vzphotos/iStock Editorial via Getty Images

After I have been rather bearish about the U.S. stock market in 2019 and 2020, I changed my mind in the last few quarters and finally accepted that fundamentals don’t matter at the moment. And I still expect the stock market to have one upward wave before this bull market is finally over. However, as I am writing this on Friday – after worse than expected CPI and horrible Michigan Consumer Sentiment – it might seem like the bear market has already started and we won’t see a final upward wave. Of course, we should not base such scenarios on a single trading day, and it doesn’t really matter if the bear market has already begun in January 2022 or if it will begin in a few months from now (after making new and final all-time highs) – we must prepare for what is coming next: a steep recession and brutal bear market.

In my opinion, we will face the steepest correction for U.S. indices since the Great Depression due to the extremely high valuation the U.S. stock market is trading for. And we must adjust our portfolio and prepare for such an environment. One of the sectors we can focus on during such times is healthcare (and especially pharmaceutical companies). And AbbVie Inc. (NYSE:ABBV) is certainly one of the companies we should look at for several reasons: not only is it one of the major pharmaceutical companies in the world (5th largest according to market capitalization), but it is also interesting for its dividend (almost 4% dividend yield).

But these aspects alone don’t make a stock a good investment. And even when just focusing on pharmaceutical businesses to prepare for a recession, there are many companies one can look at and we should not invest blindly in AbbVie.

Quarterly and Annual Results

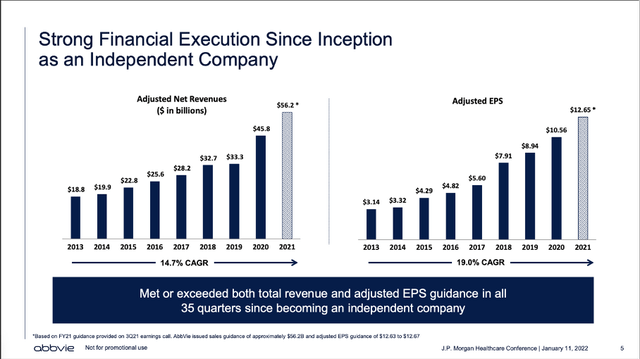

When looking at AbbVie’s results of the last few years, we see strong financial growth since the IPO in 2013. Since 2013, adjusted net revenue increased at a CAGR of 14.7% and adjusted earnings per share increased at a CAGR of 19.0%.

J.P. Morgan Healthcare Conference Presentation

And so far, AbbVie continues to increase with a stable pace in the last few quarters. In fiscal 2021, AbbVie generated $56,197 million in revenue and compared to $45,804 million in fiscal 2020 this is 22.7% year-over-year growth. Operating earnings also increased from $11,363 million in fiscal 2020 to $17,924 million in fiscal 2021 – 57.7% YoY growth. And diluted earnings per share more than doubled from $2.72 in fiscal 2020 to $6.45 in fiscal 2021 (resulting in 137% growth YoY).

Of course, these high growth rates are also a result of the Allergan acquisition, and we cannot assume AbbVie continuing to grow with a similar pace. But in the first quarter of fiscal 2022, AbbVie could still increase its revenue from $13,010 million in Q1/21 to $13,538 million in Q1/22 – an increase of 4.1% YoY. And while operating income increased 15.0% YoY from $4,103 million in Q1/21 to $4,717 million in Q1/22, diluted earnings per share increased even 58.8% from $1.99 in the same quarter last year to $3.16 this quarter.

Growth

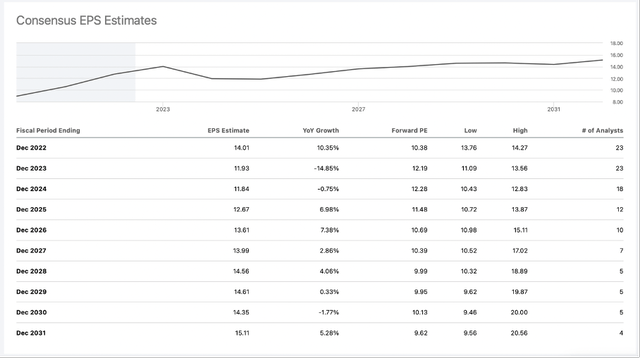

Analysts are not really expecting growth in the years to come but assume earnings per share rather to stagnate over the next ten years. Between fiscal 2021 and fiscal 2031, analysts are expecting earnings per share to grow at a CAGR of 1.75%. This is a typical pattern when looking at pharmaceutical companies and it might seem reasonable to make rather cautious assumptions as we don’t know if AbbVie (or other pharmaceutical companies) can continue to grow. It is difficult to estimate revenue in 5 or 10 years from now as the number is depending a lot on patent expiration (and the question if competitors can come up with a cheaper alternative) as well as the question if AbbVie can come up with new blockbuster drugs.

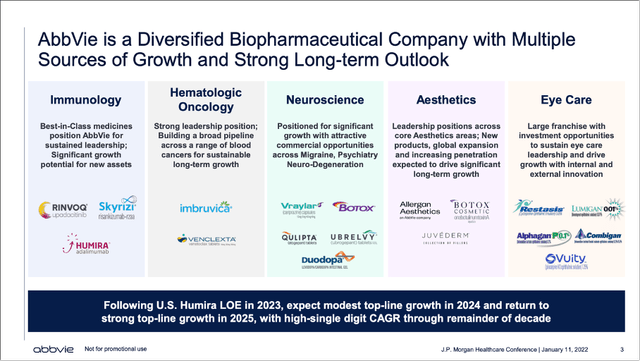

However, analysts’ estimates are in sharp contrast to the growth rates AbbVie could report in the last ten years. While revenue increased at a CAGR of 12.41%, earnings per share increased at a CAGR of 11.49%. And management is also quite optimistic for the years to come. While expecting a difficult fiscal 2023 due to the loss of exclusivity for Humira in the United States, management is expecting modest top-line growth in 2024. And from 2025 going forward, a high-single digit CAGR is expected for the rest of the decade.

J.P. Morgan Healthcare Conference Presentation

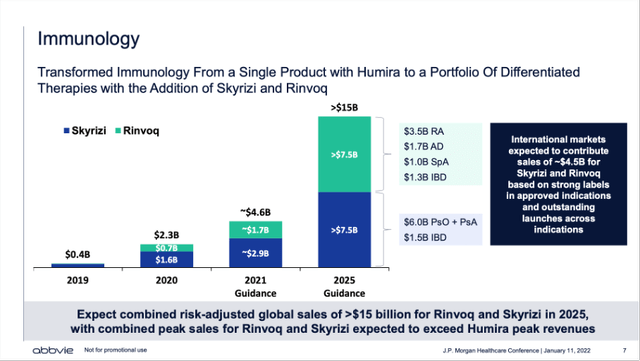

And while Oncology, Neuroscience, Aesthetics and Eye Care will also contribute to growth, a huge part of growth should come from Immunology. I already mentioned in my last article that Skyrizi and Rinvoq will contribute a huge part of growth in the next few years and for fiscal 2025, AbbVie is expecting $15 billion in combined annual sales (and as management stated in a previous presentation, both products might not even peak before early 2030s). While we don’t know if these two drugs will make up for the Humira losses (it generated $20.7 billion in revenue or 37% of total revenue in fiscal 2021), these two should be very important products for AbbVie.

J.P. Morgan Healthcare Conference Presentation

And while I don’t know if management might be a little too optimistic with high single digit growth rates, I also think analysts’ expectations might be a bit too pessimistic (which is interesting as analysts are usually too bullish and often have unrealistic high targets for companies and stocks).

Dividend

As I already mentioned above, AbbVie is still interesting for its dividend. Right now, AbbVie is paying a quarterly dividend of $1.41 resulting in an annual dividend of $5.64 and a dividend yield close to 4%. And not only has AbbVie a high dividend yield but was also increasing the dividend with a high pace in the last few years: the 5-year dividend CAGR is 17.50%.

When using the current annualized dividend of $5.64 and compare it to the GAAP earnings per share of the last four quarters ($6.97), we get a payout ratio of 81%, which seems too high and not really sustainable. However, we can also compare the current dividend to the adjusted earnings per share of $12.91 in the last four quarters, which is resulting in a payout ratio of 44%. We can also compare $9,465 million in dividends paid in the last four quarters to $22,047 million in free cash flow, which leads to a payout ratio of 43%. And although I would be rather cautious about the adjusted numbers (and also the free cash flow), the dividend seems well covered.

Problem I: Adjusted Numbers

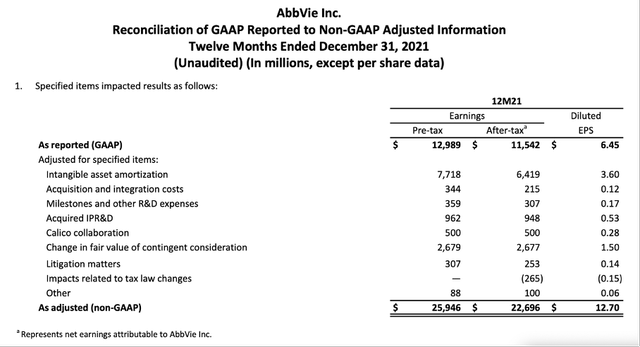

But AbbVie is not just a business that has a high dividend yield and was growing with a high pace during the last decade. I also see some issues with AbbVie – and mentioned two of them already in my last article. First, the huge discrepancy between the GAAP EPS and the adjusted EPS could be problematic. In my last article I wrote:

To be honest, these huge discrepancies make me a bit uneasy – especially as the difference is so extreme and we are seeing these discrepancies for several years now – we will return to this aspect, when calculating an intrinsic value.

When looking at the GAAP EPS vs. the adjusted, non-GAAP EPS in fiscal 2021, we can see that non-GAAP EPS is almost twice as high as GAAP EPS – and the specific items, which impact the results are especially “intangible asset amortization” as well as “Change in fair value of contingent consideration”.

I certainly would not argue that adjusted numbers should be avoided – and in some cases I use the adjusted numbers myself when results according to GAAP don’t make much sense and are not a realistic description of the business. However, we should take a close look when companies are constantly reporting adjusted numbers that don’t match GAAP numbers in any way – and the discrepancy in case of AbbVie is huge.

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

|---|---|---|---|---|---|---|---|---|---|

|

GAAP numbers |

$2.56 |

$1.10 |

$3.13 |

$3.63 |

$3.30 |

$3.66 |

$5.28 |

$2.72 |

$6.45 |

|

Adjusted numbers |

$3.14 |

$3.32 |

$4.29 |

$4.82 |

$5.60 |

$7.91 |

$8.94 |

$10.56 |

$12.70 |

|

% |

123% |

302% |

137% |

133% |

170% |

216% |

169% |

388% |

197% |

I certainly don’t claim AbbVie is “fabricating” numbers, but we should be cautious if the adjusted numbers (and free cash flow) are a realistic description of the fundamental business.

Problem II: Balance Sheet

Aside from the huge discrepancy between the GAAP and non-GAAP numbers, we also have to revisit the balance sheet once again – an aspect I already mentioned in my last article as well. However, we must point out that AbbVie has improved its balance sheet over the last twelve months (I am comparing data from March 2021 to March 2022):

- Cash and cash equivalents declined from $9,755 million to $6,098 million and short-term investments increased from $22 million to $1,474 million.

- Goodwill is more or less the same as one year earlier: It declined slightly from $32,349 million to $32,298 million.

- And while total assets declined from $150,501 million one year earlier to $143,211 million, total equity increased from $13,733 million in March 2021 to $16,314 million in March 2022.

- Long-term debt declined from $74,199 million one year earlier to $63,695 million in the last quarter and total debt (including short-term borrowings and short-term debt) declined from $85,554 million to $73,648 million.

And when looking at the different debt metrics, we see an improvement compared to March 2021:

- The debt-equity ratio improved from 6.23 to 4.51, but despite the obvious improvement we are still dealing with a D/E ratio that is not acceptable.

- Debt to operating income also improved from 5.18 years it took in March 2021 to repay the outstanding debt to only 3.67 years right now. And while the debt-equity ratio is still too high, the debt to operating income is acceptable.

The balance sheet of AbbVie is still not perfect. However, we see improvements and over the next twelve months, AbbVie will repay $9,940 million in debt and therefore improve its balance sheet further.

Recession

When looking for assets to own during a recession and economic downturn, healthcare companies (including pharmaceutical companies) are often seen as top pick. The demand for pharmaceuticals is (almost) always the same – people will get sick in a similar way during recessions as during an economic boom. This is especially true for patent-protected pharmaceuticals for which there is no cheaper alternative one might switch to in financial challenging times.

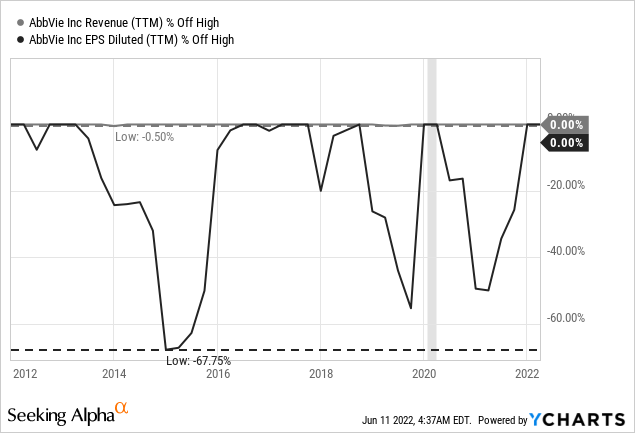

When trying to look how AbbVie performed during a recession, it gets a bit tricky as AbbVie has seen only one recession – the COVID-19 crash two years ago.

