mikulas1/E+ via Getty Images

I bought a house right before the housing crisis happened. So I paid too much and then I was stuck with it for a long time. So that was sad for me. I was like, “I’d better make a movie about this to get it out of my system. – Hamish Linklater

The Aberdeen Australia Equity Fund (NYSE:IAF) is a closed-end fund (“CEF”) that focuses on a portfolio of stocks that are primarily listed on the Australian Stock Exchange (at least 65% of the portfolio). The last time I covered this product more than a year back, valuations were extremely pricey with IAF trading at a P/E of over 24x. These days, it is a lot more palatable at 16x P/E; given the significant contraction in the multiple, should you be considering a position in IAF? Well, here are a few thoughts for your consideration.

Conditions in Australia

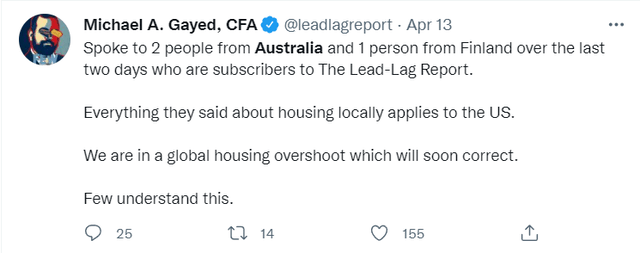

If you’ve been keeping abreast of the developments on the timeline of The Lead-Lag Report, you’d note that some time back, I had flagged the unhealthy levels of euphoria in some of the notable housing markets across the world, one of which happened to be Australia.

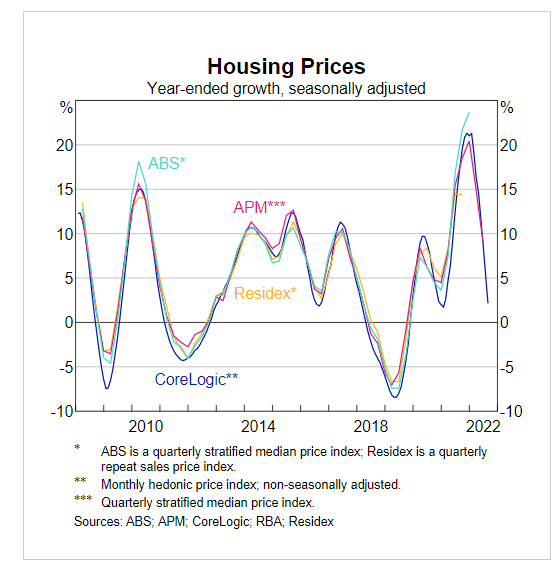

Well, I’m sorry to note that my prescience may well turn out to be right as recent reports from Down Under suggest that things are pivoting and we’re in for a fairly drastic fall. Australian housing prices which had grown by approximately 33% during the 2020 crisis, declined sequentially by 1.6% in July (incidentally the biggest drop in nearly 40 years). On a YoY basis, housing prices are only growing at mid-single digits, a long way from the +20% levels seen late last year. Given the onset of the high base effect, it would be unrealistic to see positive annual growth for too long. Indeed, according to a Reuters survey carried out amongst Aussie-based property analysts, average home prices will likely drop by 6.5% this year (in May the poll suggested a +1% increase), and worryingly next year’s decline is expected to be a lot worse at 9%.

RBA

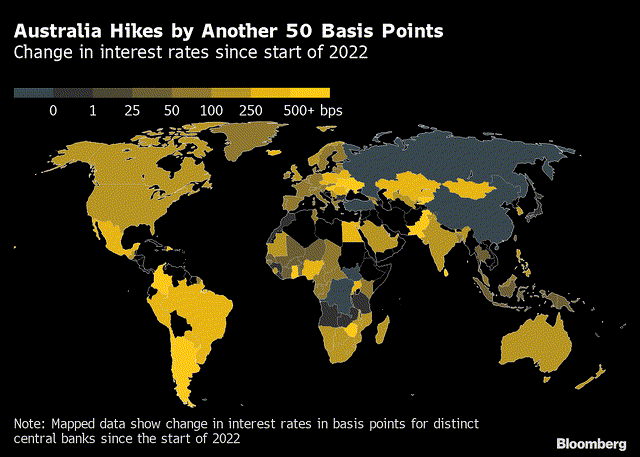

The housing slowdown is of course being driven by falling demand conditions; with inflation poised to hit 8% levels by the end of this year (source: RBA), and well above the RBA’s comfort range of 2-3%, you would expect monetary conditions to only become dearer thus putting pressure on household budgets. In fact, yesterday the RBA lifted rates yet again by 50 basis points (the fourth consecutive time) making it one of the most aggressive central banks in the world this year.

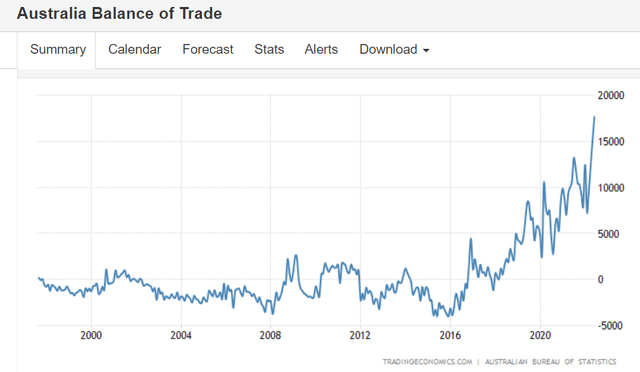

Despite an aggressive pivot this year, those rate hike initiatives are certainly not done as the central bank feels there are still some positive levers to support the economy. For instance, the Russian-Ukraine fiasco and its associated impact on the commodity markets have certainly abetted the trade surplus position which is currently at record high levels of nearly 18bn!

