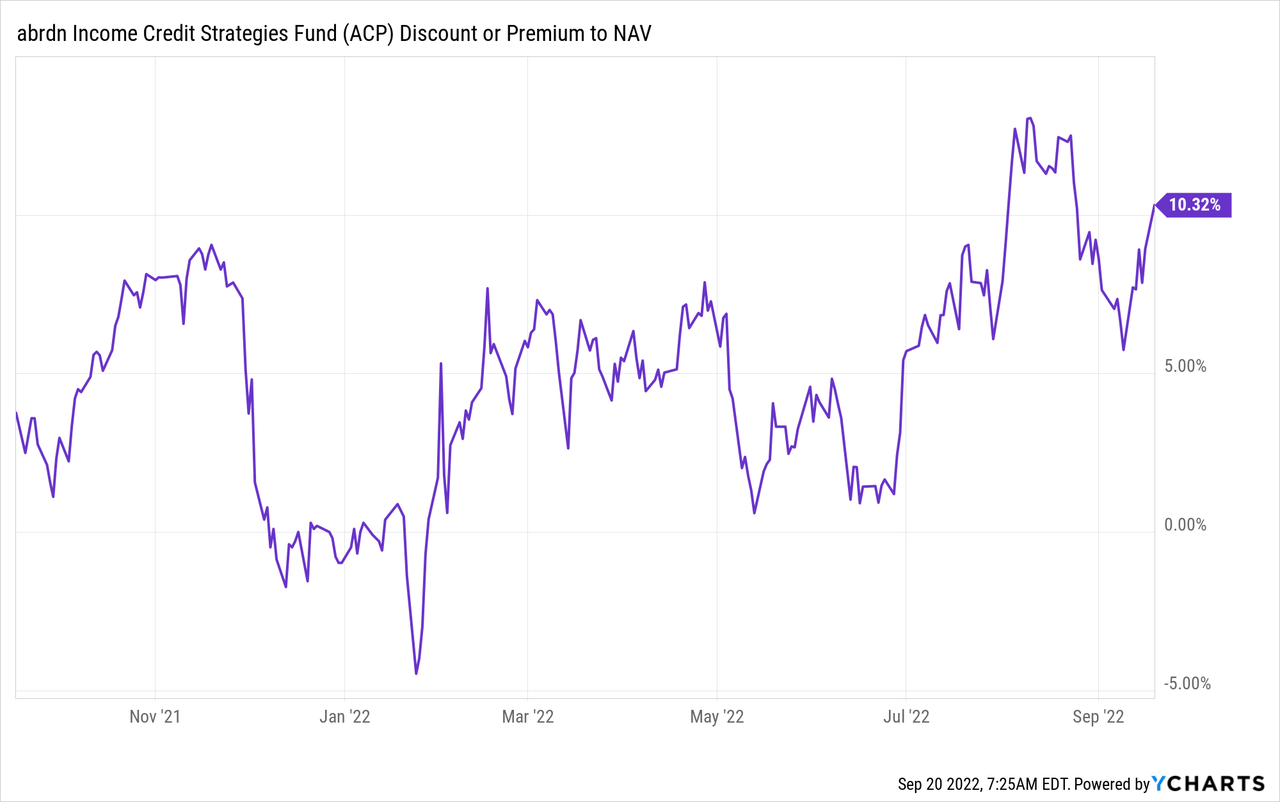

Due to the rise in risk free rates all-in CCC yields have spiked above 15%:

This figure shows an investor what a fund can get from buying CCC credits in the secondary market. When ACP has spare cash and goes to the secondary, it can pick up credits at annualized yields exceeding 15%. We have not re-tested the COVID highs, but we are quite close to that.

We believe current all-in yields are attractive because credit spreads have not widened as much:

The above graph tells us that the Fed is responsible for most of the high all-in yield, rather than the overall riskiness (i.e. probability of default) in the high yield market. This is very constructive for investors because it represents an attractive risk/reward profile.

Holdings

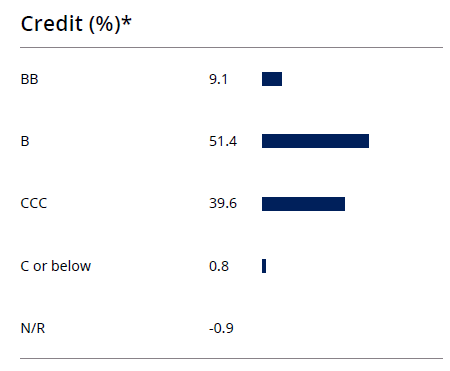

The CEF focuses on the riskiest part of the capital structure, namely “B” and “CCC” credits:

Credit (Fund Fact Sheet)

We can see that “CCC” credits account for almost 40% of the fund, while “B” and “CCC” credits make up over 90% of the portfolio. That is an extremely credit-risky portfolio, and that is where the fund gets the cash-flows to pay such high dividends.

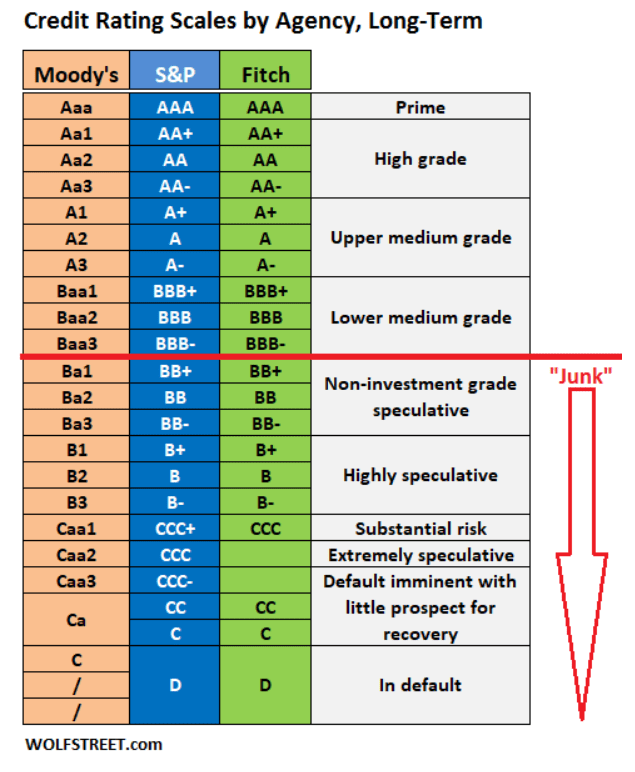

As a reminder, “B” and “CCC” credits falls in the “Highly Speculative” and “Substantial Risk” buckets:

Credit Risk (Wolf Street)

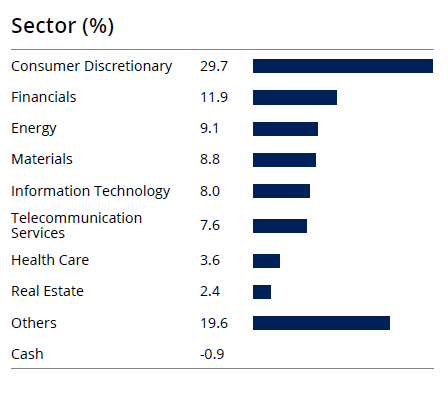

The fund has a high concentration in the “Consumer Discretionary” sector:

Sectors (Fund Fact Sheet)

We can see that almost 30% of the fund falls in that sectoral bucket. That is a fairly high concentration. We do not usually like to see single sector buckets exceeding 17% in a high yield fund.

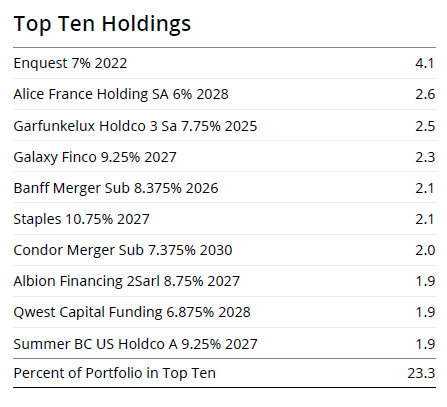

From a single name perspective the vehicle is fairly granular:

Top Holdings (Fund Fact Sheet)

The vehicle does a good job of allocating the portfolio among many credits. The rule of thumb here is that no name should be higher than 2.5% of a portfolio. We have only two issuers exceeding that threshold here.

Distributions

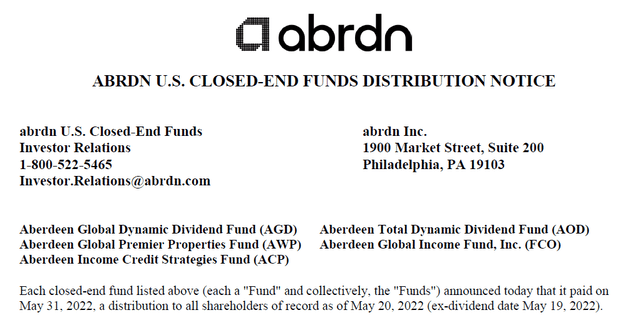

If we look at the most recently available Section 19A report, we will notice the fund is not currently using ROC:

May Section 10A (Fund Notice) May Section 19A (Fund Notice)

Premium/Discount to NAV

The fund is currently trading at a premium to NAV:

The fund is trading at a premium due to its very attractive dividend yield. However we can notice that he premium is very much dependent on risk-on / risk-off moves in the wider market. Do expect the premium to narrow during the next risk-off move.

IVH CEF Merger/Absorption

We wrote an extensive piece here regarding the potential merger between ACP and IVH. On August 11 the Delaware Ivy High Income Opportunities Fund (IVH) announced that its Board of Trustees approved the reorganization of the fund into Aberdeen Income Credit Strategies Fund (ACP). As per the announcement:

It is currently expected that the Reorganization will be completed in the first quarter of 2023 subject to (I) approval of the Reorganization by the Acquired Fund shareholders, (II) approval by Acquiring Fund shareholders of the issuance of shares of the Acquiring Fund, and (III) the satisfaction of customary closing conditions.

We believe the merger is going to go through and it will represent a positive for both sets of shareholders with ACP ending up with more assets under management.

Conclusion

ACP is a fixed income CEF that has current income as its primary goal. The fund invests more than 90% of its portfolio in credit risky “B” and “CCC” securities. With all-in yields in the space exceeding 15%, the fund is able to pass to investors true 15% annualized dividend yields (i.e. no return of capital). The fund is currently trading at a 10% premium to NAV, with investors having identified the attractive risk/reward proposition. ACP is about to get bigger with the IVH CEF merger pending shareholder approval.

We do not believe the current recession is going to see an outsized increase in default rates, hence we are of the opinion that long credit risk positions offer attractive risk/reward profiles. The downside to going long ACP is the on-boarding of substantial volatility. A retail investor needs to have an investment horizon of at least two years if buying ACP now, and be able to stomach -10% to -15% drawdowns in the name in the short term. We are of the opinion that at current levels, a two year holding period can provide an investor with a 30% total return, albeit with significant volatility.

Be the first to comment