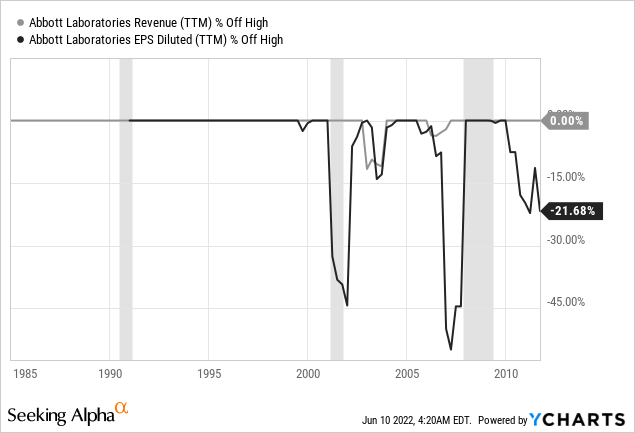

However, we can look at the performance of Abbott Laboratories (ABT) as AbbVie was integrated in Abbott Laboratories before the IPO in 2013.

At least when looking at revenue, most recessions are hardly visible in the chart. Revenue for Abbott Laboratories only declined in the years following the recession in the early 2000s. But in every other recession for the past 40 years, Abbott Laboratories or AbbVie didn’t see declining revenue. When looking at earnings per share, the picture is a bit different, and we actually see steep declines for AbbVie as well as Abbott Laboratories following several recessions. But we can also see that the company recovered rather quickly after a recession.

And while we can’t rule out a rather steep decline for earnings per share in case of a recession, I would also be quite optimistic that this is just a short and temporary issue with earnings per share reaching previous levels within a few quarters again. All in all, we can describe AbbVie as a recession-proof business.

Intrinsic Value Calculation

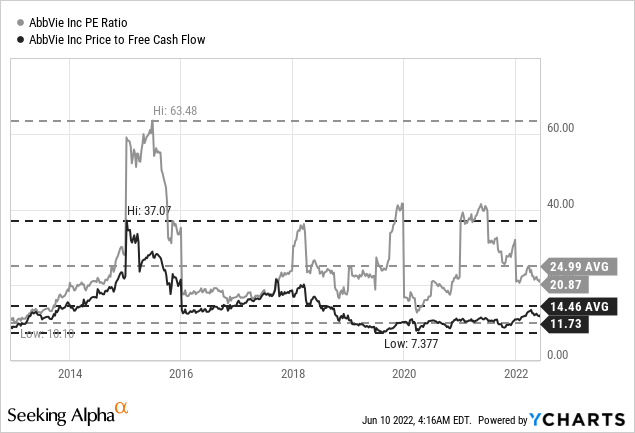

When assuming that the current free cash flow of AbbVie is sustainable (and ignoring the huge discrepancy between net income and free cash flow mentioned above), AbbVie is trading for only 11.73 times free cash flow and seems to be extremely cheap. And while the current P/FCF is higher than it was in the last few years (in 2019 AbbVie was trading for only 7.4 times free cash flow), the stock still must be considered cheap with a low double-digit P/FCF ratio, and the stock is also trading below the 10-year average P/FCF ratio of 14.46.

However, when looking at the P/E ratio the picture seems to be different. Right now, AbbVie is trading for about 21 times earnings. And while this number is also below the 10-year average of 24.99, the stock doesn’t look so cheap when looking at this metric.

When using a discount cash flow calculation to determine an intrinsic value, we can also reach the conclusion, that AbbVie might be rather undervalued. Using the free cash flow of the last four quarters as basis, the company must grow only slightly above 1% in the years to come to be fairly valued. And while we can argue what growth rates are realistic for AbbVie, the business should be able to grow at least 1%.

The problem is – as I have already mentioned above – that the free cash flow is so much higher than net income (and has been for many years) that I am rather cautious if these numbers are sustainable and should be used in a calculation. When taking the net income of the last four quarters instead, AbbVie must grow about 5% from now till perpetuity in order to be fairly valued. And that growth rate also seems achievable for AbbVie in my opinion, and we can therefore see the stock as fairly valued right now.

Conclusion

AbbVie with its business model of selling patent-protected pharmaceuticals can be a good pick for an upcoming recession as we can expect revenue to be stable (or even growing) in the quarters during a recession. Earnings per share might take a hit in case of a recession, but in the past the business usually recovered rather quickly. But we must remain cautious about the adjusted numbers and the extremely high free cash flow which is not matching net income. And of course, we never know if AbbVie can continue to grow, and the risk remains that AbbVie won’t be able to introduce new patent-protected blockbusters to the market.

I would remain neutral about AbbVie as the company seems to be fairly valued, which would imply that we can expect a 10% yield in the years to come – and this is certainly a decent return especially during a recession. But it is not a bargain, and we are missing any margin of safety in that scenario.

Be the first to comment