Besides GDP growth in Q2 still came in at a healthy rate of 3.6%. All in all, the cash rate which currently stands at 2.35% (the highest level in 7 years) could still potentially be lifted to up to 2.85%.

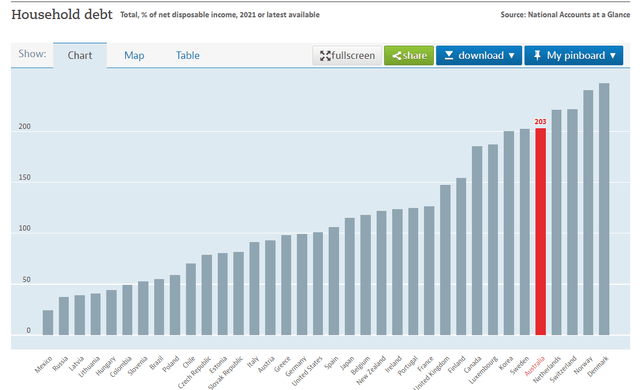

Nonetheless, it’s only a matter of time before these persistently aggressive rate hikes leave a mark on the average Australian consumer as most of the Australian borrowers have availed of variable rate mortgages; What is particularly worrying for me is that by OECD standards; Australians are an enormously indebted bunch. Household debt as a % of disposable income is over 2x, one of the highest in the world.

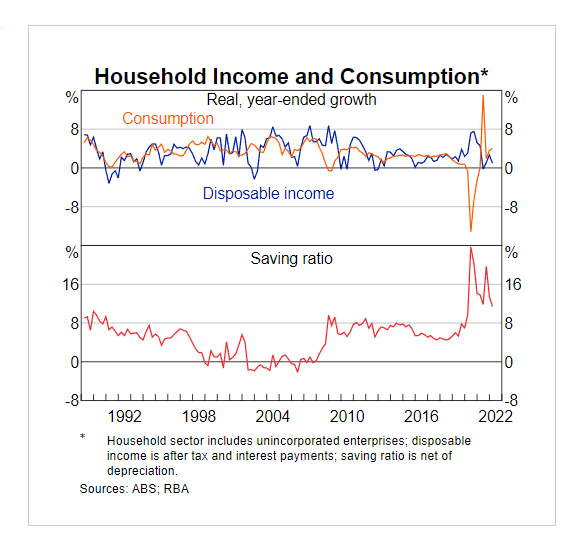

At the same time, growth in disposable income has been sliding off late.

RBA

As monetary conditions become dearer and income growth slows, these Australians have been forced to dip into their savings (which, in fairness, is still above pre-pandemic levels). Yet we can see how this has been trending down sharply, and it’s just a matter of time before it hits the pre-pandemic range of around 5%.

Conclusion

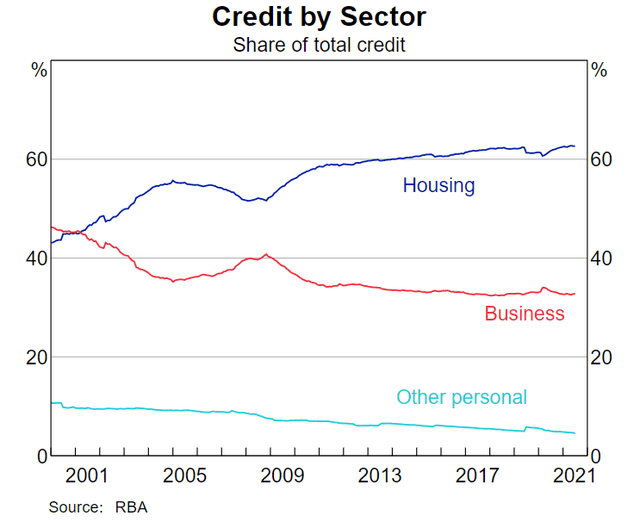

Investors should also be mindful of how the effects of a prospective housing slowdown on the Australian banking sector. This is particularly pertinent, as banks account for the largest share in IAF’s overall portfolio.

As you can see from the image above, housing-based credit accounts for a disproportionate share of total credit (over 60%), and whilst higher rates should reflect favorably on the trajectory of the net interest margins of these banks, you have to wonder if there will be sufficient appetite for these loans at higher rates. I think it’s fair to say that you will see some slowdown in credit momentum here; indeed, CBA believes housing-based credit which is up by 8% on a YTD basis (till June) will likely only grow by 2-3.5% next year. Recent reports also suggest that banks are so desperate to cling on to their existing clients that they have been resorting to discounting practices or offering significant cashback deals ranging from $3000-$6000.

I’m not going to tell these bankers how to run their businesses, but when you begin to notice signs of excess discounting, that almost always acts as a precursor of worrying times ahead. Proceed with caution.

Anticipate Crashes, Corrections, & Bear Markets

Anticipate Crashes, Corrections, & Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment